If you've ever scratched your head wondering, "What is ACH fraud?", then you're in the right lane. We're not just talking about a pesky issue — ACH fraud can potentially put a stranglehold on your financials.

Every day, innocent bank account holders become victims of an ever-morphing legion of scams, each spelled with a chilling tale of significant loss. Imagine losing the worth of a down payment for a house overnight, a nightmare that is a reality for many.

What is ACH Fraud?

ACH Fraud is the illegal manipulation of the Automated Clearing House (ACH) network, which handles electronic financial transactions between banks. Fraudsters typically gain unauthorized access to bank accounts through tactics like phishing or hacking and then alter account details to redirect funds to themselves. This type of fraud can lead to significant financial losses for both individuals and businesses.

The Growing Threat of ACH Fraud

ACH fraud is a mounting concern due to its sophisticated, hard-to-detect methods that can strike at any time. According to the Association for Finance Professionals, the incidence of ACH debit fraud rose from 34% in 2020 to 37% in 2021, highlighting an increasing trend. In September 2022, the FBI Cyber Division reported that cybercriminals are increasingly targeting healthcare payment processors, with one large healthcare company losing $840,000 due to a hacker impersonating an employee and altering ACH instructions.

Common Tactics in ACH Fraud

Fraudsters employ various strategies to commit ACH fraud, with phishing, malware, insider initiation of transactions, and more being the most prevalent.

- Phishing and Spear Phishing: Scammers deceive individuals into revealing financial details like account numbers and passwords by imitating legitimate bank communications or directing them to malicious websites that capture banking credentials.

- Malware: This method involves infiltrating computer systems to access sensitive banking information. Malware can alter transaction details or redirect funds to accounts under the control of fraudsters.

- Insider Fraud: Employees with access to critical financial data can carry out unauthorized transactions, adding another layer of risk.

- Data Breaches: Criminals access customer credentials through data breaches, using stolen information to log into bank accounts and initiate unauthorized ACH withdrawals.

- Check Kiting: This scam involves moving money between accounts at different banks to create the illusion of funds that have already been withdrawn.

- Loss or Theft of Debit Card: Unauthorized ACH withdrawals can occur if the loss or theft of a debit card is not immediately reported.

The Role of Automated Clearing House in Facilitating ACH Fraud

While the ACH system's efficiency is one of its strengths, it inadvertently aids fraud due to the batch processing of transactions, which are not individually monitored. This allows fraudulent activities to go unnoticed among legitimate transactions. Moreover, the initial stages of ACH payments, which require sensitive information like account and routing numbers, can be compromised through phishing or malware, further facilitating fraud. The Financial Crimes Enforcement Network (FinCEN) has frequently highlighted the connection between ACH fraud and identity fraud, noting that money is often illegally transferred to accounts set up with stolen or fake identities.

Types of ACH Fraud

ACH fraud manifests in three primary forms: unauthorized debits, fraudulent credits, and account takeovers.

Unauthorized Debits

Unauthorized debits occur when fraudsters access and use an account's ACH credentials to initiate withdrawals without permission. These transactions can be stealthy, often going unnoticed until they cause significant financial damage.

Businesses should conduct regular account monitoring to detect unauthorized debits, looking for small, easily missed withdrawals or unusually large transactions. Implementing strict review policies is crucial to identifying and preventing these unauthorized activities.

Fraudulent Credits

Fraudulent credits involve using stolen or fake credentials to deposit money into an account controlled by fraudsters. This tactic is commonly paired with other fraudulent activities like phishing or identity theft.

These credits may mimic legitimate transactions, making them hard to spot during routine checks. Signs of fraudulent credits include unexpected spikes in account balances or credits from unknown sources.

Prevention strategies include rigorous account monitoring, employing multi-factor authentication, and maintaining secure transaction protocols.

Account Takeover

In an account takeover, fraudsters hijack a business's financial account, altering settings and contact information to make unauthorized transactions. This may manifest as alerts for suspicious activities, unrecognized transactions, or sudden account lockouts. Subtle signs include changes in account information or unusual transaction patterns.

Protecting against account takeovers requires robust security measures, frequent account reviews, and immediate investigation of any discrepancies. Enabling notifications for account modifications can also help detect and address irregularities swiftly.

The Impact of ACH Fraud

ACH fraud poses a significant threat to even the most secure financial systems, leading to extensive financial losses, damage to business reputations, and potential legal repercussions.

Financial Losses from ACH Fraud

Successful ACH fraud can devastate businesses, draining bank accounts and halting operations. The aftermath includes not only direct financial losses but also costs related to investigating the fraud, revenue losses from paused operations, and indirect impacts such as suspended marketing activities. Even large organizations find recovering from these losses challenging.

Reputational Damage

Beyond financial implications, ACH fraud severely damages a company's reputation. Customers lose trust when their personal and financial information is compromised, potentially driving away both existing and prospective clients. The long-term financial repercussions include lost business and the costs associated with repairing a tarnished reputation.

