Trusted by over 800+ companies for accurate name screening.

Customer Onbarding and Monitoring

You can create an AML Control Program when you first open an account to a customer based on their risk levels by scanning them in more than 3000 Global Sanctions lists, PEPs Lists, and Adverse Media Data updated every 15 minutes.

+3000

DATA POINTS CHECKED

+220

COUNTRIES COVERED

15 min

ALWAYS REAL-TIME DATA

150 ms

SCANNING

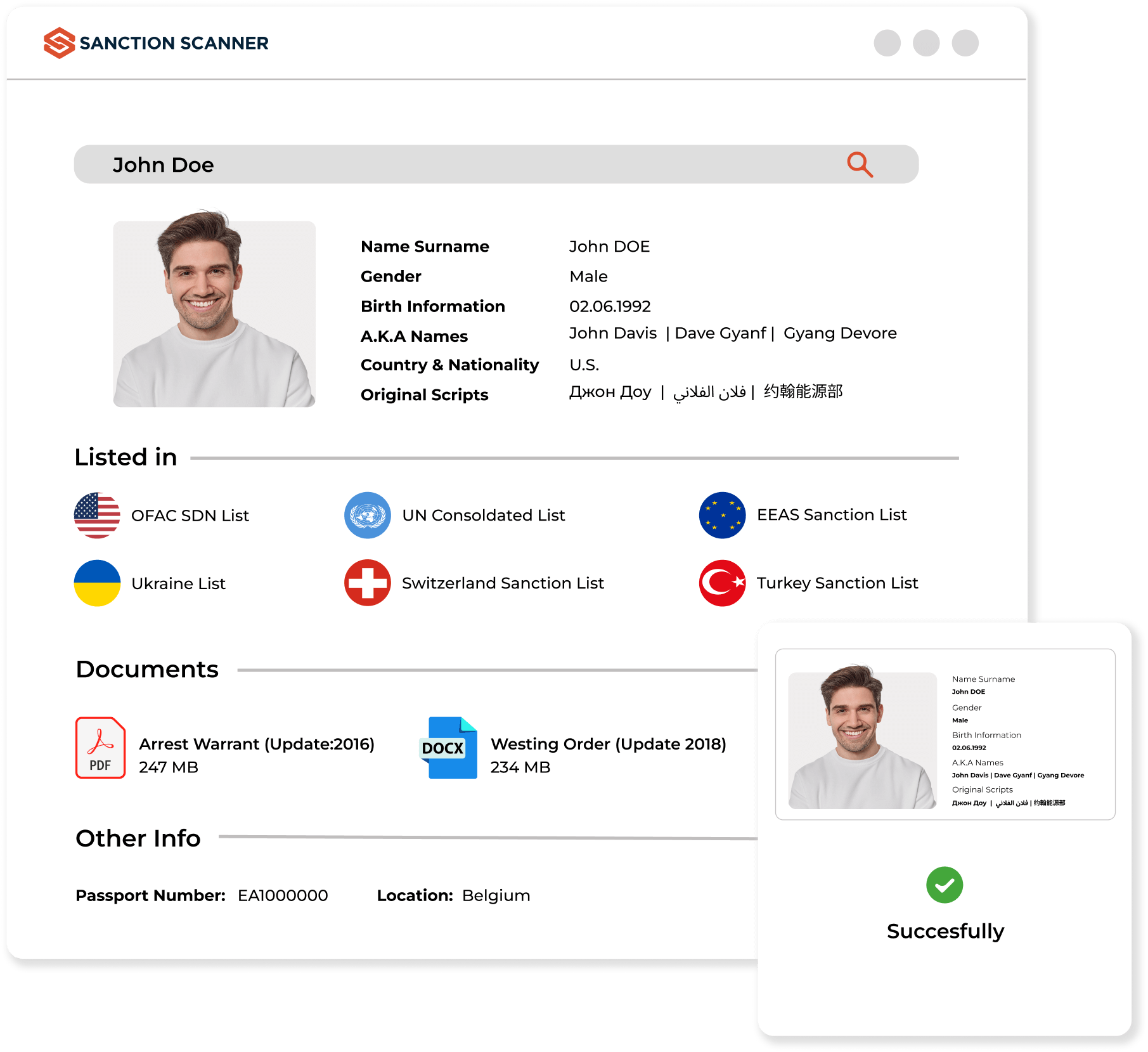

Screening and Monitoring Tool

You can perform PEP, Sanction, Remittance, Payment, Vessel, and Aircraft Screening using AML Name Scanning Software. You can also check Ultimate Beneficial Ownership for your companies. Screening and check operations can be performed single or batch with options such as Name, Identity, Passport Number.

