The Financial Action Task Force (FATF) is a global money laundering and terrorist financing watchdog established at the G7 summit in Paris in July 1989. harm to society. The primary purpose of FATF's Anti-Money Laundering (AML) Standards is to prevent organized crime, illegal drugs, human trafficking, corruption, and terrorism. Also, the FATF is working to stop funding for weapons of mass destruction.

The FATF advises countries to tackle financial crime and continually reviews its members' policies and procedures. The organization is also reviewing money laundering and terrorist financing techniques and is strengthening its standards to address new risks as cryptocurrencies gain popularity. FATF countries are monitored to ensure they fully and effectively implement the FATF Standards. In order to carry out its activities, FATF convenes three General Assembly meetings in October, February, and June every year, and also meetings of working groups formed to work on various issues are held. Taking a proactive approach to preventing financial crimes and terrorist financing, FATF plays a crucial role in maintaining the integrity of the global financial system.

What is FATF Blacklist?

The FATF blacklist includes countries deemed inadequate in AML/CFT according to FATF's international standards. When a country is blacklisted, it is called upon to take countermeasures to protect the international financial system from continuing harm. The FATF AML shortlist is another name for the blacklist, and countries on this list can be subject to economic sanctions by FATF member nations.

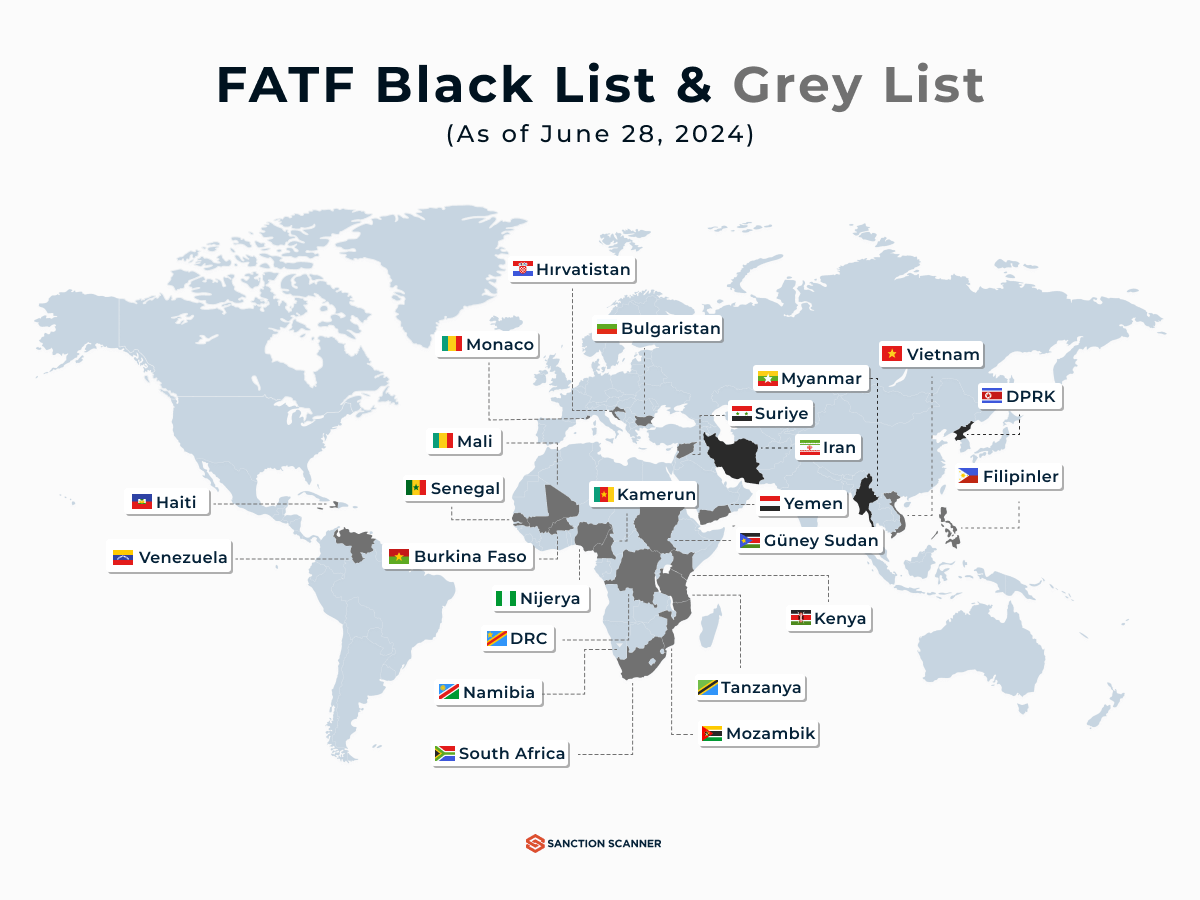

Currently, North Korea, Iran, and Myanmar are among the countries on the FATF blacklist, facing sanctions as a result. However, governments can avoid being blacklisted if they comply with FATF's standards and recommendations regarding AML/CFT measures. Therefore, all jurisdictions should take the necessary steps to prevent money laundering and terrorism financing. Member countries should take enhanced due diligence (EDD) measures to ensure that their regulatory regimes meet the FATF standards.

Countries that the FATF has blacklisted can take measures to comply with the organization's recommendations and avoid economic sanctions. In such cases, they can be removed from the blacklist if they implement appropriate AML policy measures that meet international standards. All countries need to work towards compliance with FATF's standards and recommendations to safeguard the integrity of the international financial system.

FATF mentions about two countries with the following information;

Democratic People's Republic of Korea (DPRK)

