What Are AML Fines?

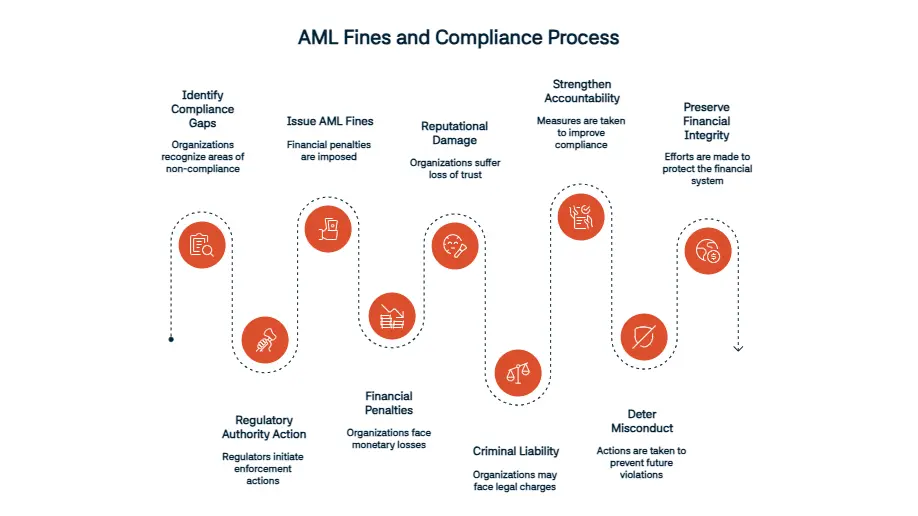

Without a doubt, awareness of AML compliance is on the rise. Anti-Money Laundering (AML) fines are financial penalties imposed by regulatory authorities. We may attribute this remarkable progress to the potential fines, reputation loss or other legal consequences. Anti-Money Laundering (AML) fines are financial penalties imposed by regulatory authorities. However, the severity of these repercussions is still not always enough to stop these acts all together. In this article, we highlight some of the largest fines in history, the sectors and countries most affected, ways to avoid them, and more.

What Are the Reasons for AML Penalties?

- It wouldn’t be wrong to say that weak Customer Due Diligence (CDD) and Know Your Customer (KYC) are some of the major reasons for AML Penalties. Knowing your customer well from the start of business relationship is a sure way to prevent future risks. It is especially important to conduct proper checks when it comes to dealing with high-risk customers such as PEPs.

- Another key reason is failure to monitor transactions. This can happen by using inappropriate, outdated or manual monitoring systems, which can lead to shortcomings in detecting red flags.

- Even if you successfully detect a suspicious activity and act on it, you are obligated to file Suspicious Activity Reports (SARs). Filing alone is not sufficient, these reports should be timely and complete.

- Whether willfully or not, processing transactions for sanctioned individuals, countries, or organizations can also result in significant fines. For example, BNP Paribas was fined $8.9B in 2014, due to the bank setting up elaborate payment structures that routed transactions to disguise their origin.

- Some other possible reasons are: Compliance program failures, corporate misconduct, and more.

The 14 Biggest AML Fines in History

1. BNP Paribas: U.S. sanctions violations

We have already covered this in the previous section, but let’s further elaborate on it due to its importance. In 2014, BNP Paribas agreed to plead guilty to criminal charges. The bank deliberately hid thousands of transactions with Iran, Sudan and Cuba for eight years. During an eight year period, senior bank officials were aware of the fact that they were breaking US law. As a result of these violations, BNP Paribas received a record fine of $8.9B.

2. TD Bank Scandal

Last year the U.S.’ tenth largest bank, Toronto-Dominion Bank, received a fine of $3.09 billion after pleading guilty to multiple charges. Among these charges, there were conspiracy to violate the Bank Secrecy Act and to commit money laundering. TD admitted that it allowed three money laundering networks to transfer more than $670 million through TD Bank accounts.

3. Goldman Sachs: 1MDB scandal

This infamous case revolves around a sovereign wealth fund that was created by the Malaysian government in order to promote economic development. However, billions of dollars were misappropriated from the fund and Goldman Sachs played a key role in this scandal. Goldman Sachs employees allegedly knew about high corruption risks and accepted large personal fees. Regulators held the bank responsible for insufficient AML and due diligence controls. Goldman agreed to settle with the DoJ for $2.9 billion and its Malaysian unit pleaded guilty to a corruption charge.

