Turnkey Risk Solutions

Anti-Money Laundering operations are no more complicated. Fast and Safe Solutions!

Trusted by over 500 clients

We make it easy for our customers to comply with AML Regulations.

Our Products

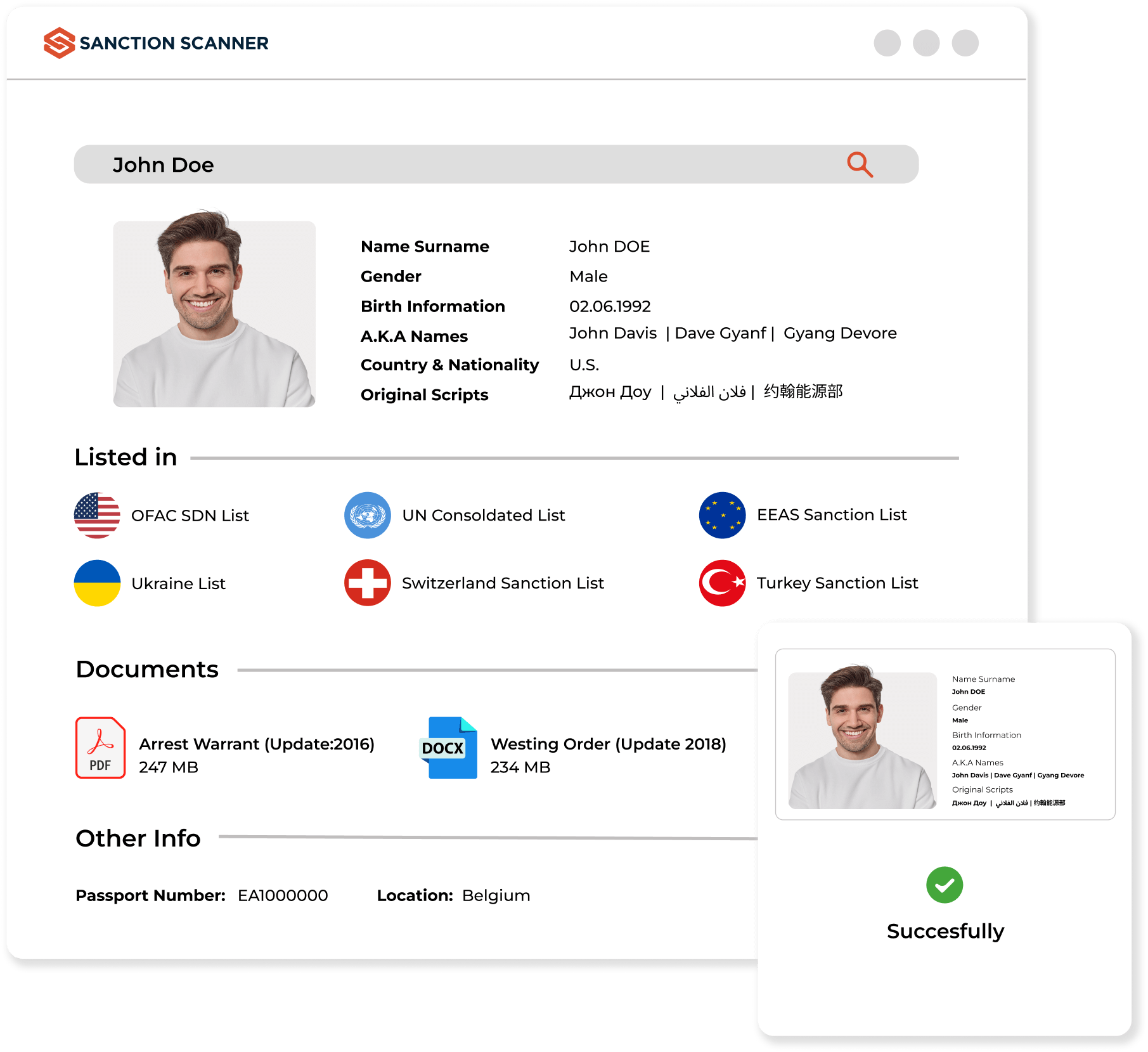

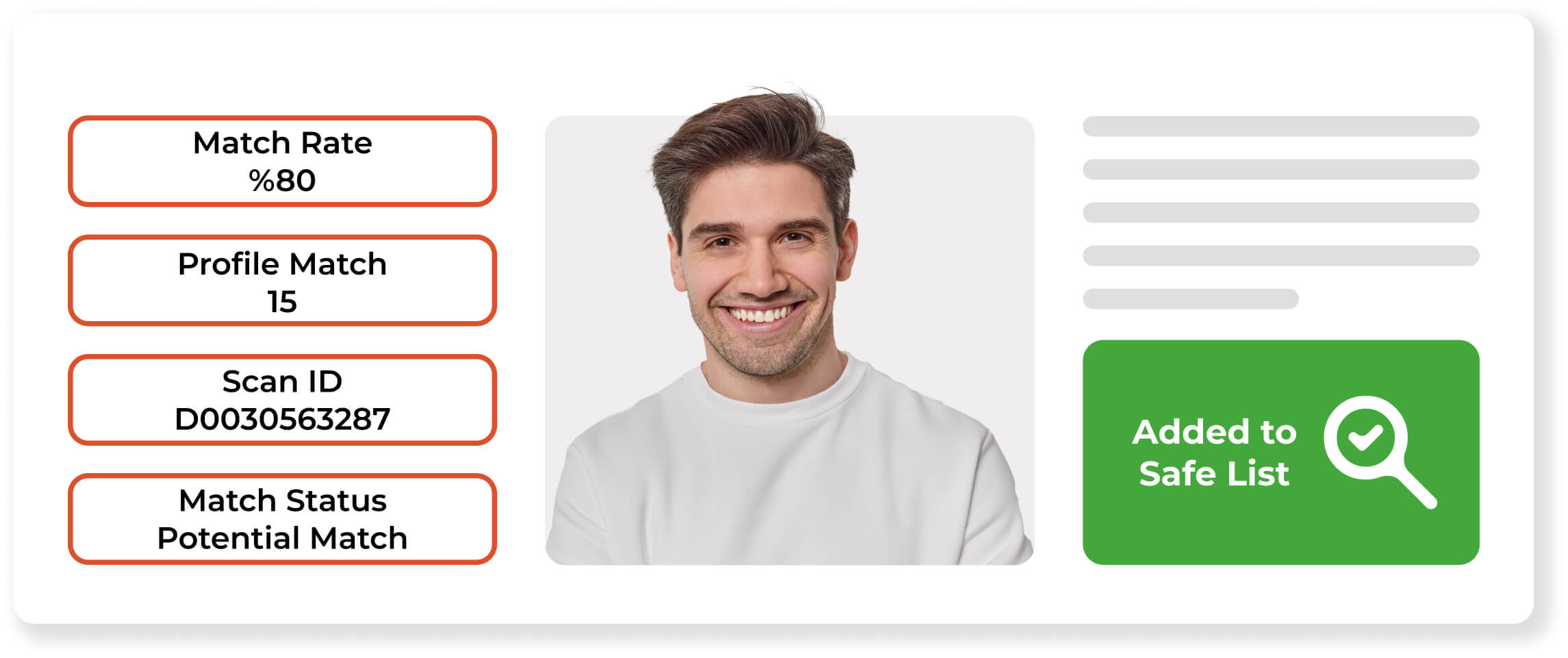

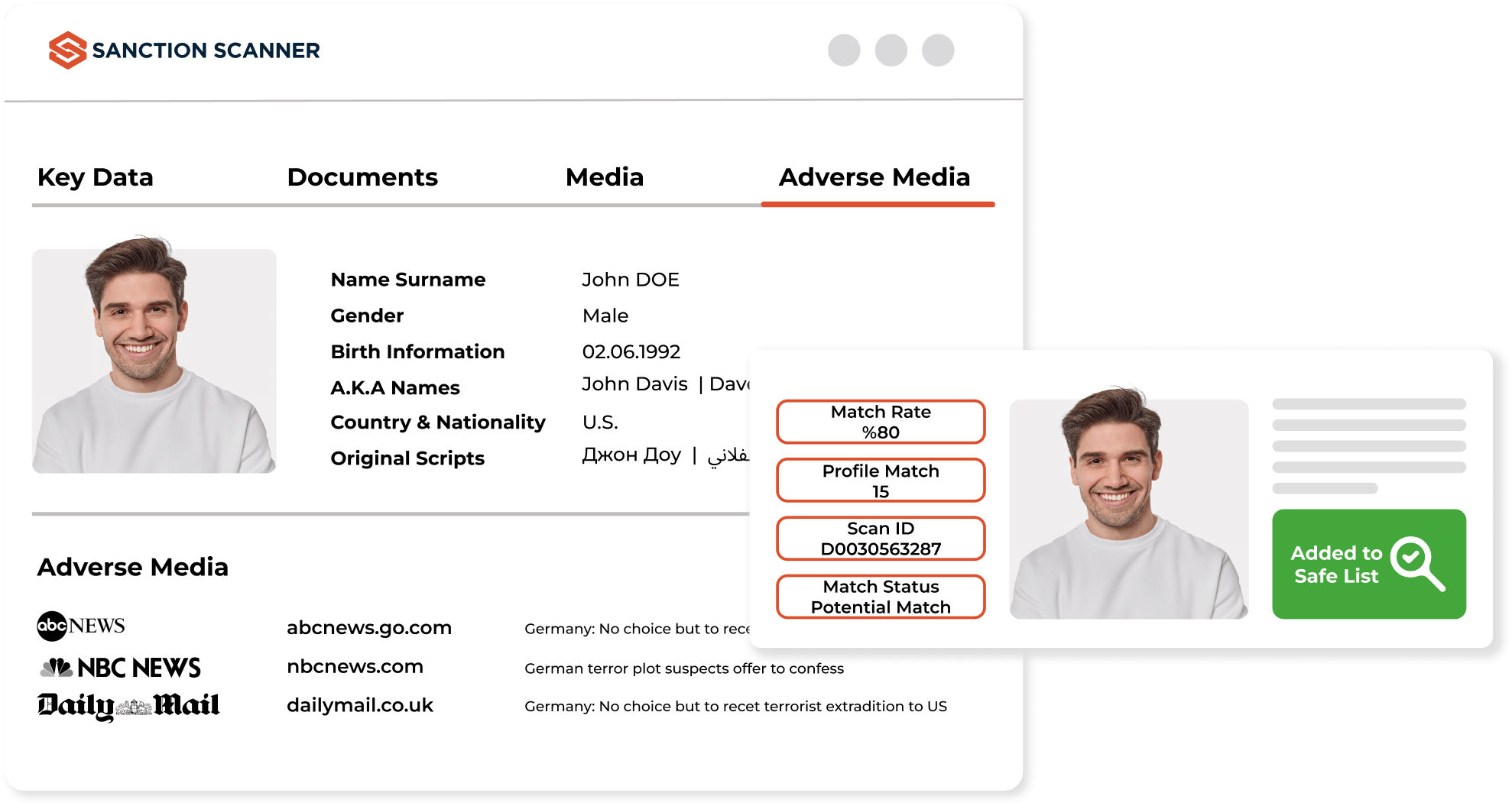

AML Name Screening

Scan your customers in 3000+ global Sanctions, Political Exposed Person lists, and Watchlists and see their risk. The data is updated every fifteen minutes.

