Sanction and Watchlists

Prevent Financial Crimes and Ensure AML Compliance with Global Comprehensive Data.

The choice of 800+ firms for sanction and watchlist screening.

Detect Risk Threats

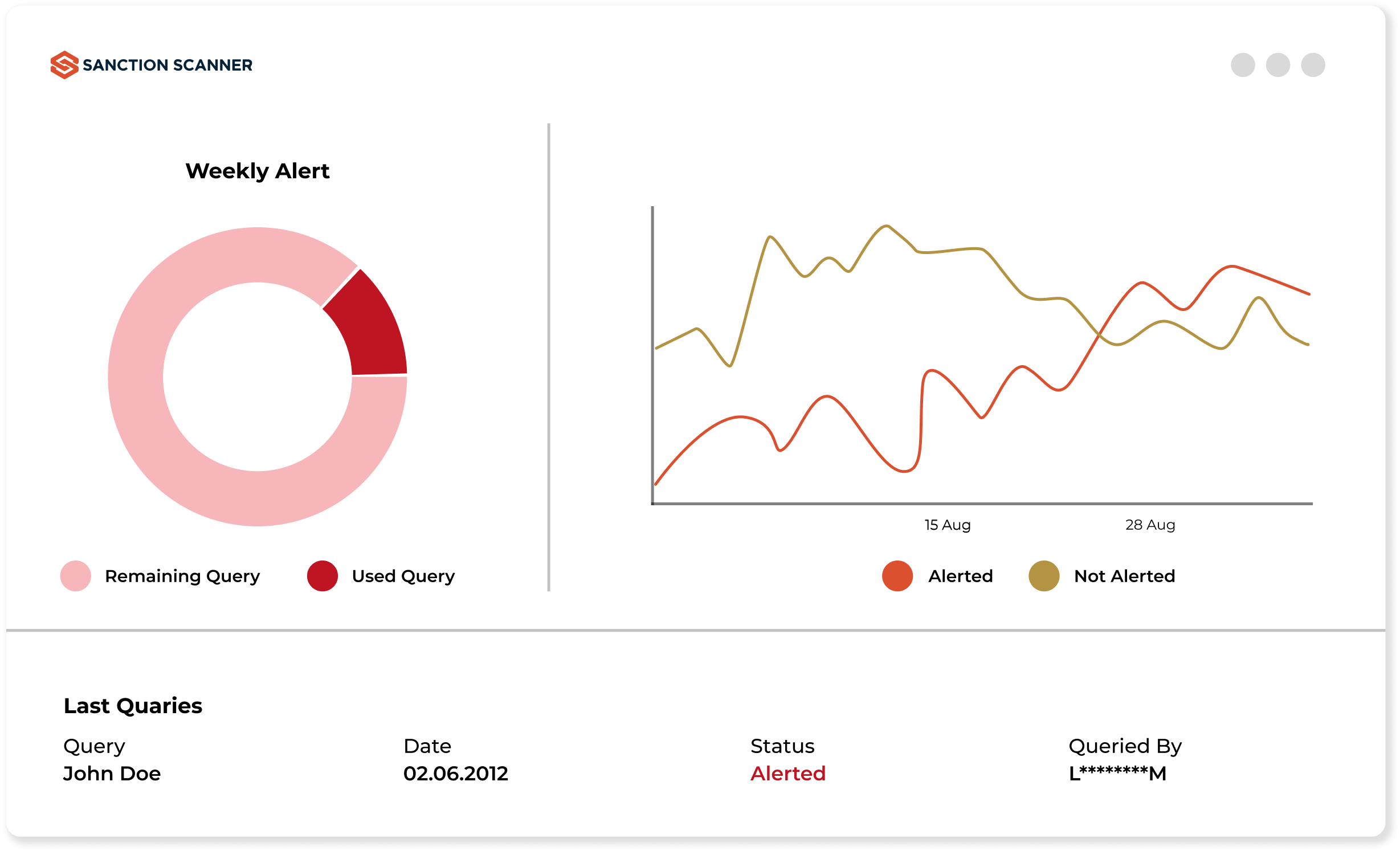

Business must scan their customers on sanctions lists to meet global and local AML requirements. There are more than 3000 sanction lists that change often. Institutions can automate their workload with AML Solutions Sanction Scanner provides.

