Helping 800+ entities navigate PEP list screening with ease.

Detecting Politically Exposed Person (PEP)

PEPs have to be seen as high risk by financial institutions due to their potential to engage in bribery and corruption. Financial institutions are not forbidden to open accounts for PEPs, but AML regulators have financial institutions necessary to detect PEPs due to high risks. You can easily detect PEPs with Sanction Scanner solutions.

+3000

DATA POINTS CHECKED

+220

COUNTRIES COVERED

15 min

ALWAYS REAL-TIME DATA

150 ms

SCANNING

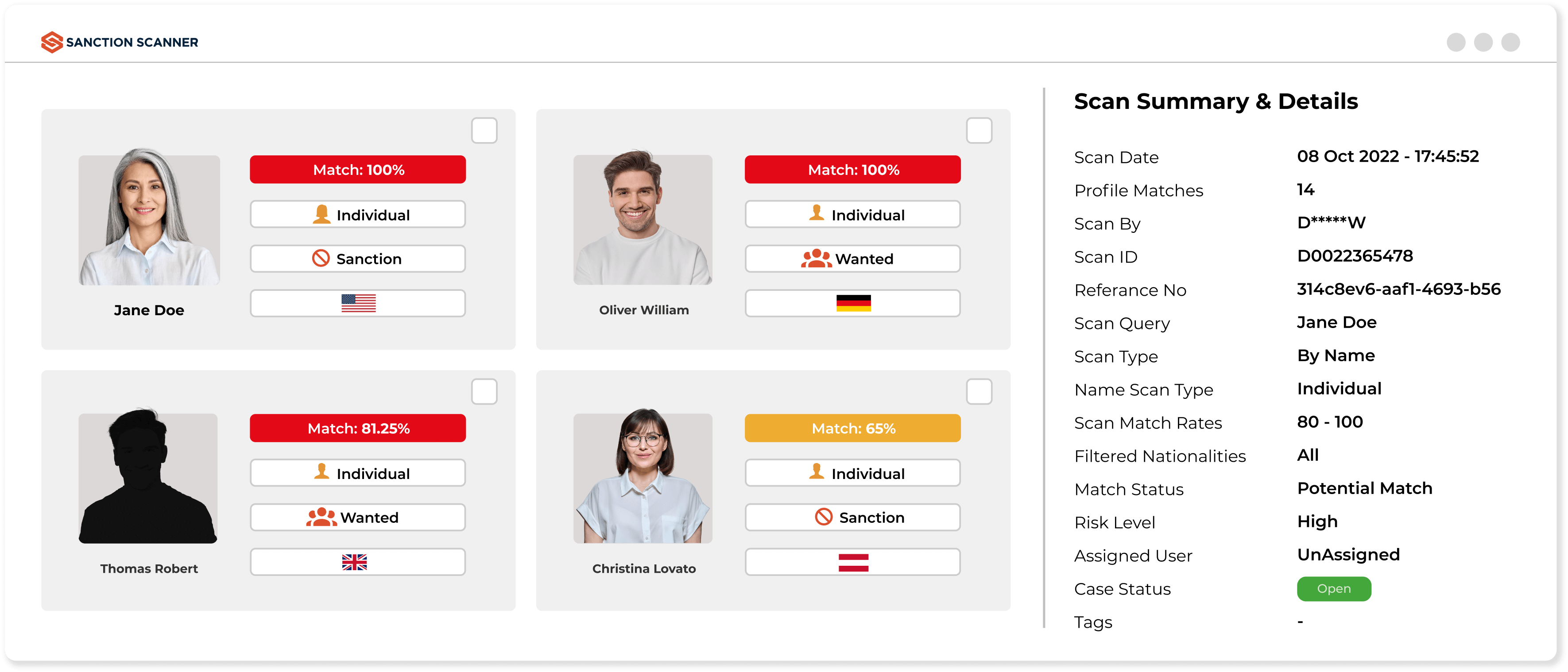

Automating PEP Screening Process

Automate PEP Screening Process using our database that contains PEP Data from 220+ countries. You can perform PEP Screening in seconds during customer onboarding and monitoring processes using API, web, or batch search options.

Classified Real-Time PEP Data

FATF classified PEPs according to their risk levels. Therefore, companies must perform PEP scans based on classified PEP data to meet AML Compliance. You can scan PEPs based on their risk levels using our products that run with real-time data.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