4. Danske Bank: Money Laundering in the Estonia Branch

In 2017, it was revealed that Danske Bank’s Estonian branch had allowed over €200 billion of suspicious transactions to move through its channels. At first this was largely attributed to the lack of communication between Copenhagen and Estonian branch, however in fact it turned out to be highly corrupt because the executive board couldn’t enforce proper communication routes and monitor whether its branches were functioning legally. A lot of repercussions followed this scandal: ten former employees in the Estonian branch were arrested, Estonia closed the branch, the CEO Thomas Borgen resigned and the value of Danske Bank shares was halved. In December 2022, Danske Bank pled guilty and agreed to a $2 billion fine in a case from the Unites States Department of Justice.

5. HSBC – $1.9B (2012): Drug cartel funds, Iran sanctions

In 2012, U.S. authorities accused HSBC of not implementing proper controls to prevent money laundering and related crimes. Their evidence showed that HSBC moved billions of dollars in illicit funds through its accounts as well as violating U.S. sanctions against countries like Iran and Sudan. These funds even included drug trafficking and terrorist financing. In 2013, the bank agreed to pay a fine of $1.9 billion to the U.S. Department of Justice.

6. UBS: Risk scoring, ownership failures

The U.S. Justice Department alleged that the Swiss bank UBS sold mortgages despite being aware of the fact that they were problematic and noncompliant. The bank agreed to pay a combined $1.4 billion in civil penalties over fraud.

7. Westpac: Ignored red flags

In 2020, regulators accused Westpac Banking Corp of 23 million breaches of AML laws. These breaches included ignoring red flags, enabling payments from convicted child sex offenders and high-risk countries. The bank failed to submit reports, monitor risks and make adequate checks. All of this led the bank to agree a $1.3 billion civil penalty for more than 23 million breaches of Anti-Money Laundering laws.

8. Standard Chartered: Iran/Sudan violations

Standard Chartered was accused of processing transactions worth $438M during the five year period between 2009 and 2014. The problematic part here is that the majority of these transactions involved Iran-linked accounts. In the end, The U.S. and the UK authorities ordered the British bank to pay $1.1B.

9. Deutsche Bank: Mirror trading with Russia

This scandal revealed around the German bank’s Moscow, London and New York offices from 2011 to 2015, in which it bought Russian blue-chip stocks in rubles worth $10B on behalf of clients and sold them at the same price through its London branch. There wasn’t any economic purpose behind these actions, and the bank missed numerous opportunities to detect, investigate and stop the scheme. This resulted in the Deutsche Bank receiving $630 million of fines and requiring an independent monitor to review the bank’s compliance programs.

10. Credit Suisse: Mozambique “Tuna Bond” scandal

Tuna Bond scandal started with the company Privinvest and its owner Iskandar Safa allegedly bribing over $100 million to officials in Mozambique, and to Credit Suisse employees for contracts and loans to develop Mozambique’s fishing industry and improving maritime security. Credit Suisse and other banks arranged around $2 billion in loans to fund Mozambican projects and companies. However, these actually consisted of bribes and kickbacks. Also, Mozambican government concealed this debt from its parliament and international donors. In 2021, Credit Suisse paid $475 million in fines to U.S., UK and Swiss regulators and agreed to cancel $200 million in Mozambican debt.

11. Rabobank: Drug cartel laundering

The Dutch bank allegedly handled hundreds of millions of dollars in “untraceable cash” from clients linked to the Mexican drug trade. Then these funds were withdrawn through wire transfers, checks and cash transactions. Moreover, the bank allegedly obstructed the investigation. It is worth mentioning that Rabobank had similar violations back in 2006 and 2008. All of these reasons led U.S. Department of Justice to fine Rabobank $369 million.

12. Swedbank: Baltic transaction failures

This dirty money scandal resulted in Sweden’s oldest retail bank to see a collapse by third in its share price. The problem stemmed from the bank’s shortcomings in in its Anti-Money Laundering solutions in the Baltics. The bank also ignored the warnings from the FSA, as well as withholding the necessary information. These factors led Sweden’s financial supervisory authority to fine Swedbank a record 4 billion Swedish kronor (approximately $365 million) for the vulnerabilities in AML processes and controls.

