AML Compliance Solutions for Legal Industry

AML compliance is easier than ever for the Legal Industry.

TRUSTED BY OVER 800+ CLIENTS

Comply with AML regulations

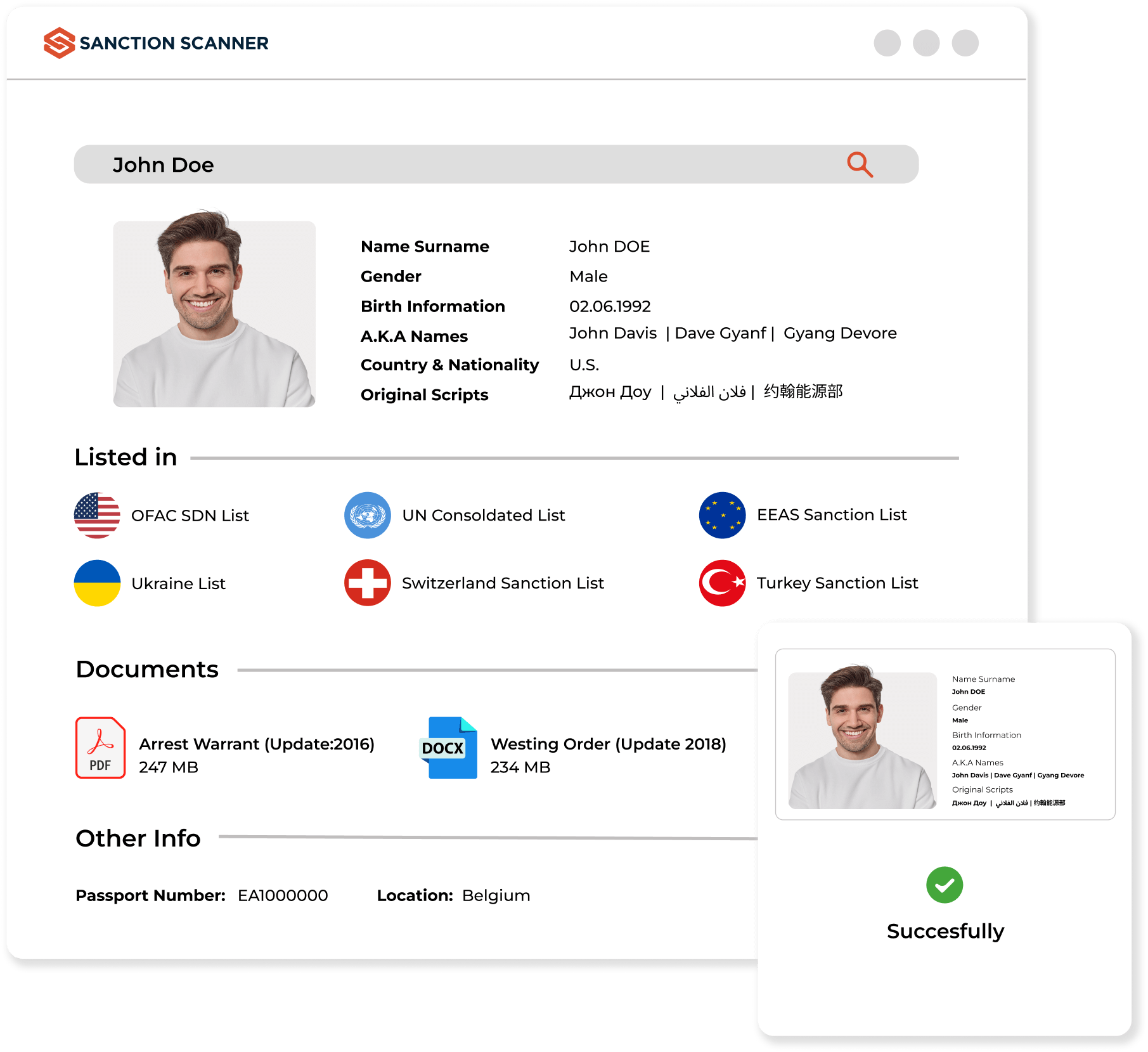

Money laundering regulations are changing rapidly. Law firms are responsible for providing their clients with professional advice on these arrangements. But they can sometimes be involved in the risks posed by people involved in financial crimes. Sanction Scanner provides AML Compliance Software support to reduce and minimize these risks. With Adverse Media and Name Screening products, you can scan clients and participants in your law firm and advance the engagement process more securely.

