What is the meaning of Enhanced Due Diligence (EDD), and why is it critical for financial institutions today? How does EDD differ from standard CDD? With over $10 billion in fines for AML non-compliance in 2023, understanding these concepts is essential.

EDD is not just a regulatory checkbox—it's a frontline defense in the war against financial crime. With criminal networks growing more sophisticated, regulators have responded by tightening the screws, demanding more from banks and businesses to ensure they know exactly who they're dealing with.

What does EDD mean for your organization’s ability to navigate regulatory pressures and protect against financial crime? This guide explores the meaning of EDD, its application, and the strategies you need to stay ahead. Ready to elevate your compliance practices? Let’s get started.

What Does EDD Mean?

EDD means "Enhanced Due Diligence".

What is Enhanced Due Diligence (EDD)?

Enhanced Due Diligence (EDD) is an advanced risk assessment process designed to scrutinize high-risk customers and significant financial transactions. Unlike standard Customer Due Diligence (CDD), which verifies customer identities and assesses general risk, EDD involves more detailed procedures to identify and mitigate potential financial crimes, such as money laundering and terrorist financing. By thoroughly investigating suspicious transactions and high-risk profiles, EDD enhances identity assurance and reduces the risk of financial crime and regulatory breaches.

What is Enhanced Due Diligence Required For?

Companies are required to use Enhanced Due Diligence procedures if they are doing business with the following organizations or individuals:

- Any business in a country on the High-Risk Third Countries list

- Politically Exposed Persons (PEPs) or their close circles, such as family members

- Companies in sectors with a higher risk of money laundering, such as gambling

- Shell corporations

- Ultimate Beneficial Owners

- Companies that funded terrorist activities and blacklisted

- Private and correspondent banking

Best Practices for EDD as Recommended by FATF

To effectively implement EDD, the FATF suggests several practical steps, including:

- Gathering additional identification information from a broader array of sources.

- Conducting more thorough searches.

- Verifying the origins of funds to ensure they are not derived from criminal activities.

- Obtaining more detailed information from customers regarding the purpose and intended nature of the business relationship.

- Commissioning intelligence reports on customers or their beneficial owners.

Who are High-Risk Customers and Why Do They Require EDD?

High-risk customers are individuals or entities that present increased risks of financial crime or regulatory breaches. They include:

- Politically Exposed Persons (PEPs)

- Customers with complex ownership structures

- Non-residential customers

- Customers with links to high-risk countries

- Customers with dubious reputations

- Customers with unusual account activity

- Customers with links to high-risk countries

- Customers associated with industries deemed as high-risk

EDD Requirements for High-Risk Customers

EDD involves collecting detailed information to manage the risks associated with high-risk customers. Key requirements include:

- Comprehensive Business Information: Detailed data on ownership, key stakeholders, and business activities.

- Beneficial Ownership: Identifying the ultimate owners of an entity to uncover concealed risks.

- Source of Funds: Verifying the legitimacy of a customer’s wealth and funds.

- Enhanced Identity Verification: More robust verification methods, including biometric checks and additional documentation.

- Risk Indicators: Evaluating factors such as geographic location, industry, transaction behavior, and past regulatory issues.

When is EDD Required in Financial Transactions?

- EDD is needed for large or unusual transactions that may signal financial crimes.

- Transactions involving PEPs and their close associates require EDD due to corruption risks.

- EDD is required for transactions involving individuals or entities from countries with high-risk designations.

- Transactions that deviate from normal patterns must be scrutinized through EDD.

- EDD is necessary for transactions involving entities with opaque or multi-layered ownership.

- Transactions in industries like gambling or luxury goods require enhanced due diligence.

- EDD is required for transactions with individuals or entities blacklisted by authorities.

CDD vs EDD: What's the Difference Between EDD and CDD?

