Many countries have their own financial intelligence centers and for Australia, it revolves around AUSTRAC. It is the country's premier anti-money laundering (AML) and counter-terrorism financing (CTF) regulator. Its dual role as both regulator and intelligence unit carries a significant weight due to evolution of financial crimes and digital threats. The fact that each year AUSTRAC processes over 200 million transaction reports and that it has witnessed a remarkable 258% increase in Suspicious Matter Reports (SMRs) since 2017 clearly shows how important the financial crime detection is.

What is AUSTRAC?

The Australian Transaction Reports and Analysis Centre (AUSTRAC) was established in 1989 under the Financial Transaction Reports Act. Their operations take place under the Treasury portfolio and maintains dual authority as both a regulatory body and an intelligence agency. It is responsible for combating money laundering, terrorism financing, and other serious financial crimes.

Also, the introduction of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act), led AUSTRAC’s mandate to expand significantly, which broadened the organization's regulatory scope and enhanced its enforcement capabilities.

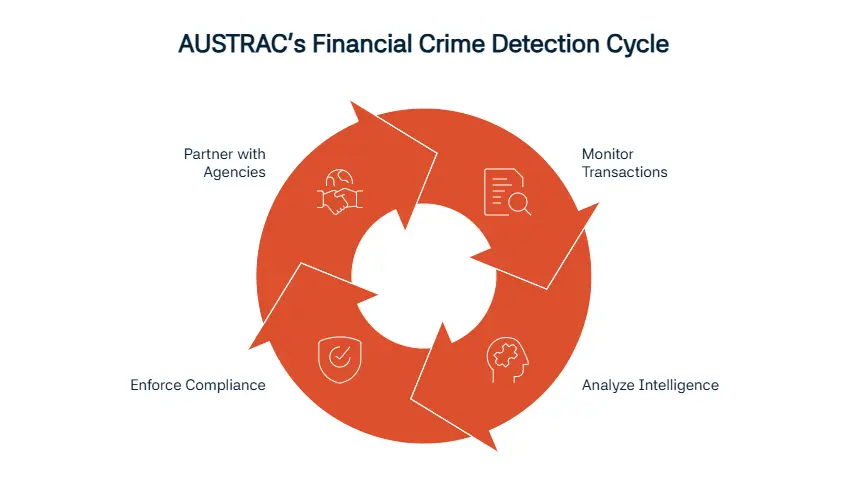

What Does AUSTRAC Do?

Monitor Financial Transactions

AUSTRAC receives and analyzes millions of transaction reports, such as Threshold Transaction Reports (TTRs), SMRs, and International Funds Transfer Instructions (IFTIs), annually through its comprehensive reporting system. The agency's analytical capabilities have expanded significantly. Just over the course of 2023-24 period alone, Fintel Alliance-coded SMRs increased from 8,433 to 12,670, which highlights how much reporting quality and enhanced analytical sophistication have improved in financial crime pattern detection.

Analyze Financial Intelligence

AUSTRAC is able to take raw transaction data and then transform it into actionable intelligence for law enforcement agencies thanks to its advanced analytical techniques. The organization also has intelligence analysts who identify suspicious patterns, trace money flows, and develop strategic assessments of emerging threats within Australia's financial system.

Enforce AML/CTF Compliance

AUSTRAC’s risk-based supervision and enforcement programs are designed in such a way that they ensure reporting entities maintain effective AML/CTF compliance programs. The organization conducts regular inspections, compliance assessments, and remediation activities across all regulated sectors.

Partner with Law Enforcement and International Agencies

AUSTRAC has extensive partnerships with domestic agencies. These partnerships include Australian Taxation Office (ATO), Australian Federal Police (AFP), and Australian Securities and Investments Commission (ASIC). Thanks to these, AUSTRAC has become a part of the comprehensive intelligence and coordinate responses to financial crime threats.

Who Must Report to AUSTRAC?

Reporting obligations extend to all entities designated as "reporting entities" under the AML/CTF Act, which encompasses multiple sectors and reveals the comprehensive scope of Australia's financial crime prevention framework.

