Know Your Customer (KYC) is a crucial practice that companies undertake to verify the identity of their clients and comply with legal requirements, laws, AML and cryptocurrency regulations. This helps financial organizations to detect high-risk customers and protect their businesses from fraudulent activities. Implementing advanced KYC compliance software can further enhance the effectiveness of this risk assessment process, providing companies with powerful tools to identify and mitigate potential risks. A risk-based approach to KYC is essential in prioritizing resources and efforts to focus on higher-risk customers and transactions.

The KYC risk rating is a critical tool used by organizations to evaluate the level of money laundering risk that a particular customer may pose. By doing so, companies can ensure that they do not conduct business with individuals or entities involved in financial crimes, such as money laundering or terrorist financing, and safeguard their reputation and financial stability. Implementing advanced KYC compliance software can further enhance the effectiveness of this risk assessment process, providing companies with powerful tools to identify and mitigate potential risks.

Risk Rating Process

Customer risk rating is a process used by financial institutions to evaluate the level of money laundering risk associated with a particular customer. The rating system involves several steps, which include data collection, analysis, and verification.

To begin with, the institution collects information about the customer, including their name, date of birth, address, and identification documents. They also gather data on the customer's transaction history, the type of account they have, and the nature of their business activities.

Once the data is collected, the institution performs a risk assessment to evaluate the customer's potential risk for money laundering. This involves analyzing the customer's transaction history, business relationships, and other factors that could indicate suspicious activities.

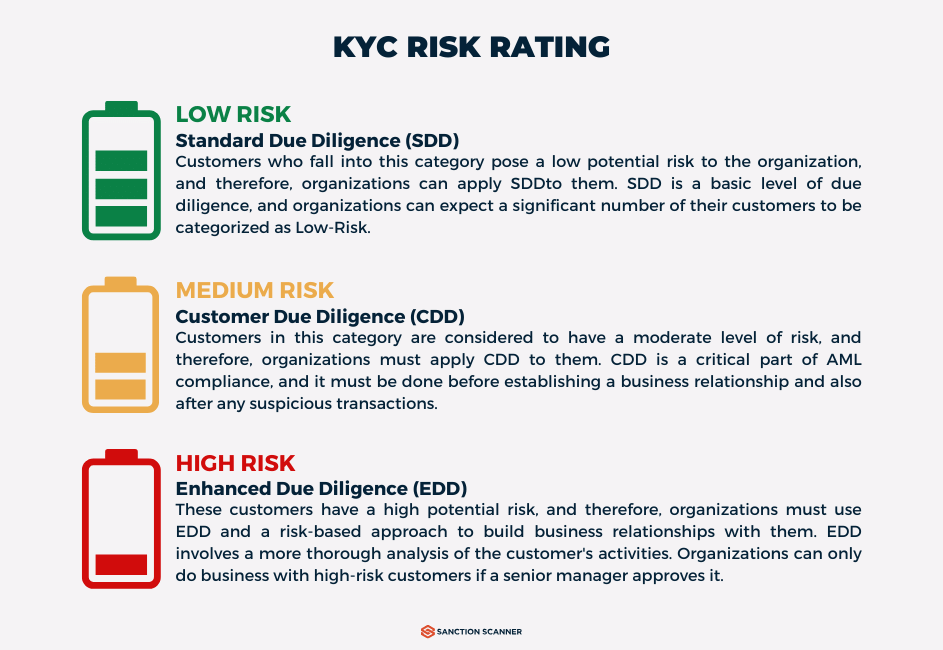

Based on the analysis, the customer is assigned a risk rating, which can range from low to high. Customers with a low-risk rating are considered to have a lower likelihood of engaging in money laundering activities, while those with a high-risk rating are deemed to have a higher probability of engaging in suspicious activities.

The Customer risk rating system is critical in helping financial institutions comply with AML and cryptocurrency regulations and detect potential risks. It enables institutions to identify high-risk customers and take appropriate measures to prevent money laundering, terrorist financing, and other fraudulent activities. Implementing advanced KYC compliance software as part of the Customer risk rating system further enhances its effectiveness, allowing financial institutions to automate and streamline the risk assessment process. A risk-based approach is integral to the Customer risk rating system, ensuring that resources are allocated efficiently to address higher-risk customers and transactions.

Types Of KYC Risk Rating

Risk Rating Factors

The rating system typically comprises several factors that are used to determine the customer's potential risk level. Some of the essential factors considered in customer risk rating are:

- Transaction patterns: The institution analyzes the customer's transaction patterns to identify any unusual or suspicious activity, such as a high volume of transactions, large transactions, or frequent transfers.

- Geographic location: The institution evaluates the customer's geographic location to determine whether it is a high-risk area for money laundering or terrorist financing activities.