Legal Consequences of ACH Fraud

Fraud incidents attract regulatory scrutiny and can lead to severe penalties for non-compliance with financial and data security regulations. Additionally, businesses may face lawsuits from affected parties, further compounding financial and reputational damages.

How to Prevent ACH Fraud?

Implementing Robust Security Measures

Security is crucial in ACH transactions, requiring more than just a solid firewall. Effective security includes multiple layers, such as advanced authentication protocols, encryption, and consistent system updates.

Advanced authentication methods, including biometric scans, one-time passwords (OTPs), and two-factor authentication (2FA), significantly boost security despite their slight inconvenience, ensuring that only authorized individuals access financial data.

Encryption adds a critical layer of protection by converting sensitive information into unreadable characters, accessible only with specific decryption keys, thus protecting against data breaches.

Regularly updating systems is essential yet often neglected. Cyber attackers frequently target known vulnerabilities in outdated software, so keeping systems current is vital for preventing ACH fraud.

Ongoing Monitoring of Transactions

Ongoing transaction monitoring is essential for detecting and preventing ACH fraud. This includes vigilance for unusual banking activities.

Prompt detection of fraudulent transactions can prevent significant financial losses and maintain customer trust. Automated systems are beneficial for conducting regular checks and highlighting suspicious activities.

Implementing transaction threshold limits can also detect anomalies in transaction patterns, reducing the risk of significant unauthorized ACH transactions.

How to Detect ACH Fraud

Early detection of ACH fraud is crucial as the growth of the ACH network introduces both opportunities and risks. Recognizing warning signs can protect your finances. Key detection strategies include:

- Identifying irregular account activities

- Noticing unexpected balance changes

- Being wary of suspicious communications

Unusual Account Activity

Familiarity with the typical patterns of your ACH transactions aids in spotting anomalies. A sudden increase in the frequency or size of withdrawals could indicate fraudulent activity.

Recognizing Deviations

Transactions occurring outside of normal business hours or those that deviate from established patterns should be scrutinized. Monitoring for high-risk transaction patterns is essential for fraud prevention.

Rapid Transfers

Large sums transferred quickly between accounts may suggest fraudulent activity. Monitoring the frequency and magnitude of such transfers is crucial, as fraudsters often use rapid movements to avoid detection.

Unexpected Balance Changes

A significant and sudden decrease in your account balance is a major warning sign. It is vital to meticulously review account statements and focus on each transaction.

Disproportionate Withdrawals

Multiple withdrawals that rapidly deplete your account or repeated withdrawals of similar amounts should raise concerns. Such patterns are typical of money laundering schemes designed to avoid detection.

Missing Deposits

An unexpected stop in expected deposits can be as telling as unauthorized withdrawals. Pay attention to any delays or interruptions in regular incoming transactions.

Suspicious Communications

Phishers employ various methods to extract sensitive information. Recognizing common phishing tactics can help identify threats.

Phishing Emails

Fraudulent emails often mimic reputable institutions. Always verify the sender's address and carefully examine any links or attachments which may contain malware.

Vishing Calls

Some fraudsters use phone calls to solicit information. This 'vishing' technique leverages the perceived authenticity of a personal interaction. Never share sensitive information over the phone unless you have initiated contact through a verified method.

How Do We Help Prevent ACH Fraud?

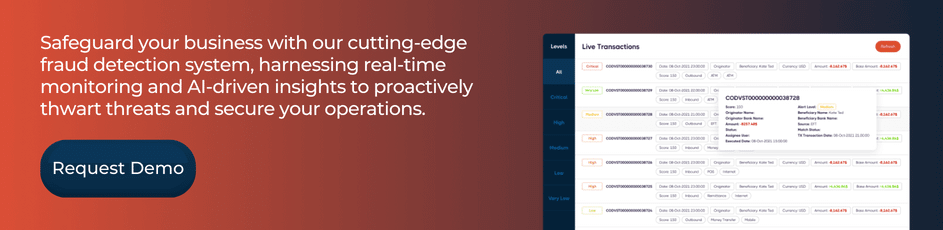

Sanction Scanner's Fraud Detection Tool plays a crucial role in preventing ACH fraud by providing advanced security solutions that monitor and analyze transaction data in real-time. By leveraging comprehensive databases of known financial risks, including sanctioned entities and watchlists, Sanction Scanner helps organizations identify and flag suspicious activities before they result in financial loss. This proactive approach ensures that unusual patterns, such as rapid transfers or irregular withdrawal behaviors, are detected early, allowing businesses to respond swiftly and effectively to potential threats. With Sanction Scanner, companies can enhance their ACH transaction security, safeguard their assets, and maintain compliance with regulatory requirements, thereby minimizing the risk of ACH fraud.

To see how Sanction Scanner can protect your business from ACH fraud, request a demo today and experience our advanced security solutions firsthand.