Romance scams, prevalent in both online and offline settings, involve perpetrators faking romantic interest to exploit individuals emotionally and financially. These scams often begin with the perpetrator creating a fake persona on dating websites, social media platforms, or even in-person encounters, with the intention of establishing trust and affection. Once a bond is formed, the scammer typically devises elaborate stories to elicit sympathy or gain the victim's trust before requesting money or personal information.

Such scams can have devastating consequences, leading to financial loss, emotional distress, and even long-term psychological trauma for the victims. Understanding the intricacies of romance scams and recognizing their common tactics is essential for safeguarding oneself from falling prey to these deceitful schemes.

Common Romance Scam Examples

Romance scams manifest in various guises, exploiting the emotional vulnerabilities and desires of unsuspecting individuals seeking genuine connections. These scams encompass a range of deceptive tactics employed by fraudsters to manipulate victims into providing money, personal information, or other resources under the facade of love and affection.

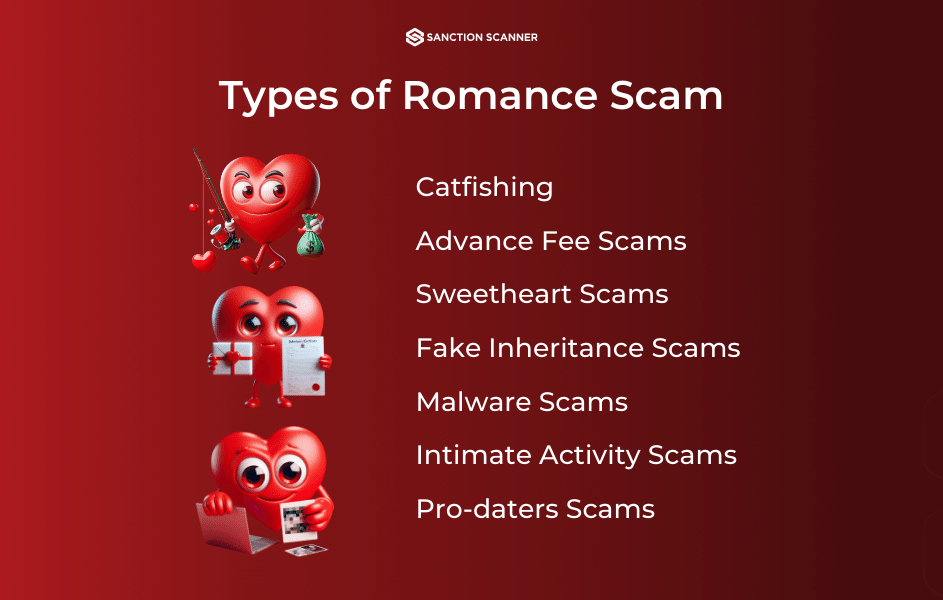

Some common types of romance scams include:

Catfishing

Fraudsters create fake profiles on dating websites or social media platforms, using stolen or fabricated photos and information to establish false identities and engage victims in online relationships. Catfishing often involves elaborate stories and manipulation to maintain the deception over an extended period.

Advance Fee Scams

Scammers develop relationships with victims and then invent fictitious reasons to request money, such as medical emergencies, travel expenses, or financial crises, often promising to repay the funds once their supposed issues are resolved. Victims may be coerced into sending money repeatedly, with the promise of a future payoff that never comes.

Sweetheart Scams

Scammers feign romantic interest in victims, gaining their trust and affection before exploiting their emotions to solicit money or financial assistance. These scams often involve building a deep emotional connection with the victim before requesting financial support, making it challenging for victims to recognize the deception.

Fake Inheritance Scams

Fraudsters claim to be beneficiaries of large inheritances, convincing victims to assist in accessing the funds by paying fees or taxes upfront. Victims are manipulated into believing they will receive a share of the inheritance once the necessary payments are made, but in reality, there is no inheritance, and the scammers disappear with the victims' money.

Malware Scams

Scammers use malicious software or links to infect victims' devices, gaining access to personal information or financial accounts. These scams often begin with seemingly innocent online interactions that lead victims to unknowingly download malware, allowing scammers to steal sensitive information or commit identity theft.

