AML Solutions for

Challenger Banks

We help to Challenger Bank in AML compliance process with our next generation AML solutions!

TRUSTED BY OVER 800+ CLIENTS

Customer Onboarding Process for Challenger Banks

The most important features that make Challenger banks stand out from traditional banks are that they are fast and agile. Therefore, Challenger Banks aim to perform customer onboarding processes in the fastest way by meeting their AML obligations. With our AML Screening Software, Challenger Banks can implement "Customer Due Diligence" procedures in traditional customer acquisition and digital customer acquisition processes within seconds.

AML Requirements For Challenger Banks

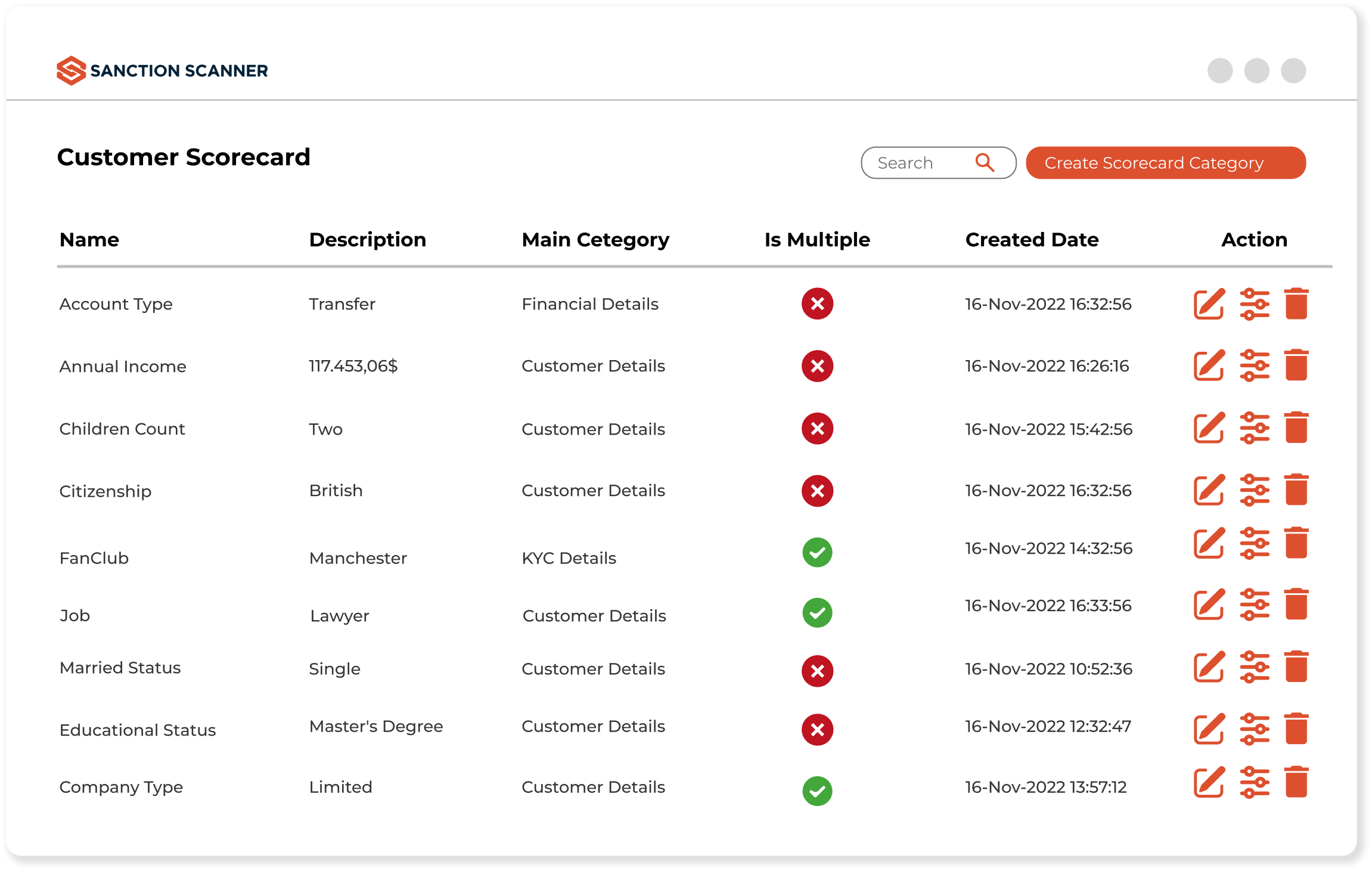

Due to the fact that Challenger banks are among the institutions at risk, they obliged to meet their AML obligations. Challenger banks are required to protect their companies from financial crimes and ensure AML and KYC compliance. Challenger banks can determine the risk level of their customers and perform a customer monitoring process according to the customer's risk level by doing our customer onboarding processes with Our AML Screening Software.

