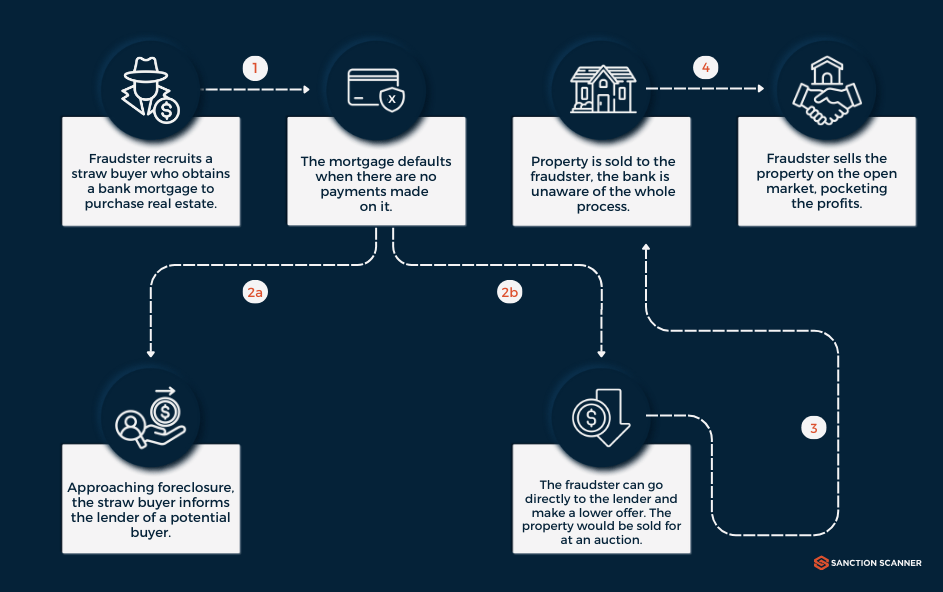

As a thorn in the side of the real estate world, mortgage fraud raises concerns about financial stability and trust in housing transactions. While navigating the intricacies of property dealings, individuals may encounter these deceptive practices that jeopardize the security of their home investments.

What is Mortgage Fraud?

Mortgage fraud, characterized by deliberate misrepresentation and deception, encompasses various deceptive activities related to housing and mortgages. The Federal Bureau of Investigation (FBI) defines mortgage fraud as any "material misstatement, misrepresentation, or omission" that impacts a property or potential mortgage and is relied upon by underwriters or lenders for loan funding, purchase, or insurance. This definition emphasizes that mortgage fraud can involve both individual borrowers and industry professionals, reflecting a wide range of deceptive practices within the real estate and mortgage lending sectors.

Two distinct categories of mortgage fraud emerge fraud for profit and fraud for housing. Fraud for profit involves industry insiders, such as bank officers, appraisers, mortgage brokers, attorneys, and loan originators, exploiting their specialized knowledge to misuse the mortgage lending process. The aim is not to secure housing but rather to illicitly obtain cash and equity from lenders or homeowners. On the other hand, fraud for housing is characterized by illegal actions taken by borrowers seeking to acquire or maintain homeownership, often involving misrepresenting income, assets, or property values. The prevalence of collusion among industry professionals in mortgage fraud underscores the complexity and varied motivations behind these deceptive practices, with significant financial implications, as illustrated by instances like the $10 million mortgage scam in Sacramento, California, in 2019.

Common Techniques in Mortgage Fraud

Common types of mortgage fraud encompass a range of tactics that exploit vulnerabilities in the mortgage lending process, compromising the integrity of property transactions. Income fraud involves misrepresenting financial details, while appraisal fraud manipulates property values. Occupancy fraud occurs when individuals falsely claim the intended use of a property, and employment fraud entails deceptive employment and income information practices. Understanding these techniques is crucial for detecting and preventing mortgage fraud.

Income Fraud

In identity fraud, individuals exploit others' personal information to dishonestly secure mortgage loans. With income fraud being the most common type of mortgage fraud, the rise of digital crime has made it easier for it to thrive. Dishonest websites now offer services, often at a cost, that help individuals create false income and employment verifications, along with forged W-2 forms or tax returns. This digital landscape facilitates identity theft, allowing borrowers to use someone else's financial information to obtain a mortgage loan and buy property without the victim's knowledge or consent.

