Between 2007 and 2015, the global financial system faced one of the most significant anti-money laundering (AML) failures in modern history, in which Danske Bank (Denmark’s largest financial institution) was implicated in a money laundering scandal amounting to over $230 billion in suspicious transactions. This scandal occurred around the bank’s Estonian branch. It both exposed critical compliance lapses and reshaped how financial institutions and regulators approach AML globally.

What Was the Danske Bank Money Laundering Scandal?

Over an eight-year period, suspicious transactions worth over $230 billion flowed predominantly from countries that are outside the EU such as Russia, Azerbaijan, and Moldova.

The regulatory and AML systems in the Baltic region were actually weak at the time and unsurprisingly, they were exploited in no time. So, how was this done? The majority of these payments were processed through offshore entities with minimal scrutiny which enabled illicit actors to funnel vast sums of money through Estonia, all under the guise of legitimacy.

How Did the Scandal Come to Light?

A former employee of Danske Bank’s Estonian branch, Howard Wilkinson acted as an in-formant and revealed systemic issues within the bank’s operations. The most striking insight about the issues was the flagging inadequacies in the handling of non-resident client accounts in 2017.

The actual scope of the violations came to light after subsequent investigations by Danish and Estonian regulators. This was followed by the resignation of the bank’s CEO and involvement of multiple jurisdictions, including the United States and the United Kingdom, who proceeded to launch formal probes to determine the extent of the misconduct and who was accountable. The revelations unsurprisingly resulted in a sharp decline in Danske Bank. The bank was left with a sharp decline in the reputation, financial penalties and si-gnificant market value losses.

Timeline of Key Events

Over a period spanning eight years between 2007 and 2015 where the transactions processed totaling $230 billion can be referred as the starting point of the incident. It is followed by the whistleblower report triggering investigations in 2017, the resignation of CEO and the investigations expanding to international scope in 2018 and finally Estonian branch inevitably shutting down operations in 2019. Today, legal proceedings and ensuing penalties still continue.

Key Compliance Failures Behind the Scandal

So far, we have only briefly touched upon the compliance failures behind this scandal. Since, it is serves as a notable example of how multiple compliance failures may lead up to an International crisis, it would be wise to elaborate the failures behind this scandal.

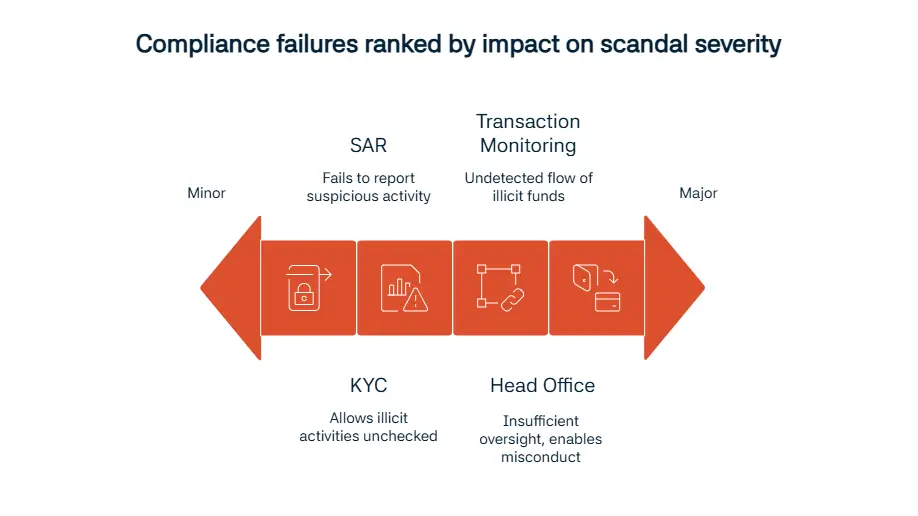

Know Your Customer (KYC): First of all, poor Know Your Customer (KYC) certainly didn’t help the Estonian branch. A significant number of non-resident client accounts were accepted and the weak KYC processes, as well as risk assessment failures, created a gateway for illicit activities to occur unchecked.

