Fraud Detection

Safeguard your business with our cutting-edge fraud detection system, harnessing real-time monitoring and AI-driven insights to proactively thwart threats and secure your operations.

Trusted by over 800+ companies for accurate fraud detection

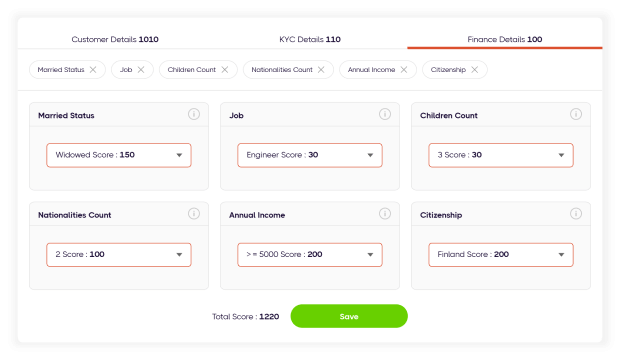

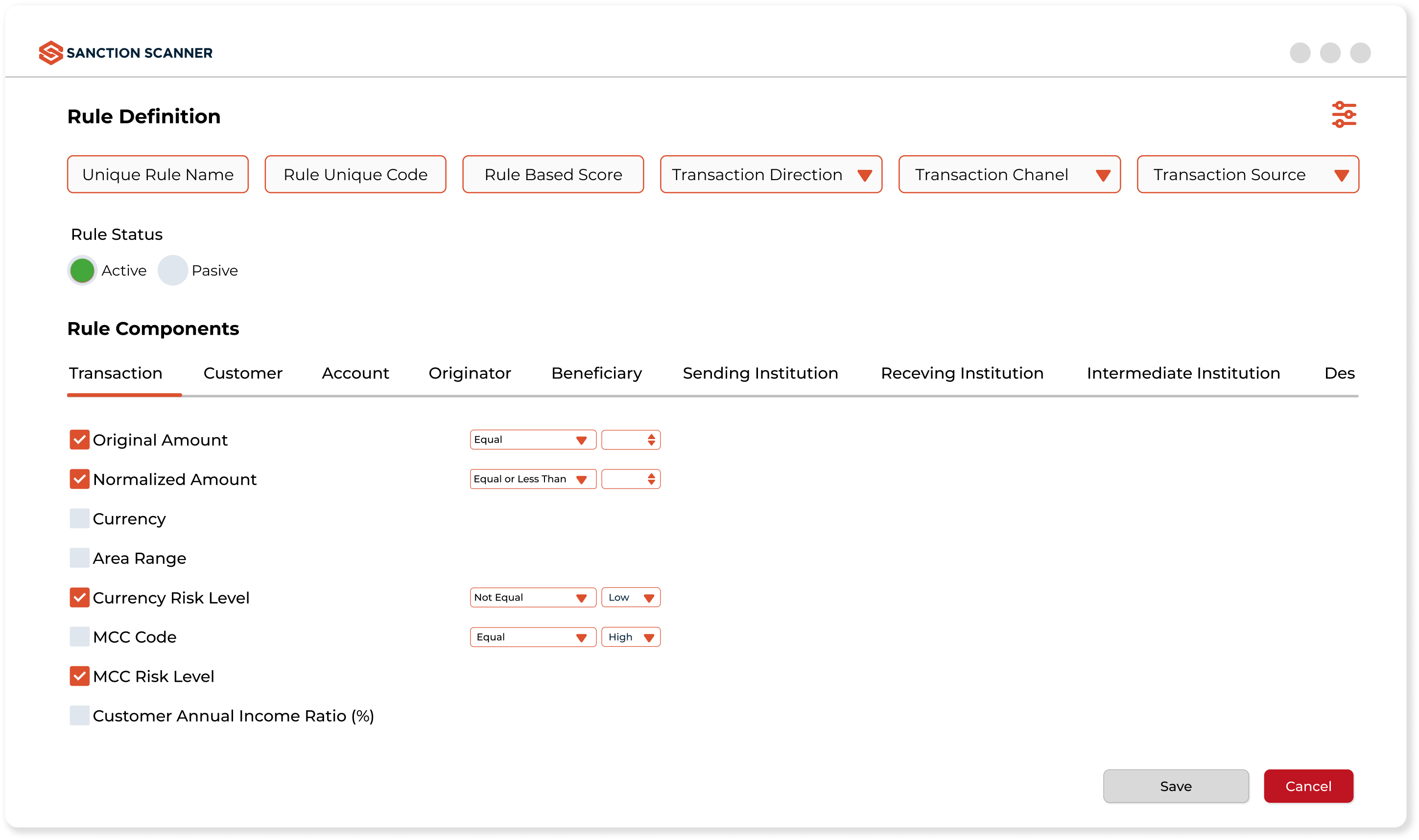

Rule-Based Fraud Screening

Our platform allows you to design tailored scenarios that target the unique fraud risks facing your industry, reducing the noise from false positives by 96.99%. Customize detection thresholds, take control over transactional red flags, and calibrate the sensitivity of monitoring systems to align with your specific business requirements.

This bespoke approach not only refines your fraud detection capabilities but also enhances the efficiency of your overall fraud management strategy.