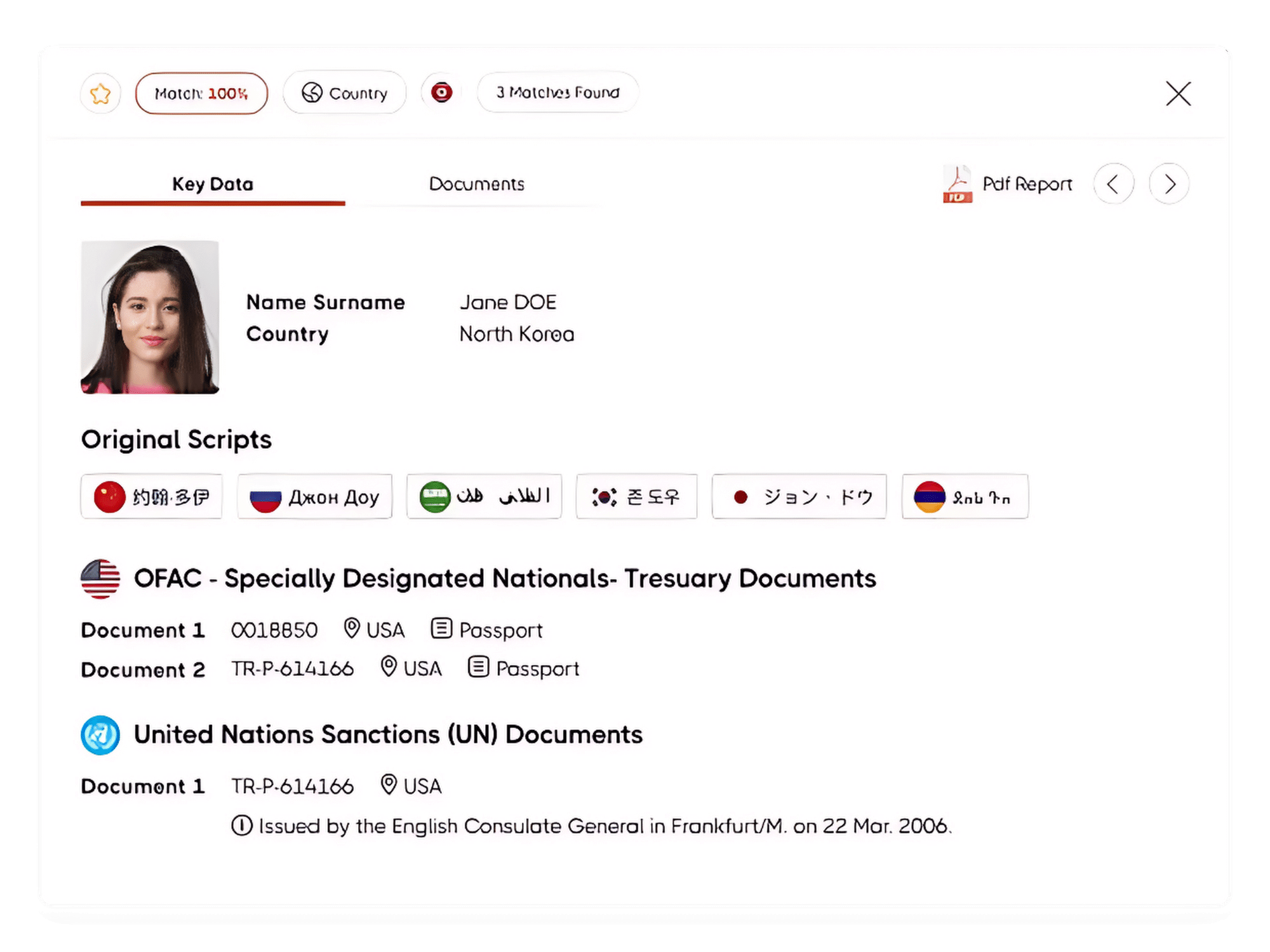

AML Name Screening

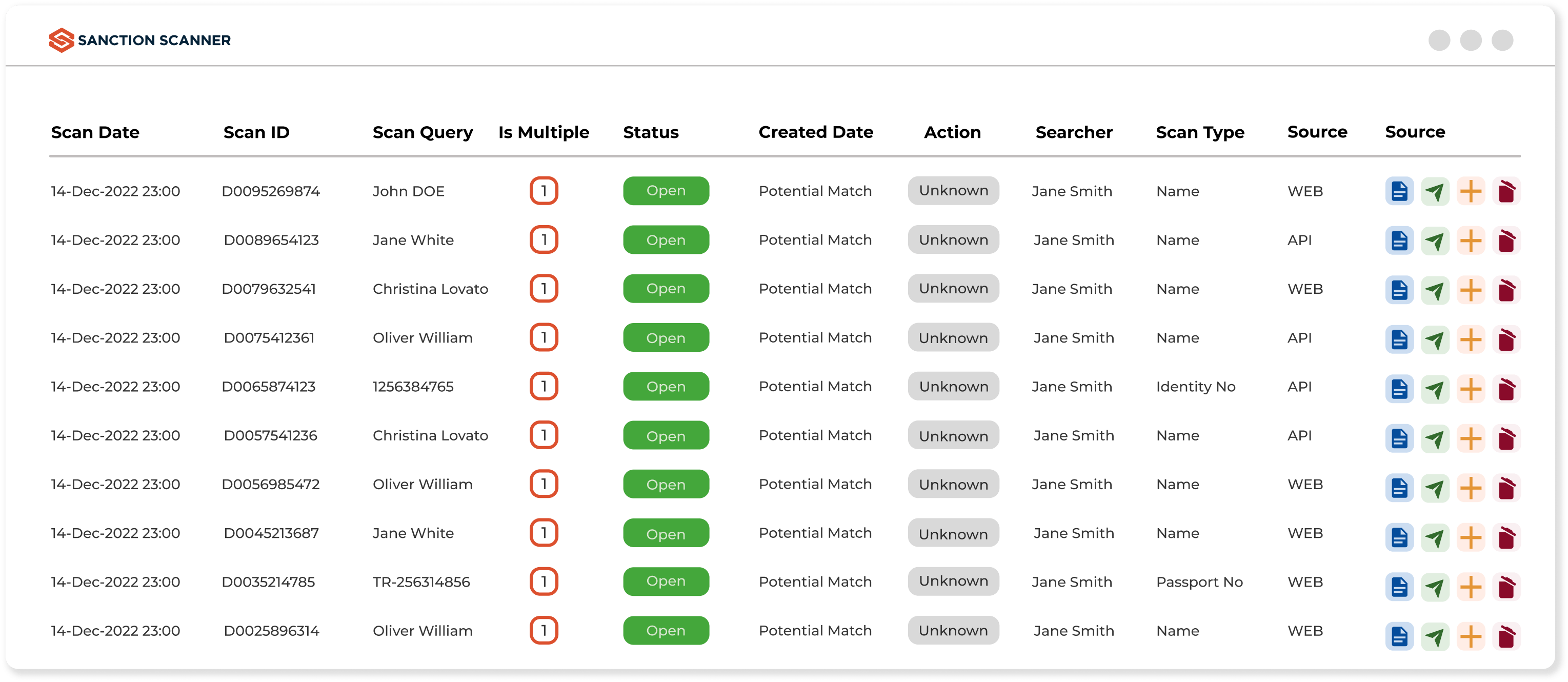

You can automate many processes such as Customer Onboarding and Monitoring, PEP and Sanction Screening, Know Your Customer and Customer Due Diligence, Automate Ongoing Monitoring with AML Screening products.

