TRUSTED BY OVER 800+ CLIENTS

The future of Banks: Neobanks

Neobanks are bridging the gap between the services offered by traditional banks and the changing expectations of customers in the digital age. Neobanks are financial institutions that don't have any physical branches. They provide services traditional banks don't.

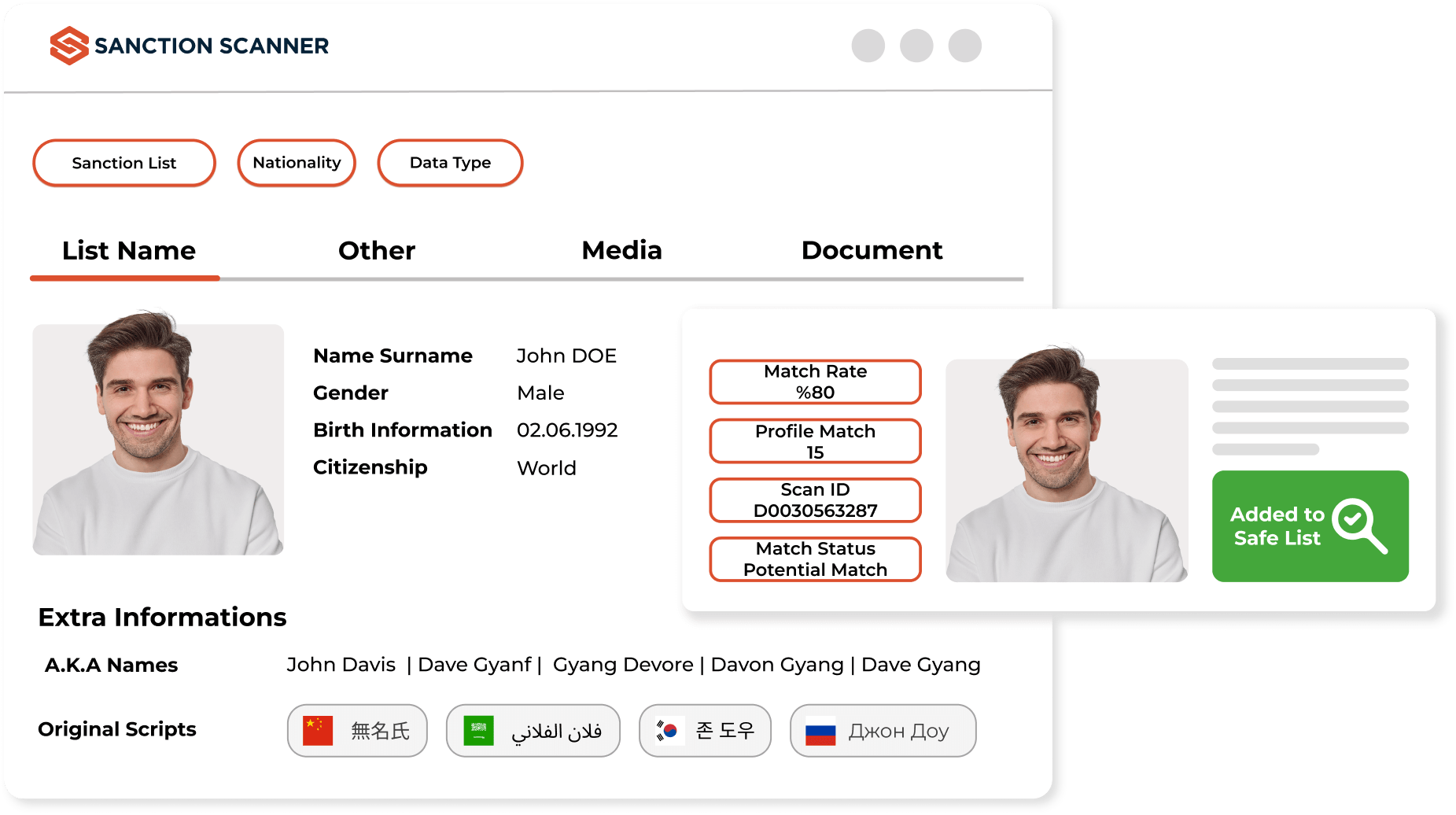

Customer Onboarding Process

Neobanks have to fulfill their AML and KYC obligations during the customer account opening processes. Neobanks can see the risks customers bring during the account opening process using an AML Control Program that has more than 3000 Global Sanctions lists, PEPs lists, and Adverse Media Data that are updated every 15 minutes.