Global Comprehensive Sanction Data

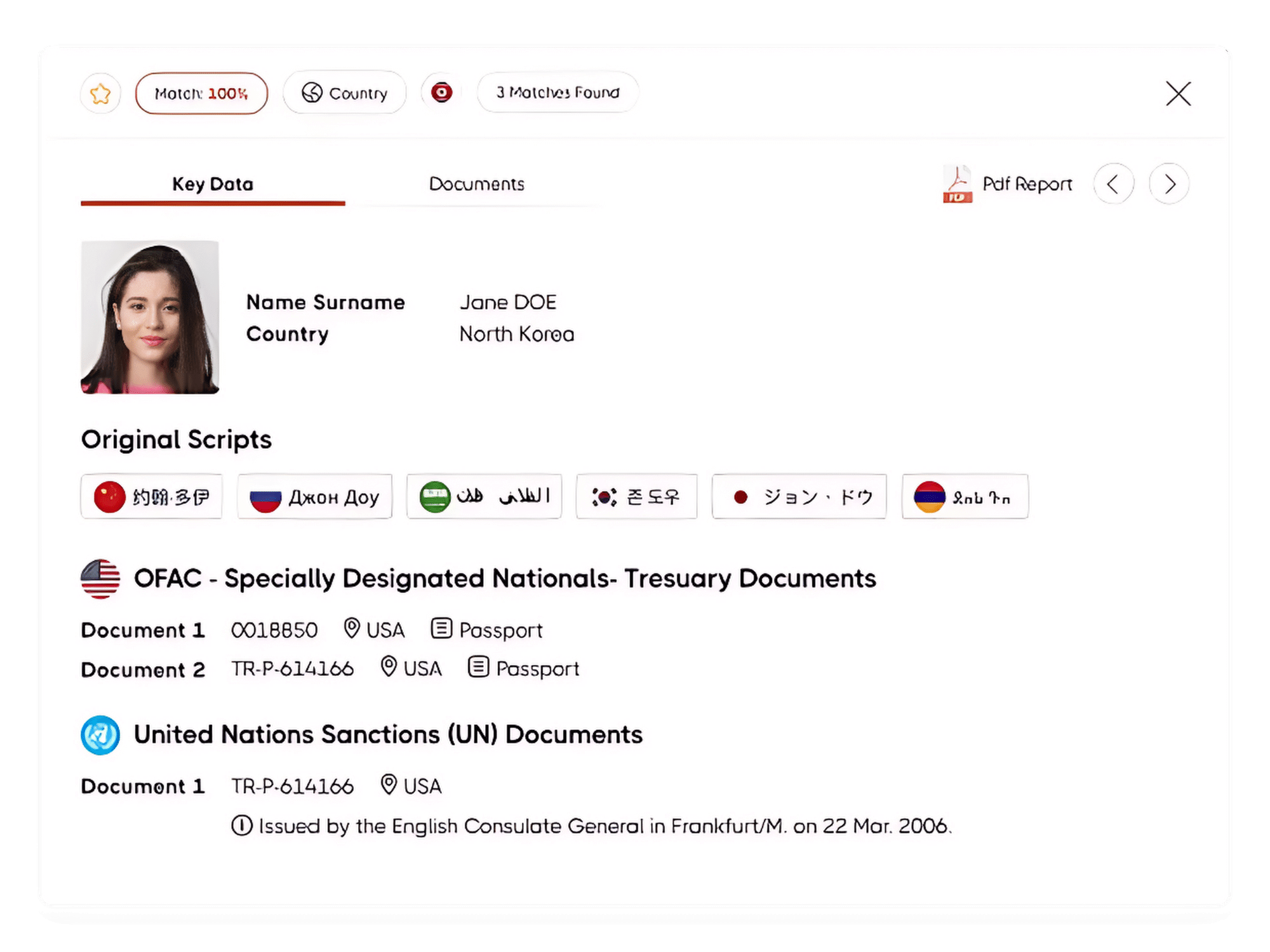

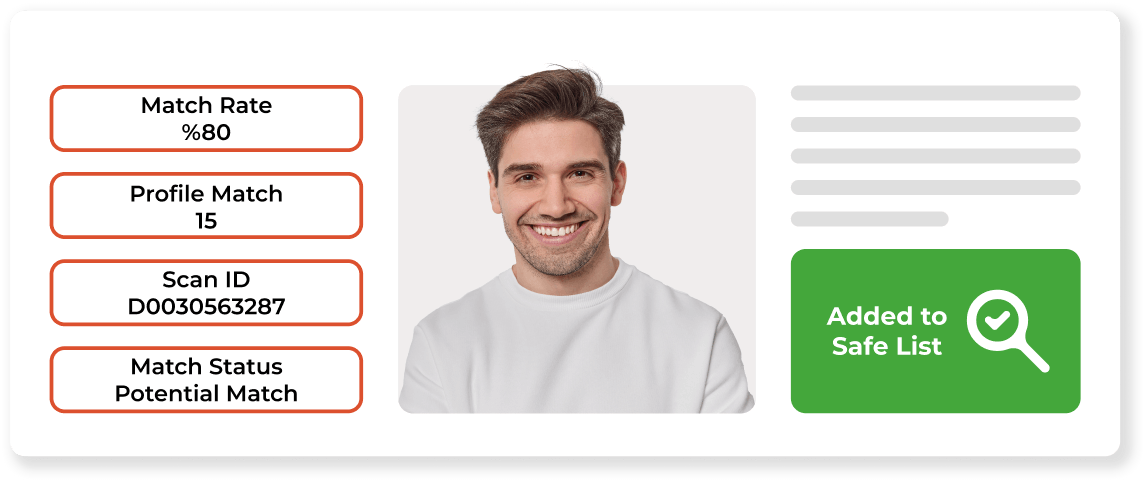

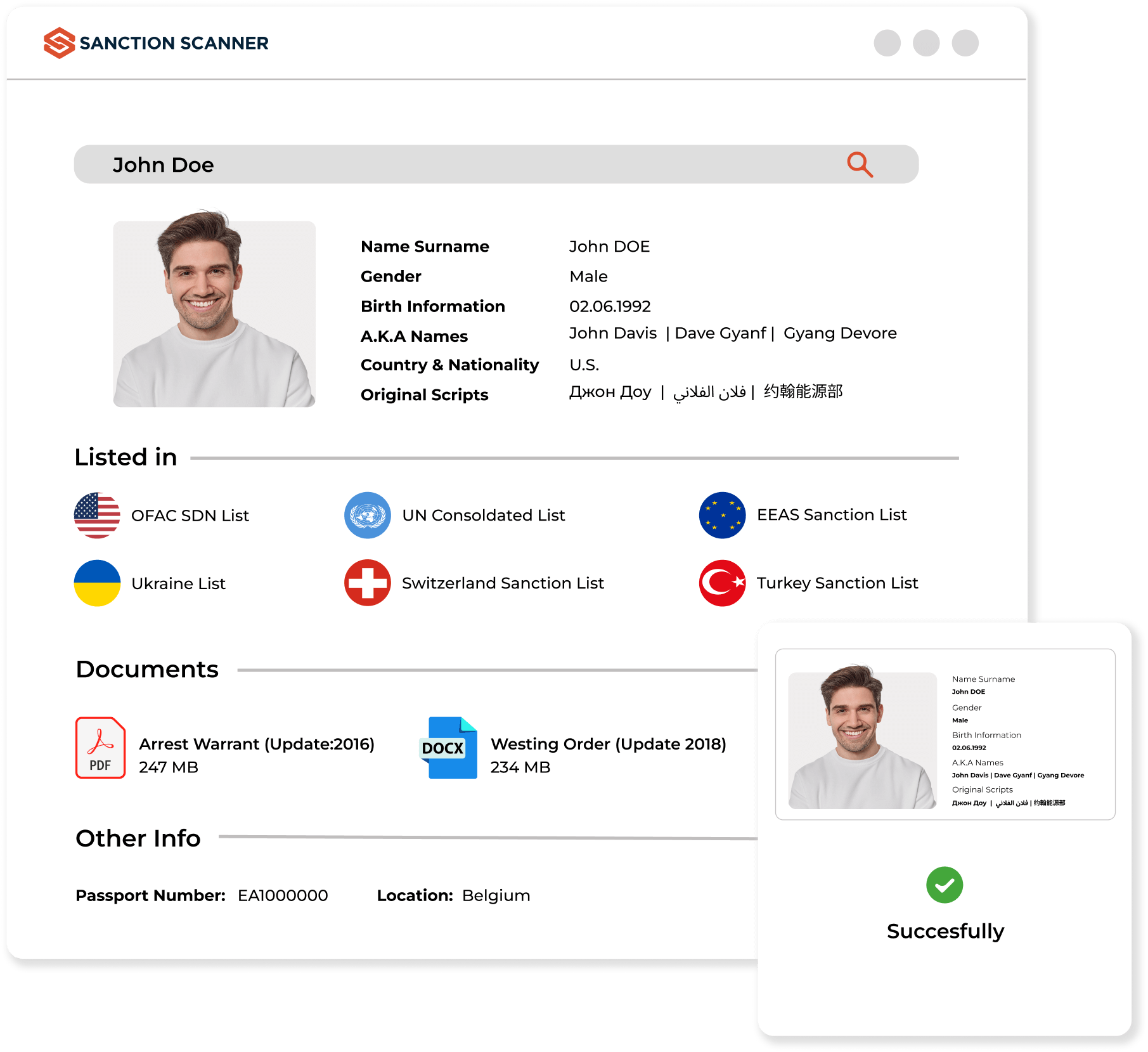

Sanction Scanner collects and structures more than 3000 sanctions and watchlists worldwide with the power of AI. In addition, businesses can search their customer based on their name, ID number, or passport number or create custom search options to reduce false positives.