Detect and Avoid Risks for Your Clients

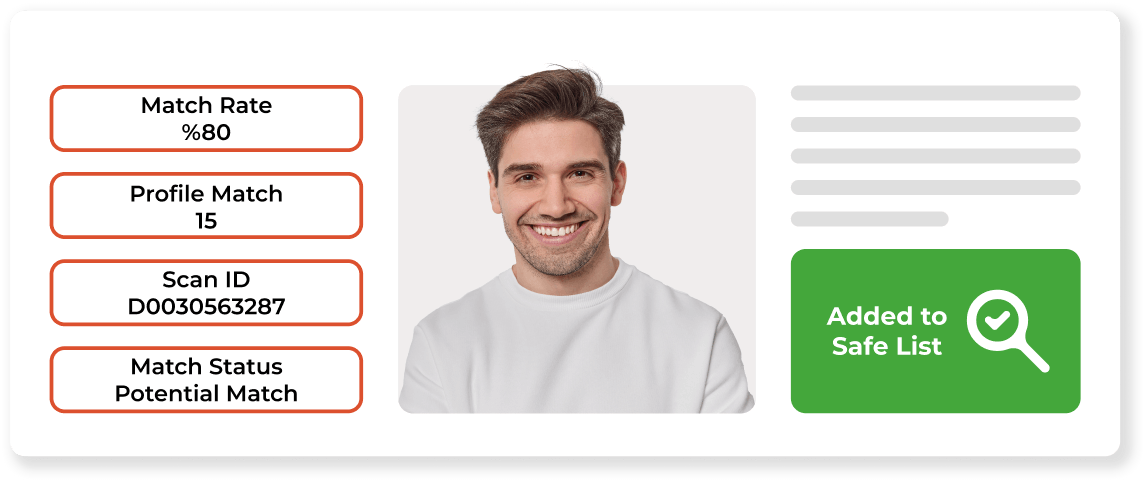

With AML Screening Tools, you can create customers' risk scorecard. You can also create a special list for risky customers.

