The Wolfsberg Group is an association of thirteen global banks and financial institutions that was formed in 2000. Wolfsberg Group aims to develop financial industry standards and best practices related to Anti-money laundering (AML), Counter-Terrorism Financing (CTF), and sanctions compliance.

The founding members of the Wolfsberg Group include some of the world's largest financial institutions, such as Citigroup, Barclays, and UBS. The group has since expanded to include other major financial institutions such as Deutsche Bank, HSBC, and JPMorgan Chase.

| Wolfsberg Group Members | ||

|---|---|---|

| Bank of America | Société Générale | HSBC |

| Credit Suisse | Deutsche Bank | UBS |

| MUFG Bank | Barclays | Goldman Sachs |

| Banco Santander | Citigroup | Standard Chartered Bank |

| J.P. Morgan Chase | ||

The Wolfsberg Group develops guidance and recommendations for the financial industry in areas such as customer due diligence, risk assessments, and suspicious transaction reporting. Wolfsberg's goal is to establish a common framework for AML, CTF, and sanctions compliance that is consistent across the financial industry and to promote high professionalism and integrity in the banking sector.

The Wolfsberg Group has also collaborated with other organizations, such as the Financial Action Task Force (FATF), to help combat financial crime, counter-terrorist financing, and improve global AML, CTF, and sanctions compliance standards.

What is the Wolfsberg Principle?

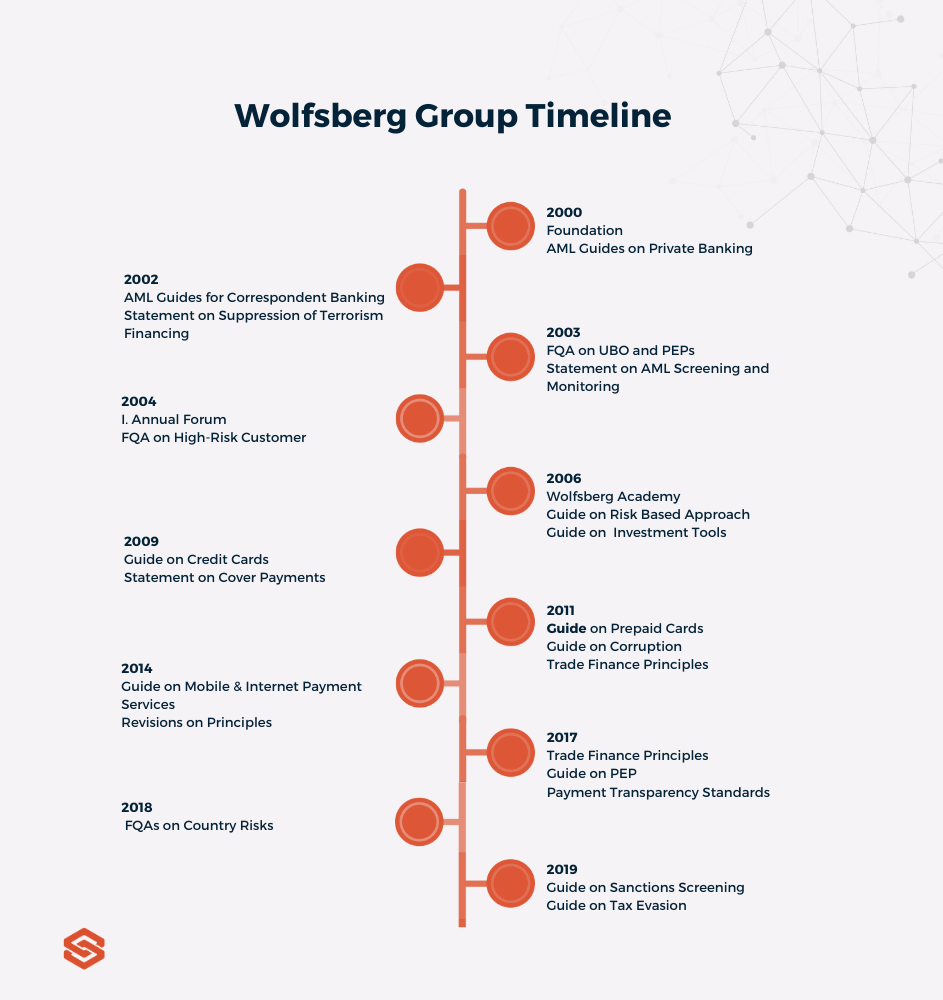

The Wolfsberg Group has published several guidelines for emerging finance, including AML, KYC, and CTF standards. These principles of Wolfsber Group and documents are periodically updated according to the economic situation. Wolfsberg Group's works are just like the Financial Action Task Force (FATF) AML works. In addition to the AML activities, the Wolfsberg Group also works in the field of anti-corruption. The group serves as a collective action group to fight corruption and has collaborated with other organizations to combat financial crime and financial crime risks and promote ethical behavior in the financial industry.

The Wolfsberg Group's AML, KYC, and CTF standards provide detailed guidance on best practices for risk management and regulatory compliance. The Wolfsberg Principle covers a wide range of topics, including how to conduct due diligence on customers, how to identify and report suspicious transactions, and how to implement effective internal controls to prevent money laundering and terrorist financing. The Wolfsberg Group's guidelines are not legally binding but still affect the financial industry and banks around the world who are voluntarily adhering to the principles.