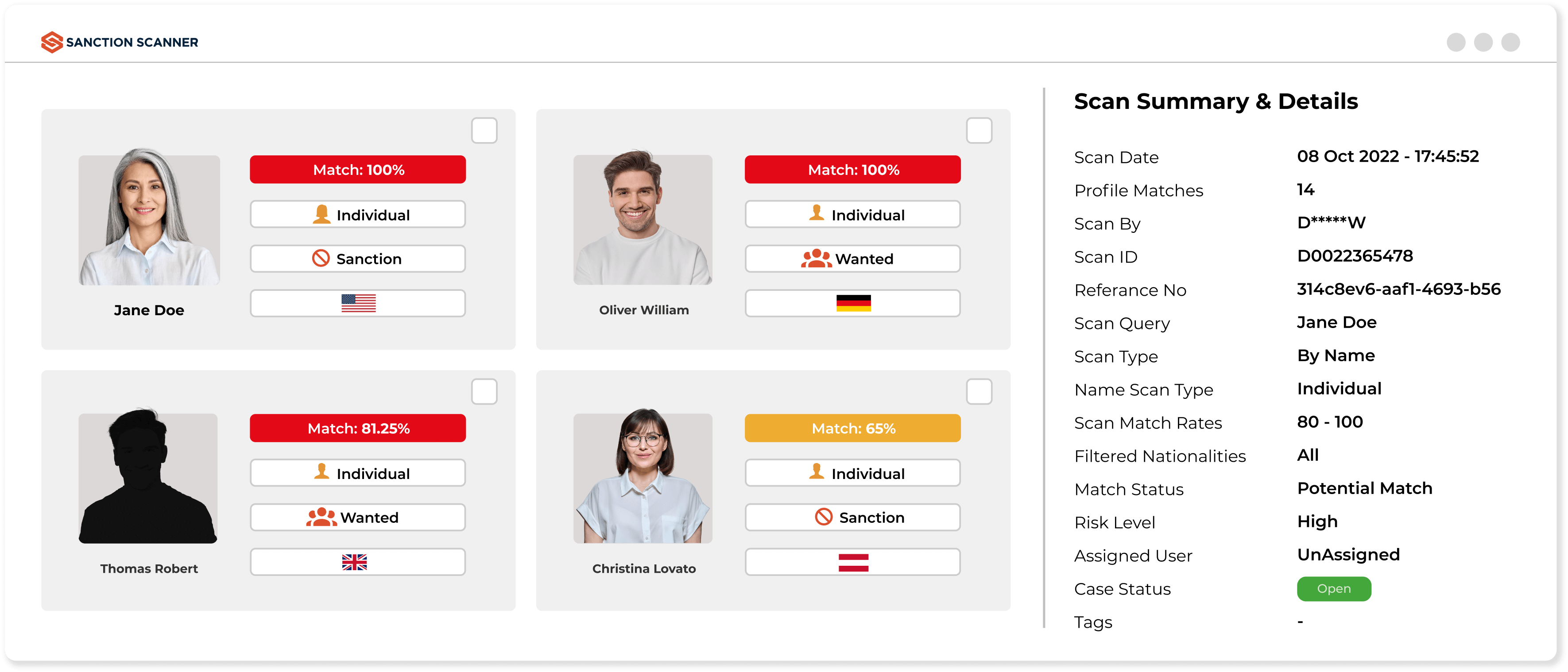

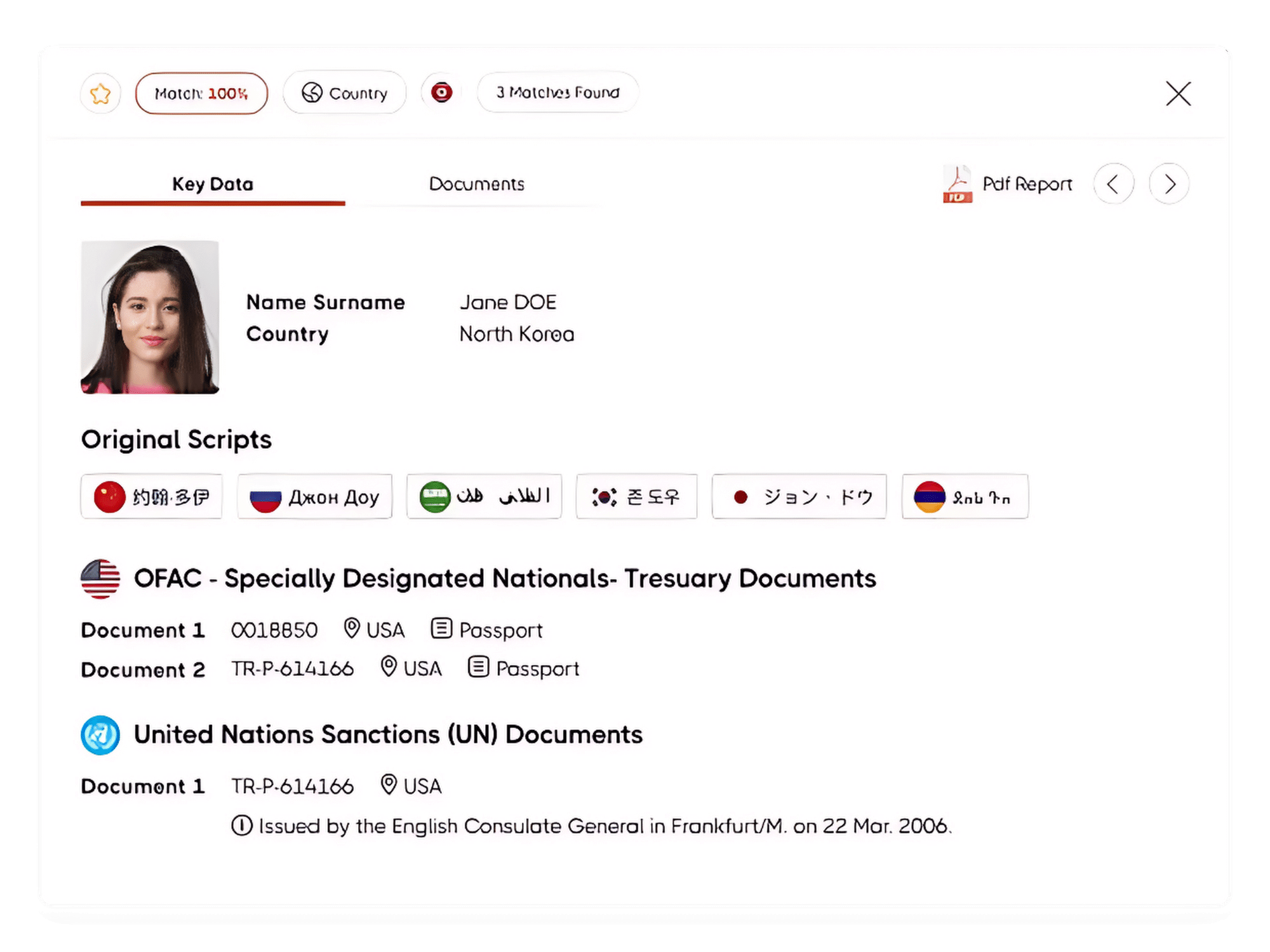

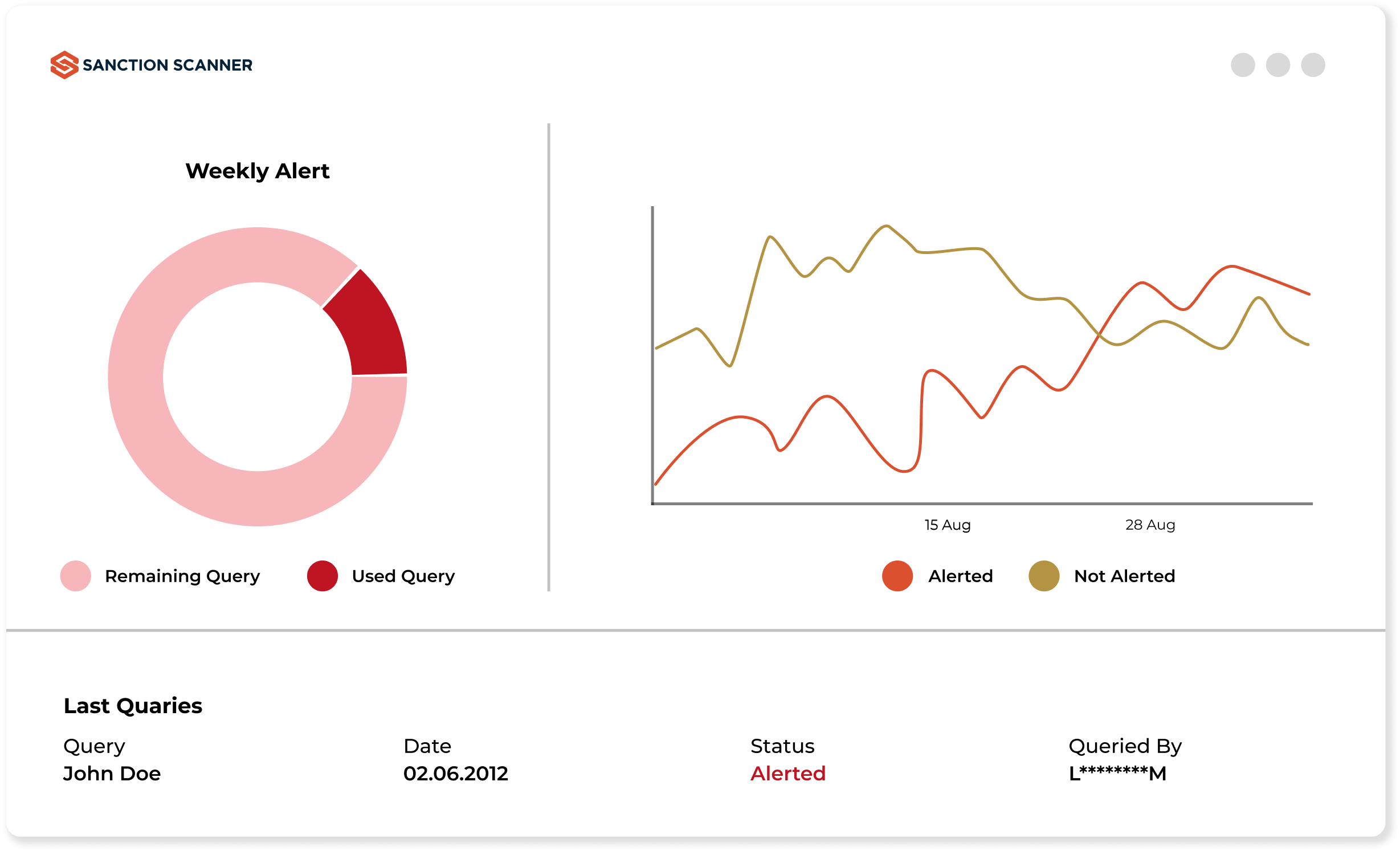

Screening and Monitoring

Neobanks can scan and control operations individually or collectively with options such as Name, Identity, and Passport number with our AML Name Screening Software that includes Sanctions, PEP lists and Adverse Media Data.