Financial Institutions

Banks, credit unions, building societies, and other authorized deposit-taking institutions have extensive customer names and transaction processing capabilities, which leads them to generate the highest volume of transaction reports. So, it is only expected that they must register with AUSTRAC and implement comprehensive AML/CTF programs.

Reporting obligations for non-bank financial service providers like finance companies, money transfer operators, and payment service providers are not much different but they may vary based on their specific risk profiles and operational models.

Gaming and Entertainment Sectors

Casinos, bookmakers, and other gaming service providers must comply with comprehensive AML/CTF requirements to address the unique risks associated with gaming activities. They are one of the priority focuses of AUSTRAC’s supervision because of the sectors' vulnerability to money laundering.

Commodity Dealers

The nature of precious metals is rather high-value and portable. This leads to significant money laundering risks that are hard to address without specialized compliance approaches. All of these obligates bullion dealers and other precious metals traders to report suspicious transactions and maintain comprehensive customer due diligence programs.

Digital Currency Exchanges

Since 2018, digital currency exchanges (DCEs) have been classified as reporting entities under the AML/CTF Act, which necessitates providers to implement comprehensive AML/CTF programs equivalent to those of traditional financial institutions. AUSTRAC is very aware of the sector’s rapid evolution and emerging risk profiles. Hence it has developed a specialized guidance in order to address the unique risks and operational characteristics of digital currency services.

Remittance Service Providers

Money transfer operators and remittance service providers must register with AUSTRAC and maintain comprehensive AML/CTF programs that address cross-border payment risks. Specialized compliance approaches remain very important because these providers often serve communities with limited access to traditional banking services that require specialized compliance approaches.

How to Register as a Reporting Entity with AUSTRAC

Providing financial, remittance, gambling, or digital asset services in Australia, may result in the classification as a reporting entity under the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Act 2006. Being a reporting entity comes with the requirement of registering with AUSTRAC and complying with its obligations.

The registration process is composed of 5 steps.

- It starts with determining if you are a reporting entity or not. If you or your business offers “designated services”, then you are considered as a reporting entity by AUSTRAC. Among these, there are banks, credit unions, money remitters, casinos, betting agencies, digital currency exchange providers, bullion dealers and specific fintech startups.

- If you are unsure about whether your business qualifies, you can use AUSTRAC’s Regulated Business Assessment Tool.

- After confirming your status, you must first create an AUSTRAC online account and then assign a dedicated compliance officer.

- Now that you’re logged in, first choose your business category to start filling the registration form. Then proceed to submit information such as legal entity details, ownership structure, business model and compliance capabilities. Lastly, upload documents like ABN/ACN details, AML/CTF program and identification of beneficial owners and senior officers, to support your registration.

- From now on, you will be waiting for AUSTRAC to assess your application. AUSTRAC may decide to approve your registration, request additional information or schedule a supervisory interview. Businesses usually get approved within 10 to 20 business days. Processing times may vary, but most approvals are issued within 10–20 business days.

Things to do don’t stop once you register. You should maintain an AML/CTF program, file SMRs/TTRs/IFTIs, update AUSTRAC about changes, and complete annual compliance reports.

AUSTRAC Reporting Obligations

Suspicious Matter Reports (SMRs)

AUSTRAC's intelligence collection system’s cornerstones are SMRs. Whenever a suspicious transaction comes up, reporting entities must submit SMRs. They must be top quality and timely. Normally, you must submit SMRs within three business days but when it comes to terrorism-related SMRs, you must submit them within 24 hours.

Threshold Transaction Reports (TTRs)

If they exceed AUD 10,000 or equivalent foreign currency amounts, you are expected to submit TTRs for all cash transactions and electronic funds transfers. AUSTRAC gathers comprehensive visibility into high-value transactions within Australia's financial system thanks to these reports.

International Funds Transfer Instructions (IFTIs)

In order to provide AUSTRAC with comprehensive visibility into international payment flows, you must report IFTIs for all cross-border electronic funds transfers. Both domestic investigations and international intelligence sharing with partner FIUs are supported by these reports.

