What Is Credit Card Fraud?

Despite their numerous advantages, debit cards and credit cards present many openings for fraudsters. There are several ways that these fraudsters can exploit these cards to make purchases or withdraw funds. In this post, we will elaborate on this subject, from its types to its red flags. Acording to the CBS News, three people got arrested after they scammed more than 100 credit cards, 300 payment cards and thousands of dollars in Dallas, this is a basic case by the way.

Main Types of Credit Card Fraud

Card-Not-Present (CNP) Fraud

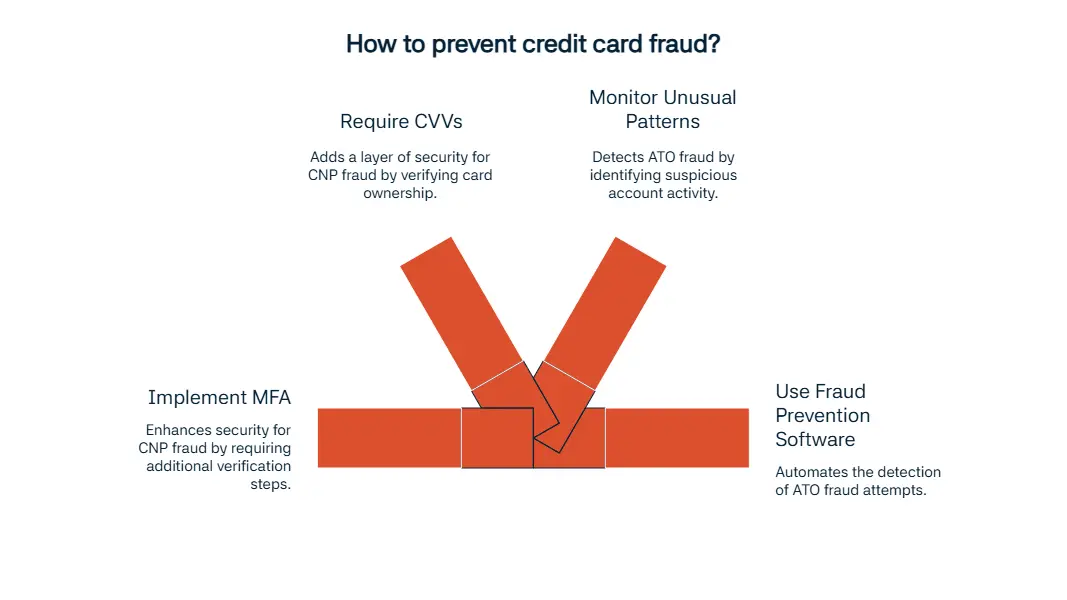

As you may have inferred from the title, CNP fraud concerns the usage of a card that is not physically present. Thus, they often use these to make online purchases through bots. However, this type of fraud is hard to detect. You must implement multi-factor authentication (MFA) and require CVVs in order to prevent CNP fraud.

Card-Present Fraud

Despite being less common than CNP fraud, it can still cause severe repercussions. This happens when a thief gets their hands on a credit card and then uses it before the cardholder reports it missing.

Account Takeover (ATO)

Today breaches and leaks have been becoming increasingly prevalent, despite the endeavors to stop these. In ATO, a criminal tries to access someone’s account based on the data emerged from phishing or breaches. After the access, they make purchases with the saved cards on the account. However, automated login attempts can give away these fraud attempts, and in order to spot these, you can use fraud prevention softwares. It is also possible to spot these acts by being on the outlook for unusual patterns.

Application Fraud

This happens when a fraudster submits false or stolen information on an application. They may present false information about income, hide addresses or use fake/stolen documents.

What Are the Red Flags of Credit Card Fraud?

There are some obvious and not-so-obvious red flags that you may come across when trying to identify credit card frauds. The first one is very expected and can almost apply to almost every case in any financial fraud: Unfamiliar charges and transaction alerts. These unusual patterns are always one of the first things you should keep an eye on. Of course, it is not always foolproof, so one must be careful when evaluating these. Also, there are other things to watch for, such as declined transactions without cause, charges in billing address/contact info, OTP or login notifications you didn’t initiate, missing physical card or smaller test charges. These are some strong indicators that come before larger thefts.