The FATF warns about the failure of the Democratic People's Republic of Korea (DPRK) and its concerns about them, which have remained unchanged since February 2020, to address its crucial shortcomings in its AML/CFT regime. These pose serious threats to the international financial system. FATF demands that the DPRK establish an effective AML/CFT regime. In addition, the FATF has expressed its concerns about the danger of North Korea's informal activities and financing of weapons of mass destruction. The FATF renewed the warning of 25 February 2011, reaffirming its members and all jurisdictions to pay special attention to their economic connections with the DPRK, those related with the country.

Iran

Although in 2016, Iran agreed to meet FATF's standards, it failed to complete the action plan by January 2018. Due to Iran's failure to enact the Palermo and Terrorist Financing Conventions in line with the FATF Standards, the FATF fully lifts the suspension of counter-measures and calls on its members and urges all jurisdictions to apply effective counter-measures. The FATF also urged its members to require increased supervisory examination for branches and subsidiaries of financial institutions based in Iran, introduce enhanced reporting mechanisms for financial transactions, and require increased external audit requirements for financial groups with respect to any of their branches and subsidiaries located in Iran.

Iran is still on the FATF statement on [High-Risk Jurisdictions Subject to a Call for Action] until the full Action Plan has been completed. The FATF will remain concerned with the terrorist financing risk emanating from Iran and the threat it poses to the international financial system until Iran implements the measures required to address the deficiencies identified with respect to countering terrorism financing in the Action Plan. If Iran ratifies the Palermo and Terrorist Financing Conventions regarding the FATF standards, the FATF will decide on the next steps, including whether to suspend countermeasures.

Myanmar

In February 2020, Myanmar pledged to tackle its AML/CFT strategic deficiencies but failed to fully address them by the action plan's expiration in September 2021. Due to insufficient progress, in October 2022, the FATF urged members to apply enhanced due diligence to transactions related to Myanmar, emphasizing the need not to disrupt legitimate financial flows for humanitarian and NPO activities. Despite some efforts since October 2023, including prioritizing inspections based on risk, Myanmar's overall progress remains slow. The FATF has outlined specific areas for improvement, including better understanding and handling of money laundering risks, registration and supervision of hundi operators, and more effective use of financial intelligence. Myanmar is encouraged to continue its efforts to complete its action plan and address all identified deficiencies to be removed from the FATF's call for action list.

