AML Transaction Monitoring

Reduce false positives and strengthen your compliance process.

Where over 800+ firms redefine transaction security and compliance.

Be Aware of Suspicious Transactions

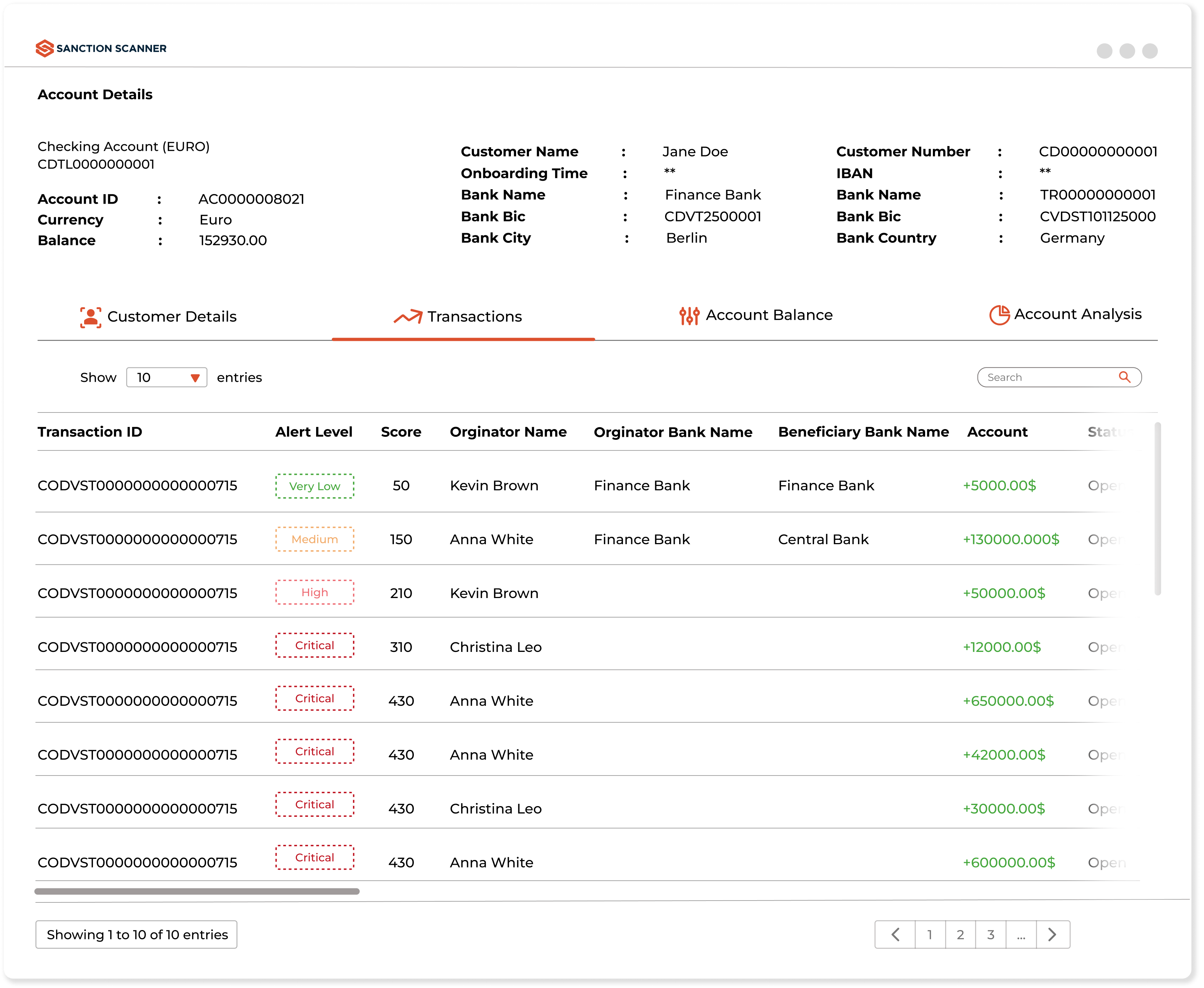

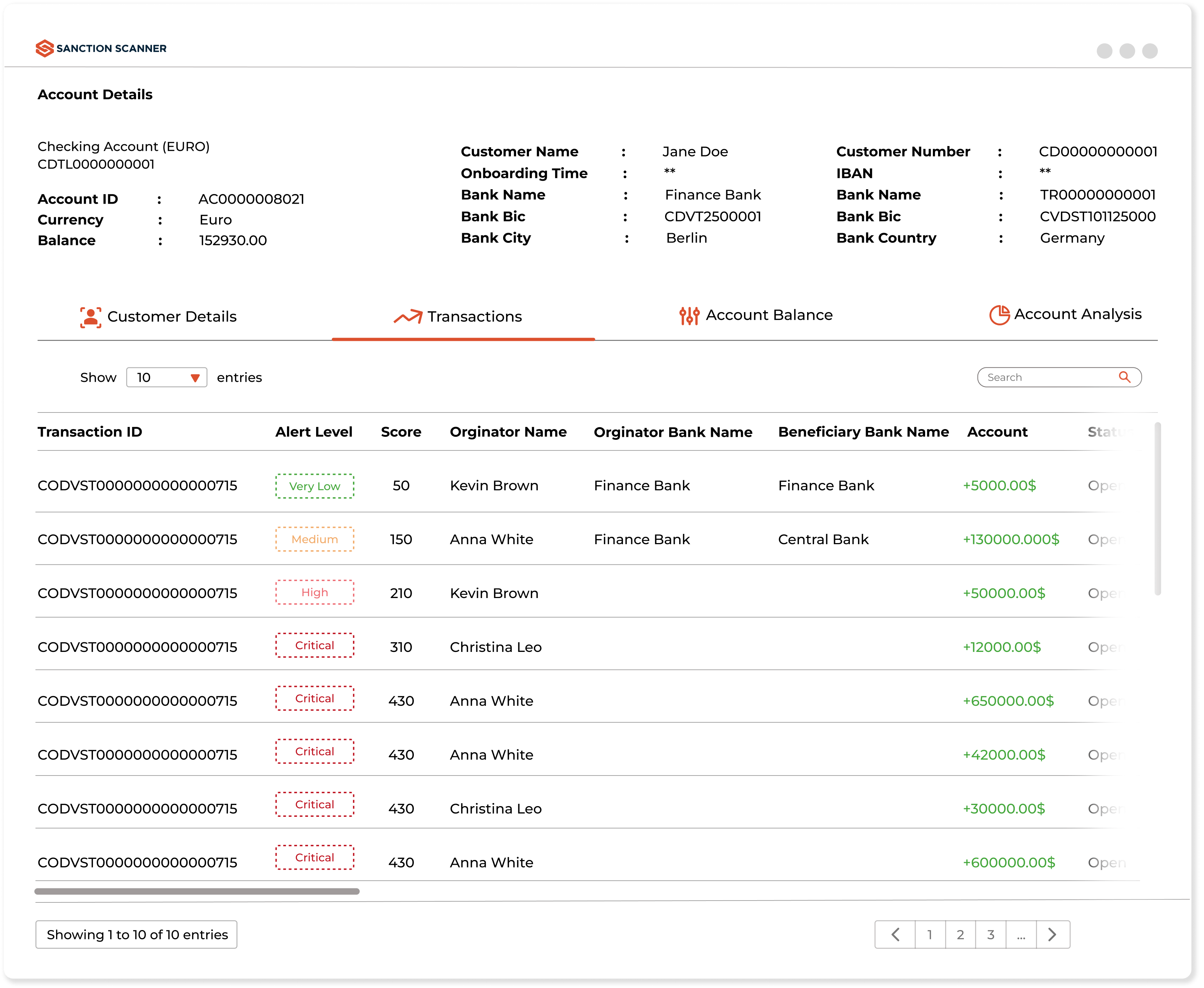

Sanction Scanner monitors transactions your customer make in real-time to detect suspicious transactions. The software stops the transactions and records the transaction for investigation if it detects a suspicious transaction. You can easily integrate Sanction Scanner into your project with API.

