AML Solutions for Investment Firms

AML compliance is easier than ever for the Investment Industry.

TRUSTED BY OVER 800+ CLIENTS

We bring solutions that will make it easier for our customers to comply with AML Regulations.

AML and KYC Compliance Solutions for Investment Industry

Investment firms, wealth management organizations, private equities, investment banks, and others face challenges in customer onboarding processes, customer transactions, and monitoring ongoing customer behavior. Meet Sanction Scanner AI-Driven AML/CFT software to overcome these challenges,

Fast Customer Onboarding with Minimized Risk

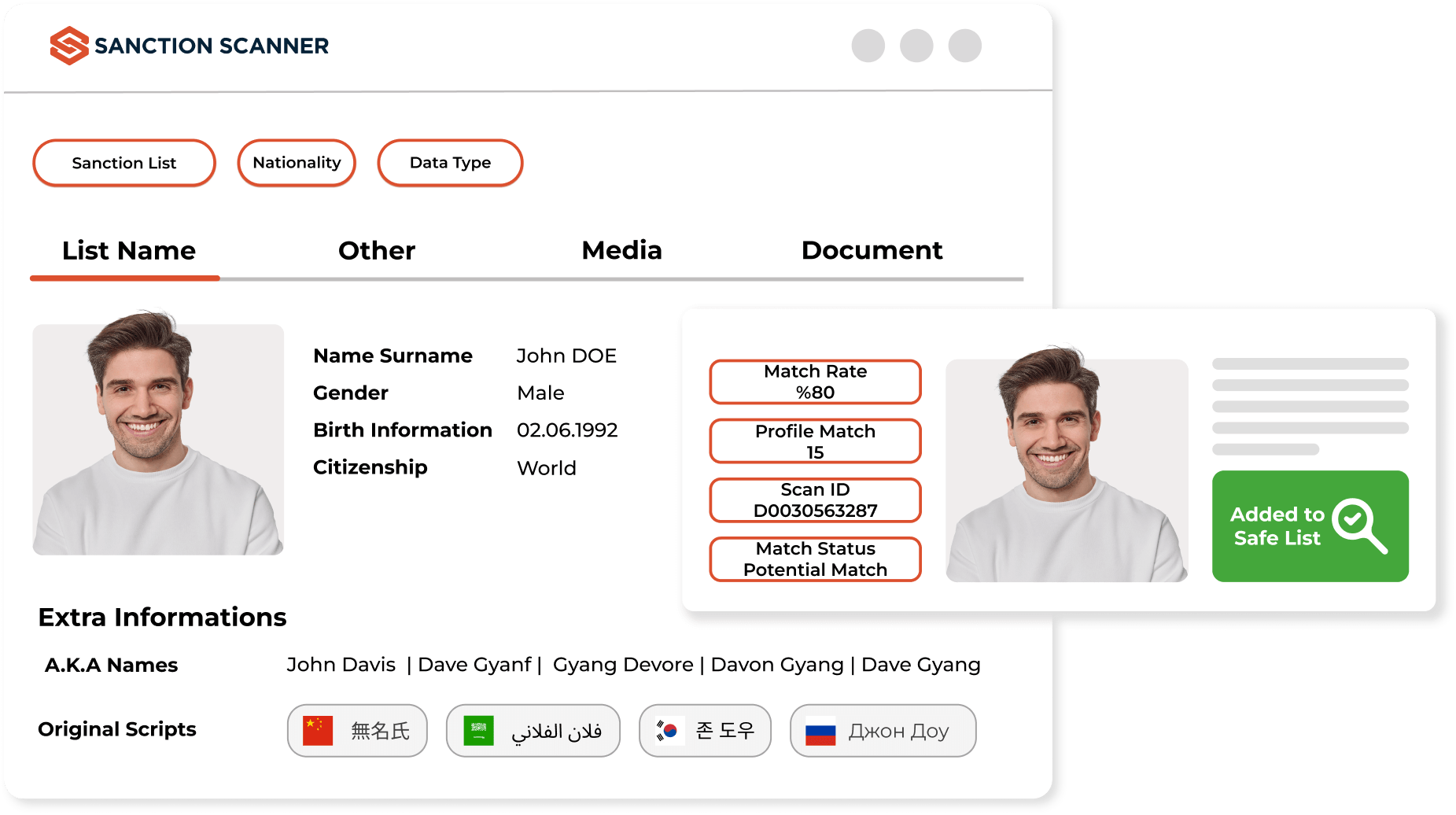

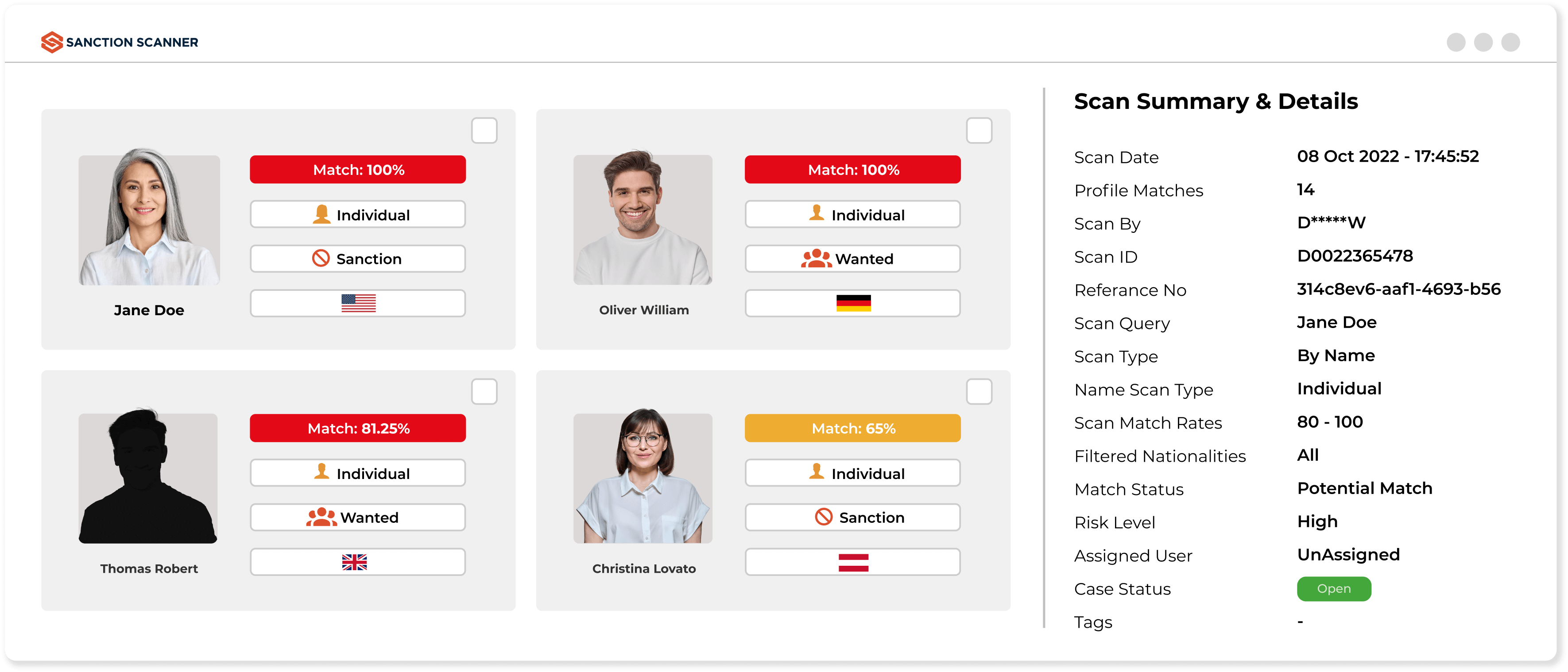

The customer onboarding process is crucial for investment firms. Firms aim to provide fast and safe service to improve their customers experience. Investment instituations meet AML obligations in account opening process for their customers with our AML Screening Software. Our products check Global Sanction Lists, PEP lists, and Adverse Media Data to find your customers that might harm your company and warn you.

