What is Corruption?

Corruption is the abuse of power for personal gain. It weakens institutions, fuels inequality, and disrupts economic growth. Corruption keeps to destabilize societies by means of eroding agree with, weakening institutions, and distorting economic structures. At its root, corruption is a breakdown of ethical requirements and transparency in both public and private sectors. In our region of statistics, we outline corruption as the misuse of energy via individuals in authority to reap personal or financial benefits.

Corruption typically manifests in 3 foremost categories, each with wonderful traits and implications.

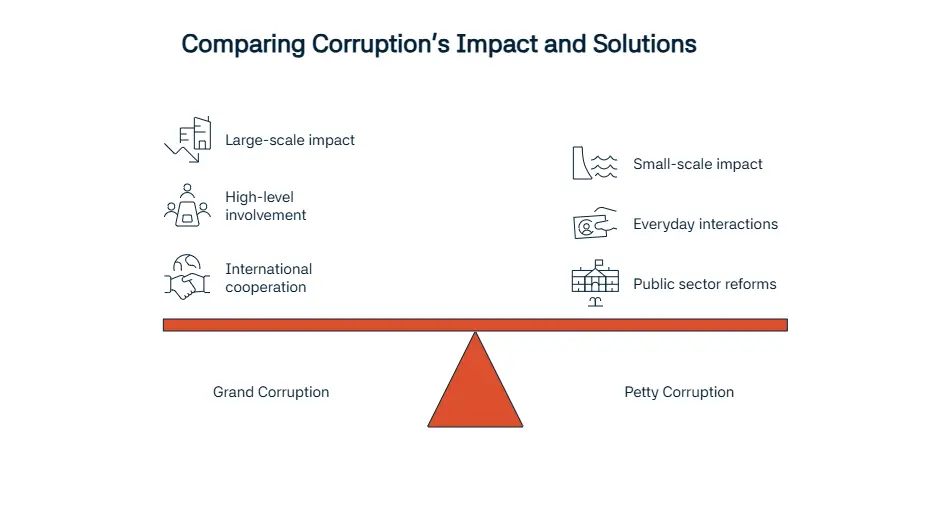

Grand corruption includes high-ranking officers or executives conducting large-scale embezzlement or abuse of power, often associated with infrastructure obligations, country wide budgets, or United states of America-owned institutions. These cases usually have giant consequences, draining big public sources and weakening institutional integrity at the very best ranges. In our area of expertise, addressing grand corruption requires strong international cooperation, forensic monetary tracking, and independent oversight mechanisms.

Petty and political corruption, even as one-of-a-kind in scale, are similarly adverse to public trust and governance. Petty corruption takes area in regular interactions—such as paying a bribe for a driving force’s license or get entry to to public services—and disproportionately affects decrease-profits individuals.

Political corruption, however, involves elected or appointed officials the usage of their have an impact on to steady favors, skip biased legislation, or divert finances for personal or celebration advantage. Understanding those differences is essential whilst designing focused anti-corruption policies, as every kind calls for tailor-made tools, from public area reforms to political finance transparency.

What Are the Types of Corruption?

Corruption manifests in numerous recognizable paperwork, each undermining ethical conduct and trustworthy governance in its private manner.

Bribery

Bribery stays one of the most generic techniques, in which individuals provide or take delivery of cash, gifts, or favors to steer choices or benefit unfair blessings. This practice distorts techniques which might be intended to be impartial, in particular in public procurement, licensing, and criminal proceedings.

Embezzlement

Embezzlement is any other not unusual form, regarding the misappropriation of budget via those in positions of agree with. When authorities officials or company employees divert assets for personal use, it no longer only drains public or organizational budgets but additionally erodes stakeholder self assurance.

Fraud and Extortion

Other paperwork including fraud and extortion in addition compound the problem. Fraud includes intentional deception, like forging economic files or inflating invoices, to obtain illicit economic advantages. This sort of misconduct can critically harm establishments via misrepresenting their economic fitness and misleading traders or the general public. Extortion, then again, is driven through coercion, in which people are forced to conform under chance, whether physical, prison, or reputational.

Nepotism and Cronyism

Nepotism and cronyism also play a significant role in weakening institutional integrity. In our subject of knowledge, we regularly observe how favoritism in hiring or agreement allocation erodes trust, discourages certified experts, and perpetuates inefficient and unequal systems.

State capture takes place whilst private hobbies influence government rules, regularly thru lobbying, to improve slender agendas. In our opinion, that is a number of the maximum dangerous styles of corruption because of its systemic effect.

What Are the Causes of Corruption?

Weak Governance Structures

Several key drivers make contributions to the endurance and growth of corruption throughout sectors and societies. One of the most giant factors is the presence of vulnerable establishments. In our discipline of expertise, we have visible that when inner controls are poorly implemented and oversight mechanisms are useless, people in energy regularly make the most those gaps for personal gain. Inadequate prison frameworks and compromised judicial systems allow misconduct to flourish with out very last results, making corruption a low-danger, excessive-praise interest.