Set Rules and Create Scenarios

You can set rules and create scenarios with the rule-writing feature. It'll help you reduce false positive alarms, focus on correct warnings, and reduce your workload.

96.99%

Reduced False Positives

80%

Reduce Own Control Workload

100%

AML Regulations Compliance

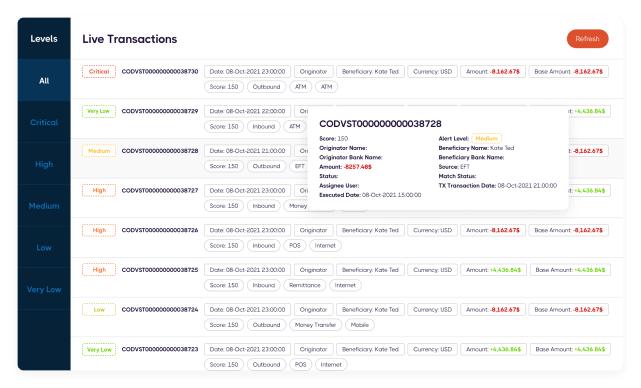

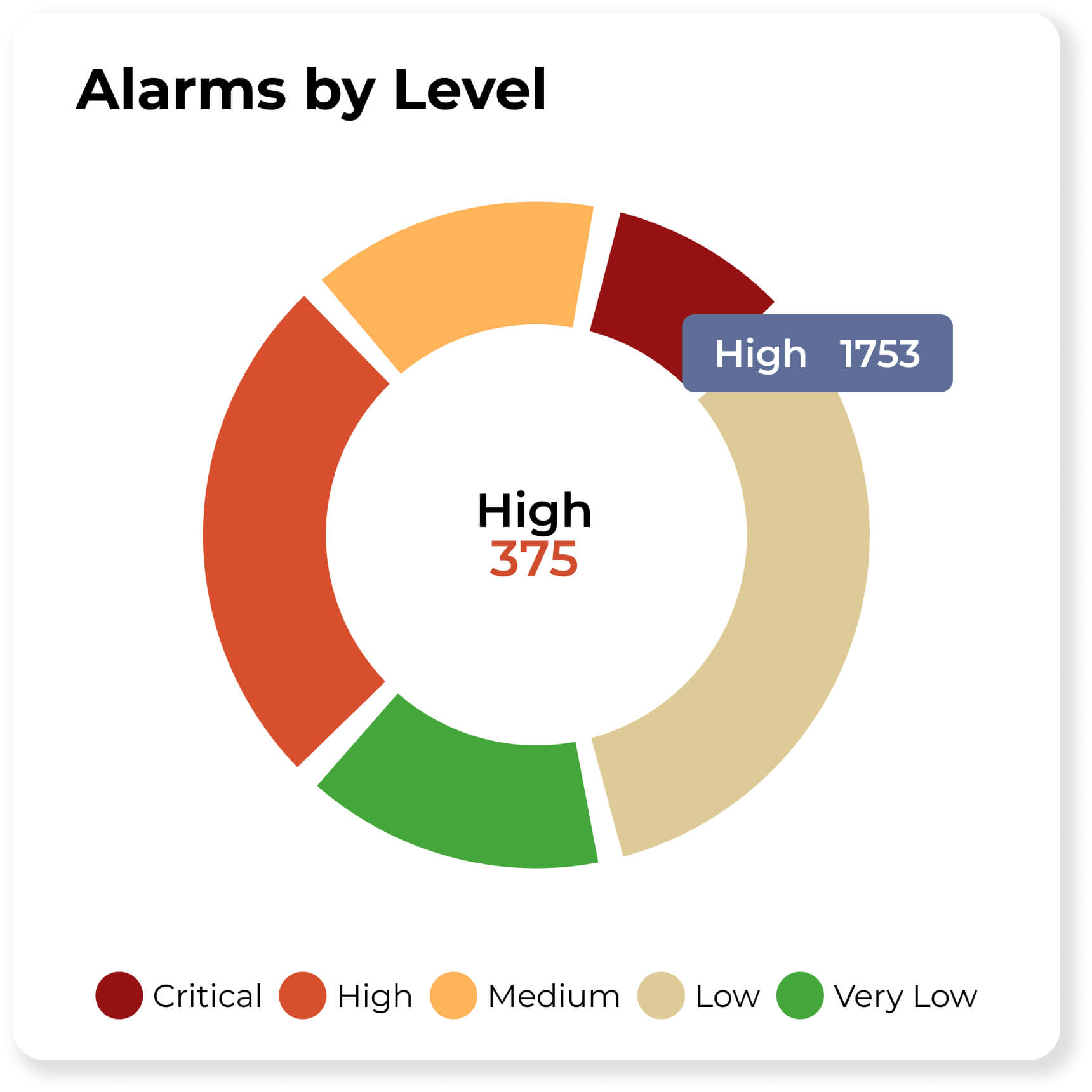

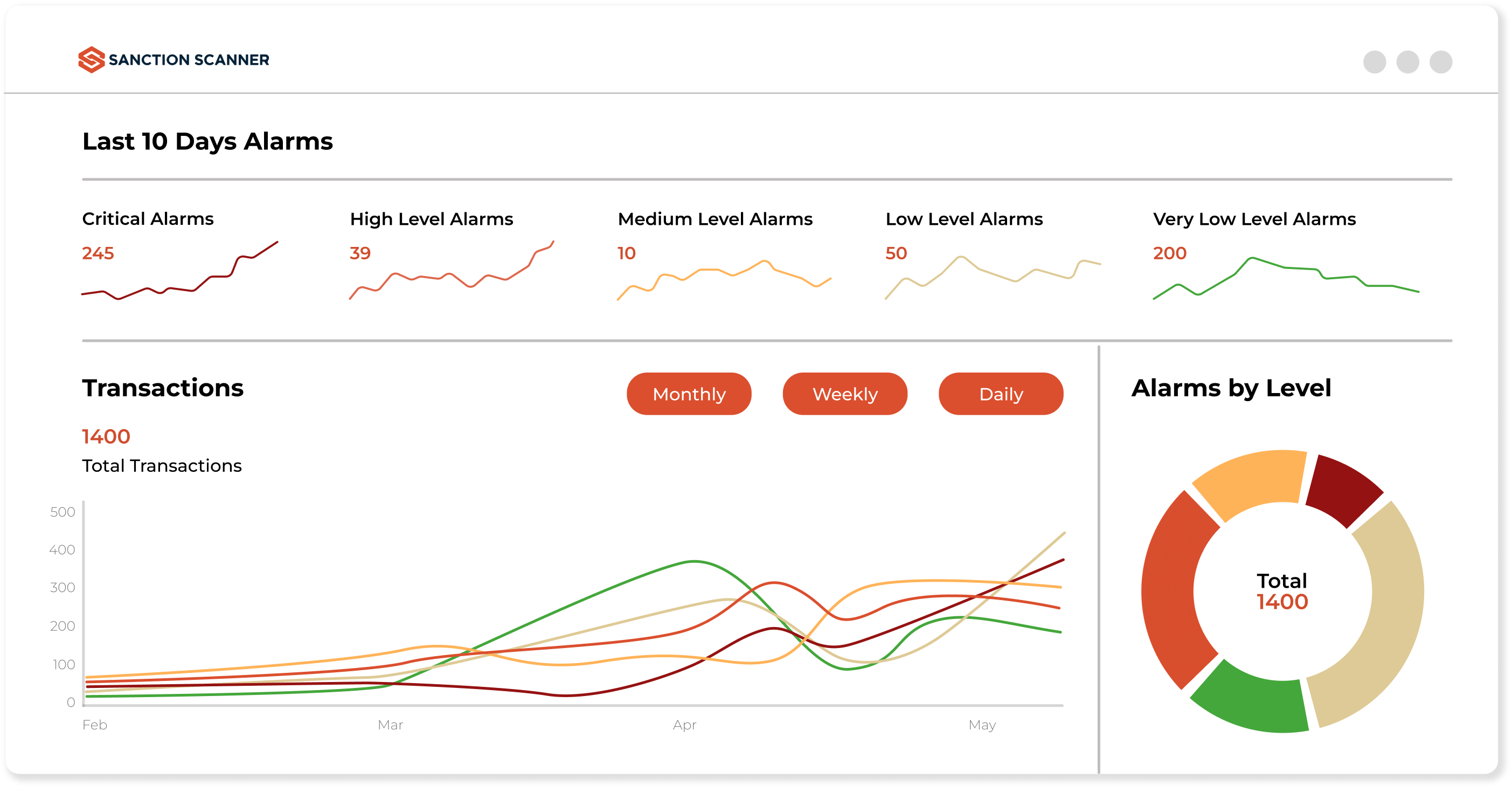

Quickly Respond to Suspicious Transactions with Real-Time Alarms

Don't wait until the end of the day to see alarms. You can see suspicious alarms depending on your scenarios and rules and see alarms by their risk levels(1-5).