Featured news and press releases

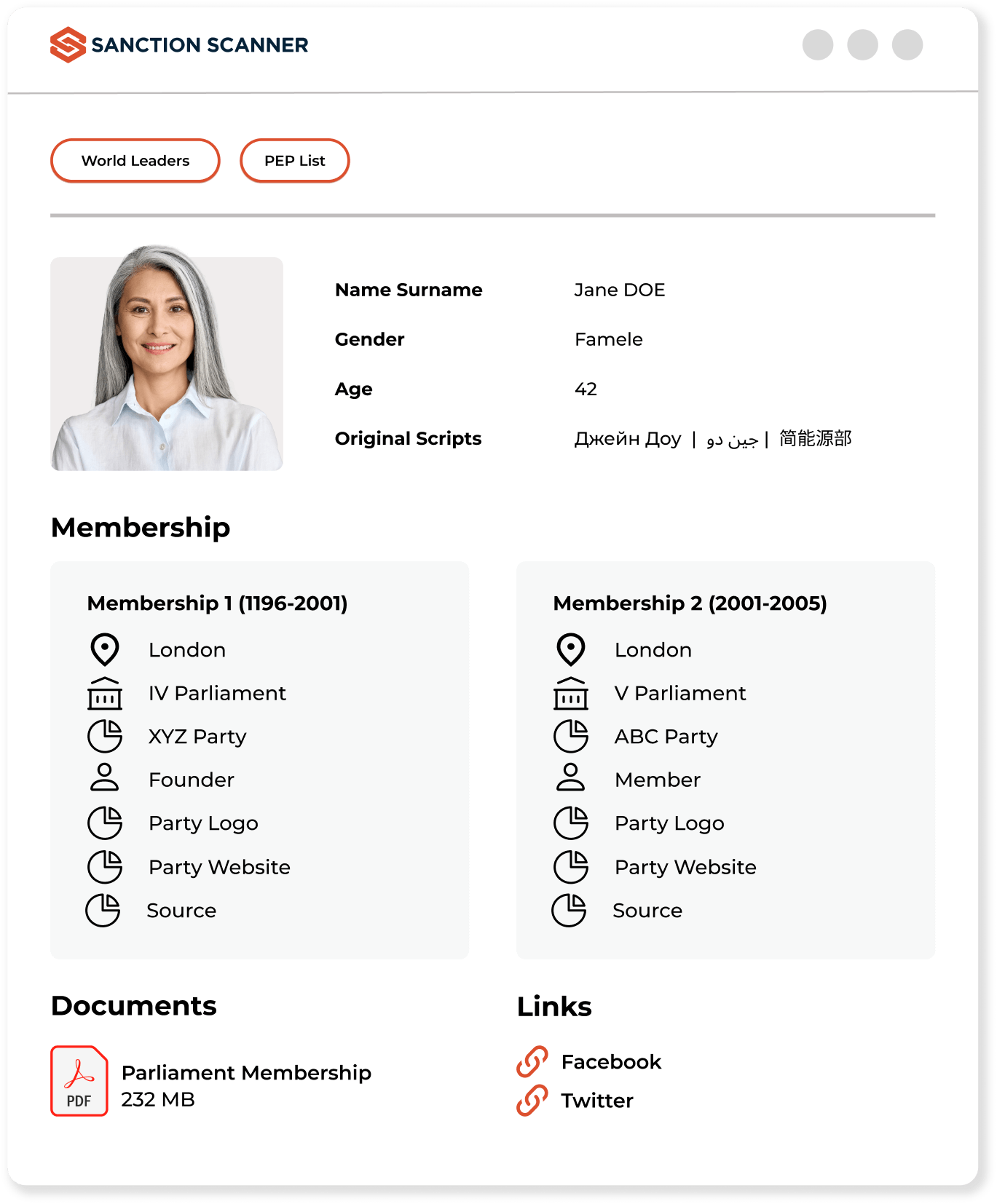

PEP List Screening & Monitoring

A Politically Exposed Person (PEP) is an individual holding a high-profile public position and therefore is more prone to corruption or abuse of power.

Sanction Scanner identifies and monitors PEPs globally in real time, keeping your business compliant with AML regulations and preventing reputational risk.

PEP screening is the process of checking customers or business associates against official PEP lists as part of Know Your Customer (KYC) and Customer Due Diligence (CDD) procedures.

Sanction Scanner allows you to check individuals and entities in real time using API, web or batch screening to detect potential PEPs.

Financial institutions have to monitor PEPs as they are more prone to bribery, corruption, or misappropriation of funds.

Through Sanction Scanner, the institutions receive immediate alerts on potential PEP matches that can protect them from fines, compliance breaches, and license suspensions.

A PEP is a person possessing a senior public position who may be vulnerable to corruption, while a sanctioned person is officially listed by the authorities for confirmed illegal practices such as terrorism or money laundering.

Sanction Scanner scans sanctions lists and PEP, giving you an overall image of risk in all profiles.

Yes. Relatives and close associates of PEPs can also indicate indirect corruption or money-laundering risk.

Sanction Scanner filters RCAs automatically in all PEP searches to comply with FATF guidelines and country-specific legislation.

There are mainly domestic and foreign PEPs, and PEPs from international organizations such as the UN or EU organizations.

Sanction Scanner's database is exhaustive for all PEP types and is updated in real-time in more than 200 countries.

PEP screening is mandatory under regulatory rules for sectors such as banking, payment, insurance, and fintech.

Sanction Scanner's platform helps companies to meet global AML requirements with full FATF and local regulator compliance.

PEP screening shouldn't be performed once. It must be an ongoing procedure as an individual's political exposure can continue to change from time to time.

Sanction Scanner's Ongoing Monitoring regularly re-screens your clients and notifies you immediately on any status change.

Yes. Automation removes the work and ensures continuous compliance.

Sanction Scanner enables full automation through API, web, and batch screening, checking thousands of global lists of information in sub-second response times.

Missing a PEP can result in severe implications, such as regulatory fines, reputational risk, or even withdrawal of license in high-risk sectors.

Sanction Scanner mitigates this risk by means of real-time alerts, accurate matching, and global database coverage.