Intimate Activity Scams

Fraudsters build trust with victims through intimate conversations or exchanges, then threaten to share compromising photos or videos unless the victim pays a ransom. Victims are coerced into paying to prevent the dissemination of private information, even if no such material exists or if the scammers have no intention of deleting it.

Pro-daters Scams

Scammers establish relationships with victims under false pretenses, often claiming to be in financial distress or facing personal hardships. They manipulate victims into providing financial assistance or gifts, exploiting their compassion and desire to help those in need while offering little to no genuine emotional connection in return.

Red Flags of Romance Scams

Romance scams can be difficult to detect, as perpetrators often use sophisticated tactics to manipulate victims' emotions and trust. However, there are several red flags that individuals should be wary of when engaging in online or in-person romantic interactions. These warning signs can help potential victims recognize and avoid falling prey to fraudulent schemes.

Some common red flags in romance scams include:

Lover Even Before the First Sight

Be cautious if the individual professes intense feelings or declares love very quickly, especially if you have not met them in person.

Reluctant to Meet in Person

If the person constantly makes excuses for avoiding face-to-face meetings or delays meeting in person despite expressing strong interest, it could be a sign of deception.

Requests for Money

Beware of any requests for financial assistance, especially if they involve urgent or emergency situations, such as medical bills and travel expenses.

Inconsistencies in Stories

Pay attention to inconsistencies or discrepancies in the person's background, details about their life, or the information they share with you over time.

Avoidant of Video Calls or Personal Information

If the individual refuses to engage in video calls or provides limited personal information, it may indicate they are hiding their true identity.

Pressure or Guilt Trips

Scammers often use emotional manipulation tactics to pressure victims into complying with their demands or making them feel guilty for questioning their intentions.

Unusual Behavior or Language

Be wary of individuals who exhibit strange behavior, use poor grammar or language skills inconsistent with their claimed background, or employ overly romantic or flattering language too quickly.

Asking for Personal Information

Exercise caution if the person asks for sensitive personal information, such as your address, social security number, or banking details, especially early in the relationship.

Avoiding, Identifying, and Reporting Romance Scams

Romance scams continue to proliferate across various platforms, but there are proactive steps individuals can take to protect themselves.

- Firstly, skepticism is key. Maintaining a healthy dose of skepticism can help individuals recognize warning signs and avoid falling victim to fraudulent schemes.

- Secondly, never send money or provide personal information to someone you've only met online, especially if they start making urgent or sob stories.

- Thirdly, conduct thorough research on the person you're interacting with; verify their identity and background using available resources.

If you suspect you are being targeted by a romance scam, cease all communication immediately and report the incident to the appropriate authorities, such as the Federal Trade Commission (FTC) or the Internet Crime Complaint Center (IC3).

In-Person Romance Scams

In-person romance scams, though less common than their online counterparts, still pose a significant threat. These scams often involve individuals who establish trust through face-to-face interactions, such as at social events or through mutual acquaintances. Perpetrators may use charm and manipulation to exploit victims' emotions and solicit money or personal information. It is essential to remain cautious and vigilant, even in offline settings, and to trust your instincts if something feels off.

Online Romance Scams

Online romance scams are pervasive on dating websites, social media platforms, and online forums. Scammers create fake profiles to engage victims in romantic conversations, gradually building trust before requesting money or personal information. They may use sophisticated tactics to manipulate emotions and maintain the illusion of a genuine relationship. To avoid online romance scams, be wary of individuals who refuse to meet in person, ask for financial assistance, or exhibit inconsistent behavior or details in their stories.

Customer Risk Assessment by Sanction Scanner

Sanction Scanner, a lead developer of AML (Anti-Money Laundering) compliance software, provides a comprehensive fraud detection solution to help businesses identify and mitigate the risk of romance scams.

By leveraging innovative solutions, Sanction Scanner enables organizations to detect suspicious behavior and patterns associated with fraudulent activities. To learn more about Sanction Scanner’s risk assessment tools that empower businesses to make informed decisions and protect themselves and their customers from financial and reputational harm, contact us or request a demo today.