A troubling variation of identity fraud involves using stolen information to get a mortgage loan against a property owned by someone else. This situation can be a shock for unsuspecting homeowners who discover a sizable mortgage on their property when trying to sell, revealing they have become victims of identity theft and highlighting the widespread risks associated with mortgage-related crimes.

Occupancy Fraud

Occupancy fraud is when people provide false information about how they plan to use a property when applying for a mortgage. Government-backed loans are meant for owner-occupants, and this impacts loan eligibility. People might commit occupancy fraud to get better mortgage terms, especially if they do not qualify for government-backed loans due to credit issues or want to reduce down payments. Others may do it to benefit from lower interest rates designated for owner-occupied homes.

Some borrowers might take a mortgage in their name for someone else, like a family member or friend with a low credit score. The aftermath of the Great Recession emphasized the need to follow lending guidelines to prevent individuals from taking on mortgages they cannot afford, highlighting the importance of honesty in stating occupancy plans.

Appraisal Fraud

Appraisal fraud happens when a home's value is dishonestly stated during the appraisal. It is all about intentionally saying a home is worth more or less than it actually is. Licensed appraisers, who are supposed to stay neutral and independent, might be influenced by outside pressures. For example, a lender could push an appraiser to boost a home's value so the lender can make more money from the sale. This manipulation could be used to benefit sellers who want more profit or lenders who want to approve a borrower's application by changing the loan-to-value ratio.

In the past, lenders have even forced appraisers to inflate property values by threatening to stop doing business with them. Appraisal fraud makes up about one in ten mortgage fraud cases, so it is important to stay alert during the appraisal process and choose an experienced and trustworthy appraiser.

Employment Fraud

Employment fraud is a major issue in the mortgage industry. Cases of mortgage brokers creating fake income and employment documents not only result in legal consequences but also undermine consumer trust in the mortgage application process. The problem is not limited to rogue brokers; prospective borrowers can easily obtain false income documents online, contributing to about 20% of loan applications having inflated income information.

A common type of employment fraud involves using fake employers. These fictitious employers often have an online presence, including phone numbers and automated call centers, making it challenging for lenders to detect.

Initiative Against Mortgage Fraud

Taking action against mortgage fraud has become essential for maintaining the honesty of the housing market. Several laws and regulations in the US, like the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, work to prevent deceptive lending practices and ensure transparency in real estate transactions.

Anti-Money Laundering (AML) laws, including the Bank Secrecy Act (BSA), require financial institutions to implement effective measures to identify and prevent money laundering in mortgage lending. AML compliance is crucial to counter mortgage fraud by enforcing strong customer due diligence (CDD). Adhering to these laws is vital for financial institutions to reduce the risk of supporting fraudulent transactions and ensure the legitimacy of funds in real estate deals.

Innovative solutions that use advanced software play a significant role in fighting mortgage fraud. By incorporating technologies like artificial intelligence (AI) and machine learning (ML), these solutions automatically analyze large datasets, identifying patterns and irregularities that may indicate fraud. These technologies not only improve the efficiency of mortgage underwriting but also take a proactive approach to identifying and preventing fraudulent activities, enhancing the overall resilience of the mortgage industry against evolving threats.

Sanction Scanner's Customer Risk Assessment Tool

As part of the ongoing effort against mortgage fraud, Sanction Scanner introduces its Customer Risk Assessment Tool. As a leading designer of AML compliance software, Sanction Scanner offers a powerful solution to assess and manage customer risk efficiently.

Sanction Scanner's AML compliance software goes beyond traditional methods, providing real-time insights and automated analysis of large datasets to detect patterns and anomalies associated with fraudulent activities. The Customer Risk Assessment Tool, in particular, is crucial in protecting individuals and companies from mortgage fraud risks, ensuring a robust defense in the ever-changing landscape of financial threats. With Sanction Scanner's innovative solutions, businesses can strengthen their risk management strategies and contribute to broader efforts to combat fraudulent practices in the financial sector. To safeguard your success, contact us or request a demo today.