What are FATF Grey Lists?

The Judicial Powers Under Increased Monitoring program is an initiative in collaboration with the FATF to address strategic deficiencies in member countries' regimes against money laundering and terrorist financing.

Countries that are identified as having such deficiencies are placed on the greylist, which subjects them to increased monitoring to ensure that they address the identified shortcomings within agreed time frames. To ensure progress, the FATF and FATF-style regional bodies (FSRBs) continue to monitor and report on the progress made in addressing these deficiencies.

It is important for FATF member countries to complete the identified jurisdictions and agreed action plans within the proposed timeframe. The FATF is open to receiving new commitments from countries that have not fulfilled their previous commitments, such as Iran. However, if these commitments are not met, the FATF may impose sanctions.

In addition to monitoring existing greylisted countries, the FATF also reviews other jurisdictions with strategic deficiencies in their regimes to combat money laundering, terrorist financing, and the financing of the spread of arms. FATF aims to ensure the integrity of the international financial system and protect against the risks posed by financial crimes.

Countries on the FATF Grey List

The FATF maintains a list known as the "Jurisdictions Under Increased Monitoring," commonly referred to as the grey list. This list is part of the FATF's efforts to enhance global AML and CTF practices. Countries that find themselves on this list have been identified as having strategic deficiencies in their national systems to prevent money laundering and terrorist financing. However, these countries have also committed to working closely with the FATF to address and rectify these shortcomings within agreed timelines.

The process of monitoring and evaluation is rigorous, involving either direct assessments by the FATF or through affiliated FATF-style regional bodies (FSRBs), which track the progress of these countries in meeting their AML/CTF improvement goals. Being on the grey list signifies a country's active engagement in reforming its financial oversight mechanisms but also signals to the international community that these jurisdictions require closer attention.

The FATF updates the grey list regularly, adding new countries that meet the criteria for increased monitoring or removing those that have successfully implemented their action plans and addressed the FATF's concerns.

As of June 2024, the countries on the FATF grey list are:

- Bulgaria

- Burkina Faso

- Cameroon

- Croatia

- Democratic Republic of Congo

- Haiti

- Kenya

- Mali

- Malta

- Monaco

- Mozambique

- Namibia

- Nigeria

- Philippines

- Senegal

- South Africa

- South Sudan

- Syria

- Tanzania

- Venezuela

- Vietnam

- Yemen

The Significance of FATF Blacklists and Grey Lists Check

FATF Blacklists and Greylists Check is an essential process that involves identifying and monitoring countries with strategic deficiencies in their anti-money laundering and counter-terrorist financing regimes.

The FATF Blacklist, also known as the "Non-Cooperative Countries or Territories" (NCCT) list, identifies countries considered inadequate in their money laundering and counter-financing of terrorism regimes. When a country is placed on the FATF Blacklist, it is subject to economic sanctions by member countries. Currently, North Korea and Iran are the only countries on the FATF Blacklist.

On the other hand, the FATF Greylist, also known as the "High-Risk Jurisdictions Under Increased Monitoring" list, identifies countries with strategic deficiencies in their anti-money laundering and counter-terrorist financing regimes but have committed to addressing these deficiencies. Countries on the Greylist are subject to increased monitoring and must handle their weaknesses within the agreed time frames.

The FATF Blacklists and Greylists Check is essential because it helps to protect the international financial system from money laundering, terrorist financing, and other related threats. FATF encourages these countries to take necessary steps to address the shortcomings and comply with the FATF Standards by identifying countries with strategic deficiencies in their AML/CFT regimes.

Moreover, the FATF Blacklists and Greylists Check guides financial institutions and other stakeholders on the risks of doing business with countries on the Blacklist or Greylist. Financial institutions are required to exercise enhanced due diligence when dealing with countries on the Greylist and apply counter-measures, including targeted economic sanctions, under applicable United Nations Security Council Resolutions, to protect their financial sectors from money laundering, financing of terrorism, and proliferation financing risks emanating from countries on the Blacklist.