+3000

DATA POINTS CHECKED

+220

COUNTRIES COVERED

15 min

ALWAYS REAL-TIME DATA

150 ms

SCANNING

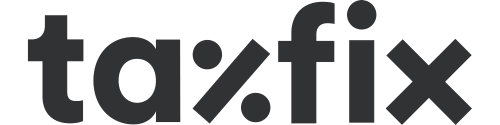

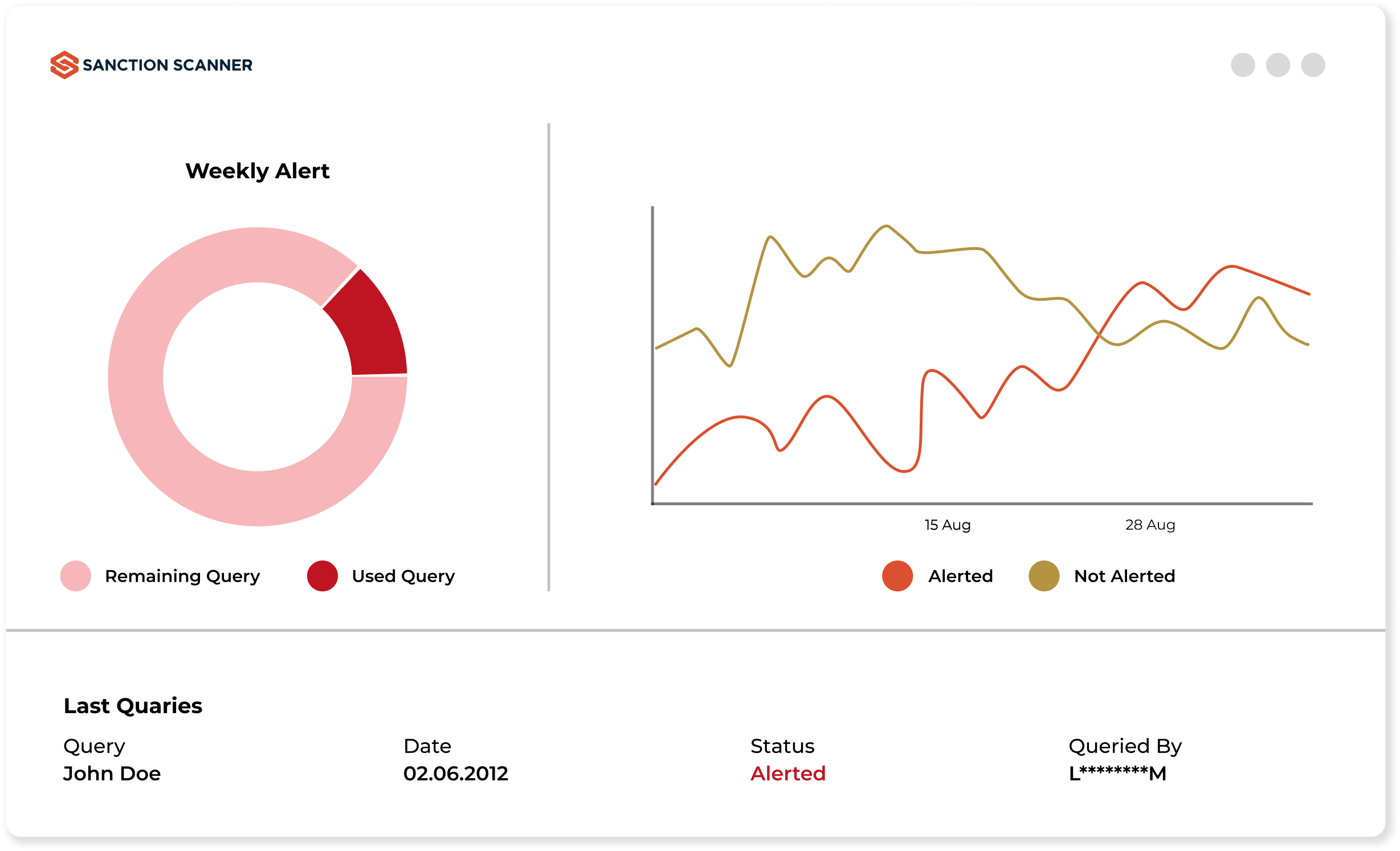

Dynamic Fraud Alerting

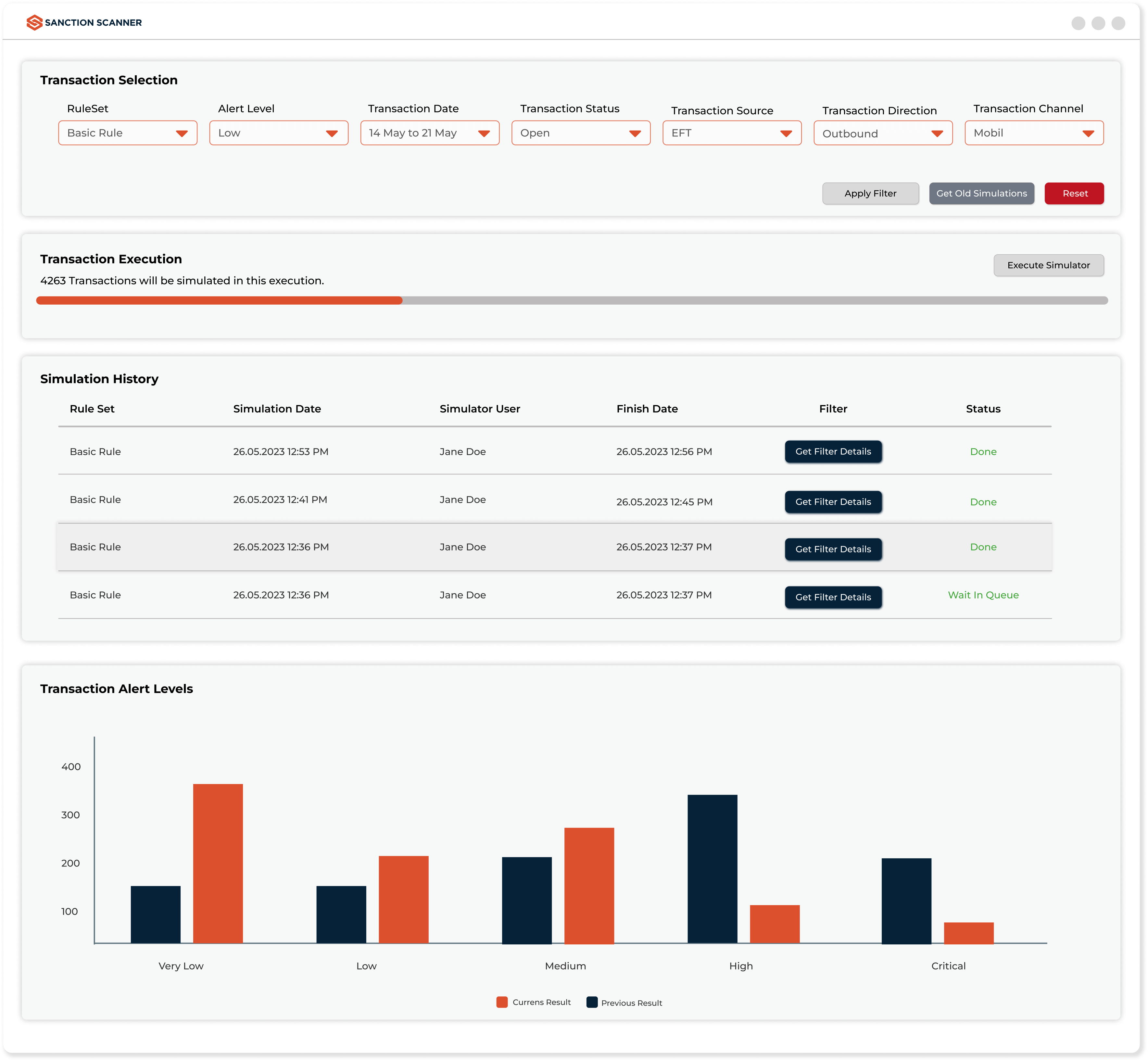

Our solution scrutinizes every transaction, assigns a risk score, and generates immediate, actionable alerts for high-priority issues, ensuring you can respond with the urgency and accuracy required.

Sophisticated algorithms assess risk factors behind the scenes, providing you not just data, but a roadmap for rapid response. Alerts can be customized to reflect your organization's risk tolerance levels, giving you control over the granularity of the monitoring process.

