Know Your Business

Verify Businesses, Uncover Ownership, Stay Compliant

KYB is a process of verifying the information provided by a company before engaging in business with them.

TRUSTED BY OVER 800+ COMPANIES

KYB Module by Sanction Scanner

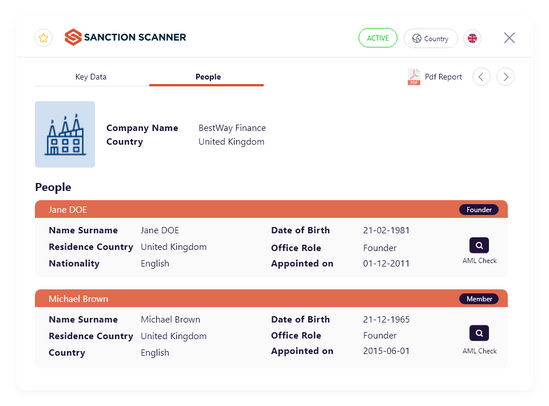

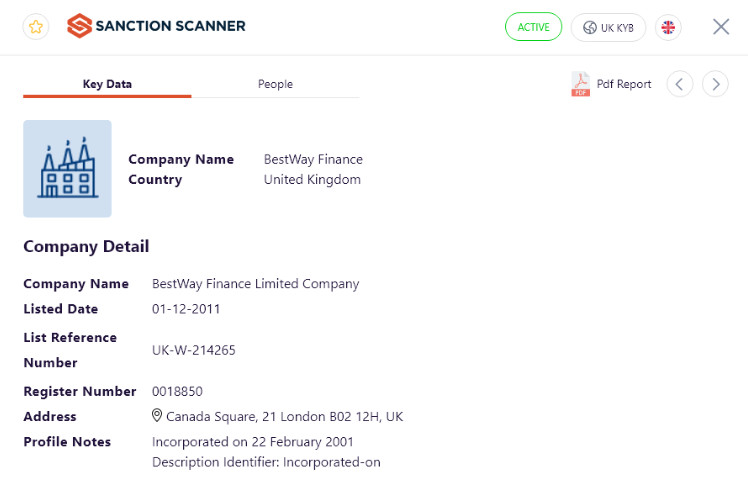

Our KYB module provides a comprehensive company detail page for verifying businesses and their key stakeholders. Review beneficial owners and officers (directors, executives, and other key roles) along with core company information like name, incorporation status, registration numbers, and address.

Perform direct compliance actions including AML checks on companies and individuals, link findings to case management, set match status, assign users, and add tags - all from one unified view.

+76.000.000

KYB DATA

+11

COUNTRIES COVERED

15 min

ALWAYS UPDATED DATA

150 ms

COMPANY CHECK

How Our KYB Tool Works

Our comprehensive KYB solution follows a systematic approach to business verification and risk assessment.

Search the Business

Enter company name with filters for incorporation date, legal status, and country.

Scan and Retrieve Official Data

Connect with global corporate registries for accurate business details.

Detect UBOs Automatically

Analyze officer roles and shareholding data to identify Ultimate Beneficial Owners.

Screen for Risk

Perform real-time checks for sanctions, PEPs, and adverse media.

Monitor Continuously

Track changes in ownership, legal status, and potential risk exposure.

Why Business Verification Is Essential

Every business has a structure, history, and risk level. Sanction Scanner makes verification effortless, comprehensive, and compliant.

KYB ensures you're working with legitimate entities and the key individuals behind them when onboarding corporate clients, vendors, or partners.

Failing to identify risky relationships can lead to regulatory fines, financial loss, or reputational damage. Stay several steps ahead.

Get Started Today!

Smarter verification, stronger compliance, lower risk. Discover how Sanction Scanner can strengthen your onboarding, improve transparency, and support your global compliance operations.

Book DemoWhy Choose Sanction Scanner KYB?

Comprehensive KYB solution with advanced features for business verification and compliance

Real-time data from official registries

Access up-to-date information from global corporate databases

Integrated screening (sanctions, PEP, media)

Comprehensive risk assessment in one platform

Full audit traceability

Complete documentation of all verification activities

Automated UBO detection

Advanced algorithms identify beneficial owners automatically

Batch and API support

Flexible integration options for enterprise needs

Reduced False Positive Results

Advanced filtering minimizes unnecessary alerts

Built for Risk & Compliance & Onboarding Teams

We're proud to support risk and compliance teams in more than 70 countries.

Sanction Scanner's KYB solution is trusted by:

Financial institutions, fintech platforms, PSPs, legal and audit firms, procurement teams, and compliance consultants.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

Know Your Business

Know Your Business (KYB) is the confirmation of the legitimacy, ownership profile, and history of companies before establishing a business relationship. Sanction Scanner's KYB solution provides real-time company data access, including shareholders, directors, and Ultimate Beneficial Owners (UBOs), from global registers.

Financial institutions have to vet the companies they conduct business with in order not to indulge in money laundering, fraud, and bad reputation. Sanction Scanner helps institutions vet corporate entities and owners against global sanctions, watchlists, and PEP lists to ensure safe partnerships.

KYC (Know Your Customer) focuses on verifying individuals, while KYB focuses on verifying businesses and networks of ownership. Sanction Scanner combines KYB and KYC solutions, wherein companies can screen individuals and corporate entities in one platform.

KYB screening typically uses company name, registration number, and jurisdiction to retrieve verified company details and ownership structures. Sanction Scanner can instantly search UBOs, shareholders, and related parties through public and commercial databases without manual document upload.

The system follows company hierarchies and structures to identify individuals with significant control. Sanction Scanner automatically reveals UBOs and connected entities, then screens them against sanctions lists, watchlists, and PEP lists via its integrated Name Screening module.

KYB applies to all regulated industries, specifically banking, fintech, insurance, crypto, and payment providers. Sanction Scanner enables compliance with over 200 jurisdictions to enable businesses across many industries to remain compliant with AML regulations.

Yes. The FATF and the AMLD of the EU mandate institutions to conduct KYB to prevent corporate misuse and financial crime. Sanction Scanner helps you maintain compliance with these by screening businesses and structures of ownership to indicate potential risk prior to the formation of the partnership.

Automating reduces manual labor and human error in verification processes. Sanction Scanner's API and batch screening functionality allow for the automation of onboarding, verification, and monitoring processes within internal systems.

Yes. Sanction Scanner may be integrated within existing onboarding platforms to have companies automatically verified and their ownership details. The system retrieves UBO and shareholder data in seconds and then screens all concerned parties against sanctions and watchlists in the onboarding process.

Yes. The ownership and status of companies change over time, so regular rechecks are required. Ongoing Monitoring for KYB by Sanction Scanner automatically re-screens corporate entities and their owners and notifies you whenever new risks arise.