High-Level Customer Experience

Customers' onboarding experience is getting more effortless and more seamless with Sanction Scanner. Firms have to automate Know Your Customer (KYC) and Client Onboarding processes, transactions and minimize manual workload. Sanction Scanner's flexible and robust APIs fit investment firms' Anti-Money Laundering requirements.

Comply with Investment Regulations

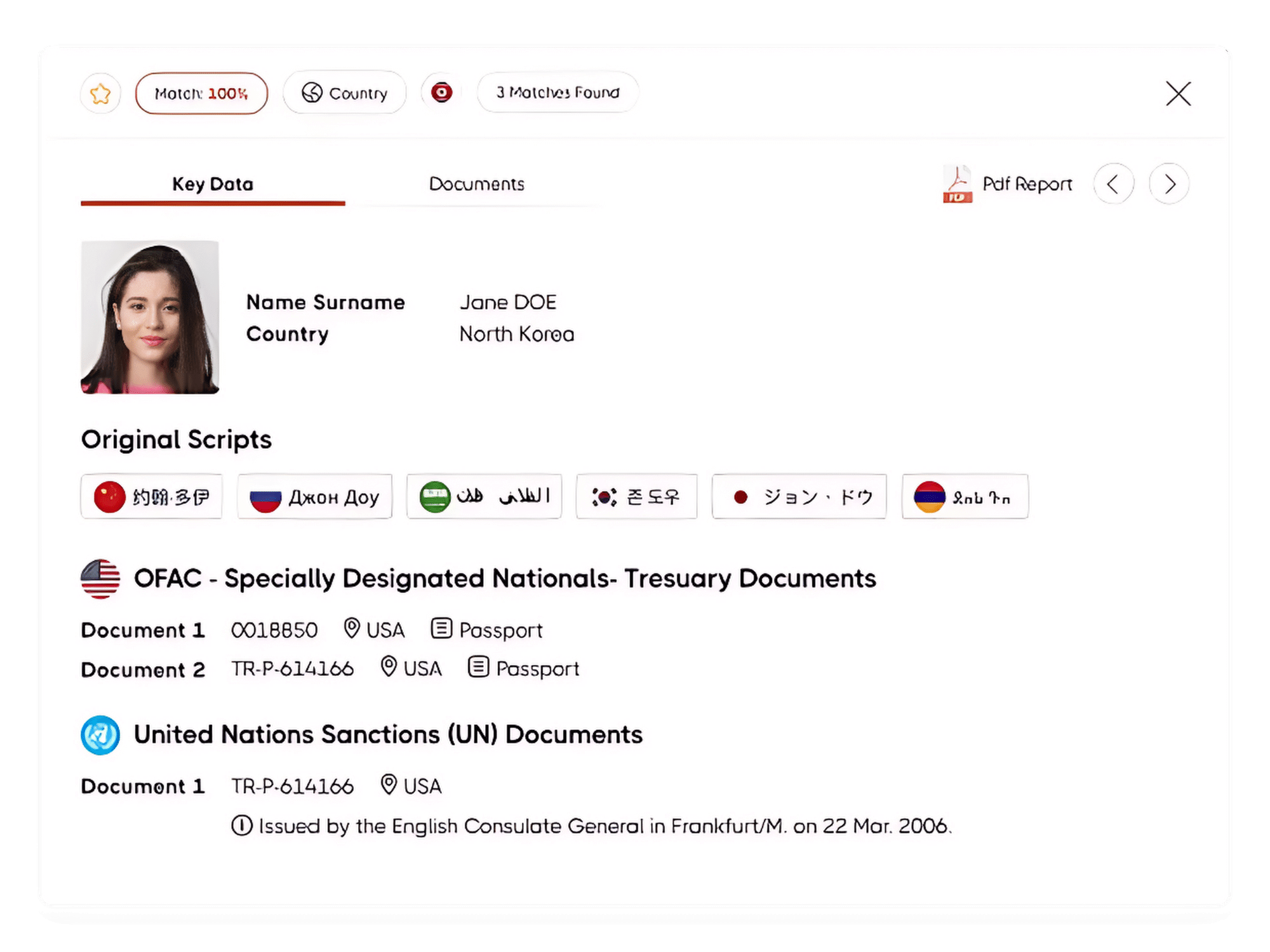

Anti-Money Laundering and Countering Financing of Terrorism regulations are different in every country, and regulations change often. However, our AML Screening Software complies with international regulations using its data updated every 15 minutes.