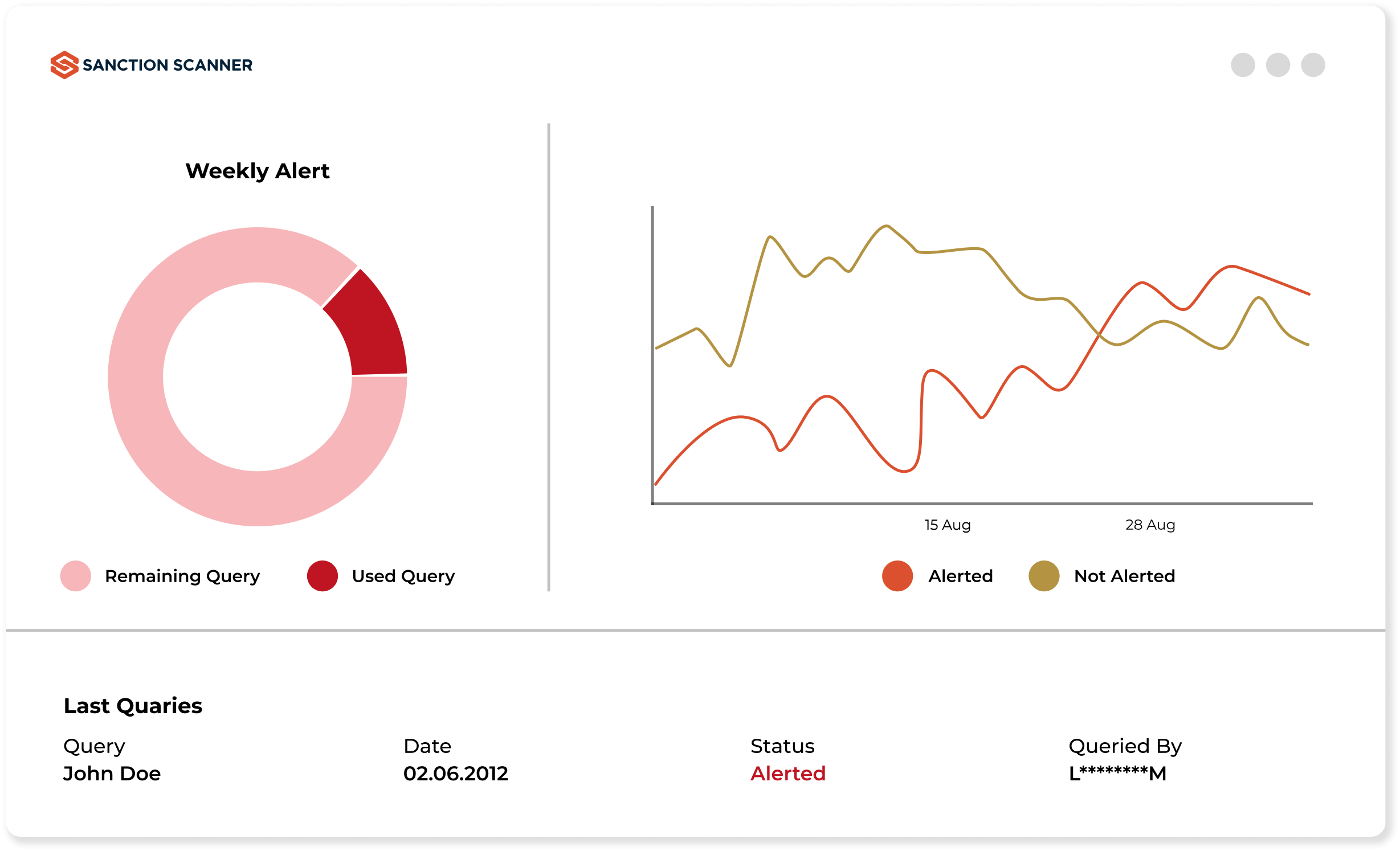

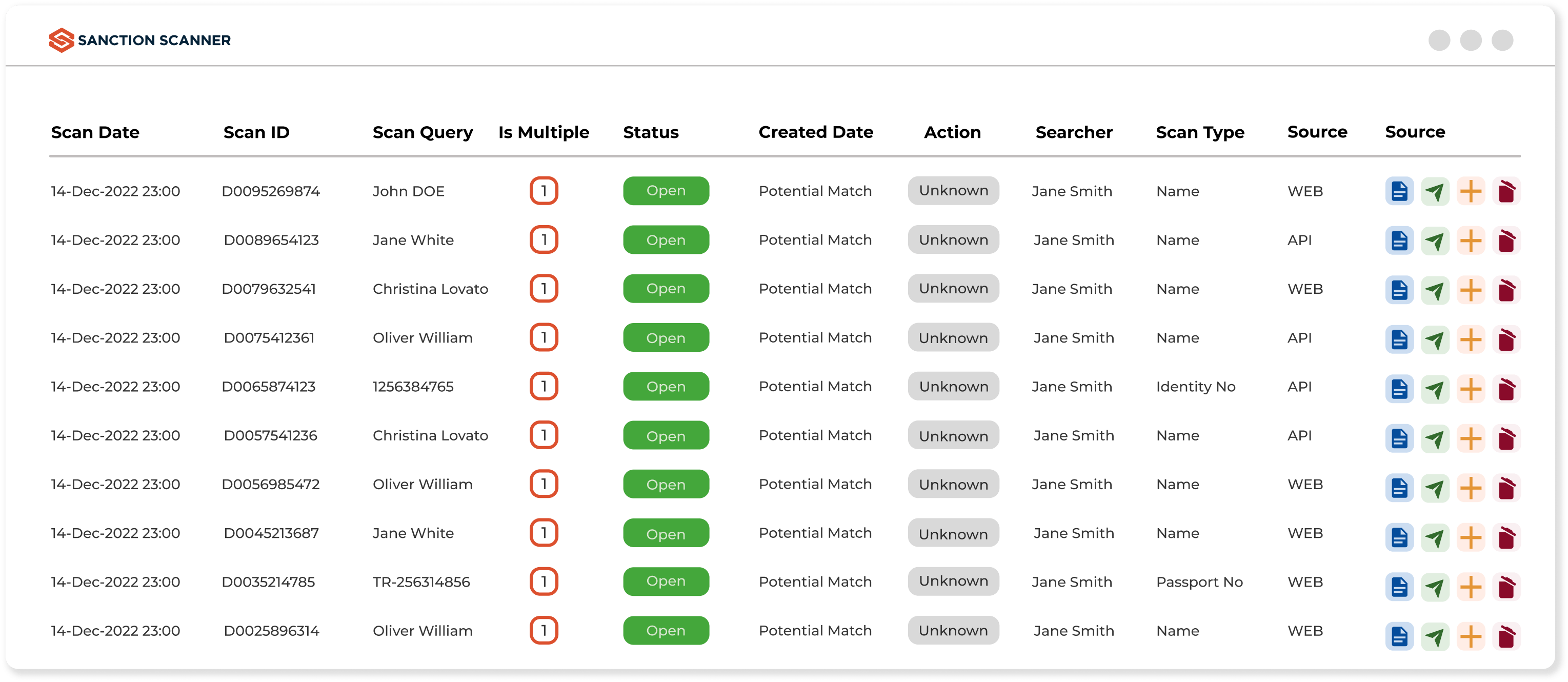

Automated Daily Ongoing Monitoring

You can plan the control period according to your customers' risk levels with Automated Daily Ongoing Monitoring. All customer monitoring checks are performed automatically. As a result, Automated Daily Ongoing Monitoring protects your businesses from risks.

