What Is a Fintech Company?

In this blog post, we’ll be talking about and explaining important details regarding Fintech. Fintech, or financial technology, is about the software and digital innovations that help improve financial services. Fintech companies helps individuals, businesses, and governments; to help them in the process of managing and growing in a more efficient way. According to the According to a blog content of Stripe, this sector has everything; online banking, mobile payment apps, and peer-to-peer lending platforms to more complex technologies like blockchain and artificial intelligence (AI).

History of Fintech Industry

The Fintech industry has been continuing to grow since 2009, for almost two decades. We’ll explore this timeline more closely now. Firstly, between the years of 2009 and 2013, Fintech was pushed forward by the rise of mboile payments. Peer-to-peer (PSP) lending increase has also took a big role in popularising Fintech solutions.

Moving forward, between 2014 and 2017, neobanks emerged and helped solidify Fintech solutions further. Also, the rise of robo-advisers has improved technology and because of this, the need for technological solutions have increased. People and companies have started to figure out that the future will be digitally-led. Next part on our list, between 2018 and 2023, things have continued to move into the online and technological parts of the world. With the pandemic, technological improvements have sky-rocketed. The growth of blockhain has increased the need for Fintech solutions dramatically. An increase of usage in decentralised finance (DeFi) and alternative credit platforms have pushed companies further to invest in fintech solutions as a precaution.

Finally, in the recent years of 2024 and 2025, AI has changed things a lot. AI-driven regulatory technology (RegTech), fraud prevention, and embedded finance have all helped push the importance of Fintech usage. Fintech companies will continue to be important for firms with its increasing popularity proving this. According to a research from Plaid.com, while 87% of consumers are comfortable using national banks, 79% say they are comfortable using fintech companies, indicating a narrowing trust gap.

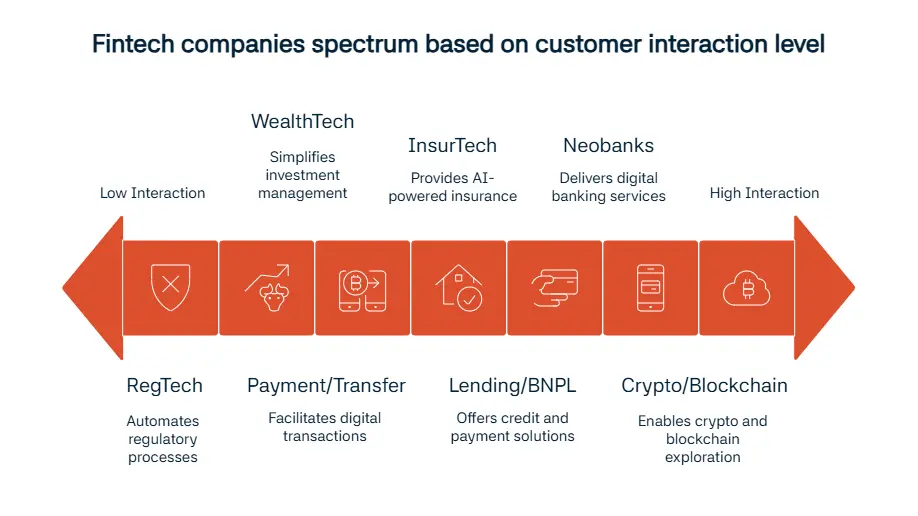

Types of Fintech Companies

There are many different types of Fintech companies all around the world. For example, neobanks like Revolut and Monzo are great for digital banking. Digital banking helps move banking to a more accessible place. One other type is companies that help with payments and transfers. Stripe is great for this category, and Wise is particularly dealing with international payments.

Another example we can give is InsurTech companies. Companies like Lemonade gives AI-powered insurance services and Root is amazing for this category as well, particularly using data sourced models. RegTech companies are one other type we’ll mention. These companies help you achieve your AML and KYC compliance goals with ease. Sanction Scanner and ComplyAdvantage can be given as two leading examples. WealthTech is another category that is worth mentioning. Companies like Robinhood and Betterment make investing easier and more accessible thanks to fintech solutions they offer. One other example is crypto and blockchain companies. These companies help you explore more about crypto and blockchain without compromising on quality and efficiency. Companies like Coinbase and Binance are great with this.

Finally, lending and buy now pay later (BNPL) companies like Klarna and SoFi are well-known for good reason. These companies offer credit solutions for every kind of customer.

How Do Fintech Companies Work?