Features

Powerful Case Management

Full Audit

Trails

User-Friendly

Dashboard

Live Transaction

Screen

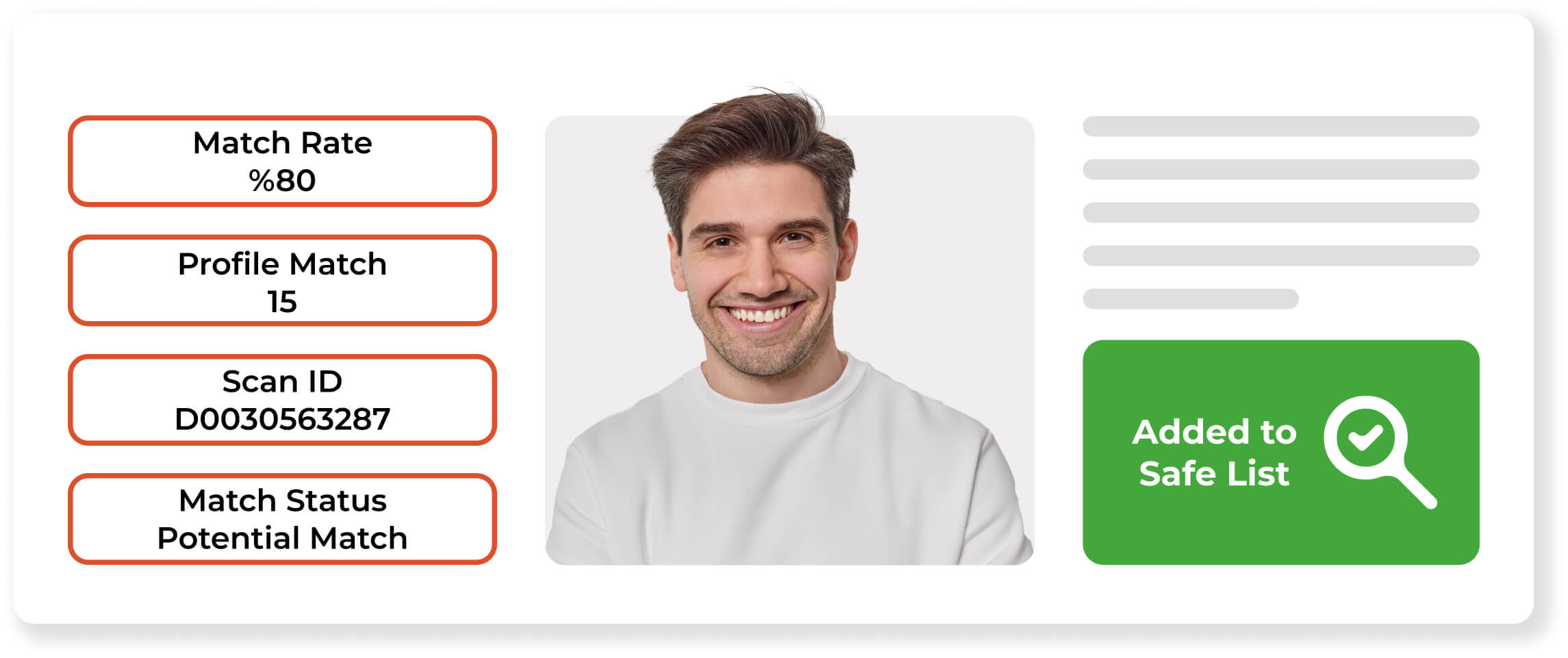

Integrated Sanction

and PEP Query

Fast & Smooth Integration with Ready to Use Rules

You can use our ready-to-use rule sets compatible with each sector. You can also create different rule sets specific to your customer group.

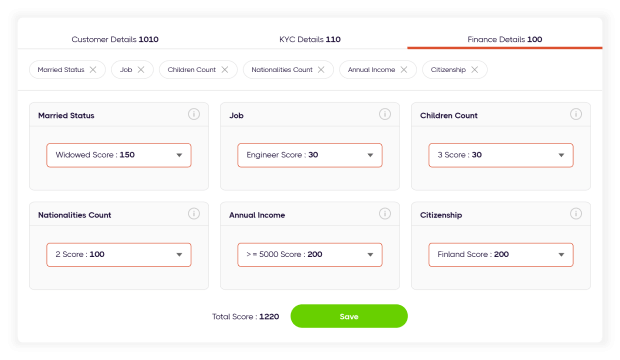

Test your Rules with Advanced Sandbox Test Environment

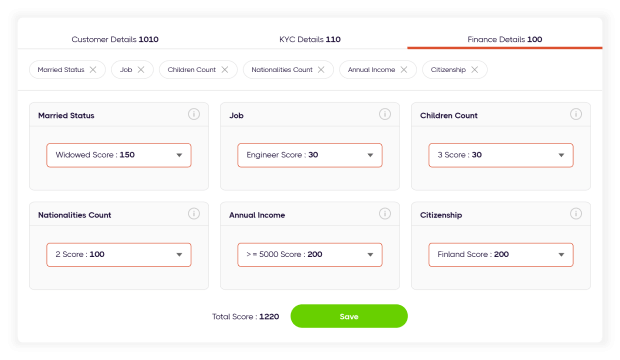

You can determine your customers' risk scores according to their job, age, income, etc. And you can define alarms (low, medium, high, critical) based on your customers' risk levels. You can also set Transaction Rules depending on your customers' risk scores.

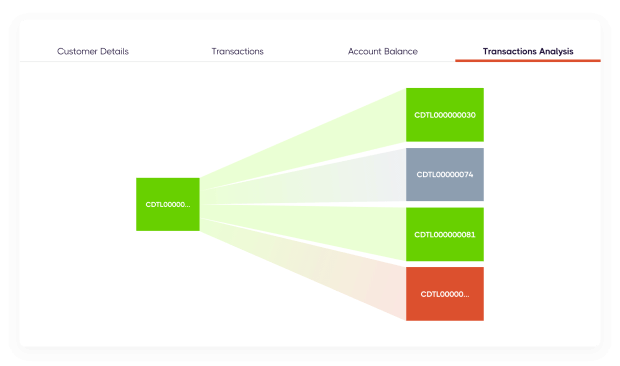

Peer Group Analysis

You can analyze the accounts trade with each other using the Transaction Analysis feature and view the Account Name, Volume, Balances, and relation of each account.