Ensure AML Compliance

with Sanction Scanner

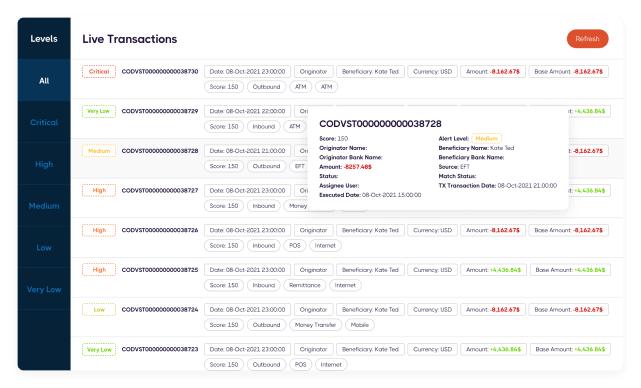

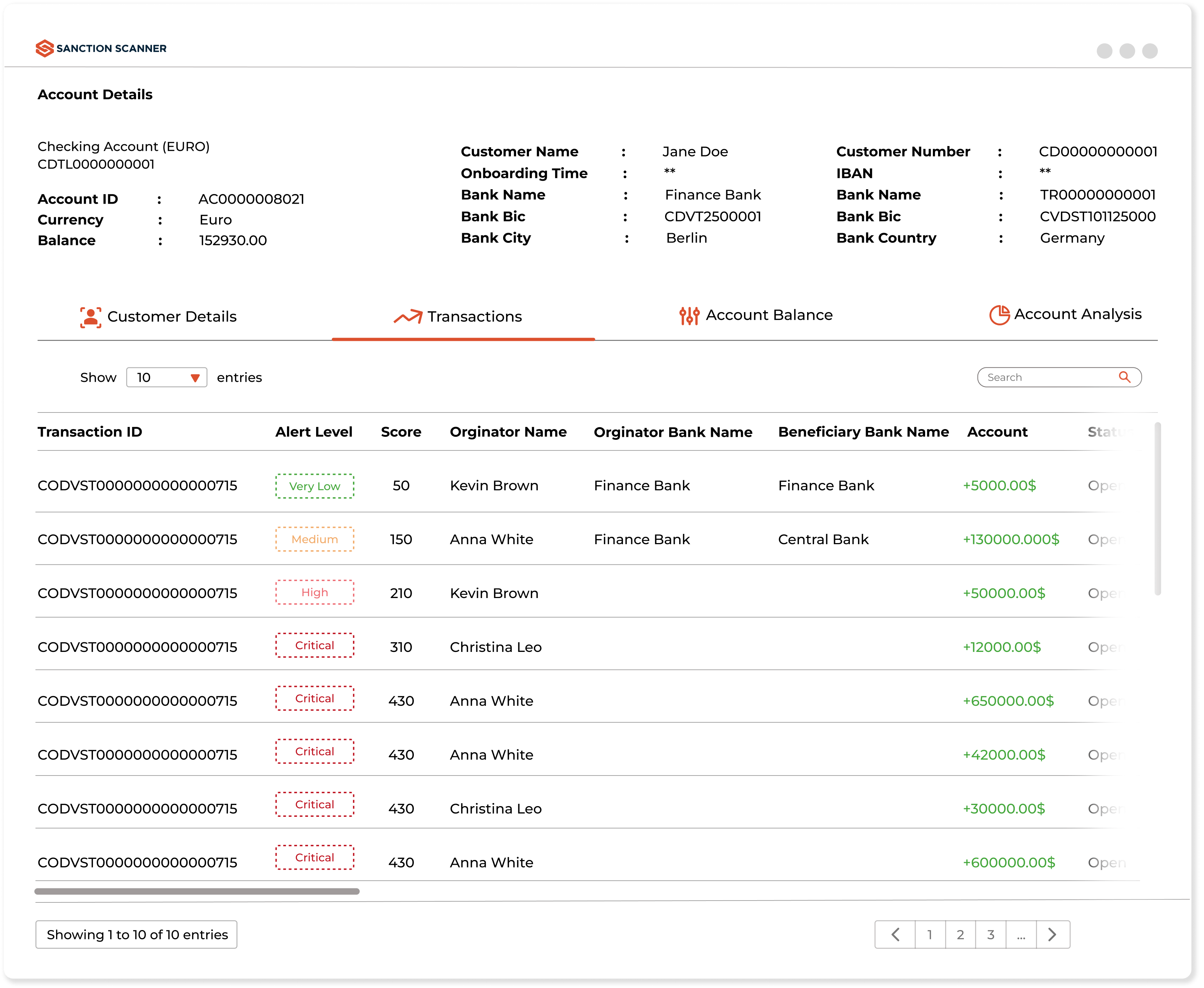

AML Transaction Monitoring

Reduce false positives and strengthen your compliance process.

Learn MoreAdverse Media Screening

Strengthen AML Compliance With Global Comprehensive Adverse Media Data

Learn MoreFAQs about Investment

Yes. Investment firms must implement AML policies, conduct KYC, monitor transactions, and report suspicious activity to meet regulatory requirements.

The sector's large fund flows, complex instruments, and cross-border transactions make it attractive for laundering illicit funds through layering and integration.

Red flags include mismatched risk profiles, early fund redemptions, shell company use, and clients from high-risk jurisdictions avoiding documentation.

KYC involves verifying client identity, collecting documents (ID, proof of address, financials), and assessing fund sources before onboarding.

CDD segments clients by risk level and ensures appropriate monitoring. It’s required under FATF standards to detect and prevent financial crime.

Yes. If they handle funds or process transactions, they must maintain internal AML controls and fulfill compliance obligations.

They monitor for abnormal redemptions, large unexpected transactions, and activity misaligned with client profiles—especially from high-risk regions.

Penalties include large fines, license loss, regulatory sanctions, and reputational damage that may impact client trust and long-term viability.

Yes. Sanction Scanner supports real-time screening, risk scoring, and integration with compliance systems to automate AML workflows for investment firms.