13. SEB Bank: AML gaps in Baltics

At the 13th place, we see another case of Baltic AML failure. Skandinaviska Enskilda Banken (SEB) and its subsidiary banks in the Baltics failed their AML duties between 2015 and 2019. Even some subsidiaries relied on customers with “a higher risk of money laundering” to prop up their business, and their AML measures definitely were not enough for onboarding these customers. This investigation caused SEB to receive a fine of $107 million by regulators due to failure in identifying money laundering risks.

14. BitMEX: No KYC for years

Cryptocurrency exchange BitMex, failed to establish and maintain a proper AML program required by the Bank Secrecy Act. In addition, the exchange didn’t have an adequate KYC program and illicitly allowed U.S. users in its platform. This ended up with BitMex receiving a $100 million fine.

| Institution | Fine Amount | Jurisdiction |

| BNP Paribas | $8.9 Billion | United States |

| TD Bank | $3.09 Billion | United States |

| Goldman Sachs | $2.9 Billion | U.S., U.K., Malaysia |

| Danske Bank | $2 Billion+ | Europe |

| HSBC | $1.9 Billion | United States |

| UBS | $1.4 Billion | Global |

| Westpac | $1.3 Billion | Australia |

| Standard Chartered | $1.1 Billion | U.S, U.K |

| Deutsche Bank | $630 Million | U.S. & U.K. |

| Credit Suisse | $475 Million | Global |

| Rabobank | $369 Million | United States |

| Swedbank | €365 Million | Sweden/Baltics |

| SEB Bank | €107 Million | Baltics |

| BitMEX | $100 Million | United States |

Sector Breakdown: Who Gets Fined the Most?

As expected, the banking sector leads the list. The banks can be easily considered as the main gateway for global money flows due to the fact that roughly 70%-80% of the fines belonging to banks. These are mainly due to failures in Know Your Customer processes, transaction monitoring, sanctions screening, high-risk clients and ignored warnings. Following the banks, crypto exchanges come next. Factors such as digital wallets, payment processors, and remittance firms facilitate quick transactions. Also, the anonymity that comes with these transactions doesn’t make it any less attractive for criminals.

FinTech and PSPs (Payment Service Providers) are also worth mentioning. Just like cryptos exchanges, these institutions help digital wallets, payment processors, and remittance firms move funds quickly and often across borders.

Global Regulatory Authorities Behind AML Enforcement

FinCEN (U.S.)

Financial Crimes Enforcement Network is the primary U.S. authority under the Bank Secrecy Act (BSA). In the context of FinCEN itself, it is both a regulator and an intelligence hub. FinCEN collects financial data, enforces AML laws, and turns raw reports into actionable intelligence for law enforcement and global partners.

FCA (UK)

The Financial Conduct Authority operates under the Financial Services and Markets Act 2000 (FSMA). It is considered as an independent public body who gets funded by fees from regulated firms and accountable to both the Treasury and Parliament. According to the FCA’s website, The Financial Conduct Authority’s central missions are; ensuring the integrity of financial markets, protecting consumers and fostering healthy competition.

MAS (Singapore)

The MAS (Monetary Authority of Singapore) is the Singapore’s central bank. It manages monetary policy, currency issuance and the supervision of payment systems. However, it also acts as the integrated financial supervisor. The MAS oversees banks, insurers, capital market intermediaries, financial advisors and market infrastructures.

BaFin (Germany)

BaFin (The Federal Financial Supervisory Authority) is an autonomous public-law institution and is subject to the legal and technical oversight of the Federal Ministry of Finance. It is funded by the institutions and undertakings under its supervision. BaFin’s aim consists of ensuring the proper functioning, stability and integrity of the German financial system.

AUSTRAC (Australia)

In Australia, AUSTRAC (Australian Transaction Reports and Analysis Centre) is the responsible institution behind AML enforcement. It acts as the country’s financial intelligence unit and Anti-Money Laundering and counter-terrorism regulator.

How Are AML Fines Calculated?

