"For the actualization of financial regulations and compliance, keeping up with Know Your Customer (KYC) standards is vital for businesses in various industries. One emerging approach to meet these requirements is Perpetual KYC (pKYC), which prioritizes ongoing verification and updating of customer details. What is pKYC? It is an innovative method that ensures customer data remains current and compliant over time, adapting to any changes in the customer's status or behavior. Unlike traditional KYC methods that focus on one-time processes during onboarding, pKYC recognizes the necessity of continuous monitoring to ensure compliance and mitigate risks associated with financial crimes.

pKYC extends beyond the typical KYC concept, acknowledging that customer information can change over time due to factors like address updates, legal status alterations, or shifts in financial behavior. By embracing a perpetual approach, organizations can maintain an accurate and current understanding of their customer base, allowing them to promptly identify and address any irregularities or discrepancies. This proactive stance not only improves regulatory compliance but also enhances the overall security and trustworthiness of financial systems, fostering confidence among stakeholders and providing protection against potential threats. Essentially, pKYC means adopting a dynamic and ongoing process for verifying and updating customer information to uphold the highest standards of financial integrity and security.

How Does pKYC Work?

pKYC represents a proactive and continuous approach to KYC processes, ensuring that customer information remains accurate and up-to-date over time. Unlike traditional KYC methods that rely on one-time verification during customer onboarding, pKYC involves ongoing monitoring and updating of customer data to comply with regulatory requirements and mitigate the risk of financial crimes. To understand how pKYC functions, it is essential to delve into its operational mechanisms and the steps involved in this dynamic process.

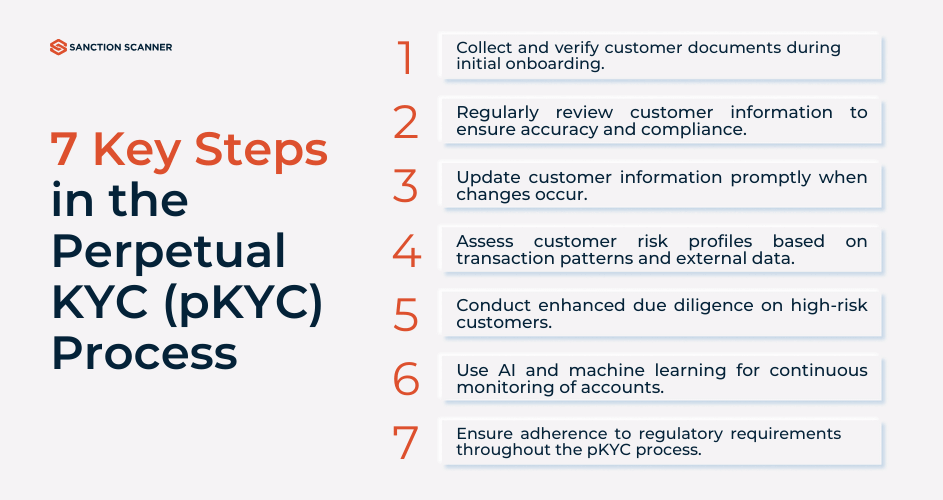

The operation of pKYC typically follows a series of steps to maintain the accuracy and currency of customer information. These steps may include:

- Initial Onboarding: Collecting and verifying customer identity documents and information during the initial onboarding process.

- Periodic Review: Conduct regular reviews of customer information at predetermined intervals to ensure its accuracy and compliance with regulatory standards.

- Data Updates: Promptly updating customer information in response to any changes, such as address updates, legal status modifications, or significant financial transactions.

- Risk Assessment: Assessing customer risk profiles based on various factors such as transaction patterns, account activity, and external data sources.

- Enhanced Due Diligence (EDD): Performing enhanced due diligence on high-risk customers to gather additional information and mitigate potential risks.

- Continuous Monitoring: Utilizing advanced technologies such as artificial intelligence and machine learning to continuously monitor customer accounts for suspicious activities or anomalies.

- Regulatory Compliance: Ensuring adherence to regulatory requirements and guidelines throughout the pKYC process to mitigate legal and reputational risks.