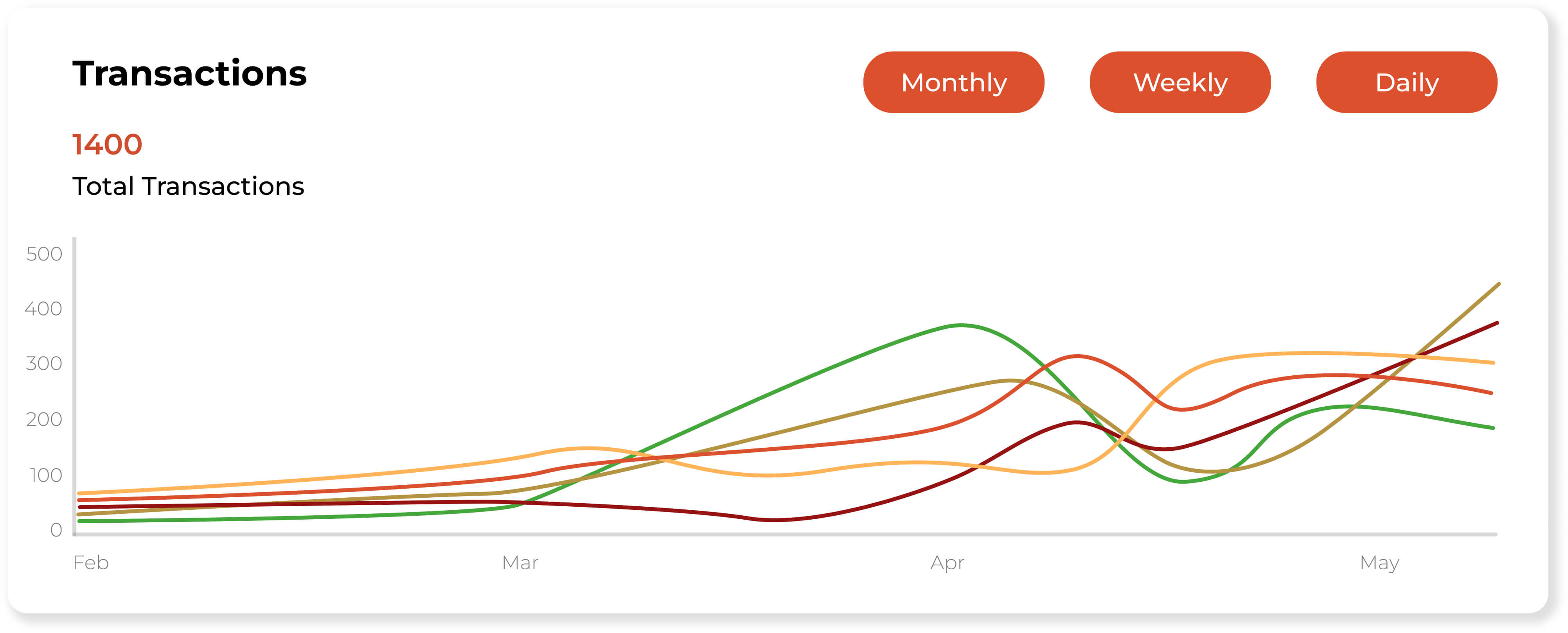

Learn MoreTransaction Monitoring

Monitor your customers' transactions, such as money transfers, with no delays. Financial institutions can automate their transaction monitoring process.

Learn MoreTransaction Screening

Financial institutions such as banks, or money transfer companies can check the receiver and sender with no delays. Automate and speed up the entire process.

Learn MoreCustomer Risk Assessment

Assign scores to your customers according to criteria such as profession, age, income, country, and currency, and make risk assessment easier.

Learn MoreAML Compliance is No More Complicated

Meet AML Needs

You can meet the AML needs with Global Sanction, PEP, and Adverse Media Data.

Global AML Data

We have more than 3000 different Sanctions, PEPs Wanted and Watched Lists from 220+ countries.

End-To-End Features

Companies of all sizes meet their Transaction Monitoring Fraud, AML, and CTF obligations using Sanction Scanner.

HOW DOES SANCTION SCANNER HELP?