In fact, there are several metrics and factors that contribute to the amount of fines. Here, we will explain the most influential ones. One of the first determinants that authorities check is that whether the incident is willful. However, a behavior being negligent isn’t enough to save institutions from hefty fines. Moreover, authorities check the transaction value as well as the size of the institution. A large bank is more likely to face a higher penalty compared to a small firm. Another factor they take into account is the duration of misconduct. As expected, longer duration will result in higher fees. Similar to the previous factor, regulators often consider whether the violation is repeated or not. Even if the case appears to be a product of negligence, repetition of offenses can raise suspicion. Thus, repeat offenders are more likely to face higher penalties and stricter supervision. Regulators are also likely to decrease the penalties depending on the degree of cooperation. You must self-report, cooperate and fix issues quickly. Concealing any information or delaying remediation results in increased penalties. Last but not least, they check the degree of social and national security harm. The reason behind the laundered money is very crucial. Is it used to finance terrorism? Or did the transactions contribute to organized crime or drug trafficking? These are all key metrics to consider.

Which Countries Issue the Most AML Fines?

The U.S. tops the list with a total of $4.08B last year. The United States is responsible for the majority of fines issued in the world. It is followed by the UK, which issued $261.68M in the same year. The United Kingdom has quickly surpassed those ahead in the ranking in the recent years. We can attribute this to the UK’s heavy KYC/EDD enforcement. From the third place onward, the penalty amounts decrease and we see countries with similar levels. The rest of the list goes as follows: Sweden totaling $47.4M across 2 cases, Finland totaling $35.99M with only one case and China totaling $31.22M with 3 cases.

How to Avoid AML Fines

A solid foundation is essential to avoid these fines. For that, you need to establish a strong AML Compliance Program that aligns with FATF. This first line of defense should consist of written policies and procedures, management oversight and most importantly, a risk-based approach.

Once you are confident in the solidity of the previous step, we can move on to the next stages. You should pay attention to details especially when onboarding a customer and for this, you must conduct proper CDD (Customer Due Diligence) and EDD (Enhanced Due Diligence). These will allow you to verify the identities of customers, particularly the high-risk ones.

After you are done with the onboarding processes, it’s time to move on to real-time monitoring and red flag alerts. Using automated systems to flag unusual patterns, thresholds, or geographic risks can be immensely helpful. We should note that these screenings should be conducted against up-to-date sanctions lists, PEP lists, and adverse media.

Even if you’ve completed all of the previous steps successfully, you will not be safe from AML fines until you file SARs (Suspicious Activity Reports). These will prove to be very beneficial later on, especially during audits and investigations.

In order for all this to be consistent and future-proof, you shouldn’t neglect the importance of fostering a culture of compliance throughout your business. You should train your staff regularly and make sure all departments are successfully collaborating.

Last but not least, you should conduct audits to see what needs to be improved. These will allow you to evaluate your approach and fix the vulnerabilities accordingly.

How Can Sanction Scanner Help?

Sanction Scanner = end-to-end AML compliance suite

We offer numerous solutions that will help you avoid fines. We have already mentioned the importance of detecting red-flags beforehand. Sanction Scanner allows you to scan your customers against more than 3000 Global Sanctions, Politically Exposed Person lists, Watchlists and adverse media. Moreover, our lists get updated every 15 minutes.

Furthermore, our transaction monitoring software can monitor your customer transactions in real-time to detect unusual transactions. After detecting these, it stops the transactions and records them for investigation. Also, it allows you to set rules and scenarios in order to tackle the unusual activities efficiently.

These are only a part of what we offer, there are other features such as powerful case management, full audit trails, user-friendly dashboard, live transaction screen, and integrated sanction and PEP Query. We should add that our software can easily be integrated with your existing systems via API. Please do not hesitate to contact us to learn more about the other features we offer.

FAQ's Blog Post

A penalty for failing to comply with anti-money laundering regulations.

Due to weak KYC, poor transaction monitoring, or missing SARs.

Banks, crypto exchanges, gambling platforms, and FinTechs.

$8.9 billion – BNP Paribas (2014), for processing payments from sanctioned countries.

Annual fines reached $4.3B in 2022; crypto-related fines are rising fast.

FinCEN (US), FCA (UK), BaFin (Germany), MAS (Singapore), AUSTRAC (Australia).

By using real-time monitoring, proper KYC, and compliance tools.