Today’s global economy is dynamic and complex in nature. That is why government agencies such as the Office of Foreign Assets Control (OFAC) in the U.S., the United Nations (UN), and the European Union (EU) impose legal restrictions. Their aim is to make sure financial transactions are secure and transparent. Our Sanction Scanner team summarizes key information about all sorts of financial transactions and the implemented sanctions in 2025.

What is a Sanctioned Country?

Sanctioned countries introduce restrictions and penalties for such actions:

- Human rights violations

- Nuclear weapons development

- Terrorism sponsorship

- Aggression toward another state

- Political corruption or election interference

The U.S. Department of the Treasury's OFAC or international organizations such as the United Nations or European Union) impose these sanctions and they include:

- Trade bans (e.g., on weapons, oil)

- Financial restrictions (e.g., freezing assets)

- Travel bans on government officials

- Export or import limitations

These sanctions are used to put pressure on countries so that their behavior can be changed without the interference of a military force.

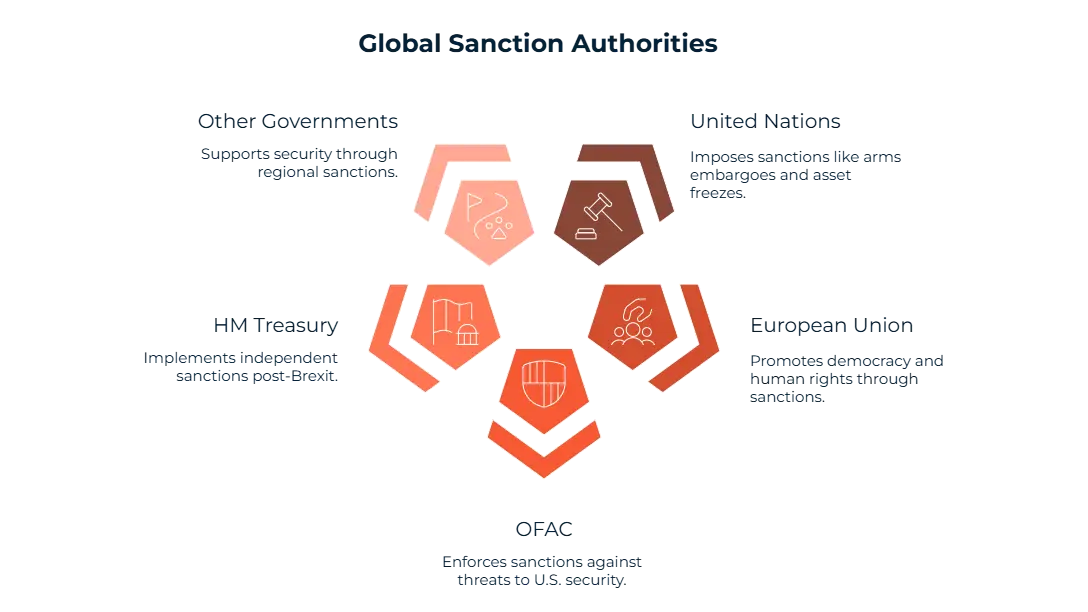

Who Imposes Sanctions?

National and international authorities determine global threats and implement sanctions accordingly. Main authorities are:

United Nations (UN): Some of the sanctions imposed by the UN Security Council are arming embargoes, traveling bans, and freezing assets against countries, groups or individuals.

European Union (EU): As part of its Common Foreign and Security Policy, the primary responsibility of the European Union (EU) is to promote democracy, human rights, and international law.

The Office of Foreign Assets Control (OFAC) is a division of the U.S. Treasury Department. It implements sanctions against individuals, companies or countries that pose a threat to U.S. national security. You can make a OFAC list check here.

HM Treasury (UK): Especially after Brexit, the UK implements its own sanctions through the Office of Financial Sanctions Implementation (OFSI).

Other National Governments and Regional Alliances: Japan, Canada, Australia, and the Gulf Cooperation Council (GCC) have applied sanctions to support security.

What is Sanction Check?

