The cryptocurrency industry in North America continues to grow, with Canada and the United States (U.S.) taking the initiative. Both countries play critical roles in shaping the global crypto market, but their approaches to regulation differ significantly. While the U.S. has often been criticized for regulatory uncertainty, Canada is widely seen as a pioneer, offering clear rules and fostering innovation.

Understanding the intricacies of their regulatory frameworks helps to analyze how each nation deals with the complexities of cryptocurrency oversight.

The Rapid Crypto Development in the U.S.

The United States emerged as a hub for cryptocurrency innovation, but its regulatory framework needs to be more cohesive and consistent. Federal agencies and state governments often take differing approaches, creating challenges for businesses dealing with the regulations.

Role of the SEC and CFTC

Two major regulators, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), oversee the U.S. crypto market.

- The SEC primarily treats cryptocurrencies as securities. It has launched enforcement actions against companies that fail to register their offerings as securities, particularly targeting Initial Coin Offerings (ICOs).

- The CFTC takes a different stance, viewing cryptocurrencies like Bitcoin and Ethereum as commodities. It regulates derivatives and futures contracts related to these digital assets.

This dual regulatory system often leads to confusion, with businesses caught between the question of how crypto assets should be treated.

Decisions on Bitcoin and Ethereum Spot ETFs

A major point of argument in U.S. crypto regulations has been the approval of spot exchange-traded funds (ETFs) for Bitcoin and Ethereum. While the SEC has approved Bitcoin futures ETFs, it has repeatedly rejected applications for spot ETFs. This was done to combat concerns over market manipulation. These delays have frustrated investors and highlighted the SEC's cautious approach.

By comparison, Canada approved its first Bitcoin ETF in 2021, providing investors with greater access to regulated crypto investment products. This issues the U.S.'s hesitance to fully embrace retail crypto innovations.

Debate on Crypto Asset Compliance

Compliance with anti-money laundering (AML) and know your customer (KYC) regulations remains a top priority for U.S. authorities. The Financial Crimes Enforcement Network (FinCEN) has called for stricter oversight of decentralized finance (DeFi) platforms, arguing that their lack of robust compliance measures paves the way for illicit activities like money laundering and terrorism financing. This focus on compliance highlights the U.S.'s commitment to combating financial crime in the crypto industry.

Canada’s Approach to Crypto Regulation

Canada has taken a more structured and proactive approach to cryptocurrency regulation. By introducing clear guidelines for crypto businesses, the country has fostered a more predictable and innovation-friendly environment.

Early Adoption of Bitcoin ETFs

Canada made history in February 2021 when it became the first country to approve a Bitcoin ETF. This move provided retail investors with a regulated means to gain exposure to cryptocurrencies, boosting market confidence and influencing other nations by taking the initiative. The success of these ETFs has demonstrated the viability of crypto investment products under a regulated framework, contrasting sharply with the U.S.'s reluctance to approve similar offerings.

Requirements for Crypto Trading Platforms

In Canada, cryptocurrency trading platforms are required to register as money services businesses (MSBs) under the oversight of the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This registration involves:

- Implementing comprehensive AML and KYC procedures to verify user identities.

- Monitoring and reporting suspicious transactions to authorities.

- Ensuring compliance with stringent record-keeping and reporting obligations.

These requirements aim to enhance transparency and reduce the risks associated with financial crimes in the crypto market.

FINTRAC Mandates for Crypto Investment Firms

Crypto investment firms in Canada are also subject to FINTRAC's mandates. They must establish robust compliance programs that include ongoing monitoring of transactions and reporting high-value activities. This approach ensures that firms meet national and international AML standards, fostering trust and accountability within the industry.

Key Differences in Crypto Regulation Between Canada and the U.S.

Although Canada and the U.S. share similar goals in regulating cryptocurrencies, their approaches reveal notable differences that shape the industry's trajectory in each country.

