Sanction Screening & Monitoring

Protect your business with our powerful sanction screening tool.

The go-to sanction list screening tool for 800+ companies.

Detect Risk Threats

You can make the control process faster and safer with our Sanction & PEP Screening products. Scan your customers in 3000 Sanctions, PEPs, and Watchlists data from 220+ countries during customer onboarding and customer monitoring processes. Strengthen your business' AML compliance and detect risks that might harm your business.

+3000

DATA POINTS CHECKED

+220

COUNTRIES COVERED

15 min

ALWAYS REAL-TIME DATA

150 ms

SCANNING

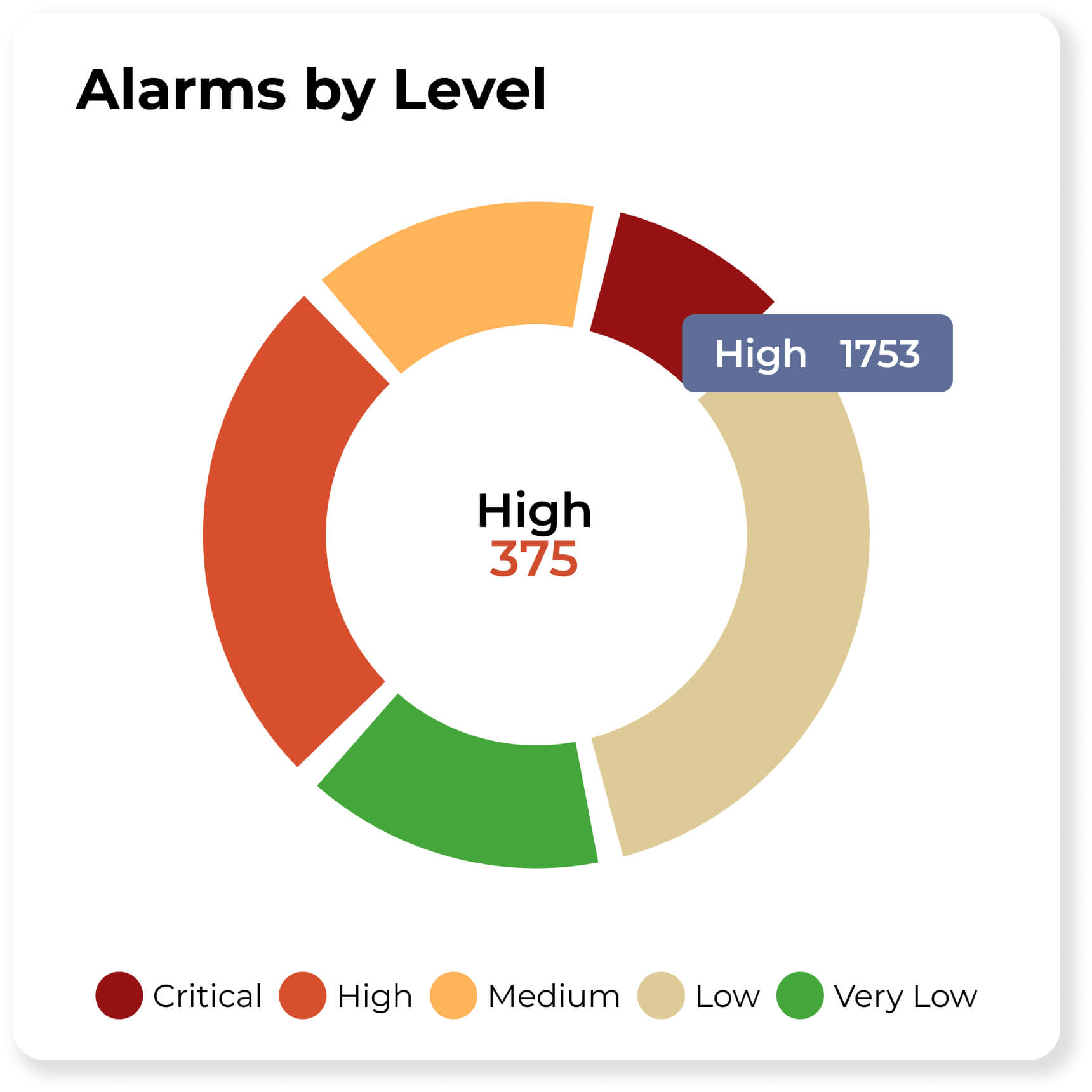

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

Scan Sanctioned Countries

You can scan sanctioned countries or search by country names manually.