EDD is used for high-risk clients and involves deeper fund/source verification, more documentation, and frequent activity reviews.

A risk-based approach means assessing each client’s AML risk level individually and applying proportionate controls—such as EDD for high-risk investors or jurisdictions.

Private equity, hedge funds, offshore funds, and complex derivatives carry higher AML risks due to low transparency and cross-border fund movements.

Yes. Investment advisors handling client funds or transactions must comply with AML laws, including CDD, recordkeeping, and reporting suspicious activities.

Firms must retain KYC records, risk assessments, transaction logs, and STR filings—usually for 5–10 years depending on local regulations.

Institutional onboarding requires verification of legal entities, beneficial owners, and source of funds—often through business registries, corporate documents, and UBO checks.

It refers to continuous transaction review and periodic client risk reassessment to identify new red flags, trigger alerts, or update due diligence levels.

PEP screening identifies politically exposed persons and triggers EDD, as these clients pose higher risks for corruption-linked money laundering.

FATF sets global AML standards, including for the investment sector. Local regulators align their AML frameworks to FATF’s recommendations and mutual evaluations.

Yes. Cross-border flows may involve jurisdictions with weak AML oversight, requiring stronger due diligence and source-of-funds checks.

Yes. Tools like Sanction Scanner offer API-based integration for real-time screening, client risk scoring, and audit trails—directly within CRM or onboarding platforms.