Financial Crime Consultants and Law Firms

Sanction Scanner saves time for Financial Crime Consultants and Law Firms with our Name and Adverse Media Scanning Softwares.

TRUSTED BY OVER 800+ CLIENTS

Challenges

Money laundering regulations vary from region to region. Financial Crime Risk Analysts provide expert advice on financial crime risks to protect companies from fines by reducing their risk levels.

+3000

DATA POINTS CHECKED

+220

COUNTRIES COVERED

15 min

ALWAYS REAL-TIME DATA

150 ms

SCANNING

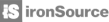

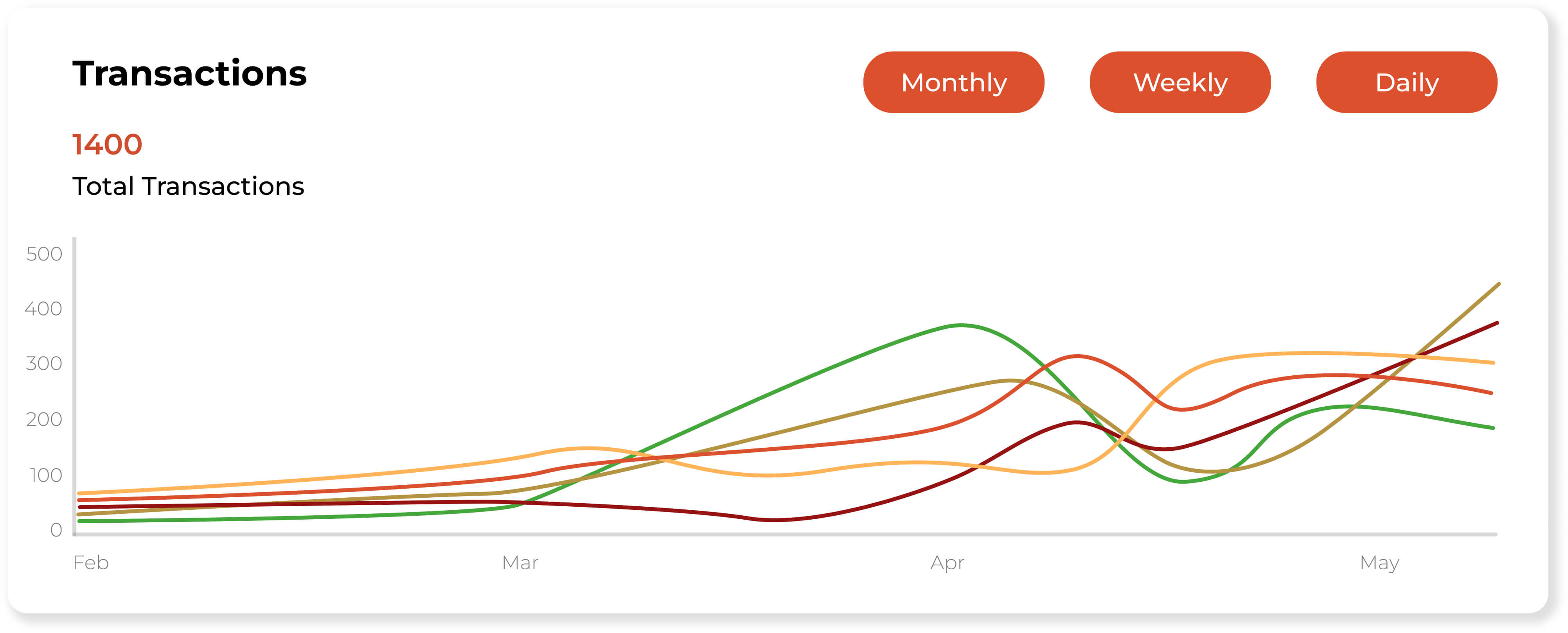

Streamline AML Compliance Processes

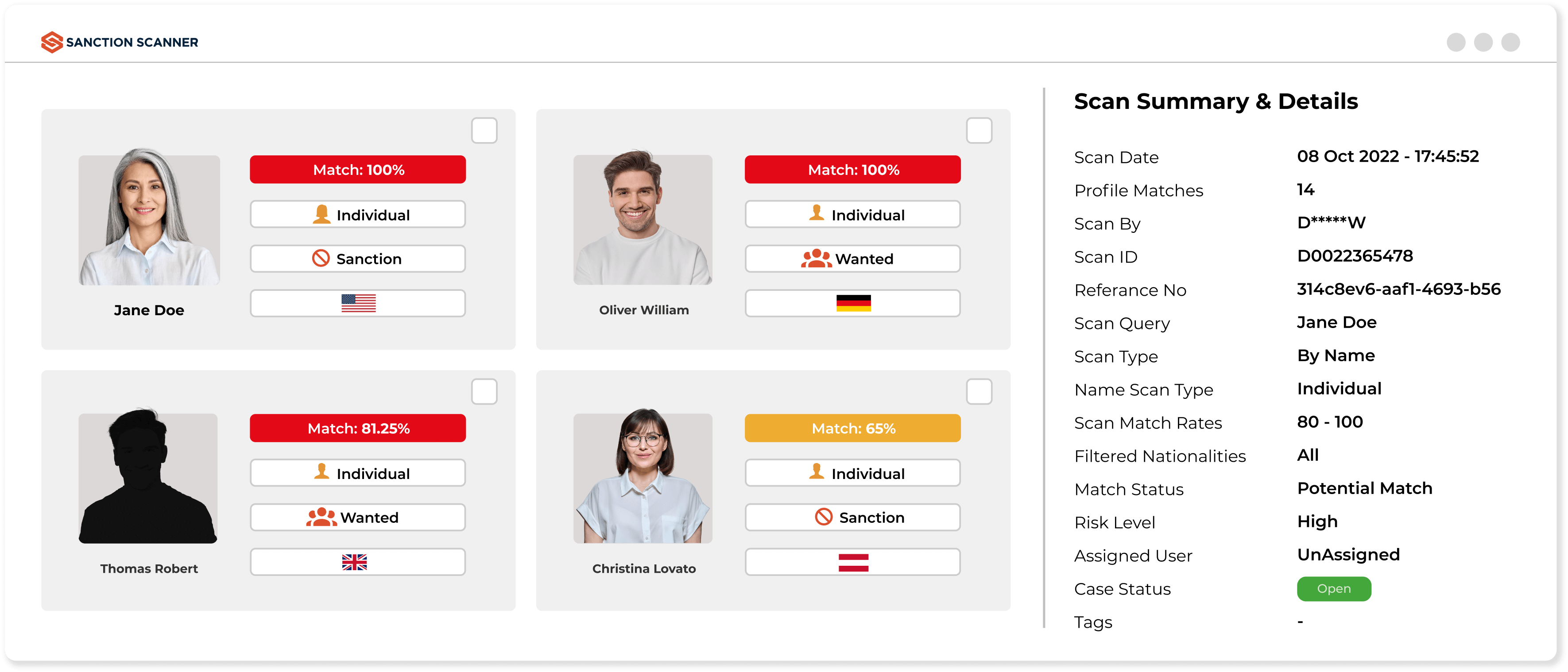

Sanction Scanner provides compliance software service for AML Compliance Officers. Many features such as Customer Onboarding and Monitoring, PEP and Sanction Screening, Know Your Customer and Customer Due Diligence, Automated Daily Ongoing Monitoring ensure that your company complies with regulations and prepares Anti-Money Laundering operations.

How Sanction Scanner Helps?

Here are a few reasons why Financial Crime Consultants and Law Firms choose Sanction Scanner