Sanction Check is the process in which individuals, companies, or countries are screened against official sanction lists (like OFAC, UN, EU) to make sure that they are not under any restrictions is called sanction check. Avoiding illegal transactions, it provides organizations an assistance to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

Complete List of Sanctioned Countries

| Country | UNSC | World Bank | SDN (US) | US Consolidated | EU | UK | Canada | Australia | Japan (METI) | China (MOFCOM) |

| Afghanistan | No | No | Yes | No | Yes | Yes | Yes | Yes | Yes | No |

| Australia | No | No | No | No | No | No | No | No | No | No |

| Balkans | No | No | No | No | No | Yes | No | No | No | No |

| Bangladesh | No | Yes | No | No | No | No | No | No | No | No |

| Belarus | No | No | Yes | Yes | Yes | Yes | Yes | No | No | No |

| Bosnia and Herzegovina | No | No | No | No | Yes | Yes | No | No | No | No |

| Burundi | No | No | No | No | Yes | Yes | No | No | No | No |

| Canada | No | No | No | No | No | No | No | No | No | Yes |

| Central African Republic | Yes | No | No | No | Yes | Yes | Yes | No | No | No |

| China | No | No | No | No | Yes | No | Yes | No | No | No |

| Crimea | No | No | No | No | Yes | No | No | No | No | No |

| Cuba | No | No | Yes | No | No | No | No | No | No | No |

| Czech Republic | No | No | No | No | No | No | No | No | No | Yes |

| Democratic People's Republic of Korea (North Korea) | Yes | No | No | No | No | Yes | Yes | Yes | Yes | No |

| Democratic Republic of Congo | Yes | No | No | No | No | Yes | Yes | No | No | No |

| Democratic Republic of the Congo | No | No | No | No | Yes | No | No | No | No | No |

| Donetsk People's Republic | No | No | No | No | Yes | No | No | No | No | No |

| Eritrea | Yes | No | No | No | No | No | No | No | No | No |

| Guatemala | No | No | No | No | Yes | No | No | No | No | No |

| Guinea | No | No | No | No | Yes | Yes | No | No | No | No |

| Guinea-Bissau | Yes | No | No | No | Yes | Yes | No | No | No | No |

| Haiti | No | No | No | No | Yes | Yes | No | No | No | No |

| India | No | Yes | No | No | No | No | No | No | No | No |

| Indonesia | No | Yes | No | No | No | No | No | No | No | No |

| Iran | Yes | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Iraq | Yes | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Lebanon | Yes | No | No | No | Yes | Yes | Yes | No | No | No |

| Libya | Yes | No | No | No | Yes | Yes | Yes | Yes | No | No |

| Lithuania | No | No | No | No | No | No | No | No | No | No |

| Luhansk People's Republic | No | No | No | No | Yes | No | No | No | No | No |

| Mali | Yes | No | No | No | Yes | Yes | No | No | No | No |

| Myanmar | No | No | No | No | Yes | Yes | Yes | Yes | No | No |

| Nicaragua | No | No | Yes | No | Yes | Yes | No | No | No | No |

| Niger | No | No | No | No | Yes | No | No | No | No | No |

| Nigeria | No | Yes | No | No | No | No | No | No | No | No |

| Philippines | No | Yes | No | No | No | No | No | No | No | No |

| Russia | No | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Serbia | No | No | No | No | Yes | No | No | No | No | No |

| Somalia | Yes | No | No | Yes | Yes | Yes | No | No | No | No |

| South Sudan | No | No | No | No | Yes | No | No | No | No | No |

| Sudan | No | No | No | No | Yes | No | No | No | No | No |

| Syria | No | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Taiwan | No | No | No | No | No | No | No | No | No | Yes |

| Transnistria | No | No | No | No | Yes | No | No | No | No | No |

| Tunisia | No | No | No | No | Yes | No | No | No | No | No |

| Türkiye | No | No | No | No | No | No | No | No | No | No |

| United Kingdom | No | No | No | No | No | No | No | No | No | Yes |

| Ukraine | No | No | No | No | No | No | No | Yes | No | No |

| United States | No | No | No | No | No | No | No | No | No | Yes |

| Venezuela | No | No | Yes | Yes | Yes | Yes | Yes | No | No | No |

| Yemen | Yes | No | Yes | No | Yes | Yes | No | No | No | No |

| Zimbabwe | No | No | No | No | Yes | Yes | Yes | Yes | No | No |

Major Countries Are Comprehensively Sanctioned in 2025

High-risk countries are involved in serious risk factors such as human rights violations and the rapid increase in nuclear power.