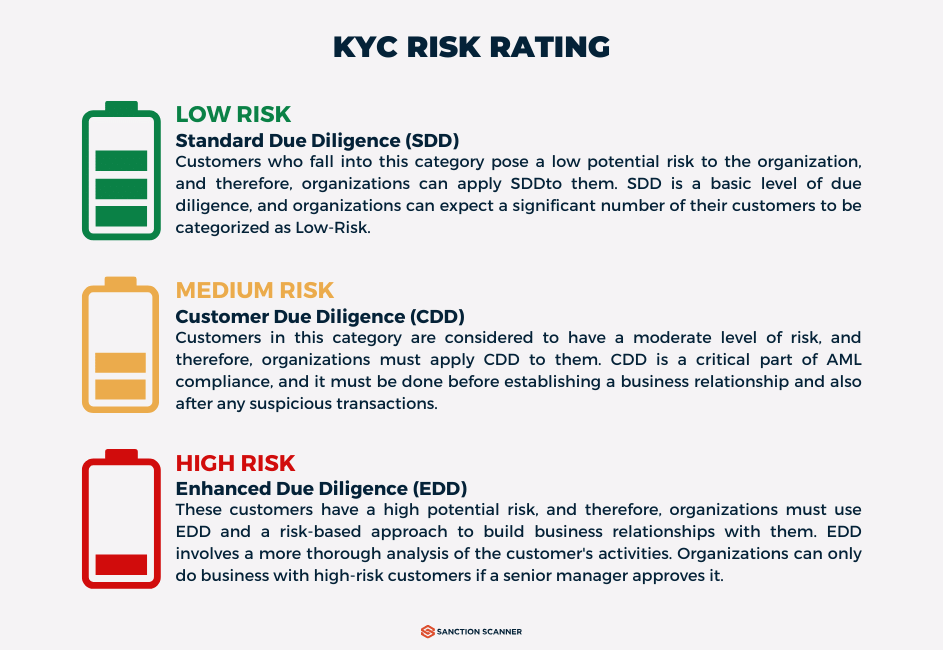

CDD and EDD are both forms of KYC procedures. The difference between EDD and CDD is rooted in their distinct roles within KYC procedures. EDD goes beyond CDD, which focuses on confirming a consumer's identity through data comparison and necessary checks like documents and biometrics during account opening. Because it is designed to handle high-risk clients and large-scale financial transactions, it requires more thorough investigations than are typically required for KYC procedures.

If a customer is deemed low risk, they may be subject to simplified customer due diligence, in which the sole obligation is to identify the customer but not verify their identity. It is necessary to differentiate client due diligence in this context. Client due diligence entails identifying the consumer by comparing given data to databases or solutions such as document and biometric checks. This is often required during account opening and to permit high-risk transactions.

It is required as an extra form of a step-up KYC process for high-risk consumers. A consumer may be considered high-risk due to location, occupation, or political exposure. Therefore, the prerequisites for completing EDD differ according to where you live.

The requirements for completing EDD measures vary depending on local regulations. Still, it is typically required when entering into a business relationship with a politically exposed person (PEP) when the transaction involves a person from a high-risk or sanctioned country or in any other situation with an increased risk of money laundering.

Why is Enhanced Due Diligence So Important?

Controlling these people's transactions is important because of state-based security concerns. The Patriot Act of 2001 introduced it as a mandatory procedure with the help of the Bank Secrecy Act.

Private financial institutions, offshore banks, and correspondent accounts were compelled to comply with customer and client due diligence rules and regulations under the Patriot Act. These rules and regulations are regarded as vital since they need a substantial quantity of proof and precise information.

The EDD process must be well recorded, particularly at the account opening and client risk assessment stages. As a result, authorities can access data managed by experienced data analysts. The papers derived from this data analysis report suspicious activity, anti-money laundering regulations, and other irregular transactions.