Ensure AML Compliance and Avoid Regulatory Penalties

Sanction Scanner offers solutions for your business to meet AML Compliance with our global AML & PEP data. Strengthen your business' AML Compliance globally with our solutions developed according to FATF and European Union regulations.

Featured news and press releases

Sanction Screening & Monitoring

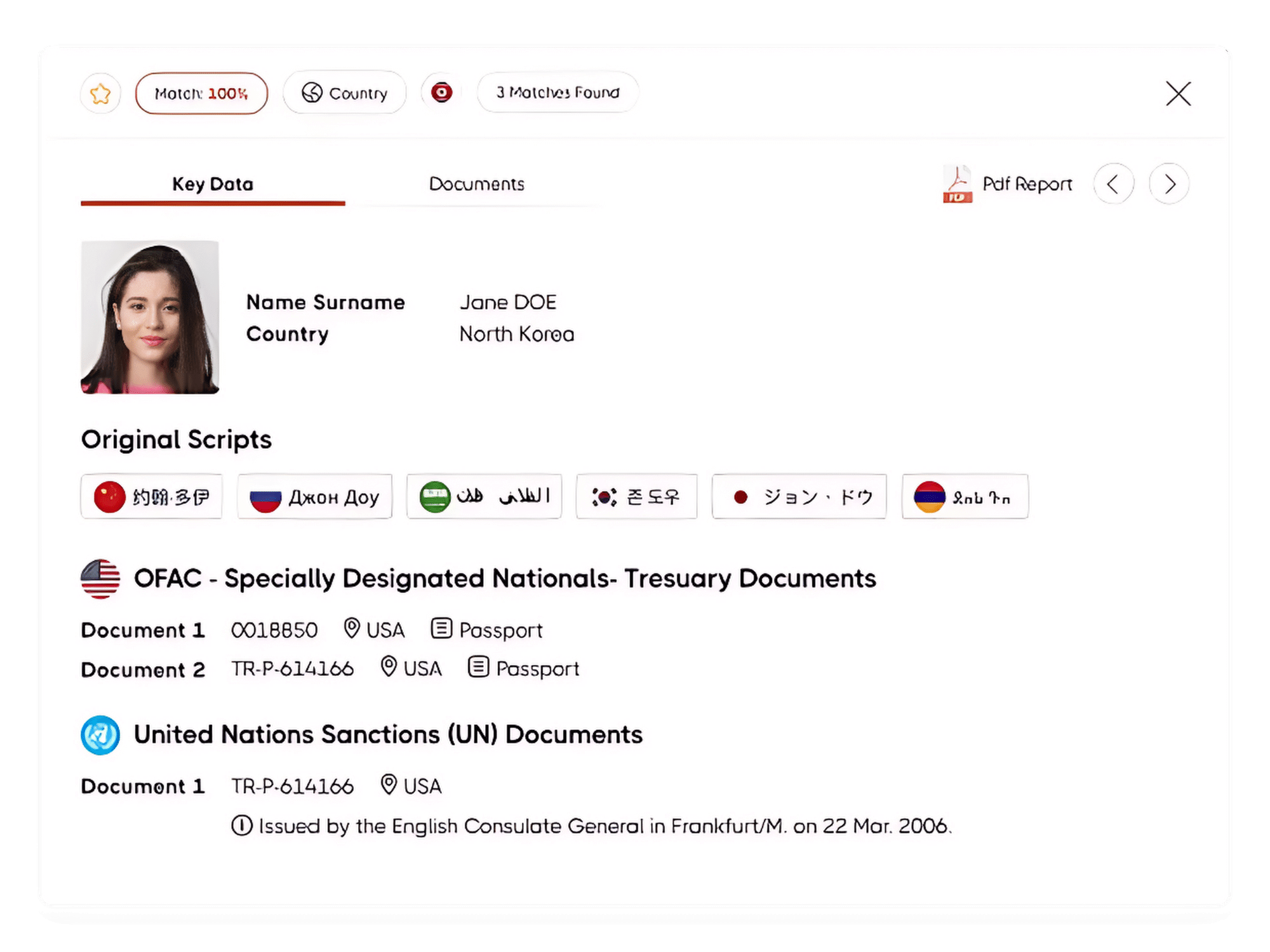

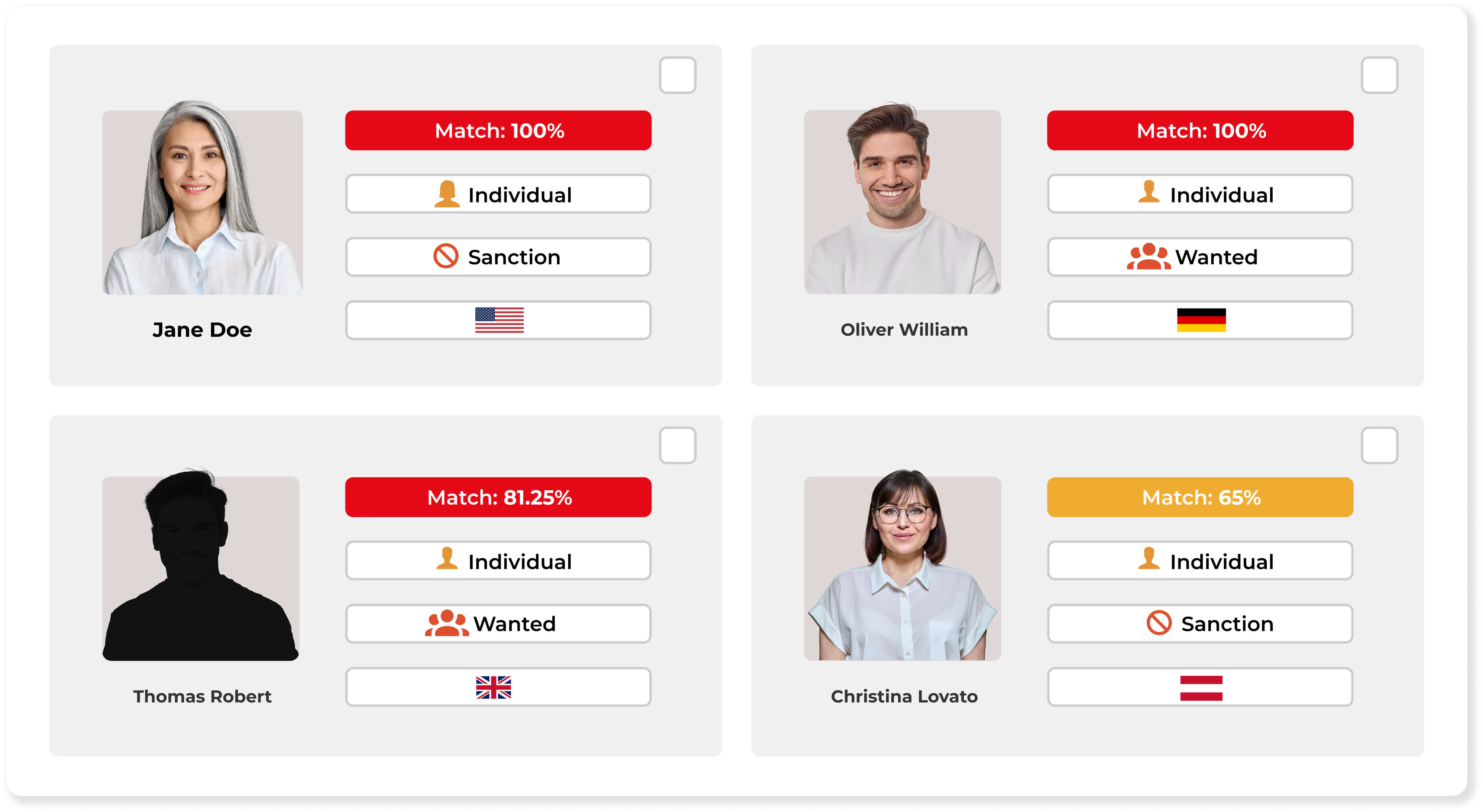

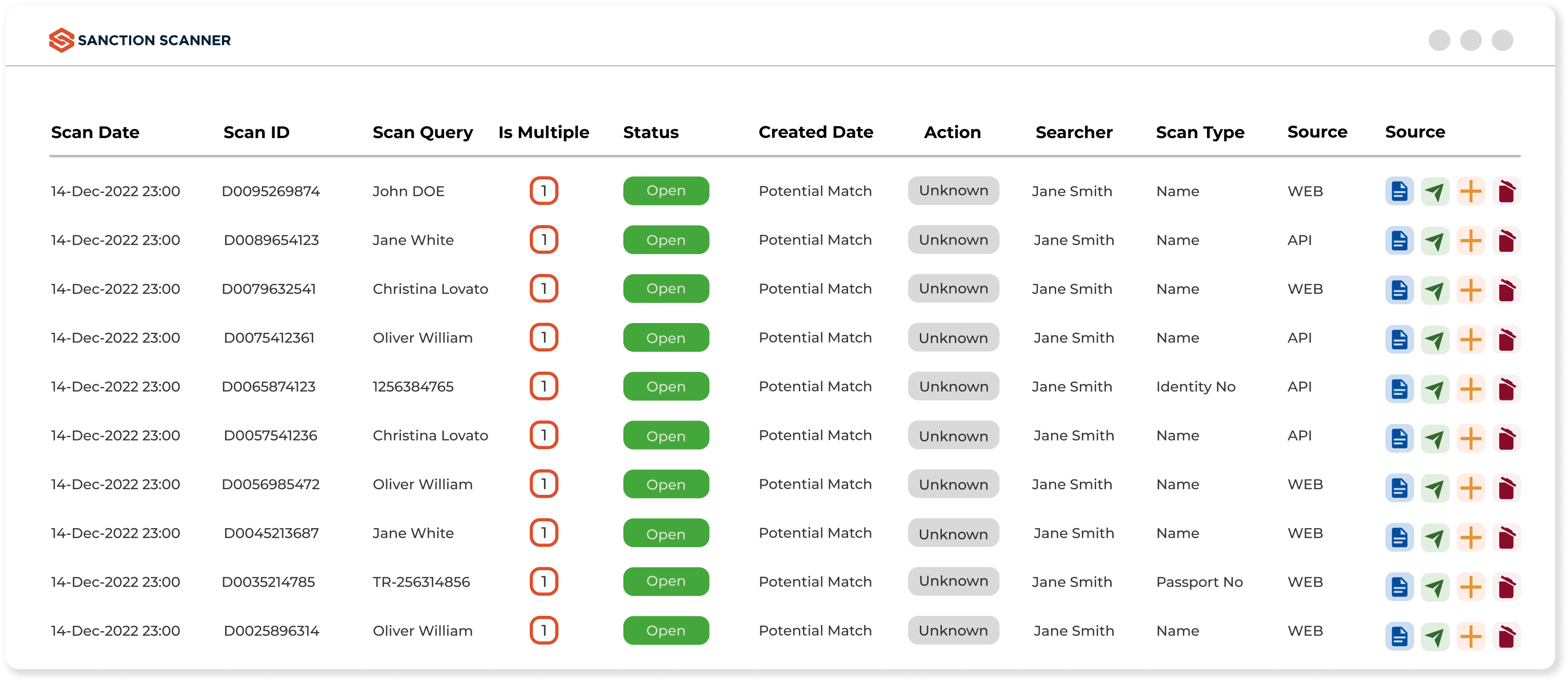

Sanctions list screening is the process of screening people and entities against international and regional sanctions lists to prevent money laundering, terrorist funding, and other financial crimes.

Sanction Scanner's screening solution regularly cross-checks customer data with international sanctions lists such as OFAC, UN, and EU to discover and flag suspicious transactions.

Regulators require organizations to screen their clients to avoid doing business with sanctioned parties or individuals. Failure to do so can result in hefty fines or revocation of operating licenses.

Sanction Scanner helps organizations meet global AML compliance, reduce compliance risk, and protect their reputation by screening sanctions in an automated manner.

Most often screened sanction lists are OFAC SDN, UN Sanctions, EU Consolidated, UK HMT, and DFAT.

Sanction Scanner screens more than 3,000 international and domestic lists from more than 220 countries, offering comprehensive and up-to-date coverage for all screenings.