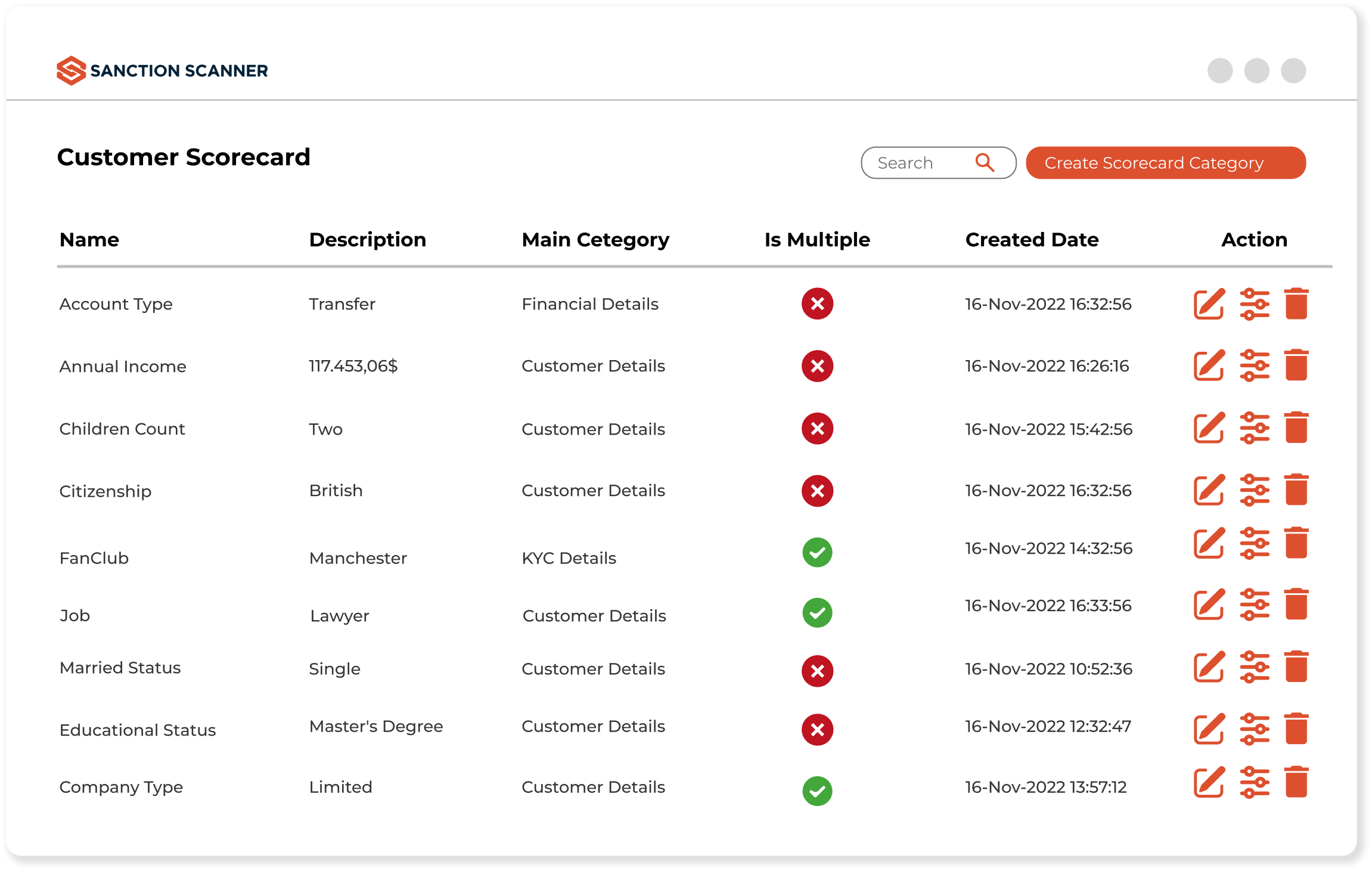

Dynamic Customer Risk Assessment and Scorecard

You can determine some criteria according to your customers' job, age, income, etc., and assign risk scores accordingly to these criteria. You can define alarms such as low, medium, high, critical accordingly to those scores or you can write Transaction Rules that depend on these Customer risks scores.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

AML Transaction Monitoring

Transaction monitoring is the real-time, continuous analysis of financial transactions to detect suspicious or anomalous activity that may be an indicator of money laundering or fraud.