- As Iran supports terrorist activities in the Middle East and also develops a nuclear program, this makes the U.S., EU, and UN restrict the trading of banking, oil and military equipment.

- North Korea also develops a nuclear program and is involved in ballistic missile production, which makes countries impose restrictions on trade, money transactions and travel.

- Since 2011 Syria has been in a full-scale civil war using chemical weapons which caused severe human rights violations. That is why countries have sanctioned the regime and blocked trade.

- After Russia invaded Ukraine in 2022, the U.S., EU, UK, and other allies sanctioned specific sectors, including energy, defense, and finance.

- Due to political differences, Cuba has been sanctioned primarily by the U.S. since the early 1960s, restricting trade and travel.

Partially Sanctioned or Sectoral Programs

Sanctions have been imposed on specific industries, individuals and countries, some of which we have summarized here for you:

- In Venezuela, sanctions are primarily imposed on oil because of financial and political corruption, violations of human rights, and undemocratic elections under the Maduro regime.

- Belarus is on the sanctions list for defense and technology because of its oppressive regime, human rights violations, and undemocratic elections under the Lukashenko regime.

- The sanctions on Myanmar address arms sales because of the military coup of 2021 and its ongoing human rights violations.

- In Afghanistan, sanctions are imposed on arms sales to prevent the Taliban’s oppressive activities.

- Compared to other countries, in Lebanon, limited sanctions are imposed on individuals involved in any sort of political and financial corruption, specifically on the groups related to Hezbollah.

Why Are Countries Sanctioned?

- If governments commit human rights violations, then they are heavily sanctioned.

- If governments support terrorism and destabilize the region, then they should be addressed with strict sanctions.

- Countries or programs that support nuclear weapons development are often sanctioned.

- States that cause sovereign nation violations are sanctioned to penalize their aggressive actions.

- If there is electoral manipulation, actions are taken against governments, organizations, or individuals.

How Do Countries Impose Sanctions? UK Sanctioned Countries

The Office of Financial Sanctions Implementation (OFSI) in the United Kingdom is responsible for detecting activities related to terrorism and human rights violations. The UK’s sanctions list includes the following countries: Afghanistan, Belarus, Bosnia and Herzegovina, Burundi, Central African Republic, Democratic Republic of Congo, Iran, Iraq, Lebanon, Libya, Mali, Myanmar, Nicaragua, North Korea, Russia, Somalia, Syria, Venezuela, Yemen, and Zimbabwe. By following the UN's foreign policy, the UK restricts arms trade, financial transactions, and travel.

Canada Sanctioned Countries

The Special Economic Measures Act (SEMA) and the United Nations Act in Canada are responsible for providing international peace. Canada's sanctions list includes: Afghanistan, Belarus, Central African Republic, Democratic Republic of Congo, Iran, Iraq, Lebanon, Libya, Myanmar, Nicaragua, North Korea, Russia, Syria, Venezuela, and Zimbabwe. Some of the measures taken by Canada include restricting trade, blocking access to funds, and prohibiting individuals involved in illicit activities.

Australia Sanctioned Countries

The Autonomous Sanctions Act 2011 and the Charter of the United Nations Act 1945 are responsible for implementing rules and administering sanctions aligning with the UN, the EU and the U.S. Australia’s sanctions list includes the following countries: Afghanistan, Belarus, Iran, Iraq, Libya, Myanmar, North Korea, Russia, Syria, Venezuela, and Zimbabwe. Some of the measures taken by Australia are blocking access to funds and imposing arms embargoes.

Japan Sanctioned Countries

The Ministry of Economy, Trade and Industry (METI) in Japan enforces sanctions that align well with the objectives of the UN Security Council. Japan’s sanctions list includes the following countries: Afghanistan, Iran, Iraq, North Korea, Russia, and Syria. Some of the measures taken by Japan are blocking access to funds, restricting nuclear proliferation and terrorism.

Singapore Sanctioned Countries

The Monetary Authority of Singapore (MAS) enforces sanctions that align with the objectives of the UN Security Council. Depending on the notices of the UN or MAS, the countries that indirectly affect Singapore can vary but the recent ones are North Korea, Iran, and Russia. Some of the measures taken by Singapore are restricting specific individuals, limiting relations with countries related to terrorism and serious crimes.