Data Quality and System Transformation

AUSTRAC has implemented its comprehensive System Transformation Program, which is particularly designed to enhance data quality and analytical capabilities. It maximizes the intelligence value of reports thanks to the program’s emphasis on precise, structured, and complete reporting fields.

AUSTRAC and Cryptocurrency Regulation

The amendments to the AML/CTF Act in 2018 have placed comprehensive AML/CTF regulations that obligated digital currency exchange providers to implement similar compliance programs to those of traditional financial institutions. Among these, there are customer identification, transaction monitoring, and suspicious matter reporting.

AUSTRAC’s specialized guidance addresses the unique characteristics of digital currency services as well. If you ask what these characteristics are, it is possible to mention wallet-to-wallet transfers, privacy coins, and decentralized finance protocols.

Enforcement and Penalties

The risk-based supervision of AUSTRAC includes regular inspections, compliance assessments, and remediation programs. Emphasis of the organization's enforcement approach is on proportionate responses that align with the severity and impact of identified compliance deficiencies.

High-profile enforcement actions make a good example of AUSTRAC's commitment to robust compliance oversight. There are significant penalties issued on major financial institutions. Westpac received a AUD 1.3 billion civil penalty, Commonwealth Bank was fined approximately AUD 700 million penalty, Tabcorp and Crown Resorts also faced substantial penalties, and the list goes on. AUSTRAC's enhanced supervisory capabilities and commitment to ensuring comprehensive compliance across all regulated sectors is substantiated by its enforcement actions.

AUSTRAC's International Cooperation

AUSTRAC is also an active member of international financial intelligence networks such as the Egmont Group of Financial Intelligence Units and the Financial Action Task Force (FATF), which allow AUSTRAC to go through a facilitated comprehensive intelligence sharing and coordination against transnational threats of financial crime. It also has formal cooperation agreements with partner agencies like the Australian Taxation Office. Thus, AUSTRAC can share intelligence systemically and coordinate investigations. These partnerships help make Australia's overall financial crime prevention framework even more efficient.

Strengthening Australia's Financial Security

Two of the critical foundations of Australia’s financial security framework are AUSTRAC’s comprehensive approach to financial intelligence and AML/CTF regulation. The fact that the organization has a dual role as both a regulator and an intelligence unit allows it to comprehensively cover financial crime prevention and detect activities.

AML/CTF programs of reporting entities must include comprehensive risk assessments, customer due diligence procedures, and transaction monitoring systems. Also, matters such as transaction monitoring, red flag indicators, and reporting obligations must be incorporated in employee training programs in order to ensure timely and accurate compliance.

There are RegTech solutions like Sanction Scanner that you can consult in order to help your business to enhance AML/CTF compliance, our automated SMR preparation, TTR reporting, and cryptocurrency transaction screening. Thus, you can manage complex compliance obligations and maintain operational efficiency with these technological solutions.

FAQ's Blog Post

AUSTRAC is Australia’s financial intelligence unit and anti-money laundering (AML) regulator. It monitors financial transactions to detect criminal abuse of the financial system.

Any business providing “designated services,” such as banking, remittance, gambling, or digital currency exchange, must register. Failure to do so may result in penalties or prosecution.

An SMR is a report submitted to AUSTRAC when a transaction or activity raises suspicion of money laundering or terrorism financing. Businesses must submit it within 3 business days.

Digital currency exchange (DCE) providers must register with AUSTRAC and comply with AML/CTF obligations. This includes KYC checks, reporting suspicious activity, and maintaining records.

Reporting entities must implement an AML/CTF program, conduct customer due diligence (CDD), and report threshold transactions and suspicious matters. Ongoing risk assessments are also mandatory.

Businesses use AUSTRAC Online to submit reports like SMRs and threshold transaction reports (TTRs). Access requires registration and proper credentials.

Penalties can include fines in the millions of dollars and civil or criminal proceedings. AUSTRAC has taken enforcement action against several banks and casinos in recent years.

Yes, AUSTRAC collaborates with over 90 international FIUs through the Egmont Group. This helps track cross-border financial crime and strengthen global AML efforts.