AML Solutions for Turkey

Meet your AML obligations in the Turkey with our AML solutions

TRUSTED BY OVER 800+ CLIENTS

AML Compliance in Turkey

Licensed organizations operating in Turkey are required to ensure AML compliance. These organizations are regulated and supervised by MASAK (Financial Crimes Investigation Board), the Financial Intelligence Unit of Turkey. Sanction Scanner enables organizations to meet their AML obligations and makes them ready for MASAK audits.

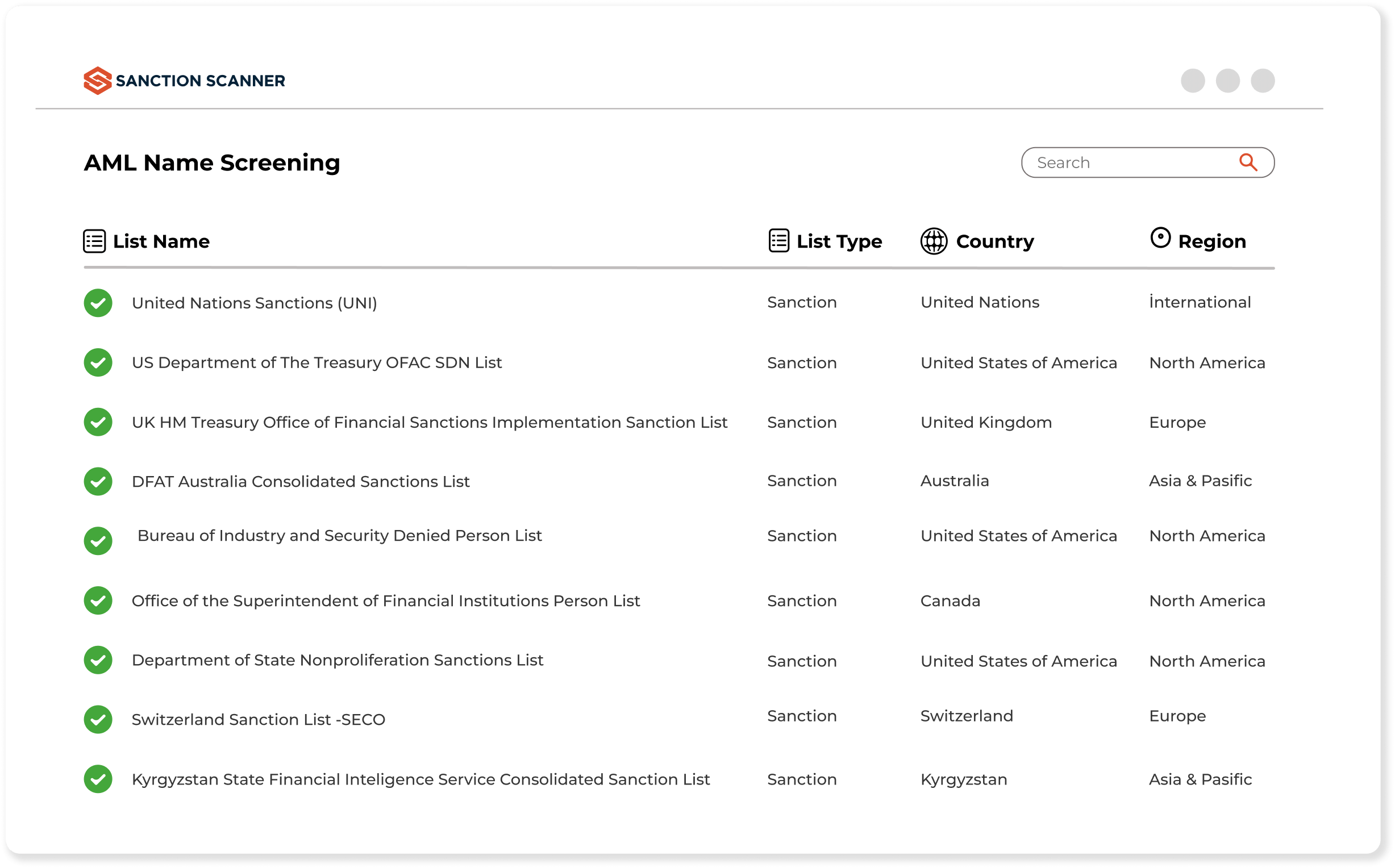

Turkey Exclusive AML & PEP Data

The comprehensive data of Sanction Scanner include important lists for Turkey such as "Turkish Terror Wanted Lists","Banned People from the Transaction Lists of Capital Markets Board of Turkey (SPK)" and “Turkish PEP Lists”.. Organizations can scan their customers in thousands of sanction, PEP and wanted lists within seconds and detect suspicious transactions with Sanction Scanner.

Real-Time Data

Current data is very important and necessary. We update our data every 15 minutes. In your control processes, you can always be protected from error risks by using up-to-date data.