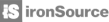

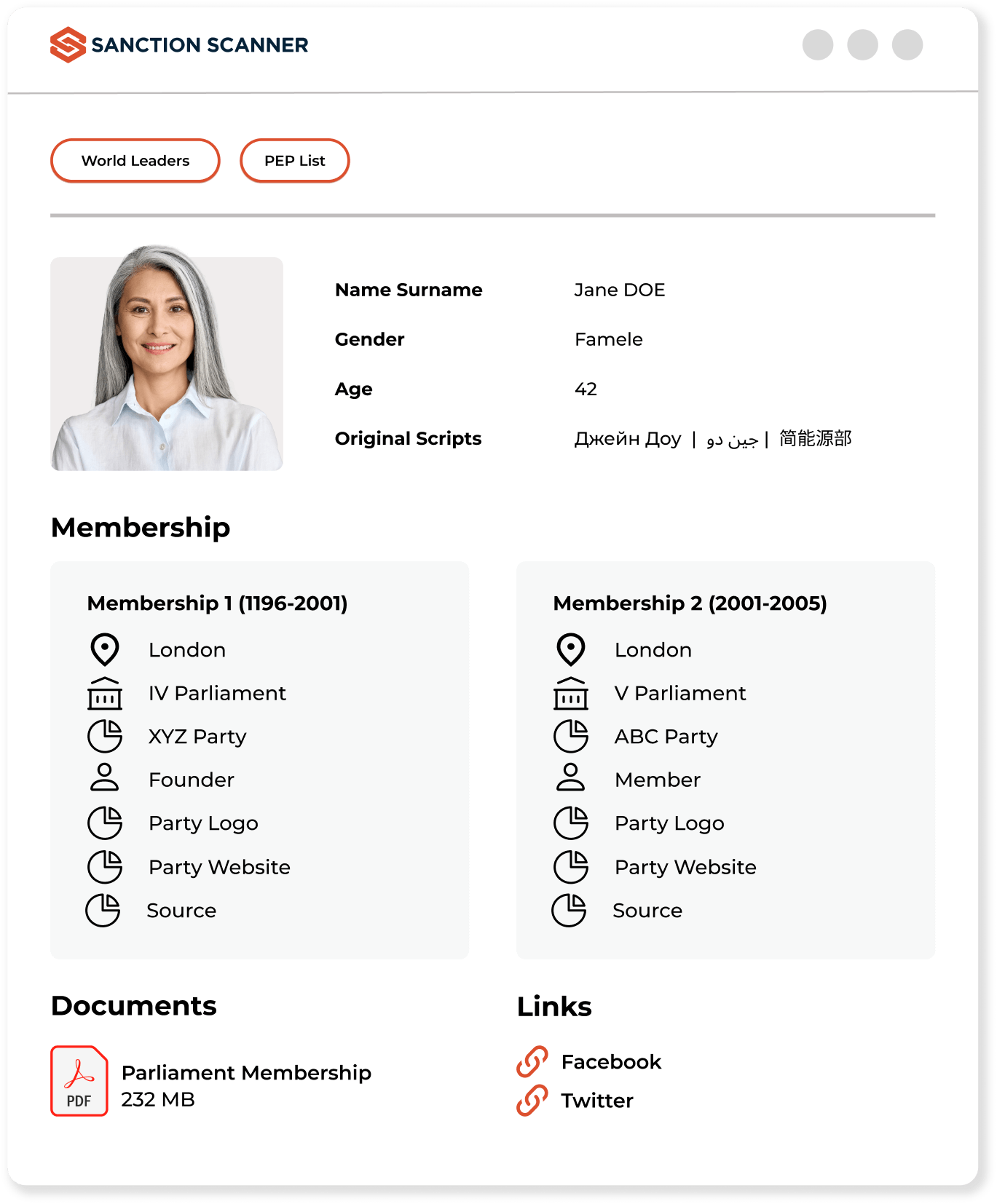

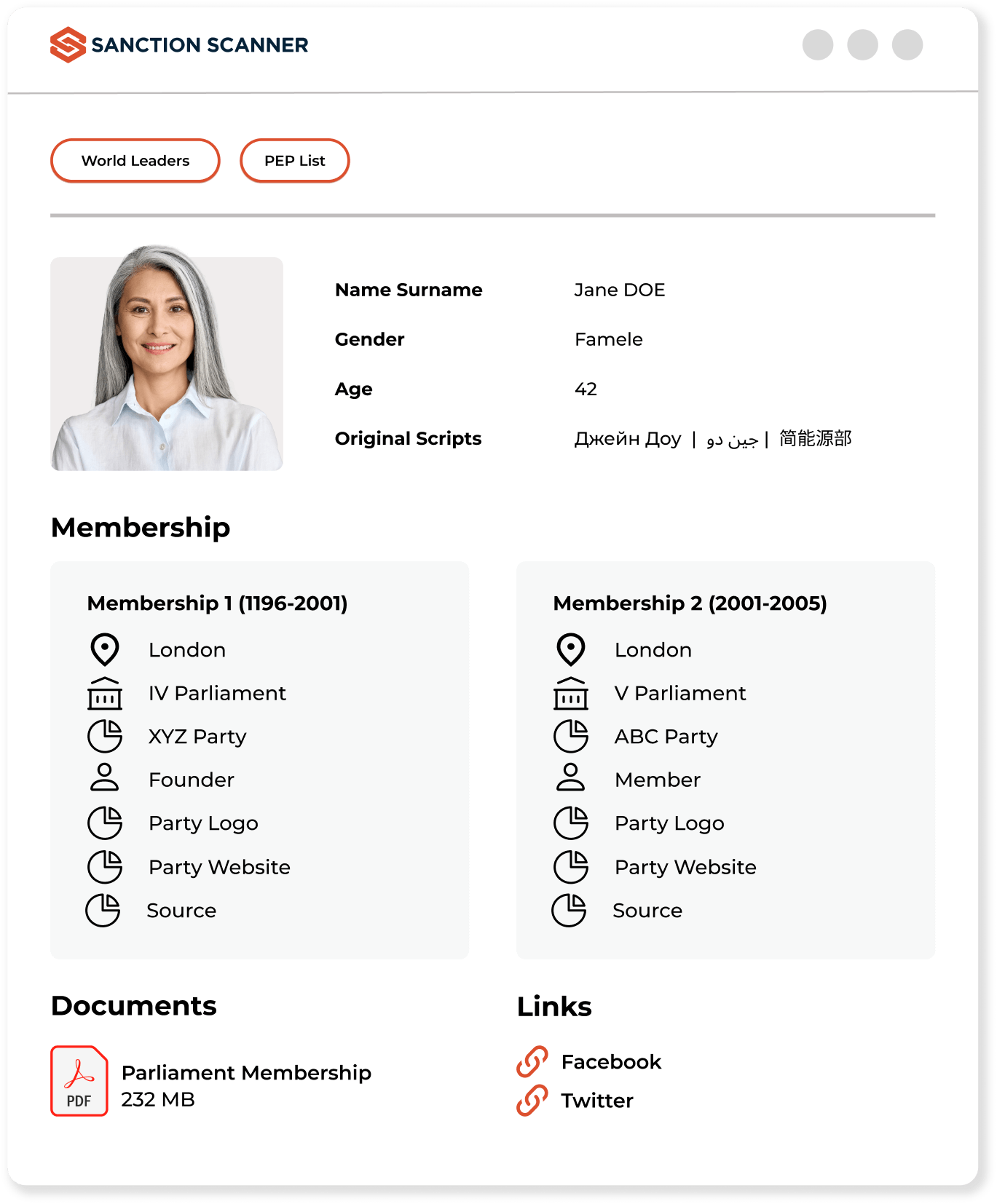

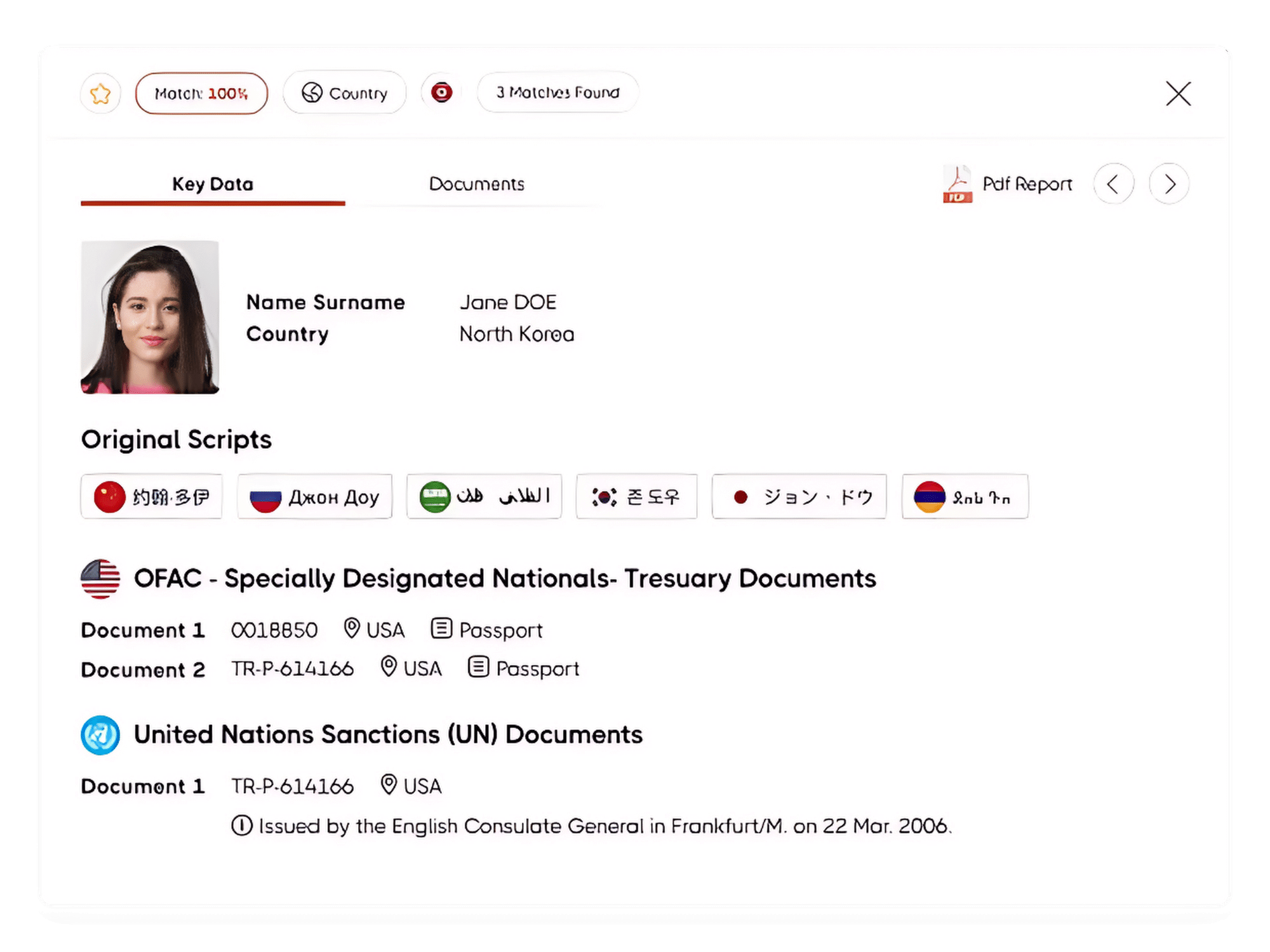

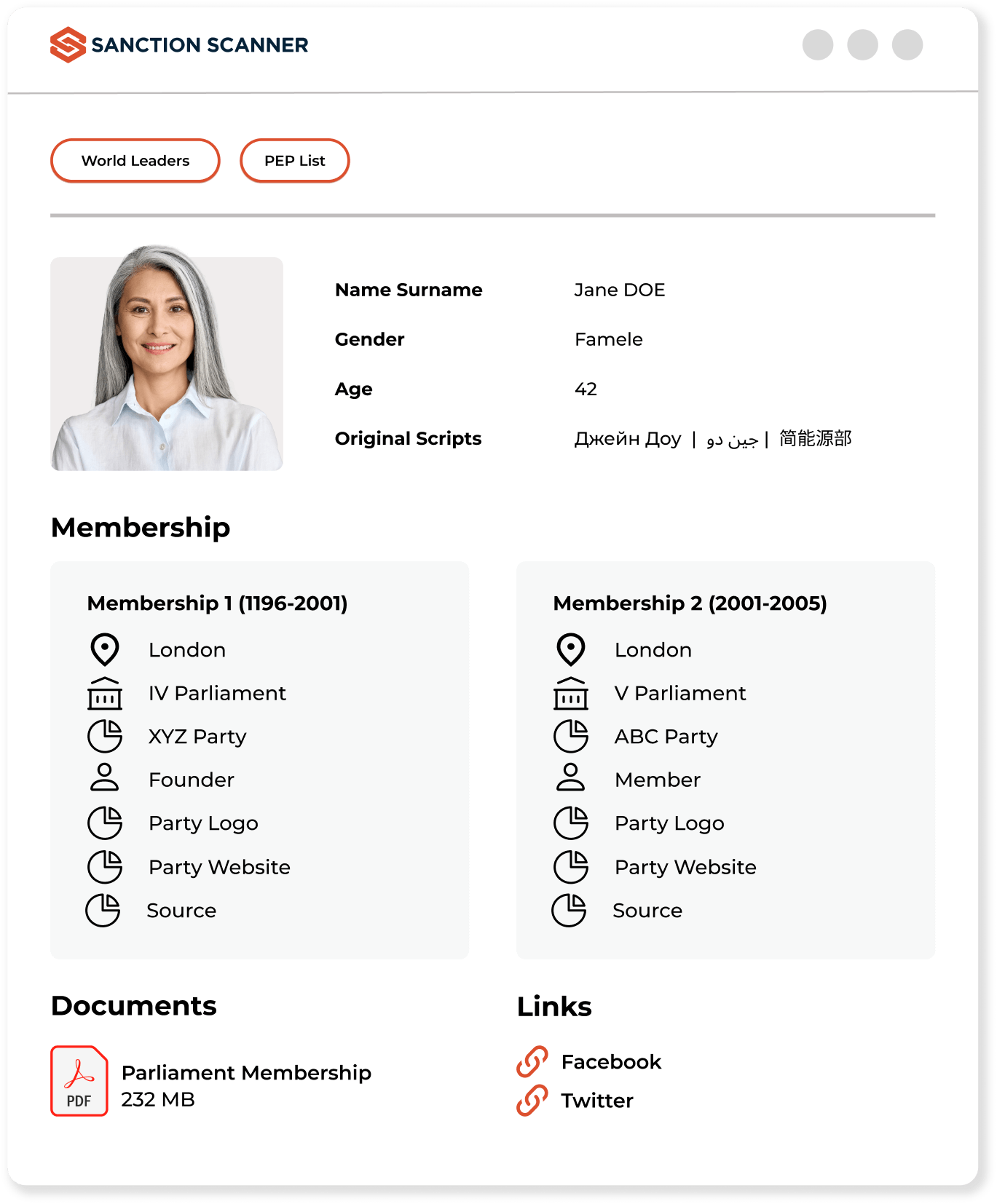

Enriched and Structured PEP Data

Sanction Scanner examines through lists of Politically Exposed Persons (PEP) and other customers with a high risk of financial crimes. We compile information about them in a detailed and organized manner. Meet the AML requirements of FATF, the European Union, and local regulators using our PEP Scanning Service. The lists are updated every 15 minutes, reducing the margin of error.