More Details

Powerful API for AML Solutions

You can integrate Sanction Scanner into your project within a day. It supports all the features of our API/AML solutions. We automate your business' AML Control Processes with a powerful API that has been powered by Webhook and reduce your workload. Webhook provides two-way data transfer between Sanction Scanner and your project.

Why is Sanction Scanner Different?

Translate Results

Translate your query results into your language

Local List Management

You can add your local blacklist and whitelist to the system.

Parametric Monitoring Settings

Customize which lists you want to run your scans and match rate for your business.

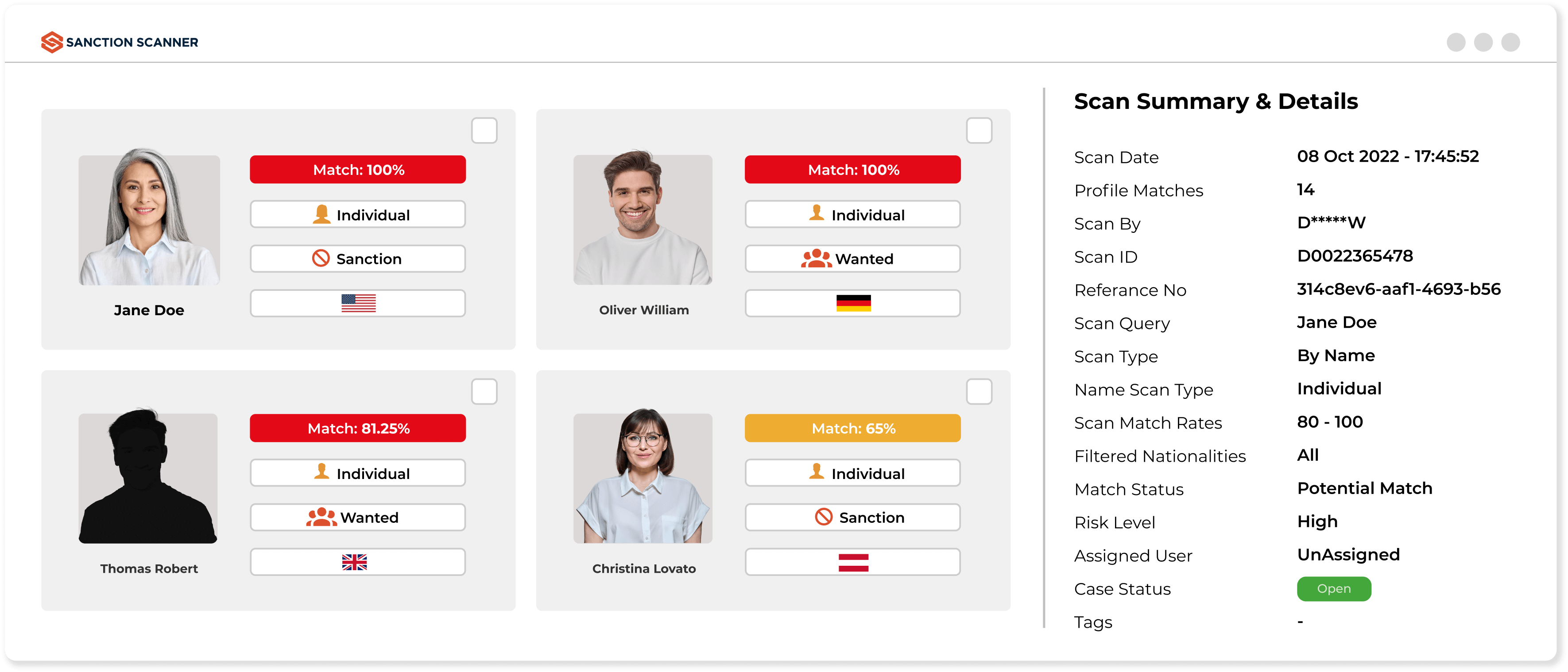

Case Management

You can check your business' scanning history and access your old scans easily.