Enhance Due Diligence in Banking

EDD in banking is a critical component of the KYC compliance procedure. It entails gathering information to authenticate clients' identities and quantify the amount of money laundering risk each customer poses. As a result, the client requested significantly more details during the EDD process than during the CDD process since this information may be utilized to minimize the associated risks.

In general, the Financial Action Task Force (FATF) recommends a risk-based approach to due diligence in banking, where "the amount and type of information obtained, as well as the extent to which this information is verified, must be increased where the risk associated with the business relationship is higher."

FATF suggests the following practical initiatives toward EDD in banking:

- Obtaining more identifying information from a more extensive range of reliable and independent sources

- Conducting additional searches (such as verifiable adverse media searches)

- Ordering an intelligence report on the customer or beneficial owner to better understand if the customer or beneficial owner is involved in illegal activities.

- Verifying the source of cash or wealth in a commercial partnership

- Obtaining more information from the consumer regarding the purpose and nature of the business connection

- The FATF then suggests that the bank adopt a risk-based monitoring strategy to detect suspicious behavior or changes in the risk profile of that customer.

How to Execute Enhanced Due Diligence?

EDD is a complicated procedure but may be broken down into simpler tasks. Here's a sample enhanced due diligence checklist to get you started:

1. Using A Risk-Based Approach

It will help you detect and investigate high-risk customers. Accurately evaluating the customer's risk level is essential for your AML compliance, as they might launder money or commit financial crimes through your business. In addition, companies that don't have vital AML compliance programs might face penalties from authorities.

2. Finding Additional Credentials

Create a checklist for your AML BSL policies for high-risk customers. This advanced due diligence checklist provides all the necessary details about your customer.

3. Analyzing the Origin and Ultimate Useful Ownership (UBO) of Funds

Companies need to understand the origin and legitimacy of the customer's wealth. They need to verify that the value of all of their customer's non-financial and financial assets is related to their real assets. Inconsistencies between earnings, wealth source, and net worth should be detected and investigated. Subsidiaries and shareholders of businesses should be checked in determining the Ultimate Useful Ownership (UBO) of an organization/company.

4. Tracking Ongoing Transactions

If a customer has a transaction history, it should be checked. The transaction details, such as purpose and nature, should be investigated based on their processing times and interested parties. Companies should ensure that the accuracy of this step meets the expected threshold.

5. Adverse Media and Negative Control

Companies should analyze relevant press articles to create a complete profile of their customers' reputations. Negative results mean the individual or organization is too risky to do business with.

6. Visit On-Site

On-site visits to physical addresses are essential for all legal entities. Documents that cannot be digitally gotten might be physically verified. In addition, the individual or organization might be risky to do business with if the physical address does not match the official address on documents.

7. Writing a Report Paper to Investigate

Businesses should understand the basic parameters to implement a risk-based approach. Then, companies can create risk factors based on their industry. For example, corporations might regularly scan their customers and write a report paper on their activities using AML compliance software.

8. Developing an Ongoing Risk-Based Monitoring Strategy

Continuous monitoring of high-risk customers takes time. Therefore, it is best to use a risk-based monitoring strategy. For example, businesses can use software to alarm them based on their customers' profiles or when they make any suspicious activity.

How Can Sanction Scanner Help?

Sanction Scanner, a leading provider of AML/CFT compliance solutions, offers a powerful technology-driven approach to EDD that can greatly benefit firms and customers' or clients' due diligence support.

By leveraging its advanced risk intelligence algorithms and comprehensive data sources, Sanction Scanner can help firms quickly identify high-risk customers and transactions that require additional scrutiny. This streamlines the EDD measures, improves the accuracy of risk assessments, and reduces the likelihood of potential compliance violations.

Sanction Scanner also provides various other AML/CFT compliance tools, such as screening against global sanctions lists and politically exposed persons (PEPs) lists, transaction monitoring, and suspicious activity reporting. These tools work in tandem with their EDD solution to create a comprehensive compliance framework that can adapt to changing risk profiles and regulatory requirements.