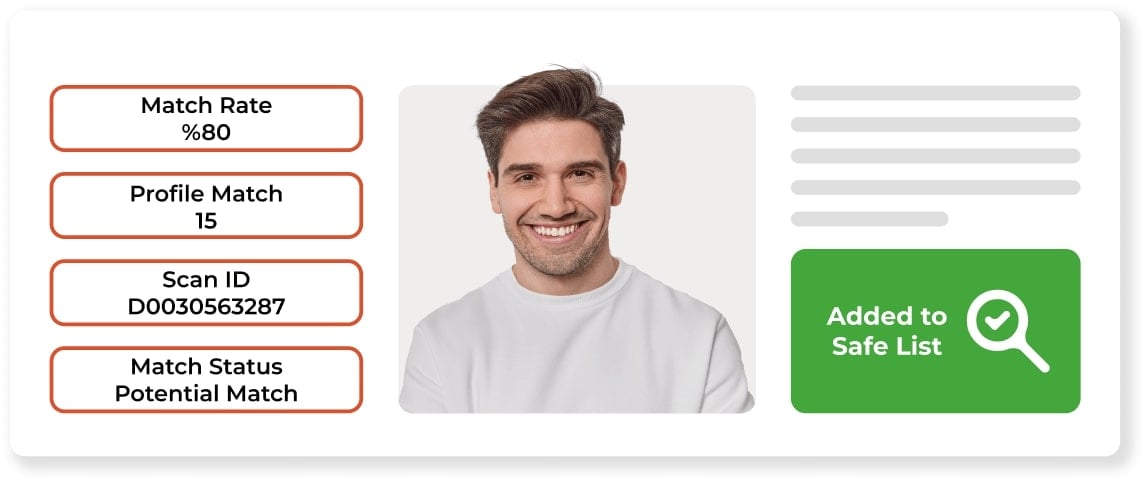

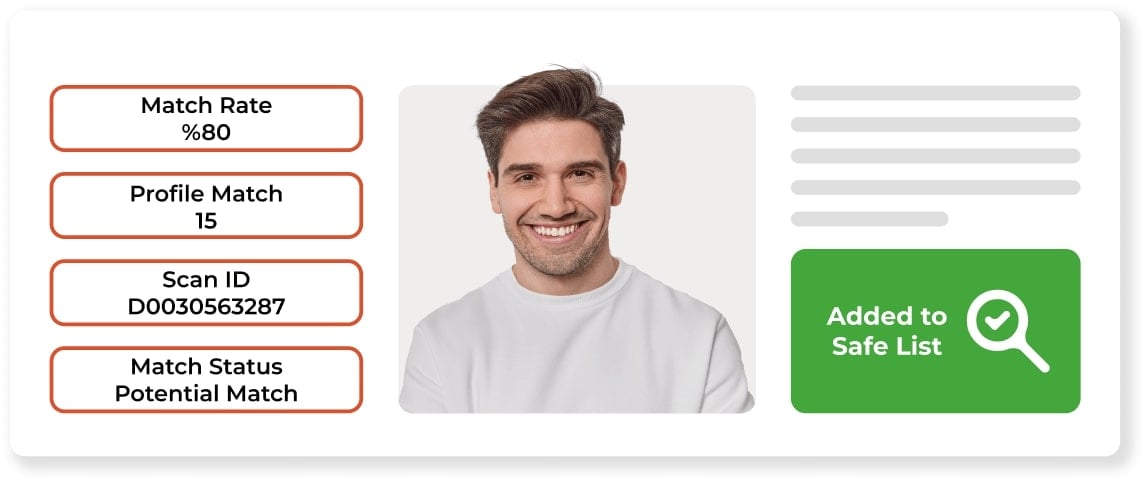

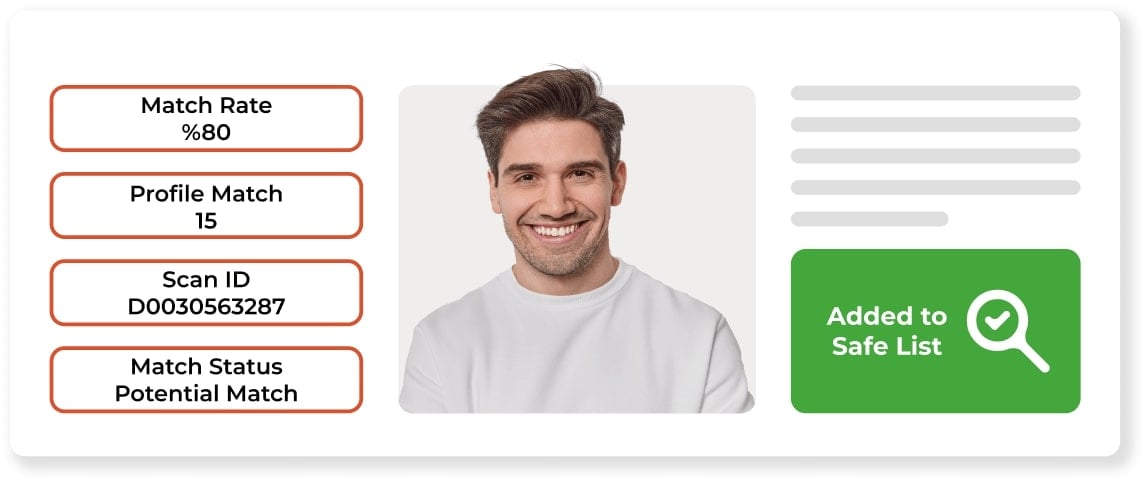

Automated Daily Ongoing Monitoring

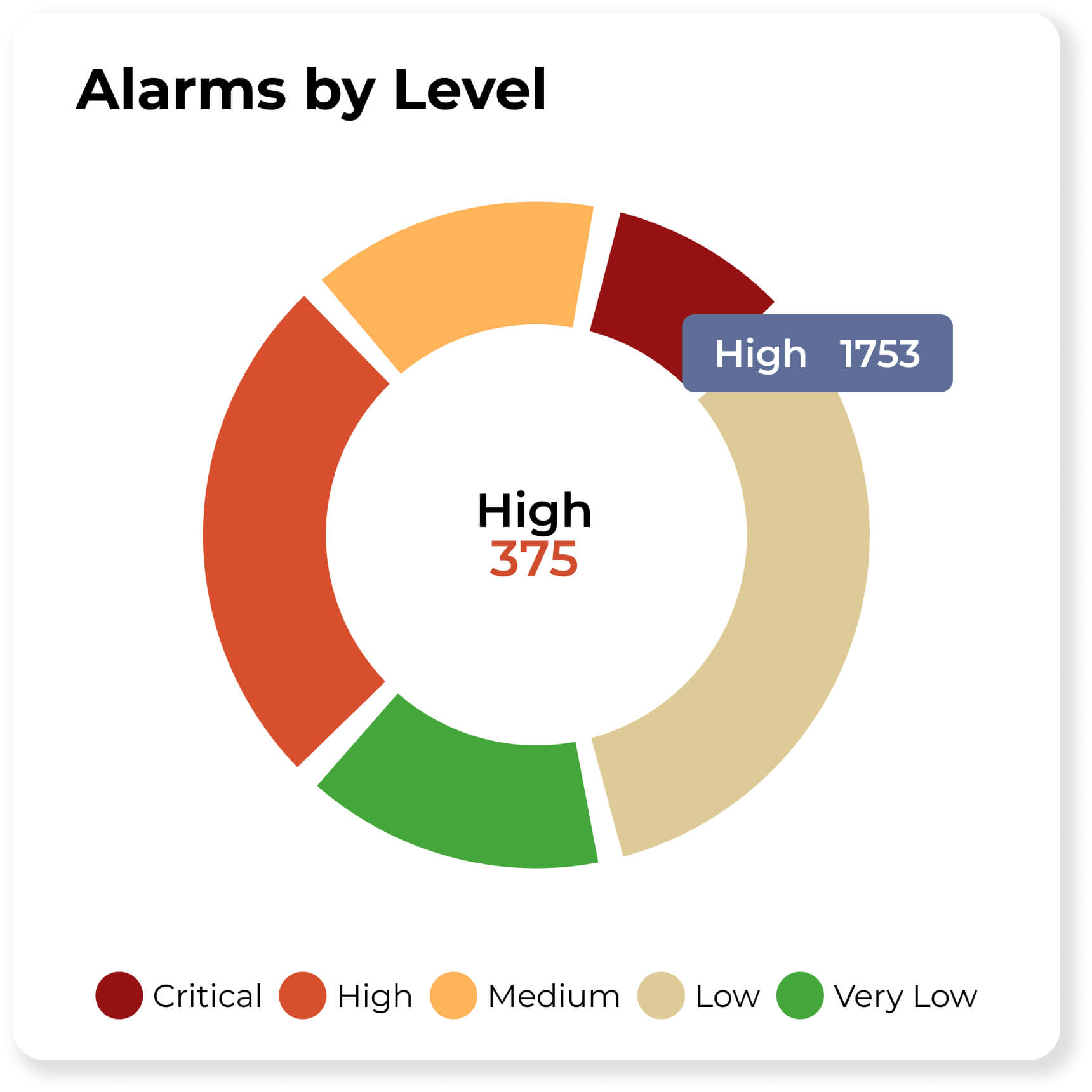

High-risk customers should be checked periodically due to the threat of crime. Automated Daily Ongoing Monitoring is applied to periodically check high-risk customers on Sanction and PEP lists. The Automated Daily Ongoing Monitoring Process protects businesses from risks such as non-compliance and loss of reputation. Businesses can plan the control time period according to their risk profiles; then, all customer monitoring checks are performed automatically by the Sanction Scanner.

