A front company is essentially an organization with minimal or no actual activities of its own. It is often a shell company connected to a larger business group. The primary purpose of a front company is to shield the parent corporation or brand from unforeseen problems and negative publicity. It accomplishes this by maintaining a discreet relationship with other parties and hiding any illegal activities or the actual beneficiaries.

A front company can be linked to intelligence agencies but is also commonly associated with organized crime groups, banned organizations, religious or political groups, and advocacy groups.

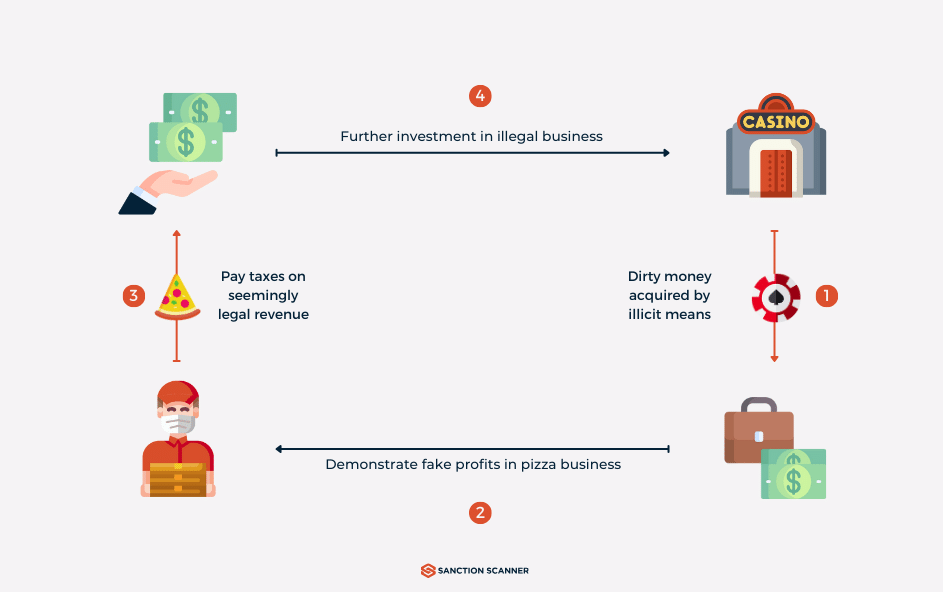

In the realm of organized crime, financial wrongdoing, and money laundering, it is common to find operations that have legitimate businesses, such as licensed casinos, construction companies, salons, bars, restaurants, and more, which serve as fronts for their illicit activities.

Differences Between Shell, Shelf, and Front Companies

In the wake of the Panama Papers leak in 2015, terms like "shell company" and "shelf company" have garnered notoriety for their association with tax evasion, fraud, and other illegal practices. These corporate entities have become attractive channels for conducting global financial transactions, thanks to modern banking technology and access to international markets.

However, it is important to note that not all shell, shelf, and front companies are involved in criminal activities. It is essential to distinguish between these various corporate structures to gain insights into how front companies are utilized for illicit purposes.

What is a Shell Company?

In essence, a shell company is a properly organized business with no employees, substantial assets, continuous business operations, or independent operations. These businesses may be vulnerable to financial crimes such as money laundering because establishing and maintaining a shell is easy and reasonably priced. It is crucial to understand that shell corporations can also have valid uses, like storing intangible assets for other companies or assisting with cross-border transactions.

What is a Shelf Company?

Even if a shelf company has already built an audience, it is essentially a registered business entity that has been "put on hold" and left inactive for an extended period. Notably, this organization has complied with all legal requirements, including paying state fees and registering. A shelf company can be bought by individuals or other corporate entities who want to avoid the laborious process of starting from scratch. These businesses frequently began operations in states that offered them advantageous conditions, such as low taxes, filing fees, or lax regulations.

What is a Front Company?

A front company is a fully functional, physically present business that helps to hide and mask illegal financial activity. Its primary goals are to conceal illicit activities that could be compromised if the actual beneficiaries or stakeholders were made public and to protect the parent company from negative publicity in the event of a problem. A front company, as opposed to a simple shell company, occasionally functions as an authentic company with actual operations. A front company is unique in that it hides the actual source or intended recipient of products or transactions.

Examples of Front Companies in Money Laundering

According to the Department of the Treasury's Office of Foreign Assets Control (OFAC), Li Fangwei and his network of Chinese shell and front companies were identified as the main suppliers to Iran's ballistic missile program during the Karl Lee investigation. Li Fangwei secretly supplied Iran with various military and metallurgical items while operating a graphite and metallurgical production factory in Dalian, China. He surreptitiously exploited the American financial system to provide Iran with Weapons of Mass Destruction (WMD) by using his front companies and Chinese shells.

Li Fangwei was charged with seven counts of money laundering, violating the International Emergency Economic Powers Act (IEEPA), and other related offenses. About $7 million was taken from U.S.-based correspondent bank accounts connected to Li's worldwide accounts as part of the investigation. Interestingly, some of Li's attempted sales involved American companies, unaware he was the Chinese shell and front company's hidden beneficial owner.

Due to the numerous foreign shell companies involved in the Karl Lee investigation, the FBI faced numerous difficulties. Determining the network of shell companies Li had used to enter the U.S. financial system proved extremely difficult and time-consuming. One significant obstacle was that most U.S.-based correspondent banks could not collect Know Your Customer (KYC) information for the shell corporation accounts, allowing transactions to occur with insufficient supervision. Fortunately, this crucial information was discovered by one bank, and it was instrumental in moving the investigation forward.

The Challenges in Identifying Potential Front Companies

Financial institutions are facing increasing pressure to comply with changing legal requirements. Still, as criminals use more intricate strategies to avoid detection, it is getting harder to identify front and shell companies. For example, the Financial Action Task Force (FATF) emphasizes that money used for illicit activities may pass through multiple tiers of front and shell companies located in different jurisdictions before its withdrawal. Many of these cases involve corporations located in other countries, making monitoring and stopping illegal financial activity more challenging.

To identify potential front and shell companies, organizations must proactively monitor transaction volumes and frequencies. They should also scrutinize clients and counterparties for high-risk indicators, including factors like the geographic locations of stakeholders, the nature of payments, the number of employees, and any mentions in the news, among others. The European Banking Authority (EBA) has also emphasized the importance of assessing how a company's products and services may enable beneficial owners and customers to hide their true identities. This comprehensive approach is crucial for enhancing due diligence and mitigating the risks associated with front and shell companies.

The existing approach employed by financial institutions is proving to be insufficient, as it frequently relies on cross-referencing client information with internal databases and querying in-house systems for high-risk indicators. The growing intricacy of front and shell company networks has also rendered enhanced due diligence (EDD) a more time-consuming and difficult process. In response to these challenges, financial institutions must adapt and implement more comprehensive and sophisticated methods for identifying and mitigating the risks associated with such entities.

How Can We Avoid False Front Merchants?

Sanction Scanner's AML solution is equipped with name screening and transaction monitoring capabilities, making it an indispensable tool for financial institutions in the fight against illicit financial activities. Name screening, powered by advanced algorithms and vast databases, allows organizations to thoroughly check clients and counterparties for high-risk indicators related to individuals or entities associated with sanctions and front companies. This feature helps identify potential threats and ensure that transactions do not involve individuals or entities with a history of illicit financial activities. To ensure your success, contact us or request a demo today.