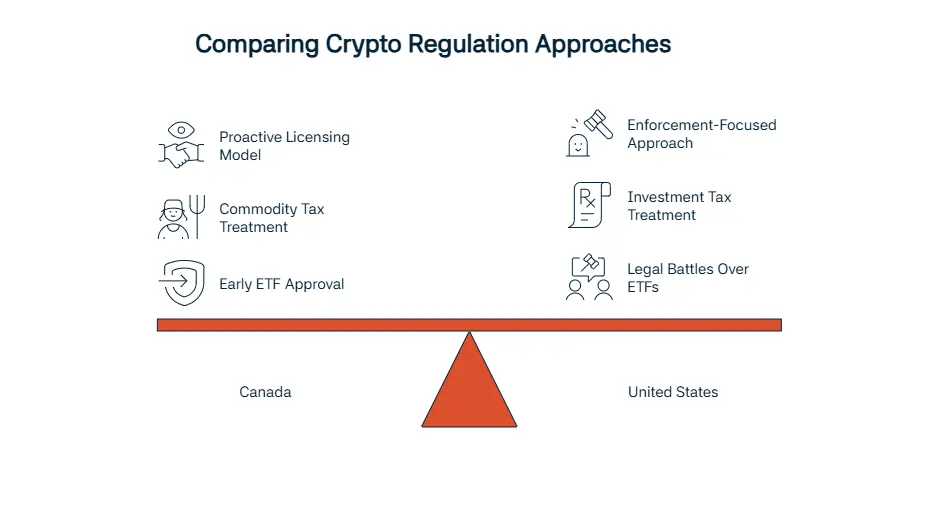

Regulatory Frameworks: Proactive Licensing (Canada) vs. Enforcement (the U.S.)

Canada adopts a proactive licensing model, ensuring that crypto businesses operate transparently. By contrast, the U.S. often relies on enforcement actions to address non-compliance, creating a reactive and sometimes unpredictable regulatory environment.

- In the U.S., the SEC's ongoing lawsuits against major crypto exchanges reflect its focus on enforcement rather than preemptive oversight.

- In Canada, regulators work closely with crypto businesses to ensure compliance, reducing the likelihood of disputed enforcement actions.

Taxation of Cryptocurrencies: Commodities (Canada) vs. Investments (the U.S.)

The tax treatment of cryptocurrencies differs significantly between the two nations:

In Canada, cryptocurrencies are classified as commodities. Transactions are subject to capital gains tax, and businesses accepting crypto must report it as income.

In the U.S., cryptocurrencies are treated as property. This means that even small transactions trigger capital gains tax, complicating their use as a medium of exchange.

Approach to Crypto ETFs: Canada’s Pioneering Role vs. U.S. Legal Battles

Canada's early approval of Bitcoin ETFs reflects its willingness to embrace innovative financial products. On the other hand, the U.S. continues to deal with legal battles over spot ETFs, with the SEC expressing concerns over market manipulation. This regulatory hesitation has hindered the growth of U.S. crypto investment products compared to Canada's thriving ETF market.

Future of Crypto Regulations in Canada and the U.S.

Prediction of Regulations in Canada

Canada is expected to maintain its proactive approach to crypto regulation, with potential developments including:

- Increased oversight of DeFi platforms to address emerging AML challenges.

- Broader integration of blockchain analytics tools to monitor transactions.

- Enhanced collaboration between regulators and crypto firms to ensure compliance and market integrity.

Updates on the U.S. Regulatory Frameworks

In the U.S., the future of crypto regulation will likely be shaped by:

- New legislative proposals aimed at creating a unified regulatory framework.

- Greater clarity on the roles of the SEC and CFTC in overseeing crypto markets.

- Potential approval of Bitcoin spot ETFs, signaling a shift towards greater acceptance of crypto investment products.

Cryptocurrency Monitoring by Sanction Scanner

Dealing with cryptocurrency regulations requires robust compliance solutions. Sanction Scanner provides top-notch tools to help crypto businesses meet their obligations effectively, with key features such as:

- Real-Time Screening: Continuously monitor transactions against updated sanction and politically exposed person (PEP) lists to ensure compliance with global AML standards.

- Blockchain Analytics: Detect and trace suspicious activities across multiple blockchains, minimizing exposure to financial crime risks.

- Customizable Risk Assessment Tools: Align risk assessments with jurisdictional requirements, enhancing operational efficiency and reducing compliance burdens.

To adapt to regulatory changes, mitigate risks, and build trust in the competitive crypto market, contact us or request a demo today.