What is eKYC?

Electronic Know Your Customer (eKYC) is a digital version of the Know Your Customer (KYC) process, and it is meant to verify customer identities in a remote manner. This process gets help from technologies like optical character recognition (OCR), biometrics, and AI to make it more accurate and secure. eKYC cuts down manual steps and this leads to faster onboarding as well as reduced fraud. In this blog post, we’ll be detailing how the process works, technologies involved in eKYC, and more.

What is the Purpose of eKYC?

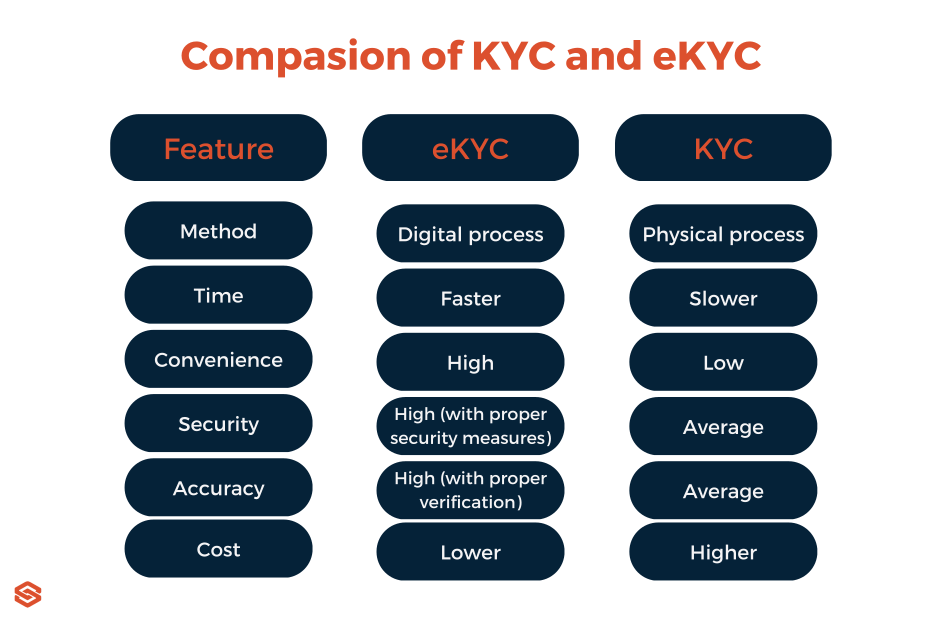

eKYC makes the verification process more secure, accurate, and cost-effective for your company. With technology developing rapidly, newer solutions are needed to keep up with the techniques fraudsters use. Traditional and paperwork reliant processes are being abandoned by companies, and eKYC reduces the time spent on verification while putting out better results. Customers are also more satisfied since eKYC builds upon manual KYC processes and makes them better and more convenient.

The eKYC process is also really important for compliance. Since this process is supported by technological tools, it helps reduce fraud within your company operations. Tools like biometric authentication and AI based data analysis make it more difficult for fraudsters to become a part of your customer base. Since they can’t use forged documents and impersonation, criminals are kept away from your company and your compliance efforts are doubled.

How Does eKYC Work?

There are many steps to eKYC since it makes sure you’re not bringing in criminals to your customer base. The first step is uploading the documents. A government issued document like a passport, ID, or driver’s license is needed to pass this step successfully. Once you upload the document, the OCR technology then scans it. This step helps turn information into structed, machine-readable versions. After this is completed, biometric verification is done. This step involves the customer providing a selfie or a short video. This way, the biometric technology can compare your live version to the documented one, and make a decision regarding your realness accordingly.

After you are verified with both documents and biometrics, the next step is sanctions and PEP screening. The extracted data you’ve gotten from the previous step will now be checked against global watchlists, including sanctions lists and politically exposed persons (PEP) lists. This step ensures that you are aren’t working with sanctioned parties and flagging the high-risk customers for more detailed checks later. After all of these are done, it’s time for AI decisioning. In this step, AI evaluates the combined information and later assigns a risk score to each customer. If there are suspicious parts in the process, it flags them accordingly and they are later manually reviewed. Using AI for eKYC will ensure you get a faster and more reliable result when it comes to assigning risk scores to customers.

The last step is auditting logs. Your company should be logging every step of the customer eKYC process and storing them for regulatory reviews and potential investigations. This step helps keep a better internal control within your company as well.

Technologies Behind eKYC

There are several technological tools used during the eKYC process to ensure it is fast and secure. The OCR scans make sure that the documents you've uploaded to the identity verification system are scanned and then the relevant information is extracted to be used in a digital system. Without the need for manual entry, errors are reduced and the verification process is made faster. Another technology used is biometrics. This tool verifies your customer’s identity by requesting a live video or selfie from them, and later comparing them to the documents your customer previously sent. The added features of scanning fingerprints or iris patterns can provide extra protection.

Another tool used during the verification process is liveness detection. This way, spoofing attacks that use altered photos, videos, and maskes are avoided. The technology can detect subtle movements, blinking, depth cues to figure out whether your customer is physically present during the verification process and not using fake media. AI and machine learning are also implemented within the process. These technologies help better fraud detection and they do this by identifying suspicious patterns, mismatched data, and unusual customer behaviours. Since these systems always learn and improve themselves, fraudulent attemps are cut short.