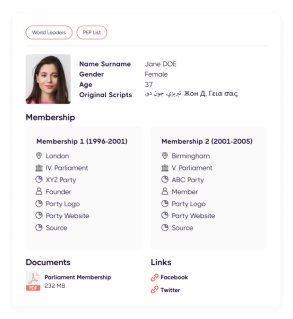

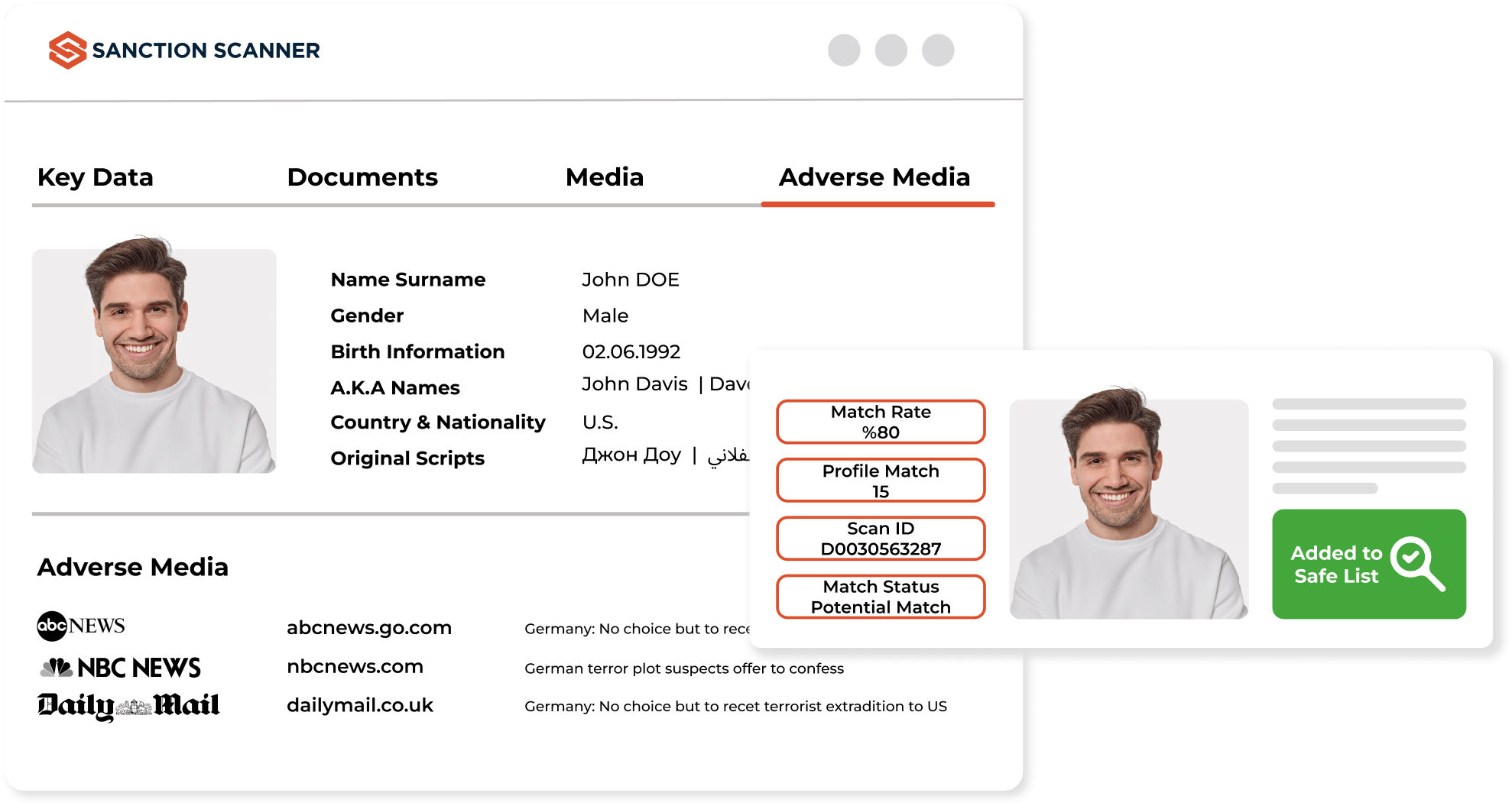

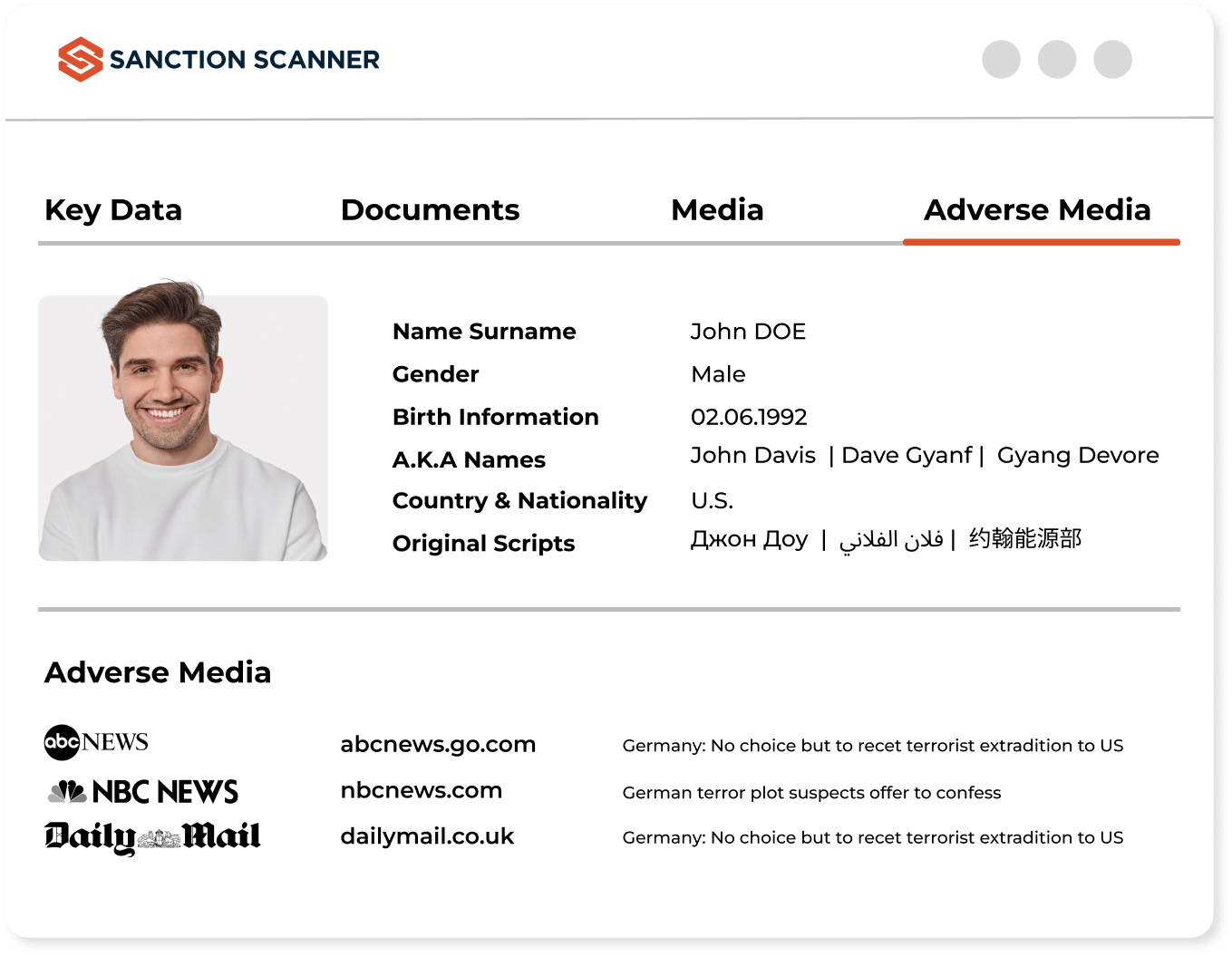

Enhanced Profile

View all results using one profile and determine the level of risk fast.

Reduce False Positive

Reduce false positives and strengthen your compliance process.

Search Support in All Alphabets

You can scan your customers with any alphabet using our Name Screening software. Sanction Scanner can translate results into many languages.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

Featured news and press releases

AML Name Screening

Client screening is the screening of individuals or entities against international sanctions, PEP, watchlists, and negative media sources in an attempt to identify risk of financial crime.

Sanction Scanner's Name Screening software helps organizations automatically detect risky entities in real-time and remain AML compliant.

Name screening enables the detection of risky customers by organizations before financial crime is actually carried out.

Sanction Scanner helps financial institutions, fintechs, and cryptocurrency businesses comply with global AML regulations such as FATF, OFAC, and the EU's 6th Directive on AML, reducing both regulatory and reputational risk.

The system scans a wide range of global and local data sources, including sanctions lists (OFAC, UN, EU), PEP lists, watchlists, and adverse media databases from more than 3000