How to Detect Credit Card Fraud?

Now that we’ve covered the red flags, let’s continue with the signs of a successful hacking attempt. The first one is an account lockout or reset. Another suspicious sign can be encountered when checking out the billing information. If you stumble upon an unfamiliar location, then this is a sure sign that something’s up. Similarly, you may receive alerts for purchases that you didn’t make or multiple failed transaction attempts. Lastly, you may see that there are new cards or accounts that you didn’t open. According to sources of AL Monitor, iIn July 2025, in Türkiye, which is one of the most beautiful tourism destinations in the world, about 20 fraudsters scammed more than $30 Millon from 268 tourists.

Prevention Tips for Credit Card Fraud

The things to watch for can vary between individuals and businesses. Let’s start with the personal prevention tips. First prevention step you can take is enabling 2FA on all financial apps. This makes it harder for hackers to access your accounts. In general, you must keep your vigilance by not saving cards on unreliable websites and do not perform any financial action when connected to public Wi-Fi. Also, don’t forget to check bank statements over time.

When it comes to businesses, you can use a verification method just like we have mentioned in the first section. For businesses, the most prominent ones that you can use are AVS and CVV verifications. Some other things that you can apply are encryption, tokenization and AI fraud detection tools. Lastly, training staff to better spot social engineering can always prove to be useful.

If You’re a Victim: What To Do

If you happen to be a victim, you can follow the steps we are going to mention in order to recover. The first thing you must do is to contact your card provider (IdentityTheft.gov for US, Action Fraud for UK…) to report the fraud. Then, proceed to monitor all of your accounts. After having placed a fraud alert or frozen credit, you can dispute charges. Lastly, since your account has been now compromised, you better update passwords and enable 2FA.

How Hackers Steal Credit Card Data

These fraudsters can steal credit card data through are several ways. One of the most common methods is phishing. They do this through malicious web links, attachments or data-entry forms. Similarly, certain malware on your devices can allow them to access your data. However, there are several situations where a lot of people can get affected at the same time due to things such as public Wi-Fi attacks or data breaches. There are various other methods skimming/shimming and social engineering as well.

What Are the Legal Consequences?

It is expected that legal consequences may vary but most of the time, there are severe repercussions. The U.S. is one of the countries that impose one of the most strict penalties. If one is involved in identity or credit card fraud, they can serve up to 30 years in federal prison. The situation is a little more lighter in European Union, which imposes 5-10 years for major fraud cases under the PSD2 and national laws. Whereas in The UK, it can go up to 10 years under the FRAUD ACT 2006. In Asia, penalties are on the heavier side as well, with pri-son time up to 20 years and hefty fines.

U.S.: Up to 30 years in prison

UK: 10 years under the Fraud Act 2006

EU: Severe penalties under PSD2 and national laws

Real Life Examples of Credit Card Fraud

Our first example comes from Torrance, CA, and revolves around a letter carrier who stole checks and cards for at least 2 years. Authorities found a total number of 133 stolen cards, 16 U.S. Department of Treasury checks and unserialized gun in the criminal’s apartment.