- Business type: The institution considers the nature of the customer's business activities to assess the level of money laundering risk associated with the industry. For instance, businesses in the financial sector may pose a higher risk than those in other sectors.

- Source of funds: The institution evaluates the source of the customer's funds to determine whether they are from legitimate sources. Suspicious sources of funds may include cash deposits or wire transfers from high-risk countries.

- Customer's reputation: The institution considers the customer's reputation in the industry and their history with the institution to assess their level of trustworthiness.

- Politically Exposed Person (PEP) status: The institution checks whether the customer is a PEP, which refers to individuals who hold prominent public positions. PEPs are considered to pose a higher risk of money laundering and terrorist financing.

Advantages Of Customer Risk Rating for Companies

- Compliance with regulatory requirements: Customer risk rating enables companies to comply with regulatory requirements related to AML/CFT. Companies that fail to comply with these regulations may face severe legal and financial consequences, including fines, reputational damage, and loss of business.

- Enhanced security: By assessing the risk level of customers, companies can identify potential vulnerabilities and take appropriate measures to mitigate them. This helps companies to safeguard their operations and assets against fraudulent activities, including money laundering, terrorist financing, and identity theft.

- Improved efficiency: Customer risk rating allows companies to allocate their resources more efficiently by prioritizing high-risk customers. This helps to focus their resources on the areas where they are most needed, reducing the likelihood of fraud and other financial crimes.

- Increased profitability: By preventing fraudulent activities and safeguarding their reputation, companies can attract more customers and retain their existing ones. This helps to increase their profitability and reduce the costs associated with regulatory compliance and legal issues.

- Better decision-making: By analyzing the factors that contribute to the customer's risk level, companies can make better-informed decisions about whether to do business with a particular customer or not. This helps to minimize the risks associated with fraudulent activities and safeguard the company's interests.

Sector-Specific Risk Factors in KYC Risk Rating

In the financial industry, KYC Risk Rating requires sector-specific considerations. Customizing KYC Risk Rating to address these factors ensures effective risk assessment, compliance, and security within the financial sector, promoting a robust risk-based approach. Different sectors have unique risk factors that demand specialized attention in the customer identification process:

- Customer Risk Rating in Banking:

- High Transaction Volume

- Correspondent Banking

- Politically Exposed Persons (PEPs)

- Customer Risk Rating in the Insurance Sector:

- Complex Ownership Structures

- Policy Lapse Risk

- High-Value Claims

- Customer Risk Rating in Investment Funds:

- Lack of Control over Fund Activities

- Offshore Funds

- Complex Investment Strategies

- Customer Risk Rating in the Cryptocurrency Sector:

- Anonymity and Pseudonymity

- Rapid International Transactions

- Lack of Regulatory Clarity

Customizing KYC Risk Rating to address these factors ensures effective risk assessment, compliance, and security within the financial sector.

Sanction Scanner 360° Customer Risk Assessment

KYC risk rating system is a vital tool used by financial institutions to evaluate the level of money laundering risk associated with a particular customer. By assessing the factors mentioned above, companies can detect high-risk customers and take appropriate measures to prevent fraudulent activities. The advantages of customer risk rating for companies include compliance with regulatory requirements, enhanced security, improved efficiency, increased profitability, and better decision-making. By implementing a robust KYC risk rating system and utilizing advanced KYC compliance software, companies can safeguard their reputation, financial stability, and operations against financial crimes and fraudulent activities.

Sanction Scanner's 360° Customer Risk Assessment can help financial institutions and other businesses to better manage and mitigate risks associated with their customers. Here are some ways it can help:

Enhanced Due Diligence (EDD): The product uses advanced technologies such as Artificial Intelligence and Machine Learning to analyze and evaluate multiple data sources, including open sources, transactional data, and social media. This helps in identifying any unusual or suspicious activities of customers, which may require Enhanced Due Diligence.

Efficient Screening: Customer Risk Assessment enables businesses to screen their customers against various global sanctions lists, including OFAC, UN, EU, and many more, which can help identify high-risk customers with links to financial crime or terrorism.

Customized Risk Scoring: The system provides a risk-based approach by offering customized risk scores based on the business needs and regulatory requirements of the organization, facilitating a risk-based approach to customer evaluation. It helps in prioritizing high-risk customers, and businesses can allocate their resources efficiently.

Regulatory Compliance: The software ensures businesses remain compliant with AML/CFT and cryptocurrency regulations globally, thus minimizing the risk of financial penalties and reputational damage.

Continuous Monitoring: The system also monitors the customer's transactions continuously and alerts the business if any suspicious activity is detected. It helps businesses to identify risks in real-time, enabling them to take prompt action and prevent potential fraudulent activities.