- Constantly adding new lists

- Updated lists (every 15 minutes)

- Easy API integration

- Search by A.K.A. and Search by Original Script feature

- Export search history feature

- Batch Query feature

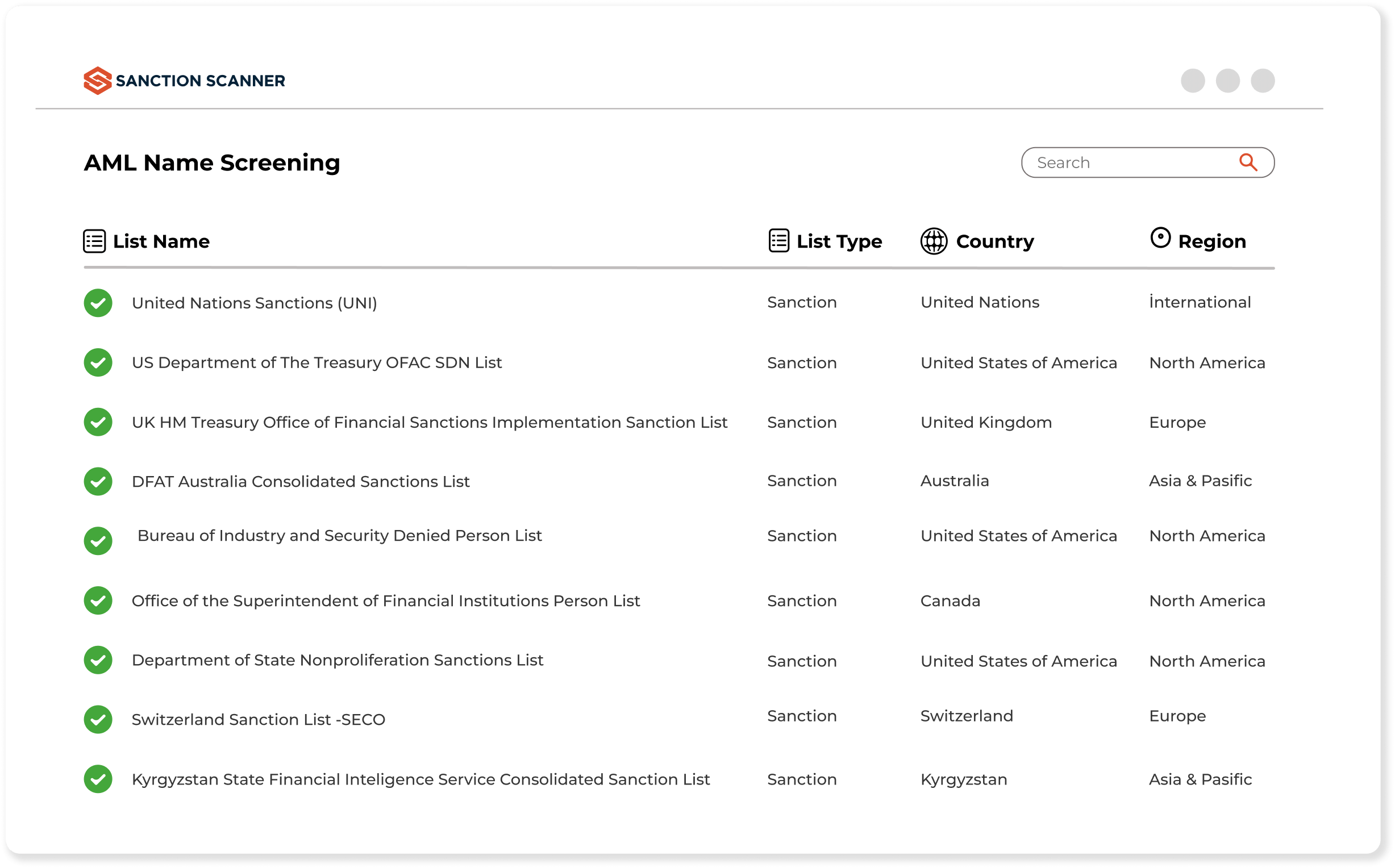

Which Lists Are Included in Sanction Scanner Data?

- United Nations Sanctions (UN)

- US Consolidated Sanctions

- OFAC — Specially Designated Nationals (SDN)

- Office of the Superintendent of Financial Institutions (Canada)

- EU Financial Sanctions

- UK Financial Sanctions (HMT)

- Australian Sanctions

- Her Majesty’s (HM) Treasury List and 1000+ different government lists

Scan Sanctioned Countries

Businesses can scan sanctioned countries by their names and view the sanctions applied and which sanctions their businesses are affected by. In addition, this feature lets you scan by name among sanctioned countries using a nationality filter.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

Ensure AML Compliance

with Sanction Scanner

AML Transaction Monitoring

Reduce false positives and strengthen your compliance process.

Learn MoreAdverse Media Screening

Strengthen AML Compliance With Global Comprehensive Adverse Media Data

Learn More