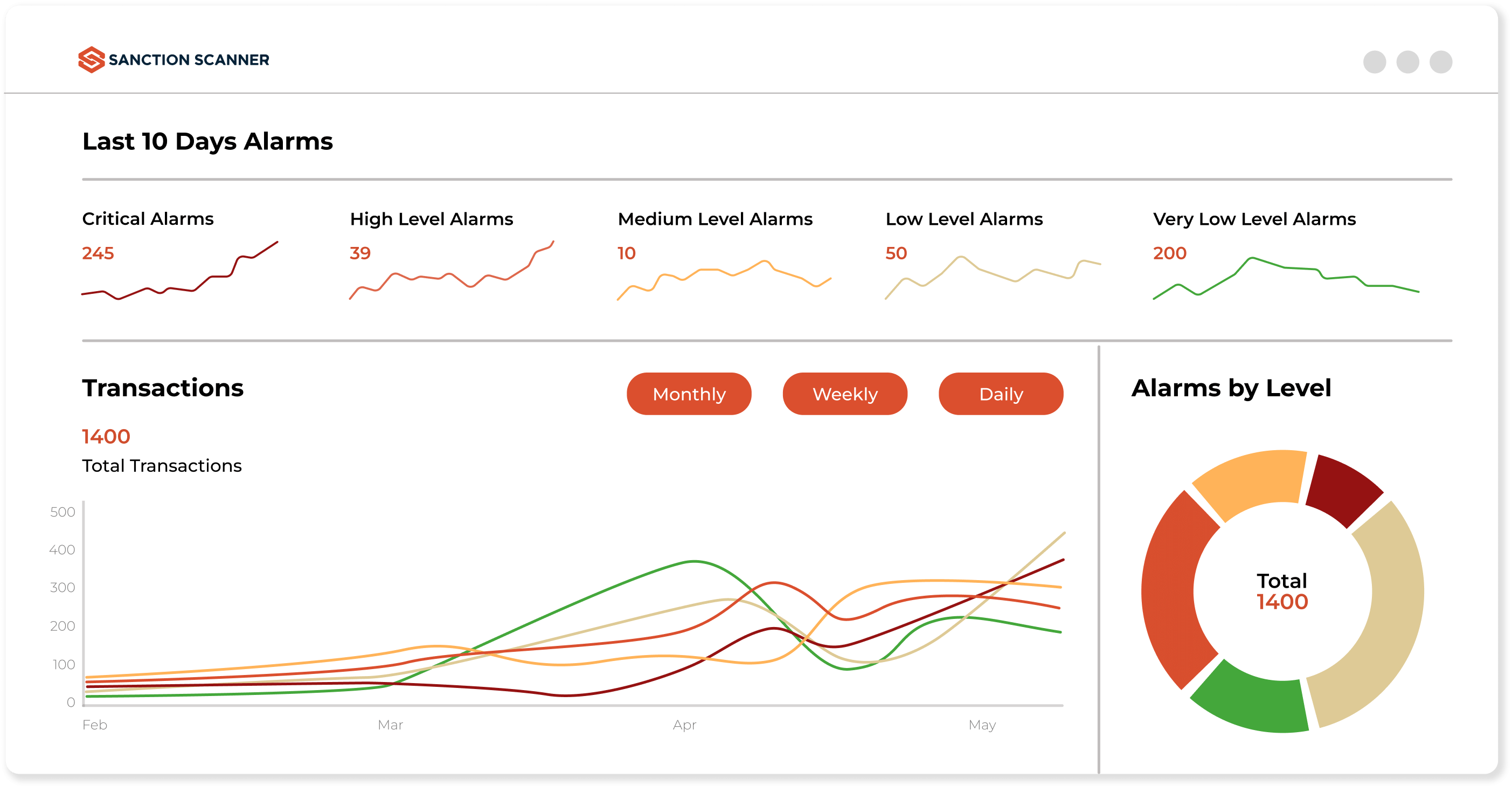

Transaction Analysis

Our tool provides you with an in-depth look into the trades between accounts, exposing pivotal details such as Account Names, Volumes, Balances, and the nature of relationships. It is engineered to unearth suspicious patterns that typical audits might miss—patterns that could indicate fraudulent schemes or complex money-laundering activities.

Seamless Fraud Detection Integration

Integrate cutting-edge fraud prevention with ease. Sanction Scanner offers a robust API that effortlessly merges with your existing systems, granting real-time oversight to halt suspect transactions swiftly. Ensure the safeguarding of your operations with minimal disruption.

Why is Sanction Scanner Different?

Translate Results

Translate your query results into your language

Local List Management

You can add your local blacklist and whitelist to the system.

Parametric Monitoring Settings

Customize which lists you want to run your scans and match rate for your business.

Case Management

You can check your business' scanning history and access your old scans easily.

Enhanced Profile

View all results using one profile and determine the level of risk fast.

Reduce False Positive

Reduce false positives and strengthen your compliance process.

User-Friendly Fraud Management

Manage your fraud detection efforts with a user-friendly interface that requires no coding knowledge. Set up rules and scenarios with simple drag-and-drop actions, making sophisticated fraud prevention accessible to all team members.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

Fraud Detection

A fraud detection tool helps businesses identify and prevent fraudulent or suspicious transactions by analyzing patterns, behavior, and points of data.

The Fraud Detection module within Sanction Scanner allows businesses to create custom rule combinations in order to detect and prevent fraudulent activity in real time.

The platform monitors transactions and user activity to identify anomalies that can indicate fraud, such as unusual IP changes or suspicious login patterns.

Sanction Scanner's rule-based engine provides real-time alerts through its Alert Management dashboard, giving compliance teams the ability to act quickly.