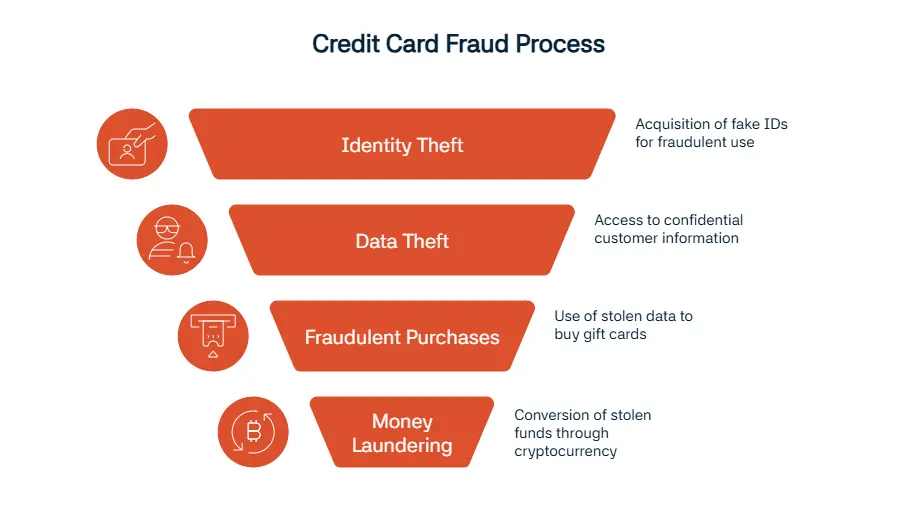

Let’s continue with another example from U.S.. This one is from Charlotte, NC. Based on the post from Secret Service, A group of conspirators got their hands on fake IDs and then proceeded to use these over several stores to obtain an amount of $500.000. The total number of stolen identities belonged to at least 40 people.

Obviously, The U.S. is not the only place where this is prevalent. It can happen practically anywhere. So, let’s finish with an example from Delhi, India. New Indian Express reported that a group of eighteen people had accessed to confidential customer information by using insiders at a call center. Then, they purchased high-value electronic gift cards from online platforms with these data to sell them to travel agents. The total amount of stolen money was around 2.6 crore (approximately $298,690). One striking point of this attempt is that they laundered this money through cryptocurrency channels as well.

Credit Card Fraud Stats (2025)

We have gathered several data from various reliable sources to show the severity of the situation. For example, the research of Javelin Strategy shows that losses linked to credit card fraud reached to $27.2 billon dollars last year, which equals to an increase of %19. Unfortunately, it doesn’t seem to stop anytime soon. The research of Merchant Cost Consulting backs this up by showing that it may reach $43 billion by 2026. Another interesting statistic that can be found in the same research is that 48% of consumers stating that it is merchant’s responsibility to protect them from fraud. So, it is no longer negotiable to hold reliable standards.

Debit vs Credit Card Fraud

There are certain differences between the risks of credit card fraud and debit card fraud. First one we will mention is the source of funds. As you may expect, the first one comes from credit line and the latter comes from bank account balance. Legal protection of each type varies significantly as well. Credit cards are better protected due to reasons such as FCBA, while the protection of debit cards are relatively weak and liable to frauds due to variation from bank to bank. Another disadvantage that comes with debit cards are that the refund speed can take longer than their counterpart. Also, credit cards prove to be safer for online use.

Credit Card Fraud vs Identity Theft

The differences between these two concepts are also worth mentioning. Scope of the credit card fraud is much smaller since it remains card focused. So, people who get their hands on these cards can only perform purchases and withdrawals. On the other hand, what identity theft encompasses is much more broad. There are many things such as SSN, tax data and full identity. Expectedly, what it can entail is much more varied compared to credit card fraud. Fraudsters can get loans, open new accounts, file taxes and much more…

As you may have noticed, there are numerous red flags, types, prevention steps, signs and more regarding credit card fraud. It is true that all of these may be daunting at once, but with the help of Sanction Scanner, you can efficiently secure your business from these threats.

FAQ's Blog Post

Credit card fraud is the unauthorized use of someone’s card details to steal money or make purchases.

Common types include card-not-present fraud, lost or stolen cards, phishing, skimming, and identity theft.

Criminals commit credit card fraud by stealing card numbers, cloning cards, or tricking victims into sharing details.

Credit card fraud is dangerous because it causes financial losses, identity theft, and reputational damage.

Customers can detect credit card fraud by checking statements and monitoring alerts.

Businesses prevent credit card fraud with transaction monitoring and fraud scoring.

AML compliance helps by detecting suspicious payments and monitoring high-risk activity.