Sanction Scanner also allows for uploading and managing internal/local blacklists and whitelists to customize their screening process.

A Client screening tool collects relevant identity information, compares it with active databases, and warns for possible matches.

Sanction Scanner uses ultimate AI-Driven fuzzy matching algorithms to identify variations, aliases, and misspells with accurate alerts in milliseconds.

Ultimate AI-Driven fuzzy matching is a technique that identifies similar or variant names that may be the same person or entity with AI and other algorithms.

Sanction Scanner's advanced fuzzy ultimate AI-Driven fuzzy matching logic identifies close matches and alias patterns with minimized missed detections and false positive alerts.

False positives occur when unrelated names are inappropriately triggered. These are reduced by mixing name information with other identifiers such as date of birth, nationality, and ID number.

Adjustable matching thresholds and AI-based context filters from Sanction Scanner reduce false positives by more than 967%.

Yes. Real-time screening enables organizations to detect and react to latent risk in real-time.

Yes. Our APIs enable real-time screening during:

• Customer onboarding

• Periodic KYC reviews

• High-risk transaction approvals

This ensures immediate decisioning and audit traceability.

Name screening is essential for:

• Banks and fintechs

• Payment and remittance firms

• Crypto exchanges

• Insurance and legal firms

• Real estate and accounting services

Any regulated business dealing with onboarding or transactions must comply.

Missed matches can lead to:

• Regulatory fines (millions in some cases)

• Breach of international sanctions

• Loss of banking licenses or correspondent partners

• Reputational and legal damage

Yes. FATF, EU AMLD, FinCEN, and other regulators require institutions to screen all customers and beneficial owners against sanctions and PEP lists.

At onboarding and continuously. Ongoing screening ensures institutions detect any new sanctions, media exposure, or PEP status changes.

Yes. Our API-first architecture allows screening to be embedded directly into CRMs, onboarding flows, and case management systems.

Absolutely. Every match, decision, and action is logged in an audit-ready format for regulatory reviews and internal compliance tracking.

Yes. You can apply different match thresholds and workflows for retail, corporate, or high-risk clients to align with your internal policies.

Yes. In addition to global sanctions and PEP sources, Sanction Scanner allows organizations to upload and screen against custom internal lists—such as banned clients, partner blacklists, or industry-specific risk databases—ensuring full flexibility in your compliance framework.