Due diligence on suppliers is crucial for organizations in the complicated and linked world of today. Companies face considerable risks from financial crime, which includes illegal actions like money laundering, fraud, and corruption. Companies need to take strong preventive efforts to counteract these risks, such as putting efficient Know Your Supplier (KYS) policies in place. In this essay, we examine the critical connection between KYS and the reduction of financial crime.

Understanding Financial Crime and Its Impact on Businesses

A variety of illegal actions that take advantage of the financial system are referred to as financial crime. This encompasses fraud and corruption, as well as money laundering, the process by which money that has been gained illegally is made to appear genuine. Financial losses, brand harm, legal repercussions, and diminished stakeholder trust are just a few of the serious effects of financial crime on businesses. Companies must proactively confront the threat of financial crime if they want to protect their operations.

The Role of Supplier Due Diligence in Preventing Financial Crime

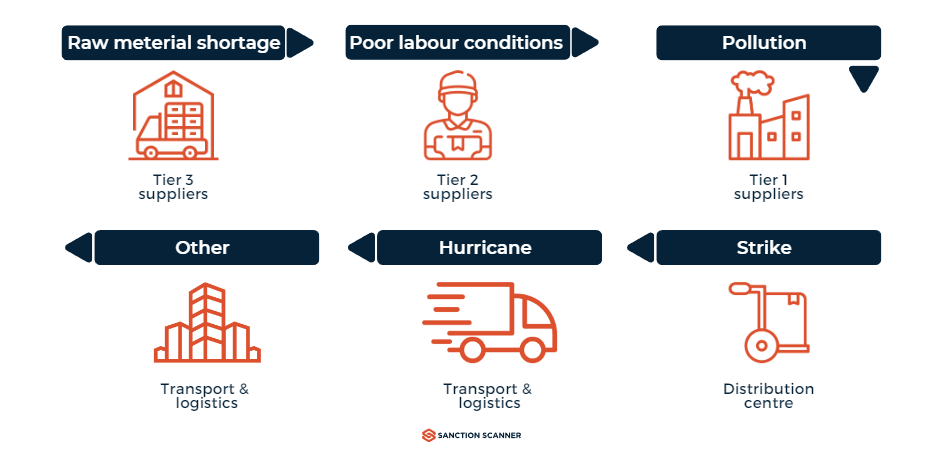

Supplier due diligence is a thorough procedure designed to evaluate and reduce risks related to working with third parties as suppliers. Ensuring that suppliers adhere to specific criteria of credibility, reliability, and conformity entails performing in-depth investigations and reviews. Companies can detect potential risks and weaknesses in their supply chain, notably the potential vulnerability to financial crime, by doing supplier due diligence. Making sure that the vendors a firm works with are reliable and transparent is one of the main goals of supplier due diligence. This entails examining a potential supplier's credentials, financial standing, and legal compliance. Companies can learn more about their credibility, financial condition, and compliance with regulatory requirements by doing in-depth background checks, checking financial documents, and evaluating the supplier's track record.

Due diligence on suppliers is essential for stopping financial crime in the supply chain. Organizations can avoid entering into commercial agreements that could expose them to illegal actions like money laundering, theft, or bribery by recognizing high-risk suppliers or those with dubious business practices. Companies can evaluate a supplier's credibility and integrity through the due diligence process, ensuring that they adhere to ethical business principles and legal and regulatory requirements. Additionally, supplier due diligence acts as a preventative tool to shield businesses from potential reputational harm and legal repercussions. Companies can reduce the danger of being linked to organizations that engage in financial crime by carefully assessing their suppliers and protecting their brand reputation and stakeholder trust.

The Know Your Supplier (KYS) Program

The term "KYS" refers to the process of verifying and understanding the background and reliability of suppliers. It plays a significant role in supplier due diligence. Some of its key objectives include identifying potential warning indicators, evaluating suppliers' moral and financial standing, and reducing the risk of financial crime in the supply chain. Working with vendors who are involved in unlawful activities is prevented in large part by KYS.

Key Components of a Successful KYS Process

Companies need to take into account a few crucial components in order to build an efficient KYS process. First, thorough risk analysis and classification of suppliers aid in identifying high-risk businesses needing closer examination. It is essential to compile thorough supplier data, including company structure and beneficial owners. The due diligence procedure is aided by thorough background checks, which may include examining previous instances of legal and regulatory compliance. An additional degree of security is provided by assessing the financial integrity and stability of suppliers. Continuous oversight and diligence also guarantee continuing compliance and risk reduction.

The Effect of KYS on the Prevention of Financial Crime

A company's defense against financial crime is strengthened in a number of ways by using KYS. Companies can stay away from dealing with firms connected to illegal activity by recognizing high-risk suppliers and potential red flags. KYS is essential for avoiding money laundering since suppliers may be utilized as channels for smuggling illicit monies. Additionally, KYS reduces the chance of supply-chain fraud and corruption, protecting the company's assets and reputation. It acts as a preventative strategy to stop terrorism financing through supplier ties.

Regulatory and Legal Frameworks for KYS

Globally, a variety of legislative and regulatory systems control KYS practices. These frameworks stress the value of supplier due diligence and the necessity for businesses to set up reliable KYS procedures. Organization for Economic Co-operation and Development (OECD) programs and international standards provide direction on putting into practice efficient KYS measures to combat financial crime.

Benefits of Using KYS for Businesses

Companies can benefit in a number of ways from KYS implementation. Companies can reduce their risk of financial crime and avoid harsh fines and legal repercussions. Effective KYS also improves a company's reputation by fostering trust among all parties, including clients, investors, and regulators. Business continuity is further ensured by improving the sustainability and resilience of the supply chain. Furthermore, by showcasing their dedication to moral business conduct and risk management, organizations that apply KYS acquire a competitive edge in the market.

Issues and Factors to Take into Account When Implementing KYS

Although there are many advantages to implementing KYS, there may be difficulties that businesses must overcome. It is essential to recognize and address typical implementation issues, including resource allocation and scalability. Careful thought must be given to how to balance the costs of performing extensive due diligence with the potential risks of non-compliance. By collaborating with dependable third-party service providers, you may make some of these problems go away.

Future Innovations and Trends in KYS

Both the field of KYS and the landscape of financial crime are constantly changing. New technologies are essential for improving KYS procedures. Automation, data analytics, and artificial intelligence can increase the effectiveness and efficiency of supplier due diligence, allowing businesses to more precisely and quickly detect possible hazards. Additionally, the regulatory environment surrounding KYS is likely to change, mandating that businesses stay current on the most recent compliance standards.

Conclusion

Know Your Supplier (KYS) and the prevention of financial crime go hand in hand. To reduce the risks of financial crime, companies must prioritize supplier due diligence and establish effective KYS procedures. Companies can efficiently avoid financial crime within their supply chains by conducting thorough risk assessments, acquiring thorough supplier information, and assessing financial stability and integrity. Beyond risk reduction, implementing KYS has advantages for improved reputation, stakeholder confidence, and supply chain stability. Companies must remain watchful, adapt to new trends, and constantly enhance their KYS processes to safeguard their operations and promote an environment of ethics and compliance as financial crime continues to change.