Here are a few reasons to choose Sanction Scanner

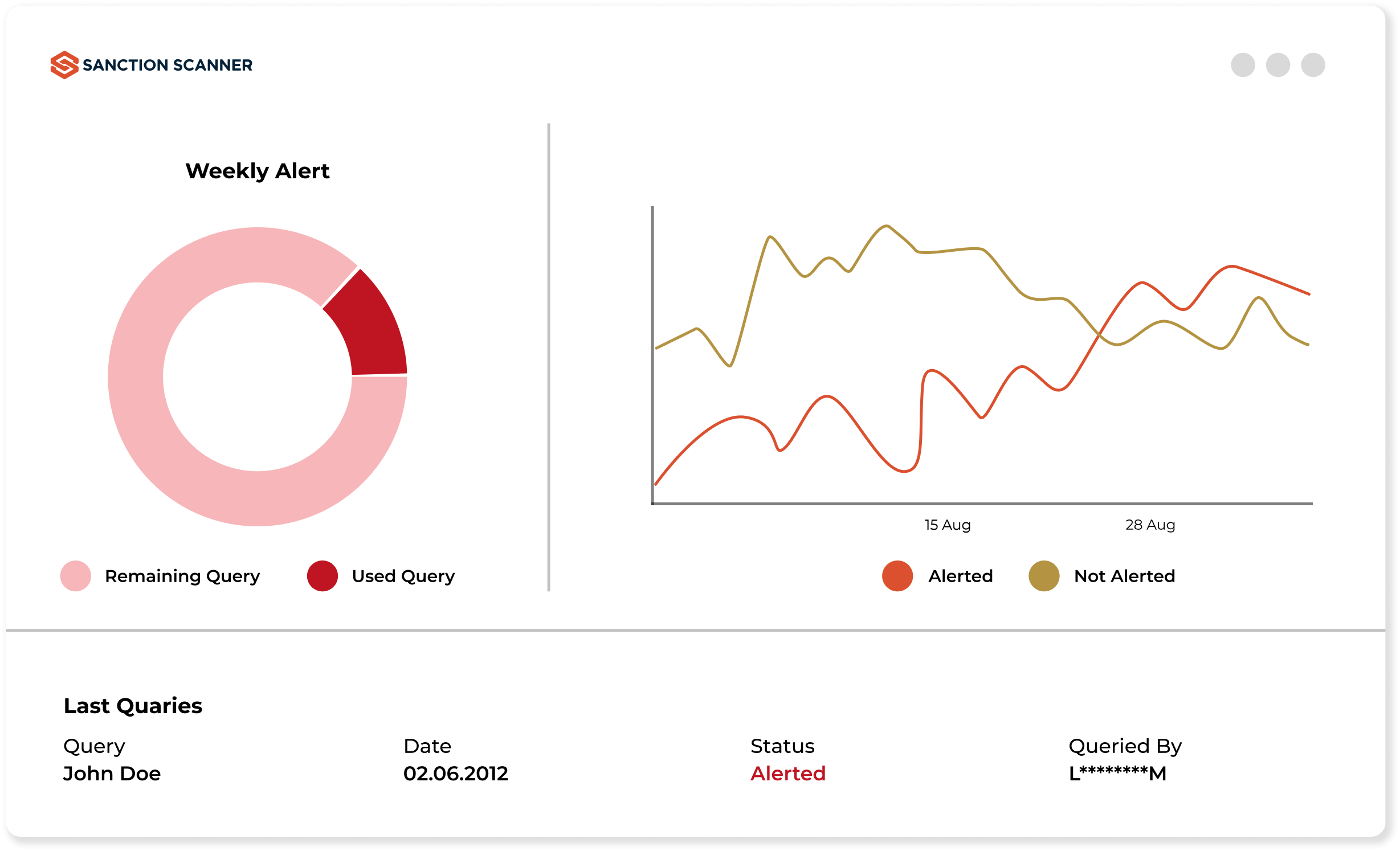

Easy to use, Easy to Integrate

Anti-Money Laundering operations are not complicated anymore with the power of AI. Our products are easy to integrate and use. You can manage our compliance products through enhanced dashboards.

Full Data Coverage

Sanction Scanner provides a database of more than 3000 different Sanctions, PEP, Wanted and Watched lists from over 220 countries. You can automate your company's sanction lists control and classify according to risk levels.

- United Nations Sanctions (UN)

- US Consolidated Sanctions

- OFAC — Specially Designated Nationals (SDN)

- Office of the Superintendent of Financial Institutions (Canada)

- Department of State, Nonproliferation Sanctions (US)

- EU Financial Sanctions

- UK Financial Sanctions (HMT)

- Her Majesty’s (HM) Treasury List and 1000+ different government lists

Powerful API

Restful API allows projects to be flexible integrated, managed and interacted with. Sanction Scanner API has been powered by webhook. With Webhook you can provide two-way data transfer between Sanction Scanner and your own project.

- In hours integration, fast and easy integration

- 250ms average call response time

- 99.95+% uptime

RESOURCES

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“Sanction Scanner made our customer onboarding processes fast and safe. We perform our AML controls automatically and comply with AML regulations with its API integration.”

Emre Kenci

CEO at Papara

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Head of Compliance at BPN

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Money Remittance Sr. Director at United Payment