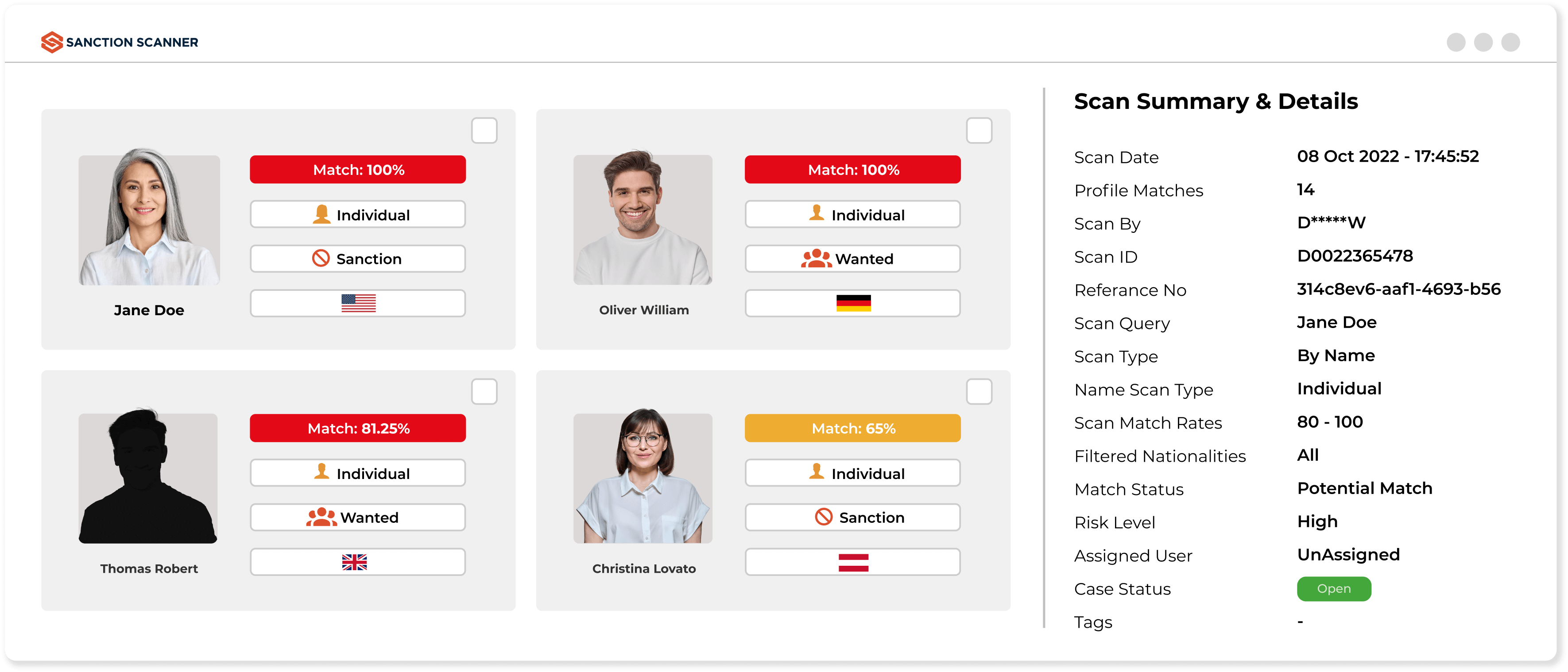

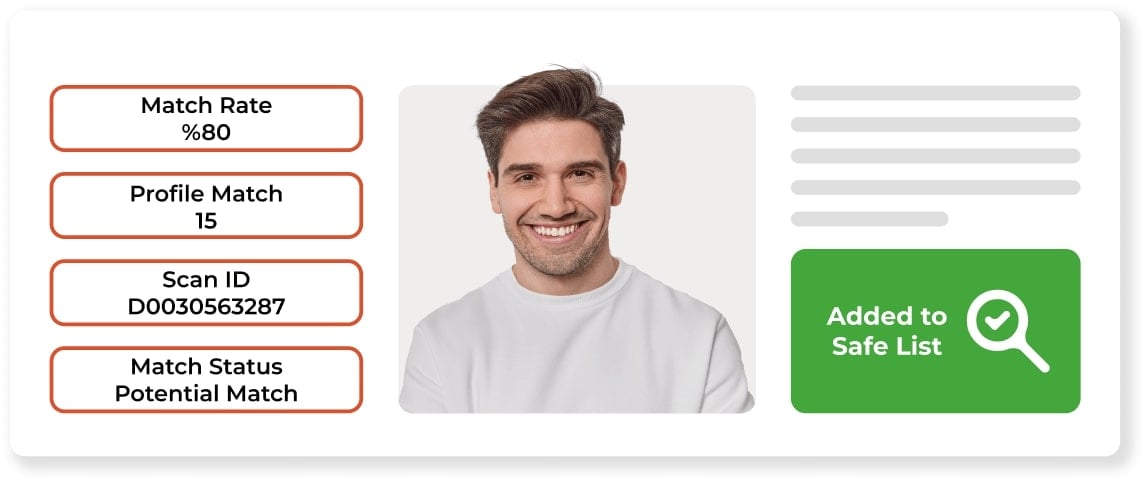

Learn MoreAI-Supported Algorithms

Special algorithms developed with artificial intelligence reduce false positives. Our AML features developed with new technology provide solutions for your AML problems.

Learn MoreGlobal AML Data Coverage

We collect all the global and local lists of more than two hundred countries. Businesses can perform all AML controls on global comprehensive data and meet AML needs.