We can explore how Fintech companies work by first talking more about B2C and B2B types of business models. Business to consumer (B2C) Fintech companies offer apps that are directly served to consumers. Chime and Robinhood can be given as examples since they aim to make financial process easier for customers with their banking, investing, and financial management tools.

Business to business (B2B) Fintech companies on the other hand, deal with serving the appropriate infrastructure for banks and other fintech companies. Companies like Plaid and ComplyAdvantage achieve this with efficiency.

Core features that all of these Fintech companies should have are cloud infrastructure, APIs, automation, embedded compliance since they are trying to ensure easy and fast solutions for their consumers and other businesses.

AI, cloud computing, the rise of blockchain, surging SaaS popularity are trends that are important for Fintech companies in 2025 according to the experts of McKinsey company. Of course, like with any other financial entity, Fintech companies should comply with anti money laundering (AML), Know Your Customer (KYC), the Revised Payment Services Directive (PSD2), the General Data Protection Regulation (GDPR), and Open Banking requirements; they first need to adhere to these requirements to make sure that their customers are also in compliance.

One example from 2025 we can give is the Fintech company Plaid announcing they will be focusing more on battling AI driven fraud to further help companies with AML compliance. Overall, Fintech helps improve the speed in finance. It makes these solutions more accessible to our readers, and it is more cost efficient than other alternatives.

What Are the Top 15 Fintech Companies in the World (2025)?

Sanction Scanner

There are many types of companies that provide Fintech solutions and are great at it. First company we’ll mention is Sanction Scanner. This company is particulary interesting because of their RegTech, AML software, and AI compliance solutions. Sanction Scanner conducts global AML screenings, transaction monitoring and PEP detection. This company is used in more than 70 countries. Sanction Scanner has released its 2024 - 2025 Financial Crime and Compliance Report. According to the report, $3.1 trillion worth of illicit funds were moved globally. Of this, $782.9 billion stemmed from drug trafficking, $346.7 billion from human trafficking, and $11.5 billion from terrorist financing.

Stripe

Another example for an amazing company is Stripe. This company is widely used for online payments, payment infrastructure, and developer tools. It is powering billions in transactions for many companies worldwide and they achieve this with their advanced APIs. Stripe also has a stablecoin arm, Bridge, which has recently partnered with MetaMask, a widely used cryptocurrency wallet provider, with both announcing the introduction of MetaMask’s own stablecoin, named MetaMask USD (mUSD); this shows Stripe’s recent activities that also deal with cryptocurrency.

Revolut

Revolut is another example that offers a great investment app with digital banking and crypto wallet options included paired with FX, and wealth management features. Through its ecosystem, Revolut offers free and subscription-based digital banking, domestic and international bank transfers, debit cards, credit cards, a stock and cryptocurrency exchange, savings accounts, loans, insurance, wealth management and more.

Paypal

Paypal as well is well-known for its digital wallet offering paired with e-commerce payments and BNPL options. Paypal continues to grow while it has more than 430 million users; this makes Paypal the leading platform for online payments and merchant services. PayPal Holdings is currently adding new technology to power a new pay-with-crypto conversion tool to connect dozens of cryptocurrencies and stablecoins for shoppers and merchants.

Adyen

One other company we’ll mention is Adyen. This company is best known for its enterprise level payments, unified commerce, and PSP. Adyen is the all-in-one global payment processor that is trusted by globally huge companies like Uber, Spotify, and eBay. Adyen is a provider of payments processing, point-of-sale hardware and software services for merchants, including retailers such as Crate & Barrel and Dick’s Sporting Goods. This Dutch company is looking forward to breaking more into the U.S. market.

Plaid

Another company that is leading in the Fintech industry is Plaid. This company is great for those who are looking for open banking, financial data APIs, and BaaS infrastructure services. Plaid connects apps to banks accounts, and it enables fintech innovation via API integrations. Plaid is currently improving its systems by adding capabilities to its portfolio to help banks and other financial institutions cut their fraud risk from remote customer onboarding, it is doing so by adding new sources of data to ensure the integrity of identity verification for new users.

Wise

Wise (formerly TransferWise) is also an example that we can give that is most likely very well-known by our readers. This company deals with global payments and currency exchange. It is a company with low fees for international money transfers and it offers these services with more than 40 currencies. It is used by more than 16 million users worldwide. Wise announced that it has become the first global fintech fully integrated with both InstaPay and PESONet. This move makes Wise a major player in the Philippine remittance market, now processing 12% of all inward personal remittances and transforming how Filipino families manage high-value transactions like tuition fees.

