Employee fraud poses a serious risk to businesses across all industries. It can take various forms and lead to significant financial losses for companies. This type of fraud is especially dangerous because it is committed from within the organization, often taking advantage of trust and existing loopholes in internal controls.

What is Employee Fraud?

As a type of financial crime, employee fraud occurs when an individual within an organization exploits their position for personal benefit. It could be something as simple as inflating expenses or more complex activities like manipulating financial records.

Employee fraud can occur in any department, including finance, human resources, operations, and even management. The most challenging aspect of combating employee fraud is that it often remains undetected for extended periods, causing long-term damage.

What are the Three Steps of Employee Fraud?

Employee fraud typically follows a pattern called the fraud triangle, which involves three key factors:

- Opportunity: This occurs when an employee identifies a vulnerability in the company’s systems, controls, or processes. Weak internal checks and an overall lack of oversight present opportunities for individuals to commit fraud without being caught. The presence of weak internal controls is one of the most significant contributing factors to employee fraud.

- Pressure: External factors often push employees toward fraud. This pressure can be financial, such as personal debts or addiction problems, or even workplace-related issues, like unrealistic performance targets. Employees under financial strain may rationalize their fraudulent behavior as a temporary solution to their problems.

- Rationalization: Fraudsters often justify their actions by convincing themselves that their actions are not harmful or that they deserve what they take due to being underpaid, mistreated, or overlooked for promotions. This rationalization phase is crucial for a fraudster to overcome any personal guilt associated with the crime.

What is the Difference Between Employee Fraud and Management Fraud?

Employee fraud is perpetrated by non-managerial staff and generally involves smaller-scale theft or manipulation of processes. It includes things like falsifying expense reports, stealing office supplies, or tampering with payroll records. While these cases may seem minor in isolation, they can accumulate and result in significant financial losses for businesses.

In contrast, management/CEO fraud is committed by executives or upper-level managers and usually involves more significant amounts of money and greater consequences for the organization. Management fraud often includes the manipulation of financial statements to mislead shareholders, inflate the company’s value, or conceal losses. This type of fraud can have major consequences, leading to loss of investor confidence, regulatory penalties, and even business failure.

How Much Does Employee Fraud Cost to Businesses?

Employee fraud can be financially devastating. According to the Association of Certified Fraud Examiners' (ACFE) 2022 Global Fraud Study, real estate companies get most affected by employee fraud, with over $435,000 median loss per case. Smaller organizations are especially vulnerable due to fewer resources for internal controls, with median losses often reaching over $150,000 per case.

Furthermore, ACFE’s 2022 Report highlighted that in cases where employee fraud was detected, 29% of the cases were caused by the lack of internal controls, and 20% caused by override of existing controls.

What Are the Common Types of Employee Fraud?

Employee fraud can be perpetrated in various ways, some of which are more common and damaging than others. Here are the most frequent types of fraud committed by employees:

- Payroll Fraud: This type of fraud occurs when employees manipulate the payroll system to inflate their income. This could involve entering false overtime hours or retaining access to payroll after leaving the company.

- Embezzlement: Embezzlement happens when an employee steals money or assets that they have access to within their role. This could involve redirecting company funds to personal accounts or taking cash from the business and concealing the loss through falsified records.

- Expense Reimbursement Fraud: This type of fraud occurs when employees submit false or inflated expense claims. Common methods include submitting receipts for personal expenses as business expenses or duplicating claims for the same expenses.

- Asset Misappropriation Fraud: This is one of the most common forms of employee fraud and involves an employee stealing or misusing company assets. These assets can range from office supplies to inventory and even intellectual property.

- Ghost Employee Fraud: Through ghost employee fraud, payroll is issued to a fictitious employee, and the fraudster collects the salary. This is particularly common in companies with large payroll systems, where it is easier to create fictitious employee records without detection.

What Are the Red Flags of Employee Fraud?

Early detection of employee fraud is critical to limiting the damage. Here are three red flags to watch for:

- Financial Record Discrepancies: Sudden or unusual changes in financial records may indicate fraudulent activity. Missing or altered financial documentation can also be a sign of attempts to cover up embezzlement.

- Inconsistent and Missing Documentation: Employees who frequently fail to provide proper documentation, such as invoices, receipts, or financial records, could be involved in fraud. Missing paperwork is a common tactic to avoid detection.

- Behavioral Signs from Employees: Changes in employee behavior can be a sign of fraudulent activity. These changes might include becoming overly protective of their work, avoiding vacations or oversight, or displaying sudden signs of wealth, such as purchasing luxury items that are out of their financial reach.

How Do Businesses Identify and Prevent Employee Fraud?

Fraud detection and prevention strategies are essential for minimizing the impact of employee fraud, with most of them falling under Know Your Employee (KYE) strategies. Here are some effective measures businesses can take:

- Utilize Whistleblowing Mechanisms: Encouraging employees to report suspicious activity anonymously is one of the most effective ways to detect fraud. The ACFE 2022 Report found that 42% of fraud cases are detected through tips, making whistleblowing mechanisms an invaluable resource for early detection.

- Maintaining Internal Controls is Essential: Strong internal controls, such as division of duties, regular audits, and multiple authorizations for significant transactions, can significantly reduce the risk of fraud. No single employee should have too much control over financial processes.

- Collaborate with External Auditors: Bringing in external auditors ensures an independent review of financial records, adding an extra layer of oversight. Regular independent audits help identify discrepancies that may otherwise go unnoticed by internal staff.

- Role the Employee Training Plays: Training employees on the importance of fraud prevention and recognizing the signs of fraud can create a culture of transparency and accountability. Employees should know how to identify suspicious activities and understand the consequences of committing fraud.

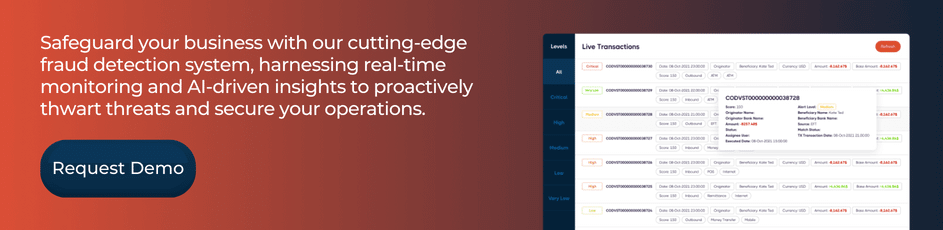

- Leverage Technology for Employee Fraud Detection: Technology plays an increasingly important role in detecting and preventing employee fraud. Automated systems, powered by artificial intelligence (AI) and machine learning (ML), can quickly flag unusual transactions or patterns, enabling early detection of fraudulent activities.

Introducing Sanction Scanner’s Fraud Detection Tool

Sanction Scanner’s fraud detection tool offers a powerful solution to combat employee fraud. With real-time monitoring, AI-based data analysis, and advanced anomaly detection, the tool helps businesses detect suspicious activities quickly and take action before the fraud causes significant financial damage. By utilizing a risk-based approach, Sanction Scanner enables organizations to strengthen internal controls and mitigate the risk of employee fraud.

To safeguard your business against threats from within, contact us or request a demo today.