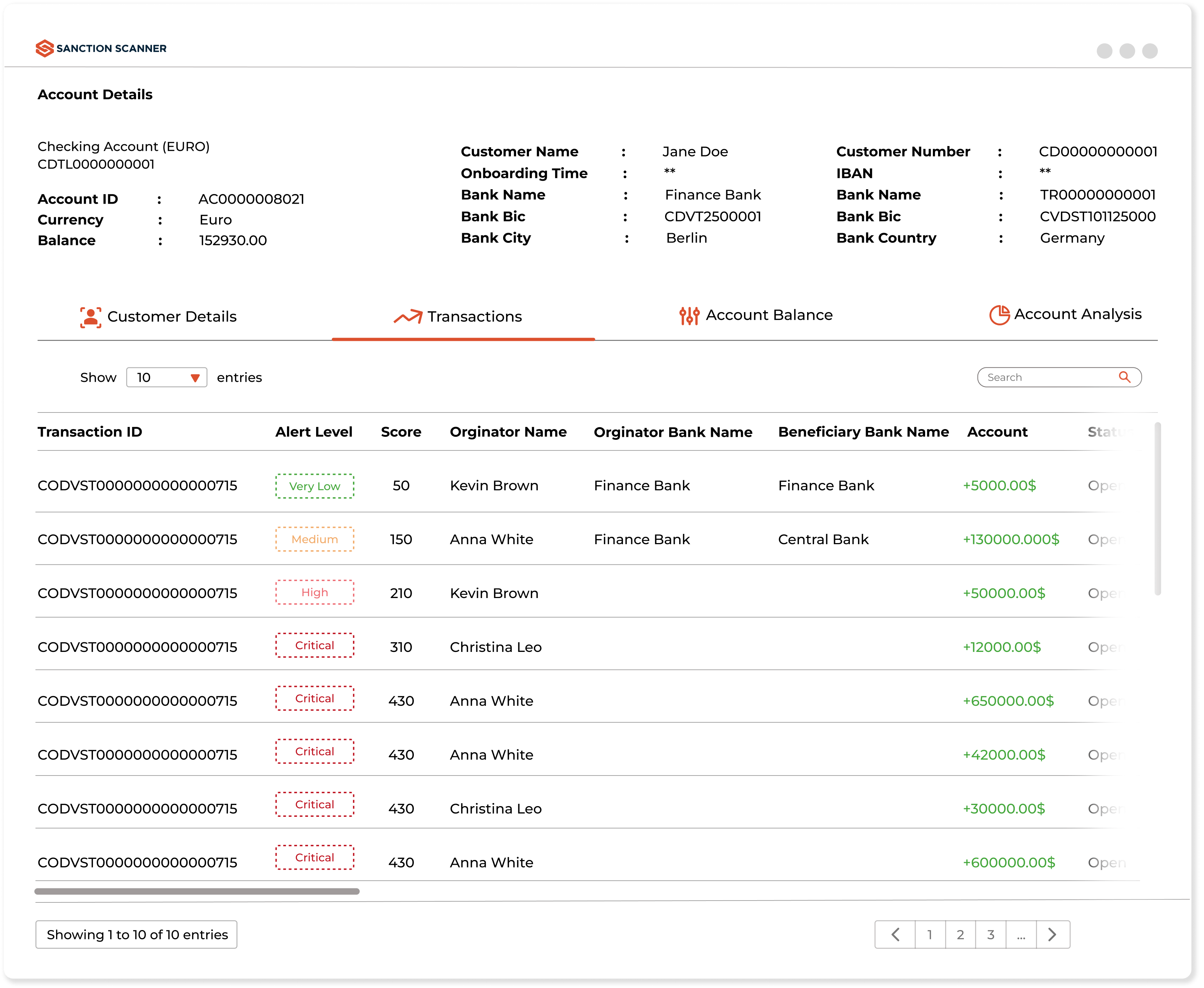

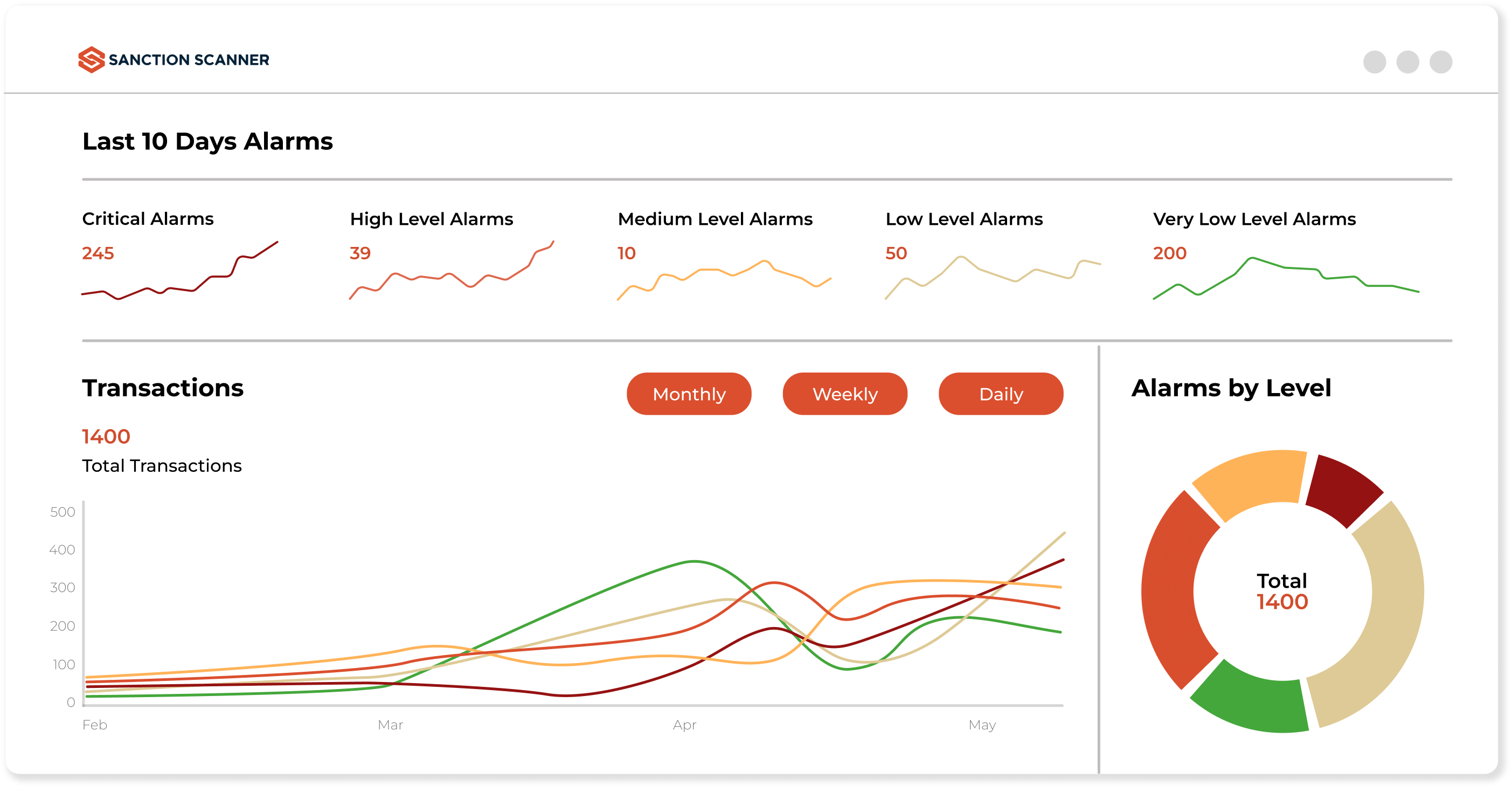

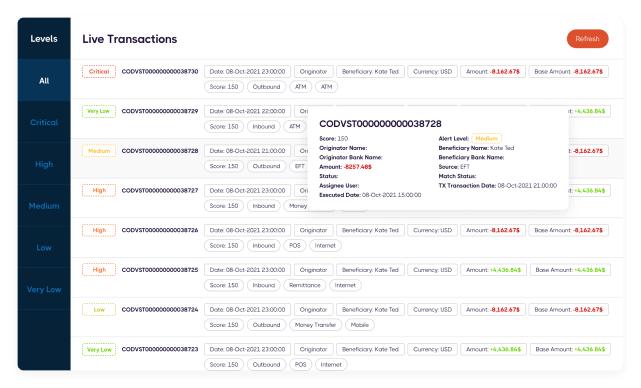

Transaction Monitoring Software for Challenger Banks

Sanction Scanner's enhanced AML Transaction Monitoring Software provides end-to-end features that enable Challenger Banks to combat money laundering and terrorist financing. Challenger Banks can automatically detect high-risk and suspicious activities with many features such as dynamic rules and scenarios, advanced sandbox test environment, real-time alarms, and risk-based scorecard. Automate your transaction monitoring and reduce false positives with enhanced tracking features.