Anti-Money Laundering analysts or officers investigate and monitor suspicious financial activities. Their role is essential as they ensure their company complies with regulations with a powerful AML compliance program. Companies without Anti-Money Laundering Analysts are vulnerable to AML penalties.

Sorting out the 'legitimate' from the 'illegitimate' transactions might be difficult for financial institutions, so investing in the technology to help AML analysts is critical for efficient and successful detection and investigation.

What Are The Responsibilities of an AML Analyst?

AML analysts should offer firms a comprehensive AML compliance program to comply with regulations. They manage the complicated and multifaceted nature of AML compliance. The responsibilities of an AML analyst are varied, and they are listed as follows:

- Investigating and assessing the financial risks posed by a company's operations and monitoring/regulating high-risk activities.

- Communicating with regulators and auditors regularly to explain their risk monitoring, control, and prioritization techniques.

- Reporting information that illustrates the organization's overall performance in terms of risk mitigation.

- Examining data and solutions to verify all AML regulations are met.

To sum up, AML analysts protect their companies from possible AML regulations, fees, and penalties.

What Skills Make an Exceptional AML Analyst?

| Skills | Description |

|---|---|

| Understanding of the firm's business | Good AML analysts have often worked in various roles inside the company in addition to establishing an AML compliance program. As a result, they are well-versed in the company's goods and services and transaction styles, including everyday customer interactions. |

| Communication skills | AML Analysts usually work in teams. Therefore, team members need to have decent communication skills no matter their job. |

| Compliance requirements | New regulations are constantly being implemented, and AML analysts should understand and apply them to their companies' AML Compliance programs. Their actions might range from facilitating the construction of different scenarios for monitoring reasons to the definition of new scenarios. |

| Data source comprehension | Legacy data from many sources/systems might be critical in constructing a complete picture of a client's operations to determine transactional risk. In rare cases, transaction monitoring systems may not regularly get all data pieces. Missing data might be the difference between detecting and not detecting a money laundering case. A crucial duty of an AML analyst is to know where to look for extra data within current systems and integrate it into their investigation procedures. |

How to Support AML Analysts as a Company?

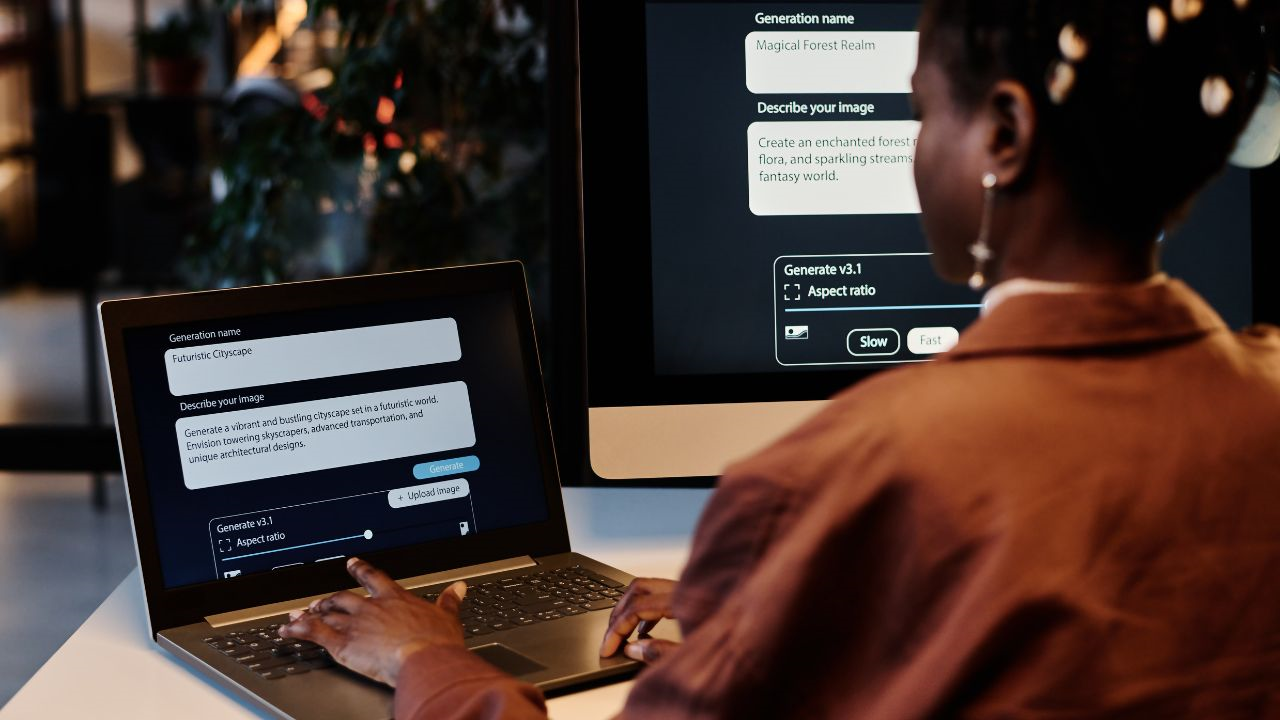

Financial organizations should invest more in advanced technologies to reduce the workload of AML analysts. AI-driven software helps AML analysts detect and investigate suspicious activities more easily and reliably.

How Does AML Software Work?

By assisting AML analysts using as-a-service technology, companies can help enterprises achieve the requirements of an AML compliance program. Sanction Scanner's AML software program exemplifies advanced technological integration with AML compliance. Such software enables AML analysts to handle their AML/CFT requirements regardless of the company's size, sector, or geographic location.

Organizations obliged to comply with AML regulations can easily comply with them, reduce their risks of facing financial crimes, and make compliance programs easy and effective using Sanction Scanner AML Compliance solutions.