The travel industry is essential to the global economy, connecting people, cultural exchange, and economic activity. The sector generates billions in revenue annually, with millions of daily transactions. However, the industry's cross-border nature, reliance on digital transactions, and consistent flow of money make it a known target for financial crimes such as money laundering, fraud, and identity theft.

Financial crime risks pose significant challenges to businesses within the travel ecosystem, which makes anti-money laundering (AML) compliance crucial. AML measures help businesses protect their financial integrity, maintain their reputation, and comply with global regulatory standards.

Common Financial Crime Risks in the Travel Industry

The travel industry is particularly susceptible to various financial crimes due to its reliance on financial transactions and its complex, cross-border nature. These risks require effective strategies to mitigate the potential harm they can cause. Here are some of the most common financial crime risks related to the travel industry:

Rental Scams

Rental scams are among the most common types of fraud in the travel industry. Fraudsters often take advantage of the growing demand for short-term rentals by posting fake listings for vacation homes, apartments, or other accommodations. They create fake property listings to trick unsuspecting customers into paying upfront deposits for rentals that do not exist.

Fraudsters sometimes impersonate landlords and provide forged documents to make their listings appear legitimate. The ease of creating fraudulent listings online and the anonymity that digital platforms offer make it challenging to detect and prevent these scams.

Stolen Payment Methods

The travel sector is also vulnerable to fraud involving stolen payment methods. Criminals often use stolen credit card information to make high-value transactions such as booking flights, accommodations, or renting vehicles. These fraudulent activities can lead to financial losses for travel agencies and service providers and may also result in chargebacks, which disrupt normal business operations.

Given the high volume of legitimate bookings, it can be difficult to detect stolen payment methods in real-time, making it critical for businesses to implement systems that can identify suspicious transactions.

False Identities

Another significant risk in the travel industry is the use of false identities. Criminals may use stolen or fabricated personal details to book services or launder money. They can create accounts on travel platforms using fake identification documents or stolen personal information, which allows them to bypass detection by traditional monitoring systems.

Without adequate identity verification measures in place, travel agencies could unknowingly facilitate financial crimes, putting them at risk of non-compliance with AML regulations and potentially damaging their reputation.

Core AML Requirements for Travel Agencies

AML regulations are designed to reduce the risks associated with financial crimes and ensure businesses adhere to anti-money laundering standards. For travel agencies, these requirements involve implementing proactive strategies to detect and prevent illegal activities and ensure compliance with global regulations.

The Role of Identity Verification to Fulfill AML Regulations

Identity verification plays a central role in AML compliance for the travel industry. To comply with regulations like Know Your Customer (KYC) and AML, travel agencies must verify the identity of their customers during transactions. Identity verification ensures businesses do not inadvertently engage with criminals or facilitate illicit activities. By confirming a customer’s identity before processing bookings or financial transactions, agencies can reduce the likelihood of fraudulent activities, safeguard their financial operations, and protect their reputation.

Effective identity verification also enhances transparency and customer trust. When customers know that a business is serious about security, they are more likely to engage with the agency and feel comfortable providing their personal information. Additionally, businesses that comply with AML regulations can avoid costly penalties and legal consequences that could arise from non-compliance.