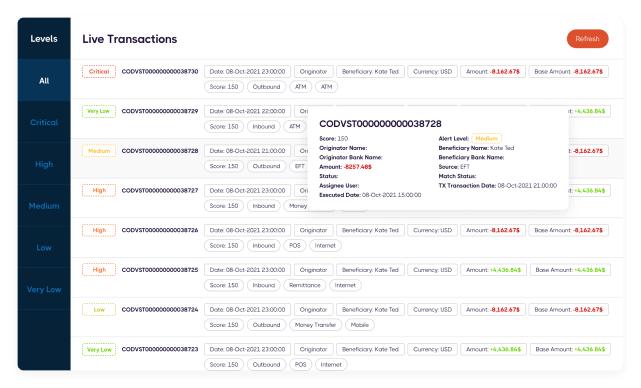

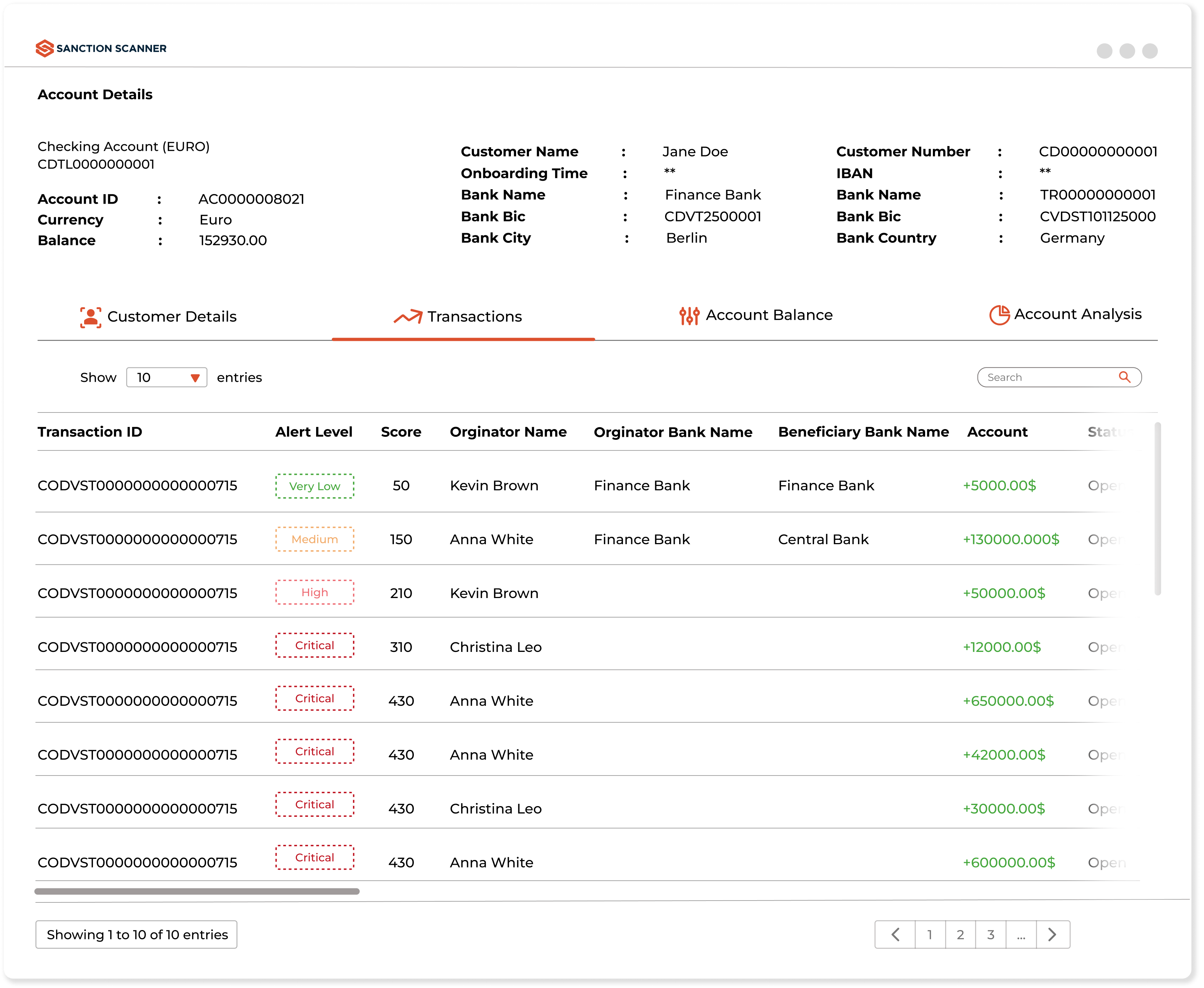

Transaction Monitoring Software for Neobanks

Neobanks can monitor transactions customers make in real-time to detect high-risk and suspicious transactions with our AML Transaction Monitoring software. Suspicious transactions can be stopped and recorded for investigation. Thus, reducing false positives and workload.

Powerful API for AML Solutions

Neobanks can easily integrate our products into their project. Webhook-powered API supports all the features of our AML Solutions. In addition, Webhook can provide two-way data transfer between Sanction Scanner and your project.