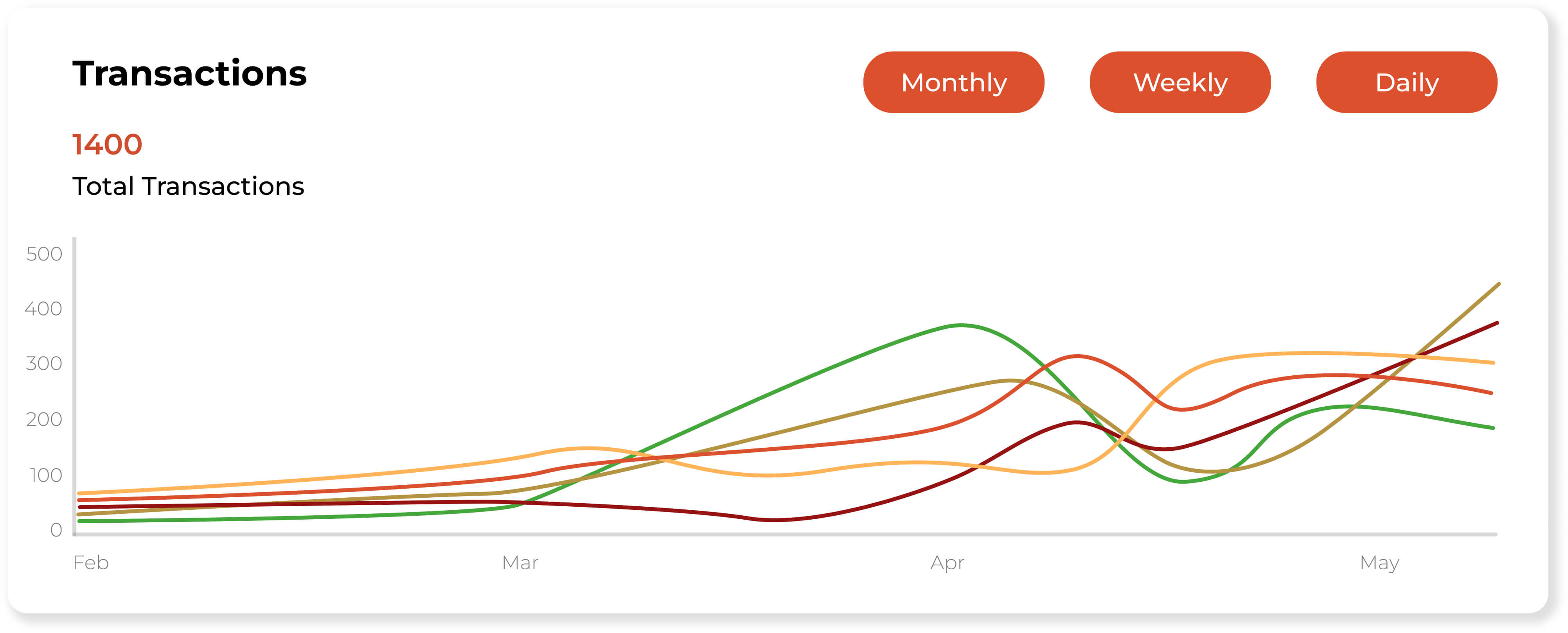

Continuous sanctions monitoring entails regularly screening customers and transactions in real-time during and after onboarding for new sanctions updates.

Sanction Scanner's Ongoing Monitoring scans your customer database automatically and informs you in real-time when fresh sanctions become available.

Losing a sanctions match can lead to very serious consequences such as regulatory fines, frozen assets, and the withdrawal of business licenses.

Sanction Scanner minimizes the risk to almost zero using real-time alerts and continuous list refreshes, so no potential match is ever missed.