Low Wages and Economic Pressure

Another important contributor is monetary strain, specifically amongst public servants and reduce-paid officers. Low wages create an surroundings in which individuals are more prone to bribery and embezzlement, viewing corruption as a critical manner of supplementing their profits. This is particularly genuine in sectors along with regulation enforcement, healthcare, and schooling, wherein underfunding can push team of workers to just accept unlawful incentives in trade for offerings or get right of entry to.

Cultural Norms and Political Instability

Cultural and political dynamics also play a function. In a few regions, longstanding practices like replacing favors or presenting items are deeply ingrained, that may difficult to understand the boundary among respect and impropriety. While the ones customs may not be inherently corrupt, they are able to by means of accident foster unethical behavior when they have an effect on expert options. Additionally, political instability frequently leaves governance structures prone, providing corrupt human beings with possibilities to govern techniques in times of transition or disaster. When authority is fragmented or management changes often, it becomes more tough to implement and enforce regular anti-corruption measures.

Sector-Specific Impacts of Corruption

| Sector | Forms of Corruption | Consequences | Notable Example |

| Healthcare | Procurement fraud, Bribery for services, Embezzlement of funds | Inflated drug costs, Medicine shortages, Erosion of trust, Poor patient outcomes | WHO reports $500 billion lost annually due to corruption |

| Banking and Finance | Money laundering, Embezzlement, Bribes for preferential lending | Systemic financial risks, Reduced foreign investment, Higher service costs, Weakened AML | 1MDB scandal in Malaysia involving billions siphoned off |

| Public Procurement and Infrastructure | Kickbacks in bidding, Inflated construction costs, Low-quality workmanship | Wasted public funds, Delayed or collapsed infrastructure, Higher taxpayer costs | Operation Car Wash: Public contract bribery scandal in Brazil |

| Education | Academic fraud, Embezzlement of school funds, Nepotistic hiring | Decline in education quality, Loss of meritocracy, Widened social inequality | Ghost schools funded to siphon off money |

| Law Enforcement and Judiciary | Bribes to avoid prosecution, Biased verdicts, Political interference | Erosion of public trust, Human rights violations, Weakened democracy | Up to one-third of citizens paying bribes to police/court officials |

| Energy and Natural Resources | Licensing bribes, Illegal resource extraction, Underreporting revenues | Environmental degradation, Loss of wealth, Fueling armed conflicts | Resource Curse theory: slower development in resource-rich countries |

| Humanitarian Aid and NGOs | Diversion of aid supplies, Favoritism, Financial mismanagement | Aid not reaching beneficiaries, Damaged NGO credibility, Increased suffering | Mismanagement of aid after 2010 Haiti earthquake |

What Are the Results of Corruption?

- Economic Downturns

- Widening Inequality

- Erosion of Trust

- Environmental Harm

- Undermining Rule of Law

Corruption creates a ways-reaching effects that contact each layer of society, starting with the economic system. In our field of knowledge, we examine that corruption diverts public funds from critical offerings like healthcare, training, and infrastructure into the hands of a few, creating inefficiencies and stalling improvement. The misallocation of sources now not only reduces the exceptional of public offerings however additionally discourages each domestic and foreign investment, as agencies turn away from unpredictable or unfair marketplace environments. The International Monetary Fund reports that bribery by myself fees the global economic system nearly 2% of its annual GDP—an significant drain that might in any other case support sustainable growth and innovation. Beyond monetary harm, corruption also weakens the social fabric. When public institutions serve the pastimes of elites instead of the wider population, inequality widens and susceptible groups are left without essential guide.

How Corruption and AML (Anti-Money Laundering) Efforts Are Interconnected?

Corruption and money laundering often cross hand in hand. In our subject of know-how, we have determined that corrupt people use complex laundering techniques to cover illicit profits. This makes Anti-Money Laundering (AML) techniques—together with due diligence, transaction monitoring, and beneficial ownership transparency—crucial in uncovering corruption networks. Strong AML compliance frameworks no longer most effective fulfill legal duties but also play an instantaneous role in exposing and stopping systemic abuse.

5 Global Examples of Corruption

Several essential corruption cases from around the arena spotlight simply how a ways-accomplishing and negative unethical practices may be.

Operation Car Wash in Brazil exposed a deep-rooted bribery network concerning the nation-run oil massive Petrobras and severa immoderate-score political figures. In alternate for inflated contracts, businesses paid big kickbacks that have been funneled into political campaigns and private enrichment schemes. The research caused hundreds of arrests and convictions, inclusive of executives and former presidents, making it one of the maximum giant anti-corruption efforts in Latin America. In our subject of understanding, this case sticks out as a turning point that spurred judicial reforms and accelerated transparency in public procurement.

| Country | Case Name | Amount Involved (USD) | Year | Notes |

| Brazil | Operation Car Wash | $2 billion+ | 2014–2020 | Involved Petrobras and top politicians |

| Malaysia | 1MDB Scandal | $4.5 billion | 2009–2015 | Funds embezzled from state investment |

| Nigeria | Sani Abacha Loot | $5 billion+ | 1993–1998 | Dictator's embezzlement of public funds |

| South Korea | Samsung Bribery Scandal | $38 million | 2016–2017 | Led to impeachment of President Park |

| United States | Enron Accounting Fraud | $74 billion (losses) | 2001 | Corporate corruption and financial fraud |

Which Institutions Combat Corruption?