Sanction Scanner's Transaction Monitoring solution automatically notifies companies of risky behavioral patterns to guarantee AML compliance and avert financial crime.

Financial regulatory authorities such as FATF, FinCEN, and the EU AMLD force financial institutions to monitor customer transactions and report anything suspicious.

Sanction Scanner assists compliance teams in identifying and investigating high-risk transactions in real time, reducing the risk of regulatory penalties and reputational loss.

Transaction monitoring systems analyze transaction data such as amount, frequency, location, and counterparty which is in real time to identify unusual activity.

Sanction Scanner provides a rule catalog where you can define and customize your own detection logic, with full API integration into your existing systems.

Common red flags include structuring, rapid or repeat transfers, large round-number transactions, and transfers to high-risk jurisdictions.

Sanction Scanner's analytics engine continuously monitors these patterns and generates instant alerts for further investigation.

Name screening mainly screens individuals and organizations against sanctions and watchlists during onboarding, while transaction monitoring actively watches customer activity on an ongoing basis for suspicious activity.

Together, these solutions form an end-to-end AML solution that delivers both initial and ongoing compliance.

FATF guidelines require institutions to perform risk-based monitoring, report Suspicious Activity Reports (SAR), and implement effective controls to identify unusual transactions.

Sanction Scanner helps organizations meet these global standards with customizable risk scoring, alert management, and automated reporting workflows.

Yes. Risk-based monitoring allows multiple customer segments to be monitored according to different thresholds and rules.

Sanction Scanner enables you to set up risk categories, scoring models, and frequency tiers that mirror your internal compliance policies.

AI identifies hidden relationships and aberrant behavioral patterns that may not be picked up by static rule-based systems.

Sanction Scanner's AI engine learns from feedback continuously to reduce false positives by up to 97%, leading to more accurate alerts and less manual review time.

Failing to monitor transactions properly can lead to severe regulatory fines, loss of licenses, and significant reputational damage.

For example, Deutsche Bank was fined $186M for inadequate AML monitoring controls. Sanction Scanner helps businesses avoid such outcomes with automated, audit-ready solutions.

Absolutely. Sanction Scanner offers scalable, API-based solutions suitable for startups and SMEs—without the need for complex infrastructure.

Yes. Our system supports SWIFT MT and ISO 20022 formats, enabling real-time monitoring of international payments. We extract key fields from SWIFT messages (e.g., sender/receiver, amount, BIC, jurisdiction) to apply screening rules and flag suspicious activity across cross-border flows.

Yes. FATF recommends risk-based transaction monitoring for all regulated entities. Institutions must monitor for suspicious activity and report it via SARs or STRs as part of ongoing due diligence.

Absolutely. Sanction Scanner allows rule sets and alert thresholds to be adjusted by customer segment—such as low, medium, or high risk—based on geography, industry, or behavior.

Monitoring tools generate alerts for unusual activity. Once reviewed, confirmed cases are escalated into Suspicious Activity Reports (SARs), enabling institutions to meet regulatory reporting obligations.

Yes. Crypto exchanges and VASPs are required to monitor transactions for layering, mixing, or rapid wallet movements—especially those involving privacy coins or high-risk jurisdictions.

Yes. Our platform includes a sandbox environment where compliance teams can test transaction monitoring rules using historical or simulated data. This allows fine-tuning of thresholds, reducing false positives and ensuring rules are well-calibrated before being applied in live environments.