Learn More

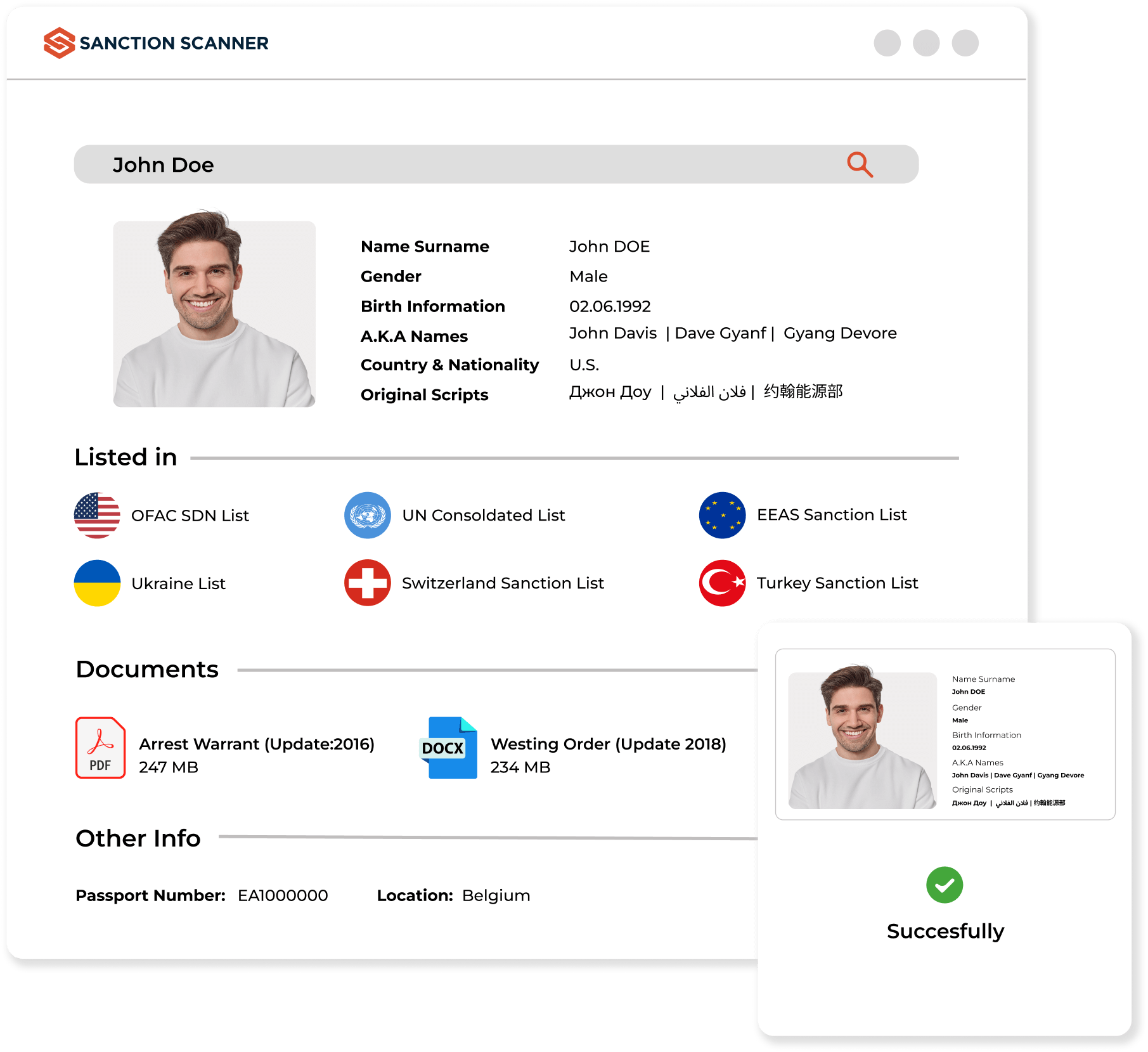

Customer Onboarding & Monitoring

Organizations under the AML obligation can automate and speed up customer onboarding & monitoring processes with the Sanction Scanner. Organizations can scan the customer in the AML and PEP data of more than two hundred countries during the customer account opening process. Sanction Scanner protects organizations from financial crime and supports AML compliance processes.

