In today's fast-paced business environment, the importance of thorough due diligence cannot be overstated, especially when it comes to selecting and managing vendors. Vendor Due Diligence (VDD) is a critical process that helps businesses assess, understand, and mitigate the risks associated with partnering with external suppliers and service providers.

This process not only ensures that vendors comply with legal and regulatory requirements but also aligns their operations and values with the hiring company's standards and expectations. When a company goes on sale, potential buyers should be shown an in-depth report on the company's financial status, called vendor due diligence. Vendor due diligence means gaining trust that a vendor is stable, and its corporate structure is solid.

What is Vendor Due Diligence?

Vendor Due Diligence (VDD) takes place in business relations between companies. If a company's shares go on sale, potential buyers need to be thoroughly researched and reported, in which case vendor due diligence comes into play. VDD reports, especially used by financial institutions, use potential vendors to evaluate or to ensure that they are still ethical and strong. VDD is necessary both to reduce threats to business operations and to reduce compliance risk and reputation risk. That's why VDD is important for AML/CTF. A Vendor Due Diligence Report is generally conducted by a third party and presented to potential investors. Potential buyers examine the report to determine the financial solvency and expectations of the company stock sold. This report helps address the seller's concerns before continuing with the purchase. It is advantageous to perform the vendor due diligence just before the sales process begins, so that if any significant financial problems are found, or any findings that may cause problems in the sales can be corrected before the sale is made.

Vendor Due Diligence Objectives

Businesses can provide valuable information to the seller during the sales process by making a vendor due diligence. For example, to support the purchase at a better price, the seller can provide very good benefits by using VDD, which is why VDD is important and important. You can find some targets of vendor due diligence below:

- To learn the problems of companies in detail.

- Companies to sell successfully at the best price.

- Identifying critical business drivers for companies' future performance.

- Increasing the purchase price.

- The buyer sees potential risks in organizations.

- Fine-tune and improve your business plan.

- Improving the quality of offers received by sellers.

What is the Vendor Due Diligence Process?

The purpose of this process is to evaluate and verify the target company's financial and legal status, as well as assess any potential risks associated with the transaction. Here are the steps involved in the vendor due diligence process:

- Contacting third parties: The vendor contacts third parties, such as maintenance providers, to ensure that necessary procedures have been implemented before the sale. This step is crucial as it helps to verify the risk of money laundering.

- Preparation of the vendor due diligence report: The vendor due diligence report is prepared based on the evaluations and is sent to the relevant parties for review. This report allows potential buyers to conduct their own due diligence.

- Negotiations: Depending on the offers of potential buyers, they may negotiate with the seller to come to an agreement.

- Completion of the sale: Once the sale is completed, the buyer receives the vendor due diligence report, which includes information about the target company's financial and legal status, as well as any potential risks associated with the transaction.

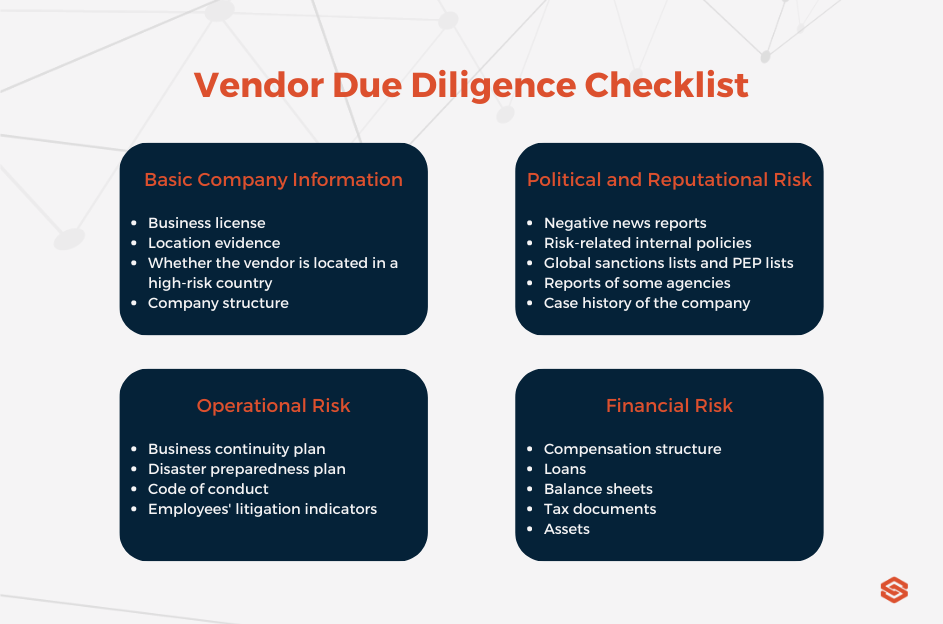

Gathering accurate information about a vendor is essential to mitigate potential risks and ensure the success of a business transaction. Below is a Vendor Due Diligence Checklist to help evaluate vendors in a comprehensive and systematic manner:

Vendor Due Diligence on AML

Money laundering is a serious issue that financial institutions and businesses must address. In the context of Vendor Due Diligence, it is important to conduct an AML check to ensure that the seller is not engaged in any illicit activities. AML is a set of procedures, laws, and regulations designed to prevent criminals from disguising the proceeds of illegal activities as legitimate income.

To mitigate the risks of money laundering, vendors need to scan political links, sector-specific risks, lists, and adverse media. Political links refer to any relationships that the company may have with politically exposed persons (PEPs), which can potentially increase the risk of money laundering. Sector-specific risks are specific to the industry in which the company operates. For example, companies in the gambling industry may be at a higher risk of money laundering due to the nature of their business. Lists, such as global sanctions lists, are important to check because they include names of individuals and companies that are known to be involved in illegal activities. Adverse media refers to any negative news reports or media coverage about the company.

When a potential buyer decides to buy a company, they need to be aware of these risks. No one wants to buy a money-laundered company, and a Vendor Due Diligence Report can be very useful in clarifying any potential problems. Financial institutions may also face legal consequences if they fail to conduct Vendor Due Diligence or if the seller engages in misbehavior.

To conduct an effective Vendor Due Diligence on AML, a detailed data collection is necessary. This includes monitoring the company's transactions for any criminal activities. The information gathered during the data collection process must be verified to ensure its accuracy. Additionally, Customer Due Diligence must be carried out during the preparation of the Vendor Due Diligence Report.

By implementing strong Vendor Due Diligence practices, financial institutions can ensure that they comply with AML procedures, protect their reputation, and avoid fines or legal consequences. To reduce the risk of appearing to work with harmless vendors, financial institutions should also use review practices, surveys, and record-keeping practices for all current vendors and brokers.

Vendor Due Diligence Best Practices

To maximize the benefits of a Vendor Due Diligence Report, enterprises must perform detailed data collection and monitor the company's transactions for criminal activities. The information gathered should then be verified through a rigorous process. Customer Due Diligence must also be conducted during the preparation of the Vendor Due Diligence Report. Financial institutions must ensure that their vendors and brokers comply with anti-money laundering procedures to protect their reputations and avoid fines. They should also implement review practices, surveys, and record-keeping practices for all current vendors and brokers to reduce the risk of seemingly harmless vendors.