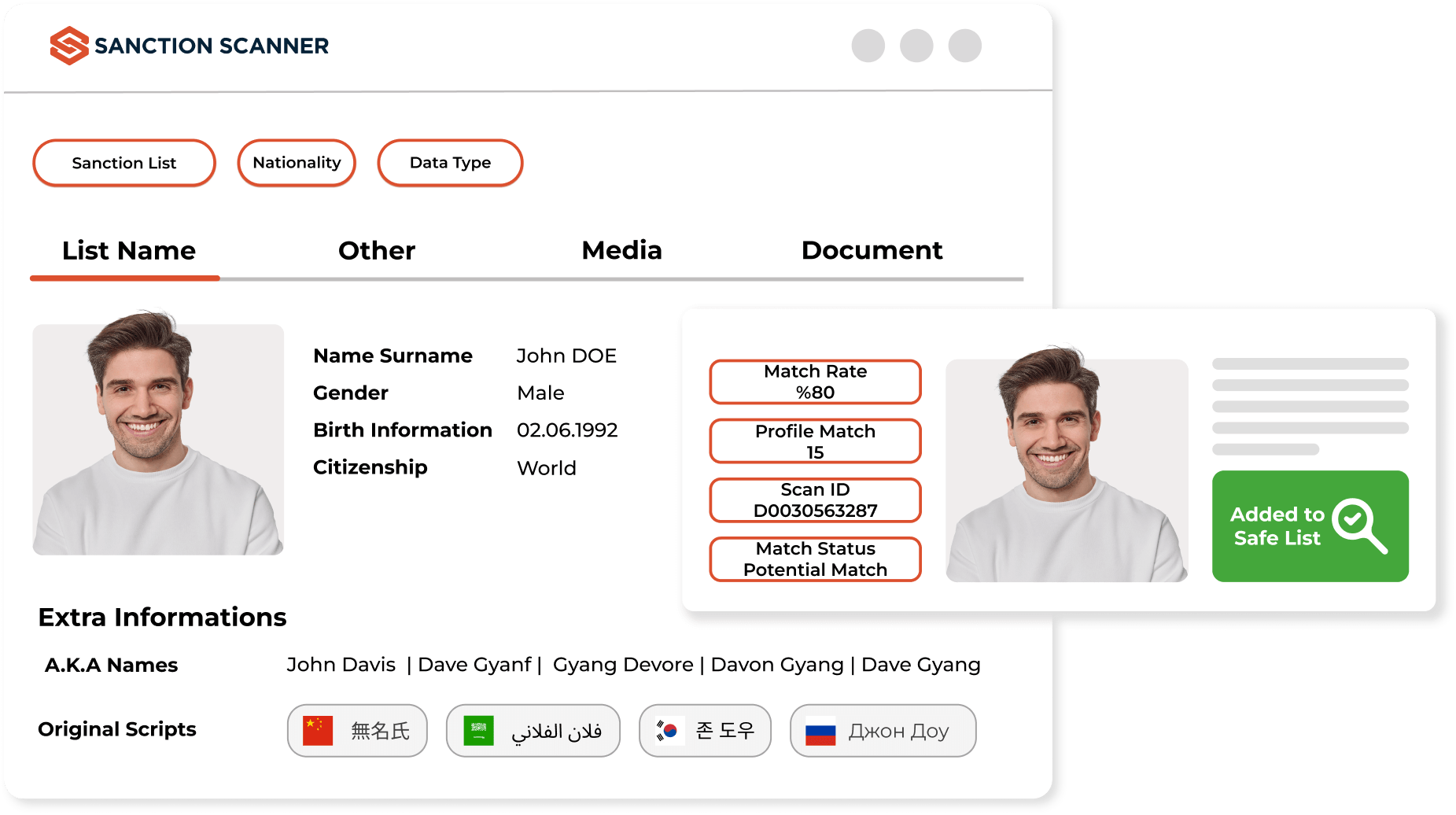

Yes. Sanction Scanner's ultimate AI-Driven fuzzy matching detects name variations, spelling variances, and aliases.

Sanction Scanner employs fuzzy logic, phonetic search, and secondary identifiers such as date of birth or location to match records effectively while keeping false positives low.

Sanctions lists update on a regular basis as governments and regulators release new updates.

Sanction Scanner updates all international lists every 15 minutes to present the most recent data and ensure your compliance team has access to the most recent information.

Sanctions screening is needed in regulated industries such as banking, payments, crypto, insurance, and legal services.

Sanction Scanner addresses all major industries and aligns with diverse regulatory frameworks, including FATF, OFAC, FCA, and EU AMLD.

Sanction Scanner offers an integrated AML platform consisting of sanctions, PEP, and watchlist screening.

With the benefit of real-time updates, fuzzy matching, and risk scoring, Sanction Scanner equips businesses with the ability to enjoy full sanctions compliance on all customer and transaction operations.

Yes. Incorporating sanctions screening into onboarding or payment workflows guarantees real-time risk identification before a transaction.

Sanction Scanner's API facilitates straightforward integration with onboarding, payment, and case management systems for real-time, automated screening.