AML Compliance Solutions for Insurance

AML compliance is easier than ever for the Insurance Industry.

TRUSTED BY OVER 800+ CLIENTS

Minimize the Risk Your Customer Bring

The insurance industry generates a massive flow of funds all over the world.Some of these funds might be dirty money. Insurance companies are vulnerable to financial crimes. Minimizing the risk your customer brings is essential. Sanction Scanner helps businesses to prevent financial crimes with our products.

Automate your KYC process and Risk Assessment

Managing time effectively is important for businesses.Sanction Scanner automates your KYC process and risk assessment with its enhanced AI-driven algorithm. You can integrate Sanction Scanner into your project within a day. It supports all the features of our API/AML solutions. We automate your business' AML Control Processes with a powerful API that has been powered by Webhook and reduce your workload. Webhook provides two-way data transfer between Sanction Scanner and your project.

Comply with insurance regulations

Insurance companies have to comply with anti-money laundering regulations requirements. The risk-based approach is central to effectively implementing recommendations for the authorities such as BSA and FATF to fight money laundering and terrorist financing. The insurance industry's risk-based approach highlights the nature and level of money laundering and terrorist financing risks of the insurance industry. Sanction Scanner helps firms to implement these risk-based recommendations and rules.

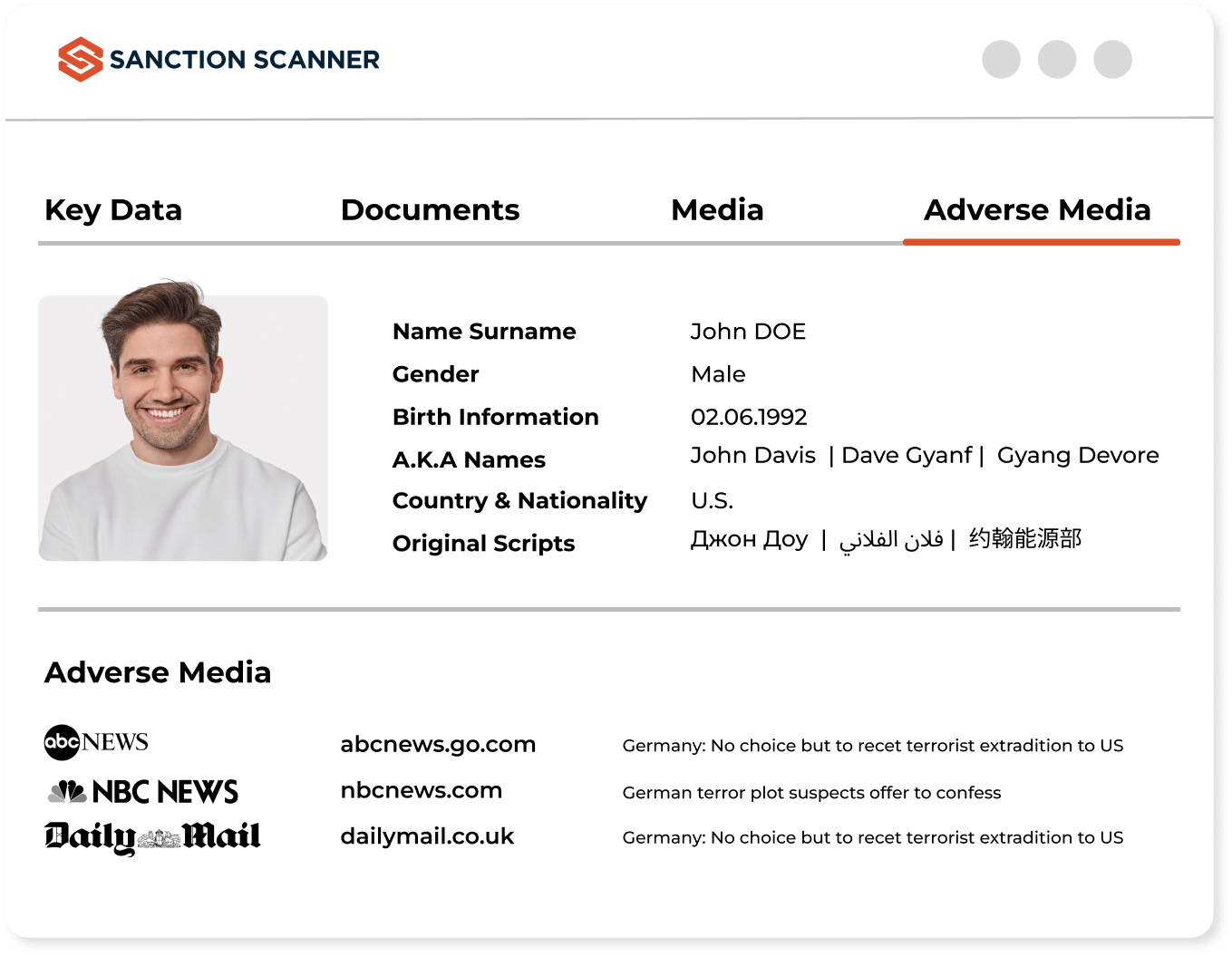

AML Screening Software for Insurance Industry

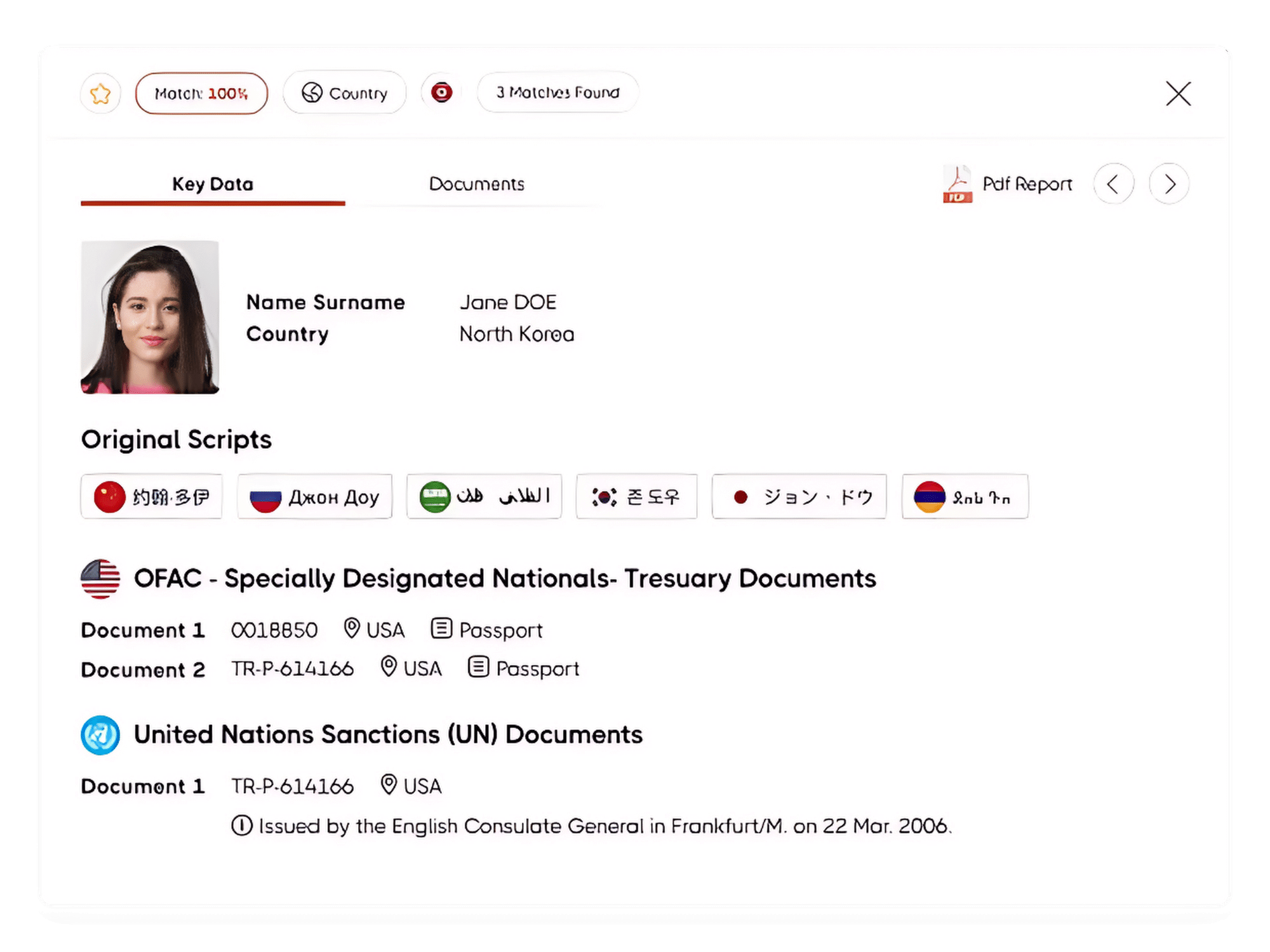

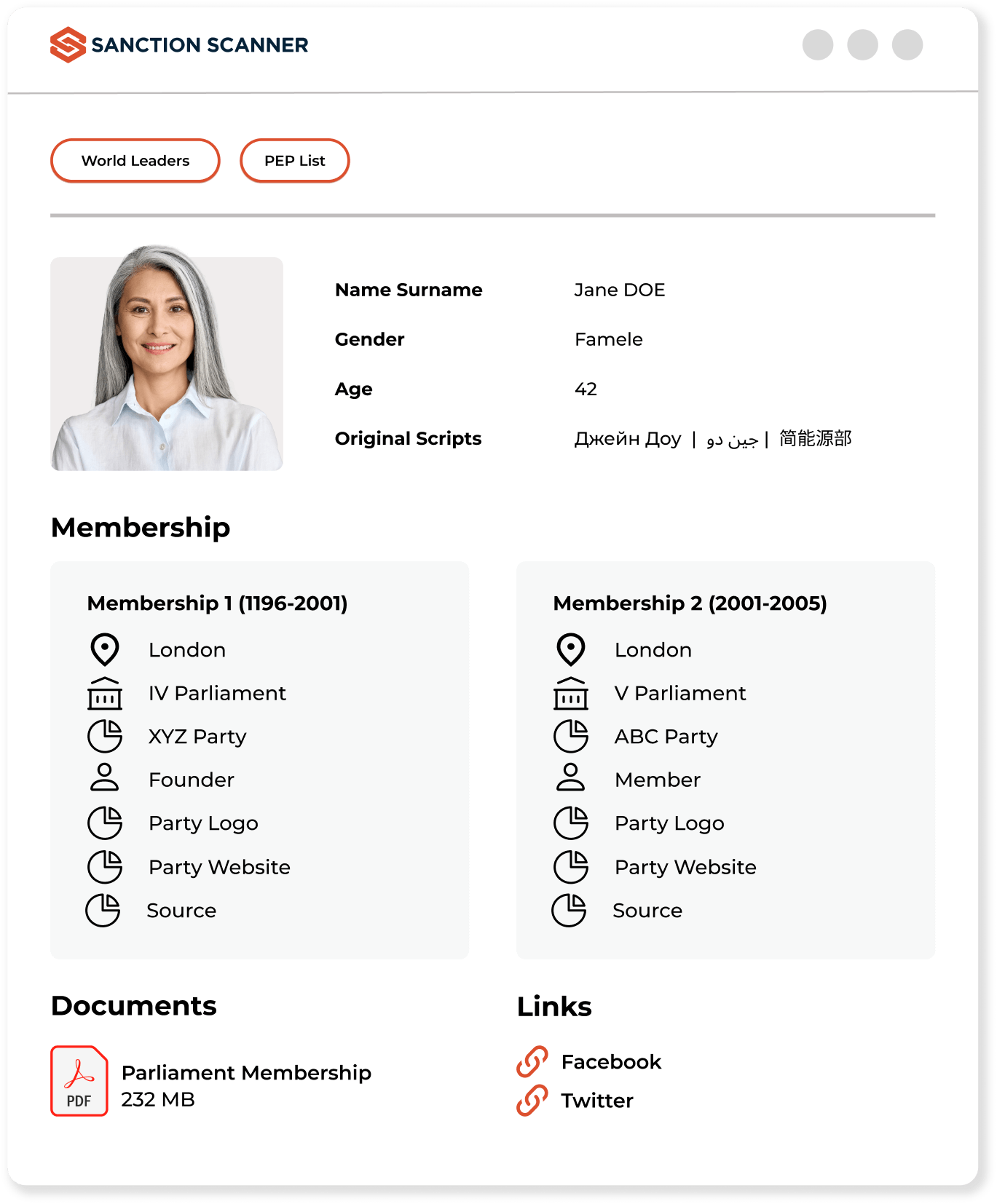

Organizations serving in the ınsurance industry must fulfill their AML and KYC obligations during the customer account opening processes. With our AML Screening Software, Insurance companies can scan their customers in 220+ countries' sanctions, PEP, and adverse media data. The insurance industry has to comply with its AML and KYC obligations to avoid AML penalties.

FAQs about Insurance

Yes. Insurers offering life or investment-linked products must follow AML and CFT rules, including KYC, transaction monitoring, and SAR filing.

Insurance products can be used to launder money via refunds, early withdrawals, or third-party payments—making AML programs essential.