Robin Hood

Robinhood is another company that serves a stock trading app, zero commission inverstion, and crypto access. This company democratizes investing for retail users like our readers with real time trading and tractional shares. Another example is Klarna; this company helps with and serves BNPL, e-commerce financing, and consumer credit. Klarna is a buy now pay later pioneer that serves more than 150 million customers globally.

SoFi

SoFi is one other company we’ll mention. SoFi is popular with helping student loans, personal finance, and credit and wealth. This company combines lending, investing, and banking with customer first approach. Nubank is a digital banking service in Latin America, it helps with digital credit cards. This company is Brazil based and it is one of the world’s largest digital banks with more than 80 million users.

Alipay

Ant Group (also known as Alipay) is a super app that includes mobile wallet and payments, lending, and wealth management. It is a China Fintech leader that is huge in Asia’s digital economy.

Chime

Another company we’ll mention is Chime, a fee-free digital banking company that provides early pay access and mobile banking. This company is popular in the U.S. for overdraft-free accounts and simple savings.

Complyadvantage

ComplyAdvantage is one other example. It deals with AML and CTF screening, and provides adverse media monitoring. ComplyAdvantage has real time AI powered financial crime detection for Fintech and traditional banks alike.

Coinbase

Finally, Coinbase is the last company on our list of leading Fintech companies. This company is a crypto firm that has wallet and instituonal custody features. It is a publicly traded crypto giant with more than 110 million verified users; it also has strong U.S. compliance focus.

How to Choose the Right Fintech Partner?

Since we’ve given you many options as examples, we’ll talk more about how to find out which Fintech company is the best for you and your firm. Regulatory compliance is the first thing to look for when choosing a partner. Requirements like AML, KYC, and GDPR must be met to leave you, our readers, in ease when dealing with your company’s financial compliance.

API capabilities and integrations are really important as well. These abilities help you when combining this company’s services with your already existing systems. Another thing to look for is real-time monitoring and automation. Making sure that all controls are happening continuously in a way that doesn’t cost your company anything in fines is essential. Another important thing to point out is getting reviews from places like G2, Gartner, and Capterra to ensure you are supplying your customers with adequate performances. Finally, having a support team and scalability options are other features to look out for. Knowing that your questions will be answered by a support team is assuring. Scalability options are equally assuring to let you know these Fintech companies can continue your journey with you as your company grows in size.

Who Regulates Fintech Companies?

Many types of Fintech companies operate in different regions of the world. In the U.S., there are SEC, FinCEN, and OCC. In another part of the world, the UK, Financial Conduct Authority (FCA) makes sure Fintech companies are compliant. In the EU, ESMA, PSD2, and GDPR are essential to keep these companies in check. Another example, in Singapore, MAS is responsible for regulation of Fintech firms. One other country, Australia, is known for ASIC regulating Fintech companies.

In Brazil, BCB (Banco Central do Brasil) deals with the issue of making sure Fintech companies are in compliance. Final region on our list, in the UAE, DFSA and ADGM check Fintech companies, this is all done to ensure AML and other compliances.

What Are the Benefits of Fintech Solutions?

In this blog post, we’ve shared details of how Fintech companies operate and how important Fintech is for all companies. We’ll continue by listing benefits of Fintech solutions. Firstly, Fintech companies provide faster onboarding and service delivery since they help automate processes that take longer otherwise. The UK Finance 2025 report shows how fraud that is caused by AI has been increasing in the UK in the recent years. The report urges companies to supply themselves with Fintech company solutions that offer AI supported and adaptive fraud systems that will help with compliance and help avoid financial crimes.

Another benefit of Fintech solutions is lower operational cost; Fintech solutions are beneficial when compared to traditional ways. One other item is enhanced user experience and mobile-first design. This makes sure that your customers are comfortable with the product they are using. Another example we can give is the inclusion of unbanked or underbanked populations. This is helpful since it provides a way to reach parts of the world that were previously inaccessible. Finally, modularity is great for our readers who are looking to partner with Fintech companies about Fintech solutions. This makes sure you only choose and integrate what you need whenever you desire to do so.

FAQ's Blog Post

Fintech refers to financial technology solutions that make banking, payments investing faster.

We selected them based on market impact, innovation, customer adoption, funding, and global presence.

North America, Europe, and Asia remain the leaders, with strong ecosystems in the U.S., UK, China.

No, they also serve payment providers, insurers, crypto firms, and businesses of all sizes across industries.

Regulation ensures compliance, customer protection, and stability, helping fintechs scale sustainably.

Both. Many fintechs collaborate with banks for infrastructure, while others compete by offering direct services.

AI, blockchain, open banking APIs, and digital identity tools are the main drivers of innovation.