Suspicious Activity Reporting (SAR): Just like the KYC procedures, ineffective Suspicious Activity Reporting (SAR) were inadequate as well, both in quantity and timeliness.

Transaction Monitoring Systems: Another shortcoming was the weak transaction monitoring systems of the bank which resulted in the vast sums of money, which can always be potentially linked to money laundering or other criminal activities, to flow through the system undetected. In addition to these compliance faults, the disconnection between the Copenhagen head office and the Estonian branch certainly didn’t help avoiding a situation like this. The head office couldn’t provide sufficient oversight, auditing and accountability measure, which resulted in local compliance lapses and unaddressed potential misconduct for extended periods of time.

Consequences for Danske Bank

Danske Bank went through several immediate and long-lasting repercussions. It goes without saying that the Estonian branch was forced to shut down operations, thus leaving a significant gap in the regional network. Unfortunately, the damage wasn’t only done to the Estonian branch. Danske Bank’s market value plummeted and key executives were compel-led to resign. Furthermore, the U.S. Department of Justice, European authorities and various financial institutions led several investigations and the bank faced further regulatory fines and legal liabilities but on the bright side, the scandal served as a catalyst for broader AML reforms within the European Union.

Why This Case Was a Turning Point for AML in Europe?

It’s because this scandal acted as a wake-up call for the European Commission and the commission subsequently proceeded to propose the creation of a centralized anti-money laundering (AML) regulatory body called AMLA.

In addition to the AMLA, financial transaction monitoring systems have shifted to empha-size real-time oversight to enable authorities to quickly detect and mitigate risks associated with transnational money laundering by leveraging advanced technology, such as AI-driven analytics.

Financial institutions are now mandated to adopt more detailed and stringent Know Your Customer (KYC) protocols that must include additional verification steps for non-resident and high-risk clients, such as detailed background checks, ongoing monitoring of transac-tional behavior, and enhanced scrutiny for politically exposed persons (PEPs).

Another thing that set off the alarm bells was that it demonstrated how urgent it was for financial institutions to adopt a more proactive compliance culture. So, the banks and other entities implemented risk-based strategies tailored to their specific operational environments. Obviously, it depends on the needs of the business but primary examples would be regular staff training, the establishment of clear internal reporting channels, and the use of advanced tools to identify and mitigate risks related to illicit activities.

How Modern Tools Prevent Cases Like Danske Bank?

Preventing another scandal of this magnitude requires adopting cutting-edge technological solutions tailored for AML compliance. Luckily, there are tools like Sanction Scanner, which are fine examples of how technology can be used to empower financial institutions to detect and mitigate financial crime risks. Let’s come to the what these technologies can deliver. Real-Time Name Screening, Automated Transaction Monitoring and Comprehensive Risk Assessments serve as good examples that incorporate competent algorithms and AI models.

FAQ's Blog Post

What is the Danske Bank money laundering scandal?

Investigations revealed that approximately €200 billion in potentially suspicious funds were moved through non-resident accounts in Danske Bank's Estonian branch over eight years.

The scandal involved Danske Bank employees, Estonian regulators, foreign shell companies, and clients from Russia, Azerbaijan, Moldova, and other high-risk jurisdictions. Several top executives, including the former CEO Thomas Borgen, resigned or faced charges.

Danske Bank’s Estonian branch was the central point for processing suspicious cross-border transactions. Estonia's relatively lax AML enforcement at the time enabled these transactions to go undetected for years.

Danske Bank faced multiple investigations by EU and US authorities. It was forced to shut down operations in Estonia, paid hundreds of millions in fines, and saw a massive reputational decline, including criminal charges filed in Denmark and other jurisdictions.

The case exposed systemic failures in AML controls, due diligence, and cross-border supervision, prompting regulators worldwide to tighten oversight, especially regarding non-resident accounts and correspondent banking.

Yes. In December 2022, Danske Bank agreed to forfeit $2 billion as part of a global settlement with the U.S. Department of Justice and the SEC for defrauding U.S. banks and violating AML laws.