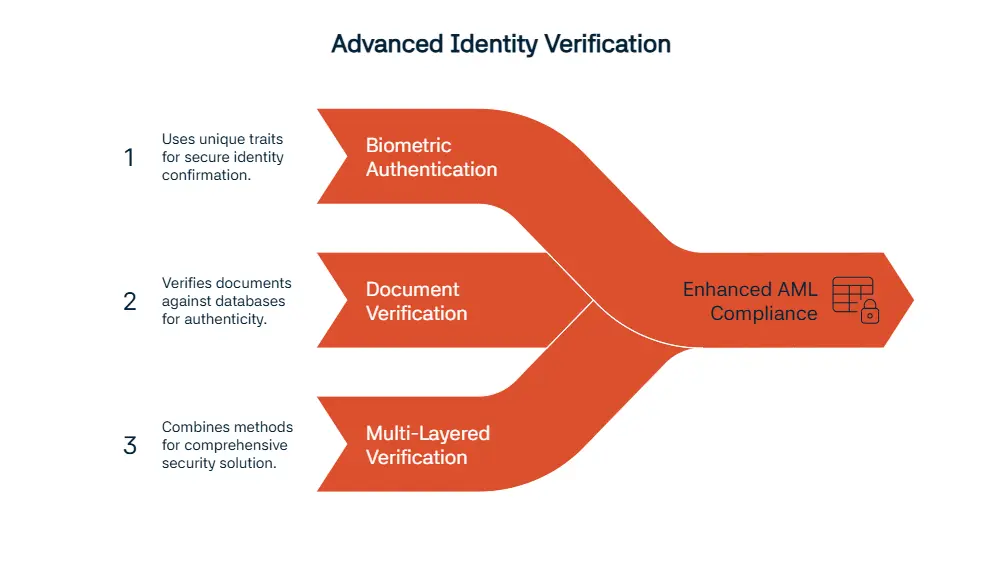

Advanced Identity Verification Methods for AML Compliance

As the travel industry becomes more sophisticated, so do the methods criminals use to exploit vulnerabilities. To combat these threats, travel agencies increasingly use advanced identity verification technologies to meet AML compliance standards.

- Biometric Authentication: Biometric authentication uses unique biological traits, such as fingerprints, facial recognition, or iris scans, to confirm an individual's identity. By using biometrics, travel agencies can ensure that only legitimate clients can access their services. Moreover, biometrics offer a high level of security that is difficult to replicate, making it harder for criminals to bypass verification systems using stolen or forged documents.

Biometric systems can also help prevent identity fraud by detecting discrepancies or attempts to impersonate others. This technology provides a faster and more accurate means of verifying identities, reducing the time spent on manual checks and enhancing the overall customer experience. - Document Verification: Document verification is another key component of AML compliance in the travel industry. Travel agencies can use automated tools to scan and verify official identification documents, such as passports, driver’s licenses, and national IDs. These tools can compare documents against global databases to check for authenticity, ensuring that customers provide valid identification before booking services.

Automated document verification also reduces the risk of human error and enhances the speed of the verification process, enabling agencies to handle a large volume of transactions while maintaining compliance with AML regulations. This technology is particularly valuable in detecting forged documents or inconsistencies in customer information that may indicate fraudulent activity. - Multi-Layered Verification: A multi-layered verification approach combines several verification methods to provide a comprehensive security solution. For instance, agencies may use biometric authentication alongside document verification and real-time database checks.

By integrating multiple security layers, travel agencies can reduce the risk of fraud and ensure that each transaction undergoes a thorough validation process. This approach strengthens the overall security framework and improves the ability to detect suspicious activities that may otherwise go unnoticed. ![]()

Overcoming Challenges in Implementing Identity Verification

Despite the benefits, implementing identity verification technologies in the travel industry comes with several challenges. Travel agencies must balance security with customer convenience, address privacy concerns, and ensure that new systems integrate seamlessly with existing platforms.

- Balancing Security with Customer Convenience: Robust verification measures are essential for detecting and preventing financial crimes. However, overly complex or time-consuming verification processes can frustrate customers. Travel agencies must integrate user-friendly technologies like biometric scanning or one-click verification to streamline the process, ensuring compliance without longing the customer journey.

- Addressing Privacy Concerns: The collection and storage of customer data raise significant privacy concerns. Travel businesses must handle customer information responsibly by encrypting sensitive data, ensuring secure storage, and adhering to regulations like GDPR. Clear communication with customers about how their data will be used and protected is essential for maintaining trust.

- Integrating Verification Tools with Existing Platforms: Many businesses still operate on old systems that may not be compatible with new verification technologies. Choosing scalable, adaptable solutions that integrate with existing infrastructure ensures a smooth transition and minimal disruption to operations.

The Future of AML Compliance in the Travel Industry

The future of AML compliance in the travel industry will be shaped by advancements in technology and increasing regulatory collaboration. The potential breakthroughs are:

- Collaborative Efforts Between Regulators and Travel Agencies: Joint training programs, data-sharing platforms, and international cooperation will strengthen defenses against financial crime. Regulators and agencies can work together to develop standardized compliance guidelines and share information on emerging threats.

- Encouraging Innovation to Safeguard the Travel Ecosystem: Technologies like artificial intelligence (AI) and machine learning will detect suspicious patterns in financial transactions. Blockchain technology offers transparent, tamper-proof transaction records, helping the industry stay ahead of emerging threats.

Identity Verification Solutions by Sanction Scanner

Sanction Scanner offers advanced identity verification solutions, including customer risk assessment and real-time global watchlist screening. These tools help travel agencies meet AML compliance requirements, detect fraudulent activities, and safeguard their operations. To ensure the safety and success of your agency, contact us or request a demo today.