Life insurance, annuities, and investment-linked policies pose higher AML risk due to liquidity, refundability, and transferability.

Key controls include KYC, premium monitoring, SAR reporting, customer risk scoring, staff training, EDD, and internal AML audits.

Red flags include early policy surrenders, overpayments with refund requests, third-party premium funding, or income-policy mismatches.

Yes. Insurers must screen policyholders, beneficiaries, and payers against global watchlists like OFAC, UN, and EU.

Non-compliance may result in fines, license suspension, regulatory action, and reputational loss affecting long-term operations.

Brokers must conduct KYC, detect suspicious activity, and ensure AML compliance during onboarding and policy distribution.

Sanction Scanner provides screening, transaction monitoring, and risk scoring via API—integrated into onboarding, claims, and policy workflows.

Yes. Reinsurers must follow AML obligations, especially for cross-border or layered premium arrangements involving high-risk structures.

Yes. While life insurance poses higher risk, non-life insurers must still follow AML rules if their products involve payments or financial value.

Beneficiaries must be screened against sanctions and PEP lists to prevent payout to individuals or entities linked to financial crime.

SARs should be filed when there's unexplained early surrender, premium anomalies, or suspicion about the source of funds or beneficiaries.

AML policies should be reviewed annually or after major regulatory updates, business model changes, or emerging risk patterns.

EDD involves additional checks for high-risk customers, such as verifying source of funds, third-party involvement, and complex ownership structures.

Yes. Using tools like Sanction Scanner, insurers can automate ID verification, sanctions screening, and risk scoring during customer onboarding.

Yes. Monitoring payment sources helps detect laundering via overpayments, third-party transfers, or use of offshore accounts.

Yes. The primary insured and, in some cases, group members or payers should be subject to risk-based AML checks.

TPAs handling customer data or claims must comply with AML protocols, perform screenings, and report suspicious patterns when detected.

They must align with local AML laws, use global screening tools, and maintain centralized policy frameworks adaptable to jurisdictional needs.