The Wolfsberg Group's rule of thumb for banks is that they only accept customers whose funding can be approved, allowing transparent agreements to achieve the targeted transparency in money laundering. In order to achieve this, the Wolfsberg Group banks should find the sources of funds, assets, and real owners of the companies and then update this information periodically.

The Wolfsberg standards and objectives are focused on promoting a culture of compliance and integrity in the financial industry. The Wolfsberg Group's goal is to help banks and other financial institutions meet their regulatory obligations and protect themselves and their customers from financial crime. The Wolfsberg Group also collaborates with highly competent authorities in the financial sector, where actions and policies that may be against financial crime are discussed in detail.

In addition to its work on AML, KYC, and CTF, the Wolfsberg Group provides frameworks and guidance on a wide range of related topics, such as trade-based money laundering, correspondent banking, and sanctions compliance. The group regularly updates its guidance to reflect changes in global AML and CTF regulations and to address emerging threats and trends in financial crime.

Wolfsberg Group Major Guides

The Wolfsberg Group has developed several major guides that provide detailed guidance on best practices for risk management and regulatory compliance in the financial industry. These guides cover a wide range of topics and have become widely respected and followed by banks and financial institutions worldwide.

- Private Banking

The guide on Private Banking is an essential tool for banks that offer services to high-net-worth individuals and other private banking clients. The guide recommends that banks perform a thorough risk assessment of their private banking clients, including identifying the source of funds, the nature of the client's business, and the client's risk profile. The guide also recommends ongoing monitoring of clients to ensure that their activities remain within the bank's established risk parameters. Additionally, the guide provides guidance on managing cross-border private banking relationships, which often present additional challenges.

- Correspondent Banking

The Correspondent Banking Guide is a comprehensive resource for banks that engage in correspondent banking relationships. The guide emphasizes the importance of conducting thorough due diligence on correspondent banks and their customers to ensure they are not engaged in money laundering or terrorist financing. The guide recommends that banks establish clear policies and procedures for managing correspondent banking relationships, including monitoring for unusual activity and responding to suspicious transactions. The guide also provides guidance on managing risks associated with shell banks and other high-risk entities.

- Risk-Based Approach

The Risk-Based Approach guide provides guidance on how banks can implement a risk-based approach to AML and CTF compliance. The guide recommends that banks assess the risks associated with different types of customers and transactions and tailor their AML and CTF controls to those risks. The Wolfsberg Group's guide emphasizes that a one-size-fits-all approach is insufficient for effective AML and CTF compliance and that banks must be flexible. The guide also recommends that banks regularly review and update their risk assessments to ensure that they remain relevant and effective.

- Investment Tools

The Investment Tools guide provides guidance on managing the risks associated with investment products and services, such as mutual funds and hedge funds. The guide recommends that banks conduct thorough due diligence on investment products and service providers, including the identification of the ultimate beneficial owners of these entities. The guide also recommends that banks establish clear policies and procedures for managing the risks associated with investment products, including monitoring for unusual activity and responding to suspicious transactions. The guide emphasizes the need for ongoing monitoring of investment products and services to ensure that they remain within the bank's risk parameters.

- Tax Evasion

The Tax Evasion guide provides guidance on managing the risks associated with tax evasion. The guide recommends that banks conduct thorough due diligence on customers and transactions to identify any signs of tax evasion. The guide also recommends that banks establish clear policies and procedures for managing the risks associated with tax evasion, including monitoring for unusual activity and responding to suspicious transactions. The guide emphasizes the need for ongoing monitoring of customer accounts and transactions to detect and prevent tax evasion.

- Payment Services

The Payment Services guide provides guidance on managing the risks associated with payment services, including wire transfers and remittances. The guide recommends that banks conduct thorough due diligence on customers using these services, including the identification of the ultimate beneficial owners of the funds being transferred. The guide also recommends that banks implement effective controls to prevent money laundering and terrorist financing through payment services, including monitoring for unusual activity and responding to suspicious transactions. The guide emphasizes the need for ongoing monitoring of payment services to ensure that they remain within the bank's risk parameters.

- Sanctions Screening

The Sanctions Screening guide provides guidance on managing the risks associated with sanctions compliance. The guide recommends that banks conduct thorough due diligence on customers and transactions to ensure that they do not violate sanctions regimes. The guide also recommends that banks implement effective sanctions screening procedures, including the use of automated screening tools. The guide emphasizes the importance of ongoing monitoring of sanctions compliance to ensure that the bank remains within the risk parameters established by regulatory authorities.

- PEP

The PEP guide provides guidance on managing the risks associated with politically exposed persons (PEPs). The guide recommends that banks conduct thorough due diligence on PEPs and their family members, as these individuals are at higher risk for money laundering and terrorist financing. The guide also recommends that banks implement effective controls to monitor PEPs' activities and prevent financial crime. The guide emphasizes the importance of ongoing monitoring of PEPs to ensure that they remain within the bank's risk parameters.