United Arab Emirates (UAE) Sanctioned Countries

Through the UAE Central Bank and the Executive Office for Control and Non-Proliferation (EOCN), the UAE enforces sanctions that align with the objectives of the UN Security Council. Although it does not issue autonomous sanctions like Western nations, the UAE follows international AML/CFT standards and has implemented sanctions against organizations related to North Korea and Iran.

EU Sanctioned Countries

According to the Common Foreign and Security Policy (CFSP), the European Union is responsible for maintaining international peace. The EU restricts trade, financial transactions, and visas. We have listed its sanction lists for you: Belarus, Iran, North Korea, Russia, Syria, Venezuela, Afghanistan, Myanmar, Libya, and Zimbabwe, additionally the regions of Donetsk and Luhansk People's Republics and Transnistria.

US Sanctioned Countries (OFAC – SDN & Consolidated Lists)

Through the Office of Foreign Assets Control (OFAC) under the U.S. Department of the Treasury, the United States strictly implements sanctions. The responsibility of OFAC is to make the SDN (Specially Designated Nationals) List and Consolidated Sanctions Lists. These lists include information about individuals and institutions involved in terrorism, narcotics trafficking, nuclear proliferation, and human rights violations. The sanctions list in the U.S. includes the following countries: Iran, North Korea, Russia, Syria, Venezuela, Cuba, Belarus, and Afghanistan. Some of the sanctions include: blocking financial transactions, freezing assets and restricting people from entering the U.S.

UN Sanctioned Countries (UNSC)

The United Nations Security Council (UNSC) imposes sanctions to address threats to global peace and security. All UN member countries restrict arms trade, financial transactions, and travel. UNSC-sanctioned countries are North Korea, Iran, Iraq, Yemen, Somalia, Libya, Lebanon, Mali, Sudan, South Sudan, the Central African Republic, the Democratic Republic of the Congo, Eritrea, and Guinea-Bissau.

China Sanctioned Countries

Chinese interests in Xinjiang, Hong Kong, and Taiwan make many countries impose strict counter-sanctions. However, China creates a strong economic diplomacy through the Unreliable Entity List and Anti-Foreign Sanctions Law. Chinese-sanctioned countries include the United States, Canada, the UK, Australia, and Lithuania.

Russia Sanctioned Countries

After the invasion of Ukraine in 2022, Russia restricted trade, visas, and media operations with various countries specifically as retaliatory sanctions. Through the Ministry of Foreign Affairs and Federal Customs Service, Russia sanctioned the United States, United Kingdom, Canada, Australia, EU member states, Japan, and Ukraine.

FAQ's Blog Post

A sanction check verifies whether a person or entity appears on global watchlists like OFAC, EU, or UN sanctions. It’s a vital compliance step to prevent illegal transactions and financial crime.

A sanction is a legal or economic measure imposed by governments or international bodies to restrict trade, financial transactions, or travel with a specific country, entity, or individual.

OFAC sanctions are restrictions imposed by the U.S. Department of the Treasury’s Office of Foreign Assets Control on countries, individuals, and organizations involved in terrorism, drug trafficking, or threats to U.S. national security.

The SDN (Specially Designated Nationals) List is a list maintained by OFAC, including individuals, companies, and countries whose assets are blocked and with whom U.S. persons are generally prohibited from dealing.

As of 2025, countries under OFAC comprehensive sanctions include Iran, North Korea, Syria, Cuba, Russia, and parts of Ukraine (e.g., Crimea, Donetsk, Luhansk). Always refer to the official OFAC website for the latest updates.

EU sanctions are adopted by the European Union to promote peace, democracy, and international law. Unlike OFAC, the EU often targets specific sectors, individuals, or entities within a country rather than imposing broad country-wide sanctions.

Yes. Many Russian individuals, banks, and companies are on the OFAC SDN List due to the ongoing conflict in Ukraine and violations of international law.

It depends on the type of sanctions. Full sanctions prohibit almost all dealings, while sectoral or targeted sanctions may allow limited activities with proper licensing or due diligence.

You can use tools like the OFAC Sanctions List Search Tool, the EU Sanctions Map, or consult national sanction authorities like the UK’s OFSI or Canada’s Global Affairs database.