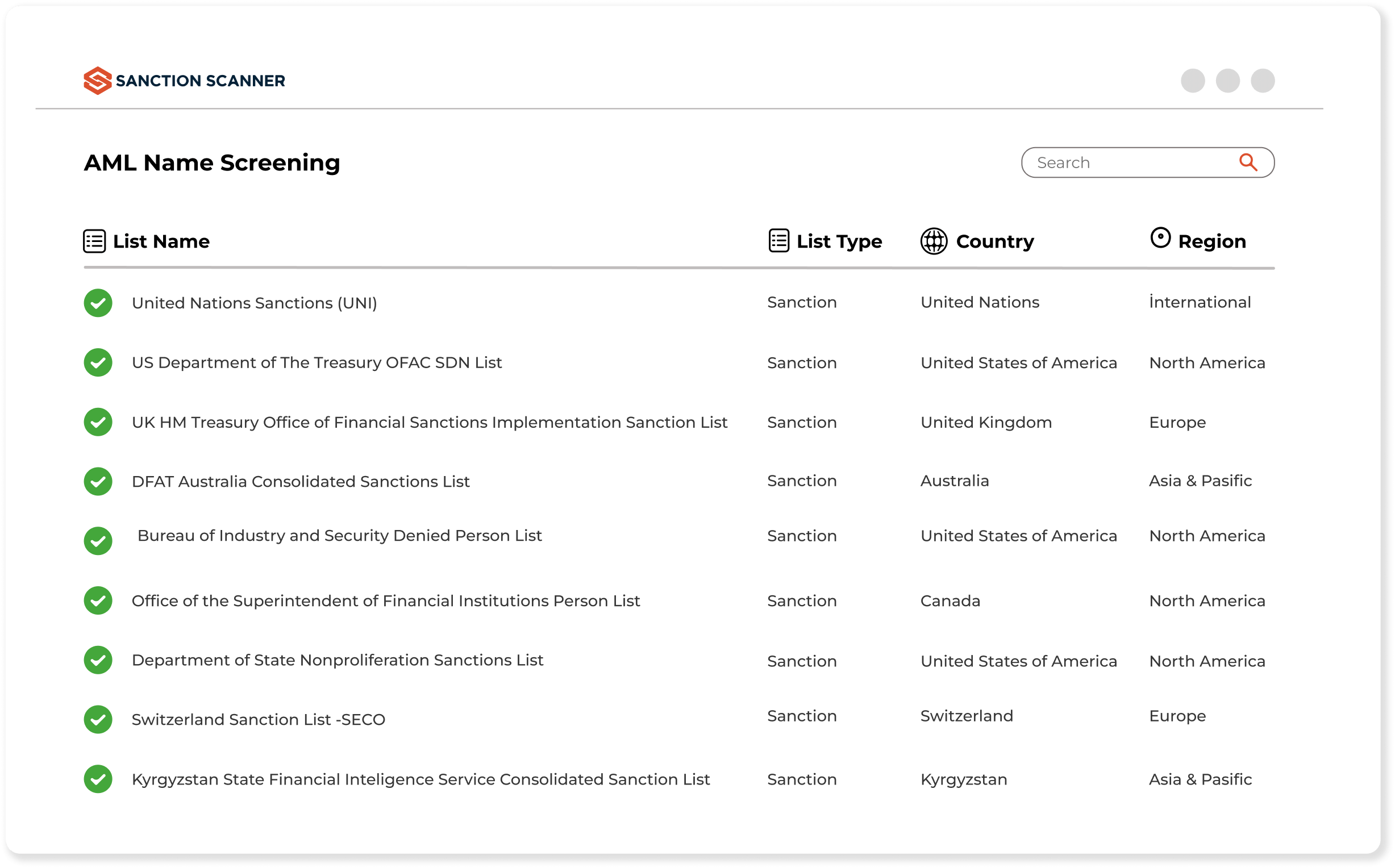

Full Data Coverage and Up-To-Date Data

In Sanction Scanner AML Data, you can find more than 3000 global sanctions, watchlists, and PEP lists from 200+ countries. Lists are updated every 15 minutes.

FAQs about Legal Industries

Yes. Law firms, notaries, and legal professionals must comply with AML rules when handling high-risk transactions or client funds.

Activities like forming companies, managing funds, handling real estate, or large financial deals trigger AML compliance duties.

Lawyers can be used to create complex structures or obscure ownership—making them attractive targets for laundering schemes.

CDD involves verifying client identity, understanding the business relationship, and identifying beneficial owners in legal entities.

Yes. Screening clients, UBOs, and third parties against global watchlists is essential to avoid working with sanctioned individuals.

Yes. Most jurisdictions require filing Suspicious Activity Reports (SARs) when potential money laundering is suspected.

By reviewing geography, fund sources, transaction size, client background, and links to PEPs or adverse media coverage.

Yes. Tools like Sanction Scanner offer automated KYC, risk scoring, and real-time screening to streamline legal AML processes.

Penalties include heavy fines, license suspension, criminal liability, and reputational harm that may impact client trust.

It provides real-time sanctions/PEP screening, risk scoring, and seamless integration into legal intake and client management systems.

Yes. EDD is required for high-risk clients—such as PEPs, offshore entities, or clients from high-risk jurisdictions—to assess fund legitimacy and potential exposure.

Yes. Managing client funds through escrow accounts triggers AML obligations including CDD, transaction monitoring, and SAR filing when necessary.

CDD is standard identity verification, while EDD involves deeper checks for higher-risk clients, including source of wealth and ongoing scrutiny.

By adopting scalable AML tools with automation features—like Sanction Scanner—that reduce manual workload and ensure regulatory adherence.

Yes, if they engage in financial transactions or services covered under AML laws (e.g., company formation, fund management, property deals).

No. Ongoing monitoring is recommended to capture changes in client risk status, PEP listings, or new sanctions exposure over time.

Yes. Screening clients against negative news sources helps law firms identify reputational risks, past fraud links, or corruption cases.

Unusual transaction volumes, unexplained urgency, vague client profiles, and third-party involvement without justification are key red flags.

Yes. Regulators may impose sanctions, revoke licenses, or initiate disciplinary actions if lawyers fail to meet AML obligations.

Yes. Cross-border transactions, especially involving high-risk countries, require strict compliance with both local and international AML standards.