Fraud detection systems can identify transaction-based fraud, account takeovers, money laundering attempts, and policy violations.

Sanction Scanner helps detect payment, banking, crypto, and insurance fraud by analyzing millions of data points in real-time.

Industries with high volume of transactions such as banking, payments, and cryptocurrency which are hit hardest by most sophisticated and frequent attempts at fraud.

Sanction Scanner boasts architecture scalable enough to suit such industries, which proves convenient for fast analysis and accurate alert even under high load.

Yes. Real-time processing is necessary to prevent fraud before it can cause damage.

Sanction Scanner processes transactions in milliseconds, simultaneously flagging or blocking suspicious activity for banks, fintechs, and payment providers.

AI & Machine Learning algorithms detects hidden relationships and unusual behavior patterns that rule-based systems might miss.

Sanction Scanner uses AI & machine learning to improve rules, reduce false positives, and continuously adapt to changing fraud trends.

Contextual business data such as the volume of transactions, IP addresses, user behavior, and device information are processed by fraud detection software.

Sanction Scanner allows businesses to define what fields of data to include to ensure flexibility and compliance with data protection laws.

Without automated fraud prevention, organizations face financial loss, regulatory penalties, business interruption, and loss of reputation.

Sanction Scanner protects organizations with real-time alerts and rules that can be customized to minimize these risks.

Sanction Scanner offers an API-based Fraud Detection solution that seamlessly integrates with your current systems.

With real-time alerts, rules that can be tailored, and blocking that is automatically performed, Sanction Scanner assists international businesses in stopping financial crime before it happens.

Yes. Internal fraud can be detected through behavior analysis, monitoring of accesses, and comparative checks of transaction profiles.

Sanction Scanner's adaptive rule engine allows compliance departments to create internal fraud scenarios tailored to your company's unique needs.