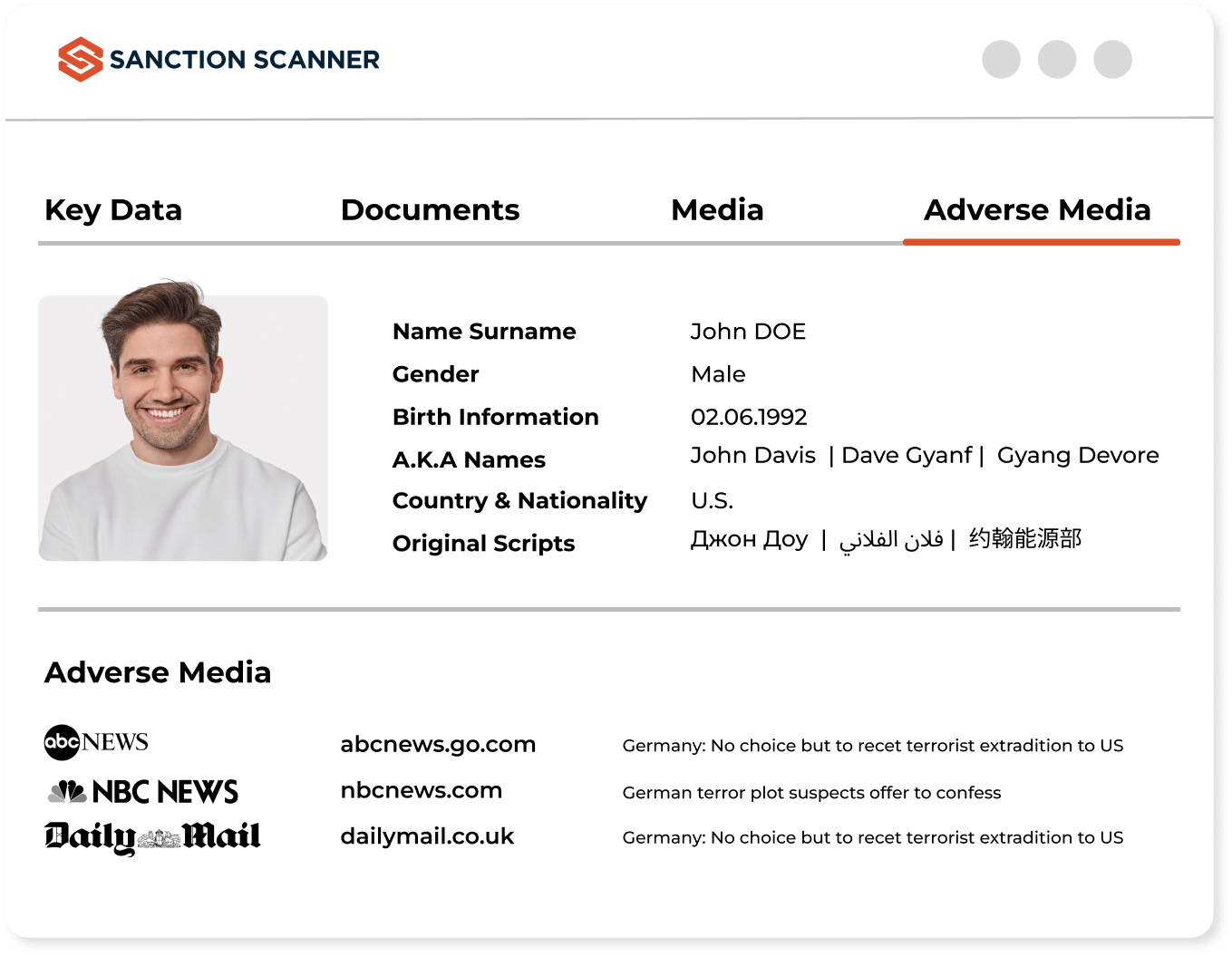

Multiple Search Options with API, Batch, and Web

Through its powerful, seamless and multiple API, you can easily integrate your projects into the system. With our Adverse Media solution, you can perform Adverse Media checks via API, batch files, or the web. Perform your checks with it, which is the most convenient method for your business.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE