AML Solutions For NGOs

NGOs use Sanction Scanner to simplify complex global regulations.

TRUSTED BY OVER 800+ CLIENTS

We offer solutions for our clients to comply with AML Regulations.

Robust AML Screening for NGOs

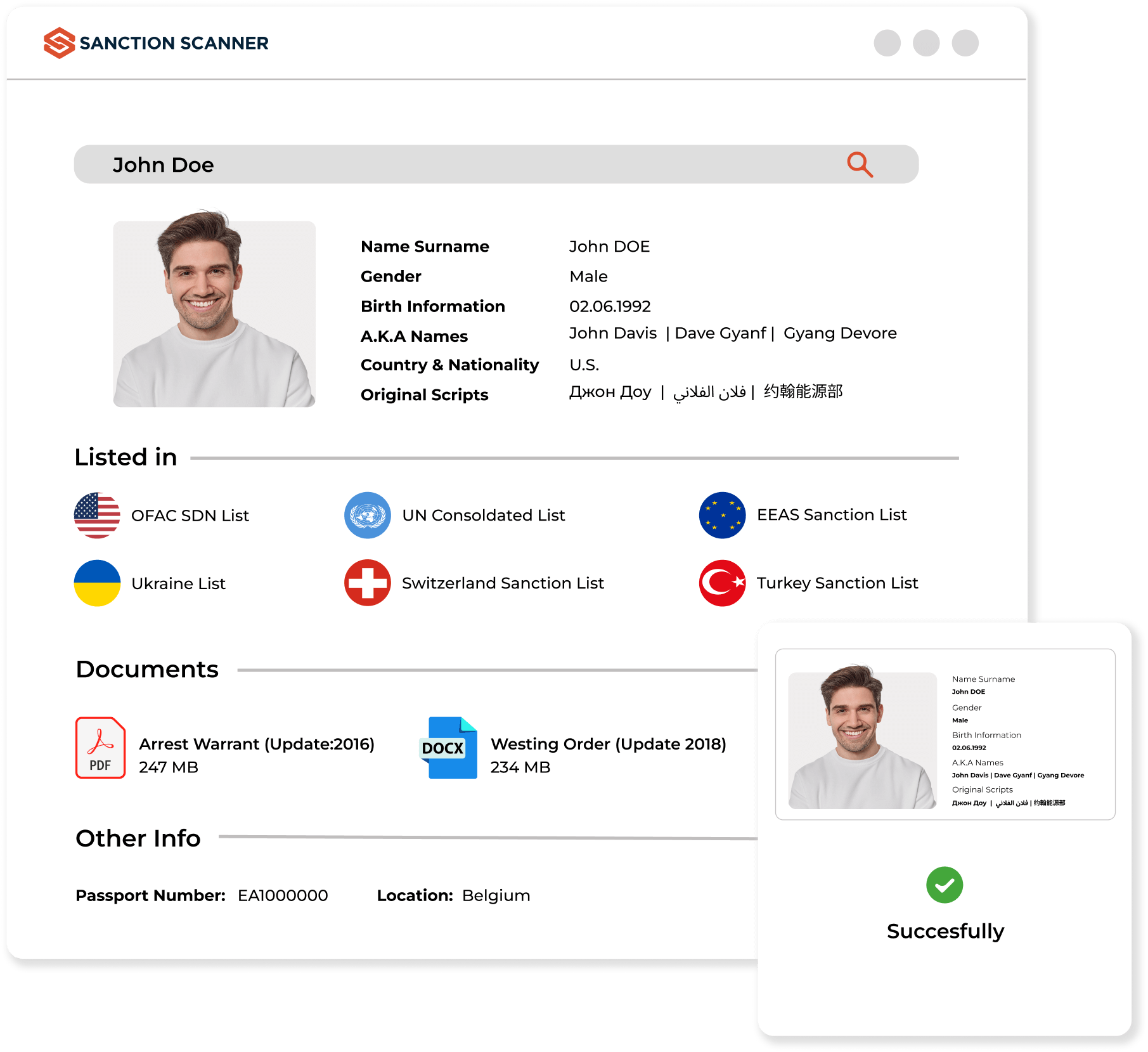

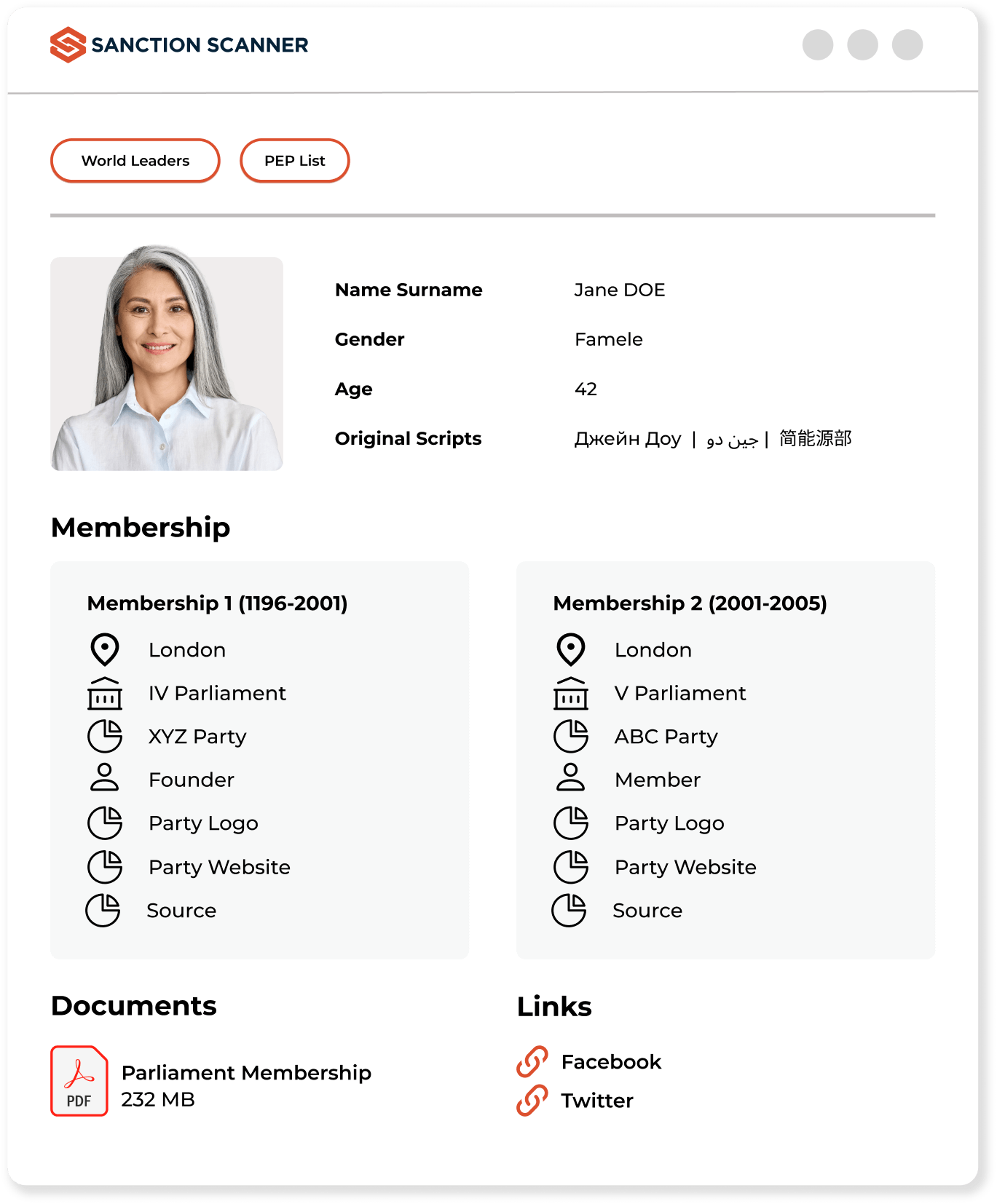

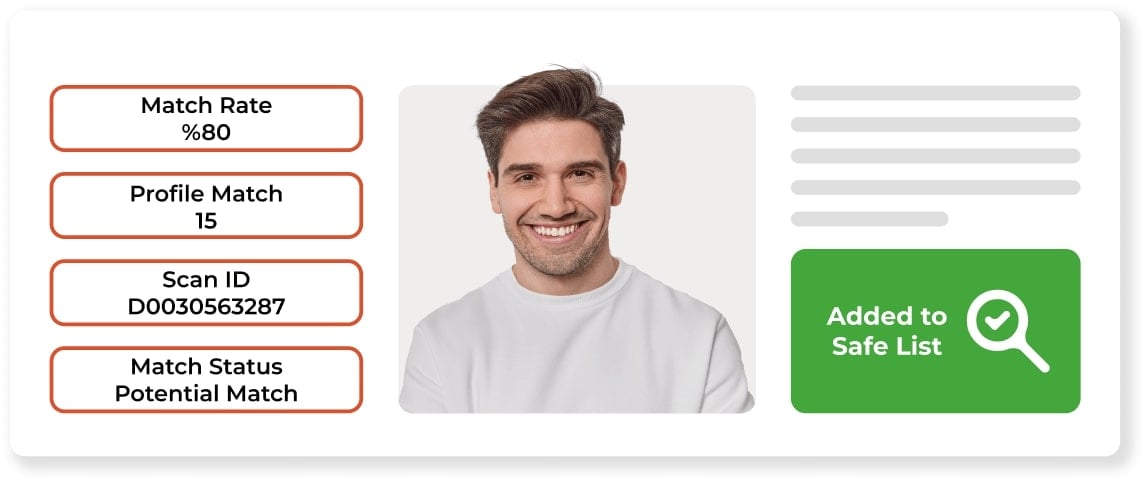

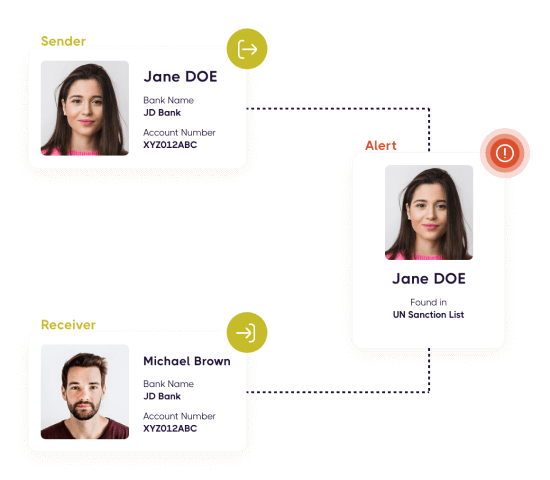

NGOs must operate globally under complex regulatory environments and comply with AML standards to mitigate financial crime risks. Sanction Scanner provides NGOs with such a tool, empowering them to perform comprehensive due diligence checks and meet compliance standards. NGOs can now conduct thorough AML screening checks against 3000+ sanction lists, PEPs, and watchlists, mitigating potential financial crime risks and ensuring compliance.

+3000

DATA POINTS CHECKED

+220

COUNTRIES COVERED

15 min

ALWAYS REAL-TIME DATA

150 ms

SCANNING

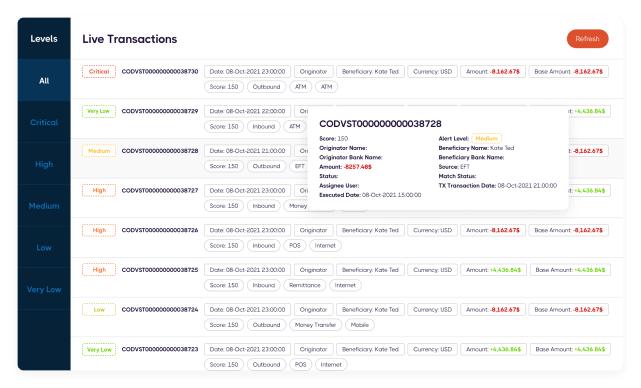

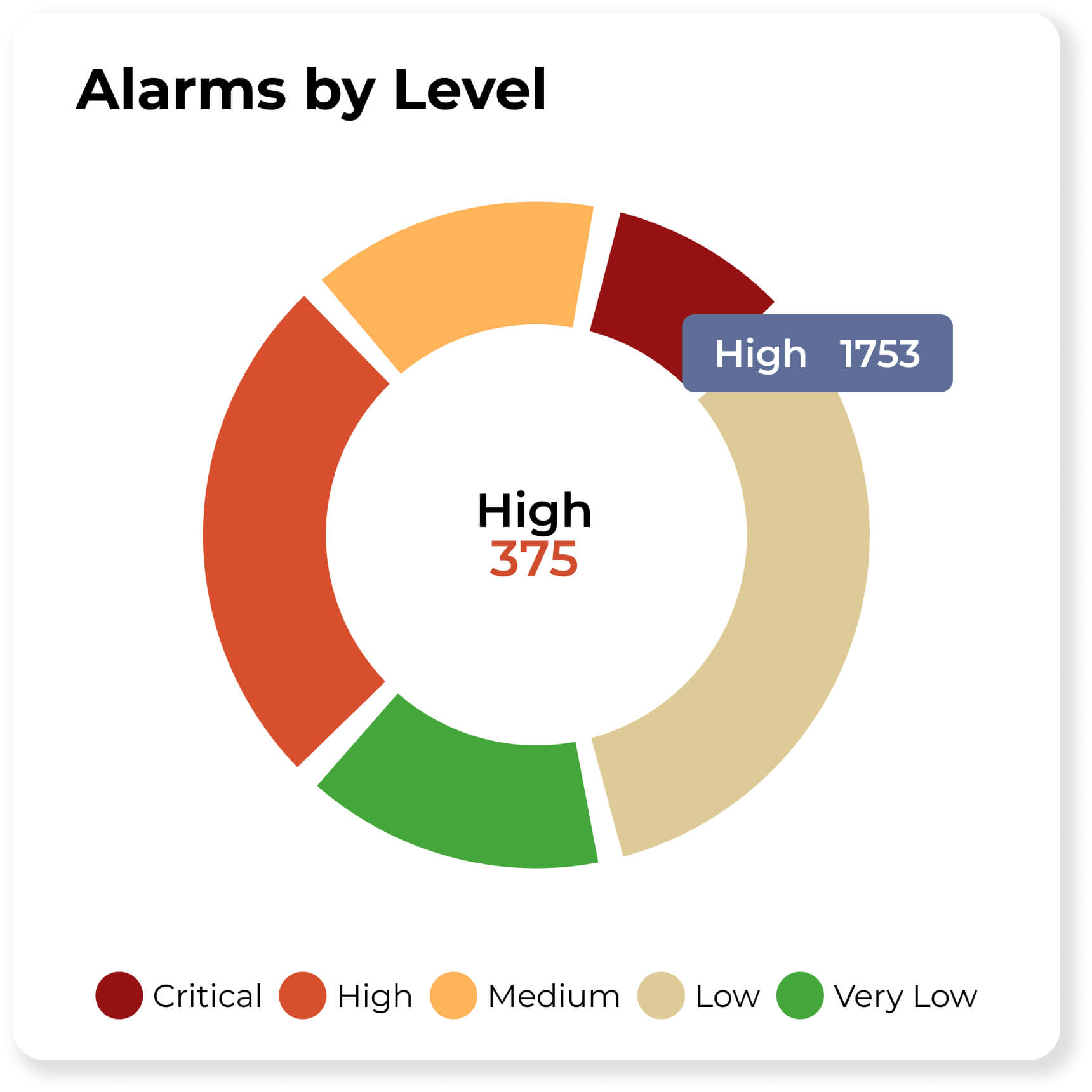

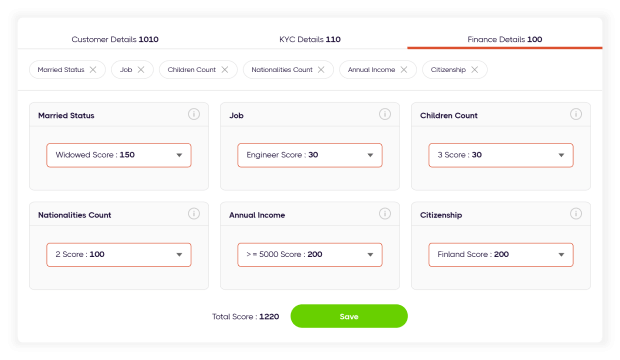

Customized Risk Management Solutions

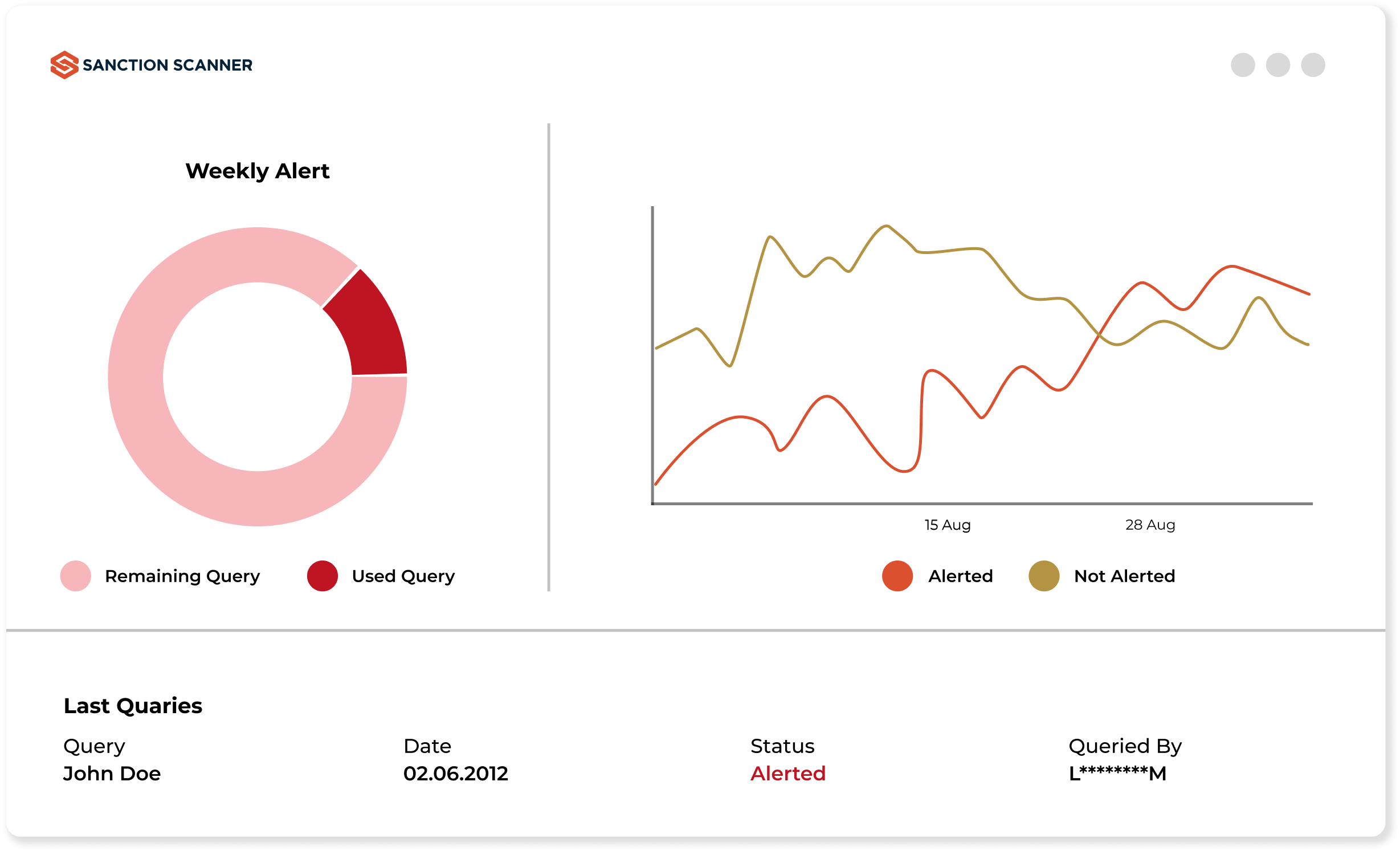

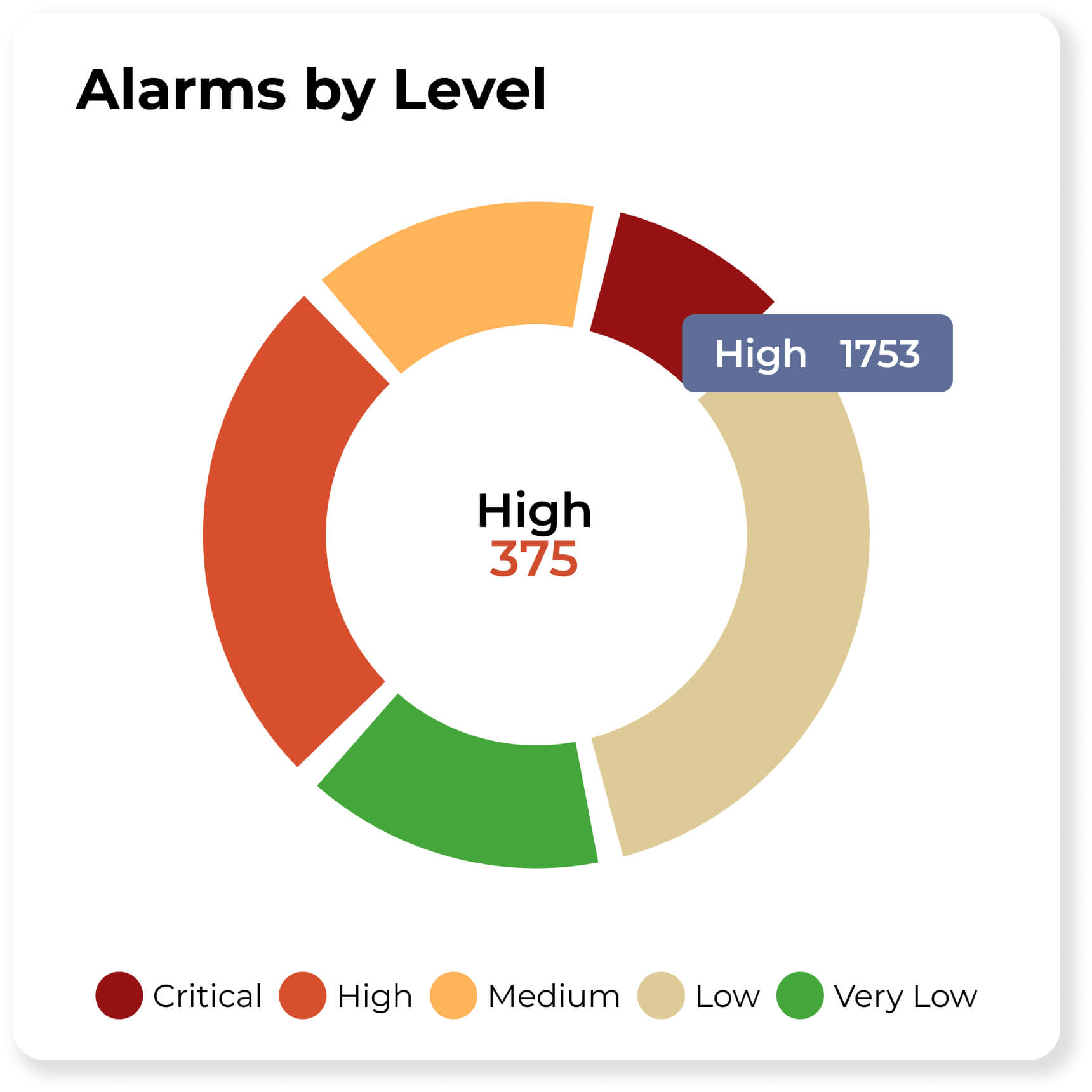

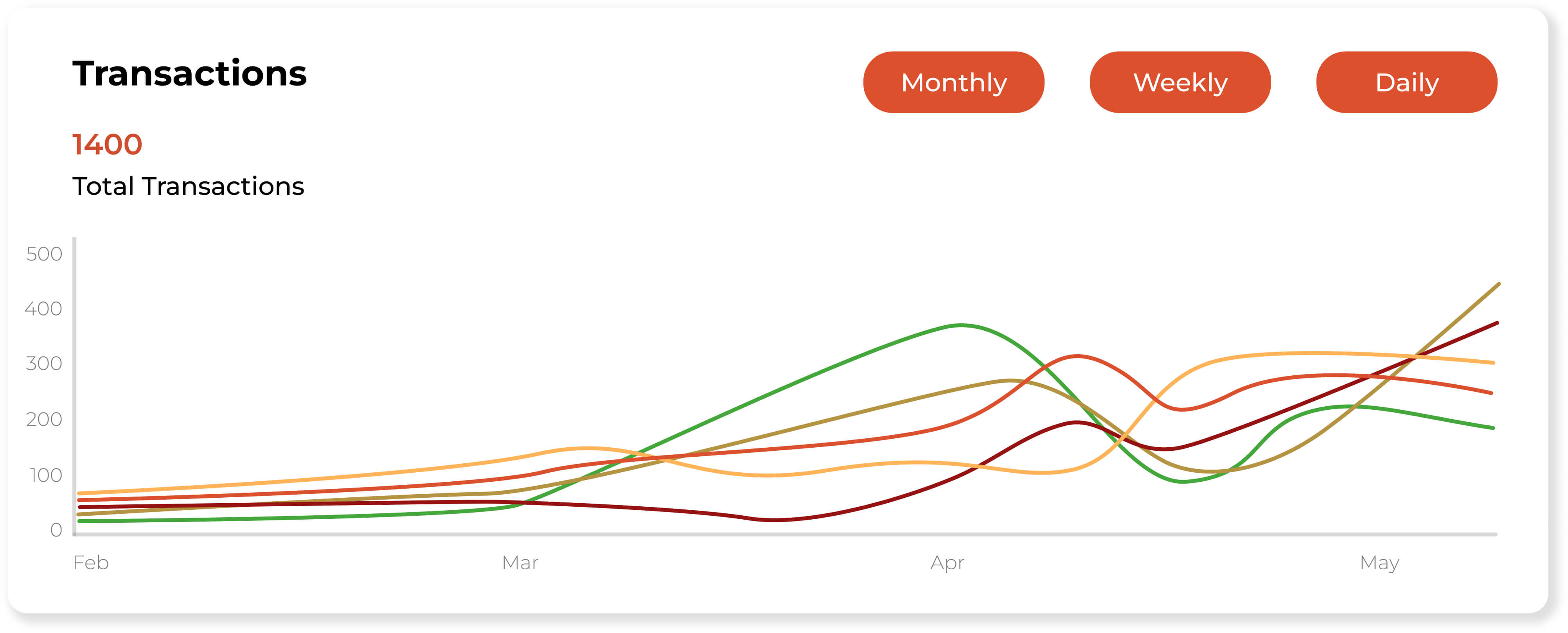

We understand that NGOs have unique needs and require customized monitoring solutions. We provide an automated daily ongoing monitoring system that is designed to keep NGOs informed of any changes in the risk profiles of their donors or partners. By adopting a proactive approach to risk management, NGOs are able to respond quickly to potential threats.

Effortless Integration for Operational Efficiency

Sanction Scanner's developer portal provides NGOs with simple integration options, including detailed documentation and SDKs. In this way, we facilitate the automation of AML control processes, allowing NGOs to devote more resources to core mission activities while ensuring compliance and security are maintained.

Dynamic Compliance Reporting for NGO

NGOs need to keep up with the constantly changing regulatory environment with regard to compliance reporting. Our platform is designed to promote transparency and accountability by allowing NGOs to create custom reports that reflect their unique compliance activities. We help simplify the complexity of AML compliance and empower NGOs to demonstrate their commitment to legal and ethical standards.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

Featured news and press releases

FAQs about Non-governmental Organization

Yes. NGOs, especially those with international operations or large donations, must comply with AML and CTF laws to prevent financial misuse.

NGOs often work in high-risk areas, handle anonymous donations, and partner with unvetted third parties—making them susceptible to misuse.

NGOs should conduct due diligence on donors and partners, monitor transactions, screen against sanctions lists, and report suspicious activity.

Yes. NGOs must screen donors, beneficiaries, and partners to avoid dealings with sanctioned individuals, entities, or regions.

It’s the practice of adjusting due diligence based on the risk level of donors, partners, or locations—applying stricter checks when needed.

Yes. NGOs should verify the source of donor funds, especially large or foreign transfers, to ensure they are legitimate and traceable.

Sanction Scanner enables real-time screening, risk scoring, and media checks for donors and partners—tailored for nonprofit compliance.

Anonymous donations, offshore transfers, high-risk partnerships, and sudden changes in donor behavior are key AML red flags.

Transparency in financial records, partnerships, and reporting builds accountability, ensures AML compliance, and earns donor trust.

Non-compliance may lead to frozen accounts, license loss, funding bans, and reputational harm—threatening the NGO’s mission.

Yes. NGOs should verify donor identities—especially for large or foreign contributions—to ensure funds are not linked to illicit sources.

Often, yes. Donations from high-risk or non-cooperative jurisdictions require enhanced due diligence and source-of-funds checks.

EDD involves deeper scrutiny of high-risk donors, partners, or projects—verifying fund origins, affiliations, and reputational risk.

Generally discouraged. Large or repeated anonymous donations can trigger regulatory concern and may require internal investigation or refusal.

Yes. Operating in sanctioned or unstable regions increases scrutiny; NGOs must apply stronger controls and document all fund flows clearly.

At least annually, or when operating environments, regulations, or donor profiles change significantly.

Yes. Even unintentional violations—such as accepting donations from a sanctioned entity—can lead to frozen assets or reputational damage.

Yes. Banks and PSPs apply AML checks to NGO transactions and may flag suspicious patterns or request additional documentation.

Yes. Foundations that distribute large sums or operate across borders must screen grantees and perform due diligence under AML frameworks.

By practicing transparent reporting, explaining verification steps, and using trusted compliance tools to protect funds and reputations.