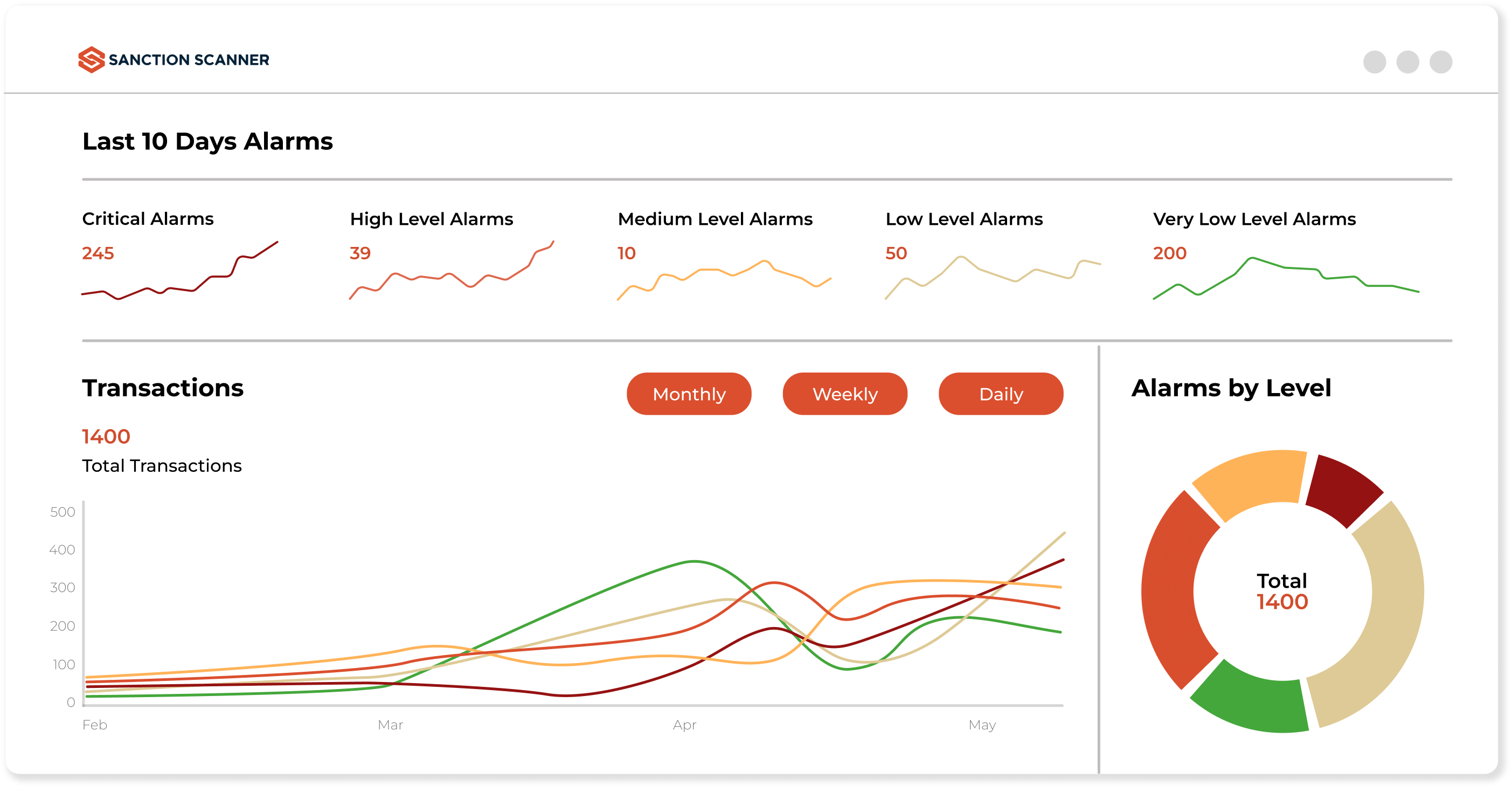

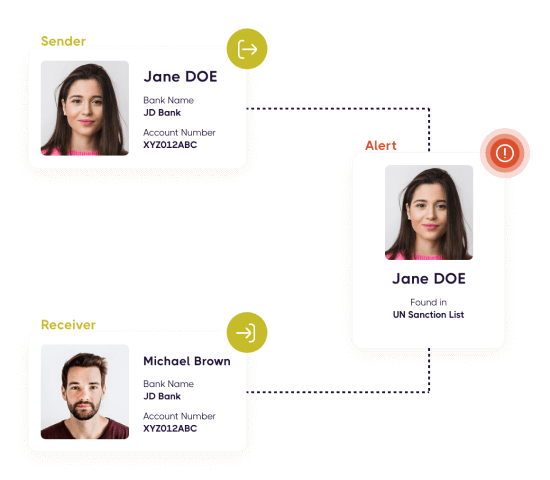

Transaction Screening

Organizations can check whether the transactions they mediate with Transaction Screening involve financial crime. Sanction Scanner checks the receiver and sender in AML data without delaying the transactions in money transfer, remittance and payment transactions. Organizations automatically control all transactions with API integration.

If the receiver or sender matches AML and PEP data, the system alarms and the process is stopped. Organizations can view screening results as reports and present them as evidence in audits by MASAK.

Organizations Under the AML Obligation in the Turkey

- Banks

- Investment Companies

- Payment Companies

- Money Transfer Companies

- E-Money Companies

- Brokerage Firms

- Cryptocurrency Exchanges

- Factoring Companies

- Asset Management Companies

- Insurance Companies

Ensure AML Compliance

with Sanction Scanner

AML Transaction Monitoring

Reduce false positives and strengthen your compliance process.

Learn MoreAdverse Media Screening

Strengthen AML Compliance With Global Comprehensive Adverse Media Data

Learn More