Global efforts to fight corruption are being led via several key institutions and frameworks that paintings to enhance transparency, duty, and legal enforcement.

The United Nations Convention Against Corruption (UNCAC) offers the maximum whole international criminal device, supporting global locations develop anti-corruption techniques that encompass law enforcement, judicial reform, and move-border asset recuperation. In our subject of information, we see UNCAC as a cornerstone for nations looking for to harmonize their policies and collaborate on complex worldwide corruption cases.

Meanwhile, Transparency International plays a vital role in raising consciousness thru its Corruption Perceptions Index, which assesses public sector integrity and guides reform priorities throughout governments and civil society.

Other influential actors embody the Financial Action Task Force (FATF), which establishes worldwide Anti-Money Laundering (AML) necessities that without delay manual anti-corruption efforts thru limiting the movement of illicit charge range. FATF also conducts mutual opinions to ensure nations enforce its hints correctly.

Additionally, the global increase of whistleblower safety felony hints has empowered more individuals to report unethical practices without worry of retaliation. Open Government responsibilities in addition guide this development through selling transparency, get entry to to statistics, and civic engagement. Together, those efforts form a multilayered technique that addresses corruption from more than one angles, reinforcing a tradition of integrity and public obligation global.

5 Key Steps to Prevent Corruption

- Strengthening Institutions

- Enhancing Transparency

- Enforcing Accountability

- Civic Awareness and Education

- Leveraging Technology

Combating corruption effectively demands coordinated action across institutions, communities, and technologies. In our field of expertise, we’ve seen that strengthening institutions is fundamental to this process. Independent courts, empowered regulatory bodies, and unbiased enforcement businesses ought to have the authority and assets to apply legal guidelines similarly. Without a robust felony framework and credible enforcement, anti-corruption measures regularly fail to benefit traction.

Additionally, promoting transparency in regions like budgeting, procurement, and authorities desire-making allows the overall public to scrutinize useful resource allocation and demand obligation from their leaders. Equally important are mechanisms that every put into effect and encourage ethical behavior. Internal controls, audits, and whistleblower protections all play important roles in ensuring that misconduct is recognized and penalized.

Civic training helps domesticate a society that values integrity, in which individuals apprehend their rights and are motivated to record wrongdoing. Finally, technology is reworking anti-corruption efforts. Blockchain guarantees that transactions are tamper-evidence, at the same time as e-procurement systems assist take away backdoor dealings by standardizing methods. These virtual gear offer the traceability and consistency had to lessen human interference and decrease possibilities for manipulation.

FAQ's Blog Post

Corruption is the abuse of entrusted power for personal gain. It can occur in public and private sectors, taking forms such as bribery, embezzlement, favoritism, or fraud.

Sectors most vulnerable to corruption include public procurement, law enforcement, judicial systems, and political institutions. These areas often involve high discretion and low transparency, making them prone to bribery, favoritism, and misuse of power.

According to Transparency International’s Corruption Perceptions Index, countries like Somalia, South Sudan, and Syria consistently rank among the most corrupt, due to weak governance, conflict, and lack of institutional oversight.

Common types include: Bribery Embezzlement Nepotism Cronyism Extortion State capture These practices undermine trust and efficiency in institutions.

Not always. While many forms of corruption—like bribery and embezzlement—are illegal, some practices like nepotism or cronyism may be legal in certain jurisdictions but are still considered unethical and damaging to institutions.

Yes, North Korea is widely regarded as one of the most corrupt countries in the world. The regime is characterized by extreme secrecy, lack of accountability, and widespread bribery. Power and privilege are often exchanged for loyalty or payment, especially in trade, military, and legal processes.

The “Corrupt Bargain” refers to the 1824 U.S. presidential election. When no candidate secured a majority, the House of Representatives chose John Quincy Adams as president. Allegedly, Adams struck a deal with Henry Clay—offering him the position of Secretary of State in exchange for support—leading to claims of political corruption.

The Corruption Perceptions Index is an annual ranking published by Transparency International. It scores countries on how corrupt their public sectors are perceived to be, based on expert assessments and opinion surveys. A score of 100 means very clean; 0 means highly corrupt.

Prevention strategies include strong legal frameworks, independent oversight bodies, whistleblower protections, public sector transparency, and digital governance tools to reduce discretion and increase accountability.

Anti-corruption agencies investigate misconduct, enforce laws, and promote public awareness. Their effectiveness depends on independence, adequate funding, and political will to act impartially.