The last technology we’ll talk about is APIs. Application programming interfaces (APIs) help connect the eKYC system you use to external databases, watchlists, and other verification services. Real-time checks against AML lists, sanctions databases, and other regulatory sources are allowed thanks to APIs.

Global Regulatory Acceptance of eKYC

It’s important to know what kind of a regulatory approach regarding eKYC is adopted by countries. For example, Singapore’s regulatory body, the Monetary Authority of Singapore (MAS) is fully permitting eKYC. This way, financial institutions are allowed to onboard their customers using a digital manner entirely. India is another example with the guidance of Unique Identification Authority of India (UIDAI) and Securities and Exchange Board of India (SEBI). eKYC is not only permitted but also mandatory for certain services like financial and telecom institutions in India. The country’s national digital identity program Aadhaar is used to verify someone’s identity. In the UK, the Financial Conduct Authority (FCA) is encouraging and accepting of the usage of eKYC during onboarding. The European Union has eIDAS. The regulatory body is working towards a wider acceptance of the eKYC process, but it’s not fully implemented across member states.

eKYC measures are still being implemented by companies and countries are encouraging them to do so. The 2024 Nigeria eKYC Report showcases Nigeria’s rapid growth from 100 million to 200 million verifications in less than a year, with using biometrics and NIN-based verifications to improve their verification compliance.

Compliance Requirements and Standards

eKYC processes should be adhering to requirements set forth by both global and regional regulatory bodies. The FATF is there to provide international guidelines for Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD). In the European Union, there is the Anti-Money Laundering Directive (AMLD) which directly points out the importance of maintaining audit trails and having automated verification processes. In the U.S., FinCEN requires onboarding procedures to be according to the Bank Secrecy Act (BSA) to make sure your company can detect and report suspicious activity. India has the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) that have established strict digital KYC mandates. Technologies like Aadhaar-based eKYC are used to create a safe identity verification process.

Benefits of eKYC

There are many benefits to using eKYC processes, both for your company, and you, as a customer. The onboarding process can be shortened into minutes thanks to the digitalised identity verification tools. The eKYC process also prevents fraud by using modern technologies like biometrics, AI, and liveness detection. The eKYC system also can handle personal data according to GDPR regulations, keeping your information safe and private. Your customers will, overall, have a better experience thanks to eKYC efforts.

Challenges in Implementing eKYC

If you’re looking to implement eKYC tools into your company’s systems, you should first learn more about the difficulties you may face because of eKYC. Even though it has many advantages, the first disadvantage eKYC brings is the risk of false matches that occur in facial recognition or biometric verification. This can lead to delays or incorrect rejections in the system, hurting both your company and the customer. Since customers give their personal information to your company’s verification systems, privacy and data protection are also brought out as one of the concerns. Your company should be adhering to regulations and law practices regarding the subject when handling these personal information. Connectivity issues you may have in remote or underserved areas can also interrupt the smooth verification process companies try to serve.

Lastly, eKYC systems attract more cyberattacks; this means that your company should be investing in cybersecurity measures accordingly if you desire to implement eKYC measures.

Trends and the Future of eKYC

The latest report by IMARC Group finds that the global e-KYC market size reached USD 805.8 million in 2024, with predictions of USD 3,562.4 million by 2033. Since this is a promising market, rapid changes in technology and regulatory frameworks will undoubtedly shape the future of the eKYC process. One trend to watch out for is decentralized digital identities, since these give people more control over their personal data while also making sure records are tamper-proof. The EU Digital Identity Wallet is also coming along; they aim to create a unified and government-backed credential system that allows citizens from member states to prove their identity online and access services with no trouble. Adaptive AI-driven KYC is another transformative tool that’s emerging. The tool uses machine learning to dynamically assess risk and detect anomalies to better prevent fraud. With the help of these tools, real-time, large-scale verification is closer than ever. This era of institutions need this update so they can process millions of onboarding requests without giving up on accuracy or compliance.

FAQ's Blog Post

eKYC (electronic Know Your Customer) is a digital process of verifying customer identity using online methods. It typically involves document scanning, biometric checks, and database verification.

Yes, eKYC is designed to meet regulatory requirements, including AML and KYC laws in most jurisdictions. It is accepted by banks, fintechs, and regulators worldwide.

eKYC offers faster onboarding, lower operational costs, and a better customer experience. It reduces fraud risks through biometric and real-time checks.

eKYC uses encryption, biometrics, and secure APIs to protect user data. Leading providers follow GDPR, ISO, and other international security standards.

eKYC is widely used in banking, fintech, cryptocurrency exchanges, insurance, and telecom sectors. It helps these industries meet compliance while scaling digitally.

Yes, eKYC is fully remote and mobile-friendly. Users can verify their identity from anywhere using their smartphones or computers.

Typically, a government-issued ID (passport, driver's license, or national ID) and a selfie are required. Some processes may also ask for address proof

Most eKYC processes are completed in minutes. Automated systems enable real-time verification, reducing customer wait times significantly.