By following these steps, organizations can maintain a robust pKYC framework that effectively identifies and addresses potential risks while upholding compliance standards.

The Benefits of pKYC in AML Compliance

Implementing pKYC procedures offers significant advantages in Anti-Money Laundering (AML) compliance efforts. Firstly, pKYC enables financial institutions to maintain a real-time understanding of their customers' identities and behaviors, reducing the likelihood of fraudulent activities slipping through undetected. By continuously updating and verifying customer information, pKYC helps institutions stay ahead of evolving threats and regulatory requirements.

Moreover, pKYC enhances the efficiency and effectiveness of AML compliance efforts by automating certain processes and minimizing manual interventions. With automated monitoring and alerts for suspicious activities, financial institutions can streamline their compliance workflows and allocate resources more strategically. This not only reduces operational costs but also enables compliance teams to focus on more complex risk management tasks, thereby strengthening the overall AML framework.

How Does pKYC Differ from KYC and eKYC?

While traditional KYC processes involve a one-time verification of customer identities during onboarding, pKYC represents a continuous and proactive approach to customer verification. Unlike KYC, which may become outdated over time due to changes in customer information, pKYC involves ongoing monitoring and updating of customer data to ensure its accuracy and compliance with regulatory requirements. This perpetual nature of pKYC enables organizations to maintain a more up-to-date understanding of their customers, reducing the risk of financial crimes and enhancing overall compliance effectiveness.

On the other hand, eKYC (Electronic Know Your Customer) leverages digital technologies to streamline the customer verification process, typically through online platforms or mobile applications. While eKYC offers advantages in terms of speed and convenience, it often involves a one-time verification similar to traditional KYC. In contrast, pKYC extends beyond the initial verification process, continuously updating and monitoring customer information to adapt to changing circumstances and regulatory requirements. Thus, while eKYC focuses on digitizing and optimizing the verification process, pKYC emphasizes the ongoing maintenance and accuracy of customer data to ensure robust compliance and risk mitigation.

The Role of Technology in pKYC

Technology plays a pivotal role in the implementation and success of pKYC processes. One of the key aspects is the utilization of advanced data analytics and artificial intelligence (AI) algorithms to continuously monitor and analyze customer data for any suspicious activities or anomalies. These technologies enable financial institutions to sift through vast amounts of data efficiently and identify potential risks in real-time, enhancing the effectiveness of pKYC in detecting and preventing financial crimes.

Moreover, automation is a critical component of pKYC, as it streamlines various aspects of the customer verification process. Automated tools can handle tasks such as data collection, document verification, and risk assessment, reducing the need for manual intervention and improving efficiency. By automating routine tasks, financial institutions can allocate resources more effectively and focus on addressing high-risk cases or complex compliance issues, thereby enhancing the overall effectiveness of their pKYC initiatives.

Furthermore, the integration of biometric authentication technologies adds an extra layer of security to pKYC processes. Biometric identifiers such as fingerprints, facial recognition, or iris scans provide a more robust method of verifying customer identities compared to traditional methods like passwords or security questions. By incorporating biometric authentication into pKYC workflows, financial institutions can enhance the accuracy and reliability of customer identification, reducing the risk of identity fraud and improving overall compliance with regulatory requirements.

KYC Solutions by Sanction Scanner

Discover a cutting-edge solution for your KYC compliance needs with Sanction Scanner. As a leading developer of AML compliance software, Sanction Scanner stands out as a distinguished member of Regtech100, showcasing its commitment to innovation and excellence in regulatory technology. With Sanction Scanner's robust suite of KYC solutions, businesses can streamline their compliance processes, mitigate risks, and enhance their overall security.

Sanction Scanner offers a comprehensive range of tools designed to meet the evolving demands of KYC compliance. From identity verification and screening for politically exposed persons (PEPs) and sanctions lists to ongoing monitoring and pKYC updates, Sanction Scanner provides a one-stop solution for all your compliance needs. With its user-friendly interface, advanced analytics, and real-time monitoring capabilities, To stay ahead of regulatory requirements and safeguard against financial crime effectively, contact us or request a demo today.